Introduction:

Payroll management is a critical aspect of any business, encompassing the administration of employee salaries, wages, bonuses, deductions, and taxes. It plays a pivotal role in maintaining organizational compliance, financial accuracy, and employee satisfaction. Efficient payroll management ensures that employees are compensated accurately and on time, contributing to overall business success and employee morale.

Definition of Payroll Management:

Payroll management refers to the systematic process of handling financial aspects related to employee compensation within an organization. This includes calculating wages, withholding taxes, and ensuring compliance with labor laws. It involves a comprehensive approach to managing employee earnings, deductions, and benefits in a structured and timely manner. The process involves various tasks such as tracking attendance, calculating working hours, and handling statutory obligations.

Importance of Efficient Payroll Management:

Efficient payroll management is crucial for several reasons. Firstly, it ensures compliance with labor laws and tax regulations, mitigating the risk of legal issues and financial penalties. Accurate and timely payroll processing also enhances employee satisfaction and trust, as it reflects a commitment to fair compensation and reliability. Additionally, effective payroll management contributes to financial transparency, enabling businesses to track their labor costs and budget effectively. Ultimately, it streamlines administrative processes, allowing organizations to focus on core business activities.

Role of QuickBooks in Payroll Management:

QuickBooks, a widely used accounting software, plays a significant role in payroll management for businesses of all sizes. It automates many aspects of payroll processing, such as calculating taxes, generating paychecks, and keeping track of employee benefits. QuickBooks simplifies the complexities of payroll tasks, making it easier for businesses to stay compliant and reduce the risk of errors. The software also provides reporting features, allowing organizations to analyze payroll data and make informed decisions. By integrating with time-tracking systems and other relevant tools, QuickBooks enhances the efficiency of payroll management, saving time and resources for businesses.

Getting Started with QuickBooks Payroll

QuickBooks Payroll is a comprehensive solution designed to streamline and automate the payroll process for businesses of all sizes. Whether you are a small business owner or manage a larger enterprise, QuickBooks Payroll offers a user-friendly platform to handle payroll tasks efficiently. Getting started with QuickBooks Payroll involves a few key steps to set up your account, configure payroll settings, and begin managing your employees’ payroll seamlessly.

QuickBooks Overview

QuickBooks is a popular accounting software that provides a range of tools to help businesses manage their financial activities effectively. QuickBooks Payroll is an extension of the core QuickBooks software, specifically tailored for handling payroll tasks. It integrates seamlessly with the main accounting platform, allowing users to maintain a cohesive financial management system. With features like automatic tax calculations, direct deposit capabilities, and compliance tracking, QuickBooks Payroll simplifies payroll processing and ensures accuracy in financial records.

Different Versions of QuickBooks

QuickBooks offers different versions to cater to the diverse needs of businesses. These versions include QuickBooks Online, QuickBooks Desktop, and QuickBooks Self-Employed. Each version has its unique features and advantages, making it essential to choose the one that aligns with your business requirements. QuickBooks Payroll is available for both QuickBooks Online and QuickBooks Desktop, allowing users to select the version that best suits their accounting preferences and business structure.

Choosing the Right QuickBooks Payroll Plan

Selecting the right QuickBooks Payroll plan is a crucial decision that depends on the size of your business, the number of employees, and the specific payroll features you require. QuickBooks Payroll offers various plans, such as Core, Premium, and Elite, each catering to different business needs. The plans differ in terms of cost, features, and level of support. It’s essential to evaluate your business requirements and budget constraints to make an informed decision when choosing the most suitable QuickBooks Payroll plan for your organization.

Getting started with QuickBooks Payroll involves understanding the broader context of QuickBooks, exploring the different versions available, and carefully selecting the appropriate payroll plan for your business. By doing so, you can leverage the full potential of QuickBooks Payroll to simplify payroll management and ensure accurate financial records for your business.

Setting Up QuickBooks Payroll

Setting up QuickBooks Payroll is a crucial step for businesses to efficiently manage their payroll processes. This involves a series of tasks, including creating a QuickBooks account, configuring company information, and setting up payroll preferences.

Creating a QuickBooks account is the initial step in the process. Users need to sign up for a QuickBooks subscription and provide essential business details during the setup. This typically includes information such as the company’s name, address, industry type, and tax identification number. Once the account is established, users gain access to the QuickBooks platform, where they can navigate various features, including payroll.

After creating the QuickBooks account, the next step is configuring company information. This involves inputting accurate and up-to-date details about the business, such as its legal name, address, contact information, and any relevant tax information. Accurate company information is crucial for payroll processing, ensuring that employee paychecks and tax filings are precise and compliant with regulations.

Following the configuration of company information, users must focus on setting up payroll preferences. QuickBooks Payroll allows customization based on specific business needs and regulations. Users can define payroll settings, such as pay frequency, wage types, and other relevant parameters. Additionally, payroll preferences may include options for benefits, deductions, and tax withholding. Configuring these preferences accurately is essential to ensure that payroll calculations align with the company’s policies and legal requirements.

Setting up QuickBooks Payroll involves a systematic process, starting with creating a QuickBooks account, followed by configuring company information and setting up payroll preferences. Each of these steps plays a vital role in ensuring the accuracy, efficiency, and compliance of the payroll system within the QuickBooks platform. Businesses can tailor the setup to meet their specific needs, ultimately streamlining payroll processes and reducing the likelihood of errors or compliance issues.

Employee Setup and Management

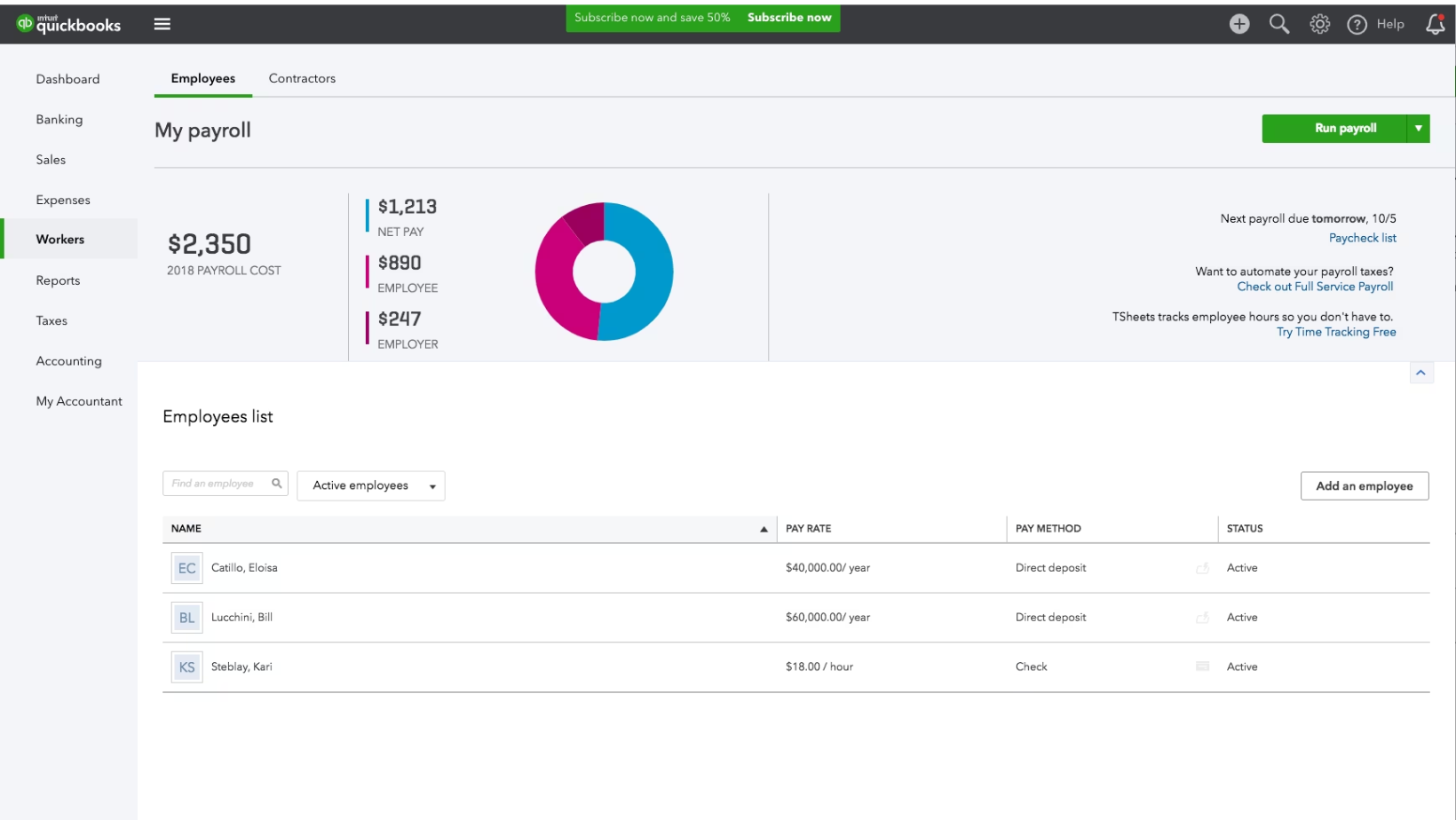

Employee setup and management are critical components of efficient business operations, and QuickBooks provides a comprehensive platform for handling these tasks seamlessly. The process begins with adding employees to the QuickBooks system, a straightforward yet crucial step in establishing accurate and up-to-date records. This involves inputting basic information such as names, contact details, and employment start dates.

Once employees are added, QuickBooks allows for the creation and management of comprehensive employee profiles. These profiles not only include basic personal information but also extend to detailed payroll records. This ensures that the system can accurately calculate salaries, wages, and other compensations, providing a reliable foundation for payroll management.

Adding Employees to QuickBooks

Adding employees to QuickBooks is a user-friendly process designed to streamline data entry. Users can input essential details through a simple interface, including employee names, addresses, and tax information. QuickBooks also facilitates the customization of employee profiles to accommodate various job roles, departments, and other specific attributes. This flexibility allows businesses to tailor the system to their organizational structure, creating a more personalized and efficient employee setup.

Moreover, the integration of employee data into QuickBooks enhances the overall accuracy and consistency of financial records. This integration simplifies the payroll process, minimizing errors and ensuring compliance with tax regulations. As a result, businesses can save time and resources while maintaining a high level of precision in their financial management.

Employee Information and Payroll Records

In-depth employee information and payroll records form the backbone of effective workforce management within QuickBooks. Beyond basic details, the system enables users to maintain detailed payroll records for each employee. This encompasses salary structures, hourly rates, tax withholdings, and other compensation-related information. These records are crucial for generating accurate paychecks, calculating taxes, and adhering to legal requirements.

The ability to access and update employee information swiftly is another key feature of QuickBooks. Changes such as promotions, salary adjustments, or updated contact details can be effortlessly incorporated into the system. This ensures that businesses maintain real-time, accurate records, fostering compliance and reducing the likelihood of payroll discrepancies.

Managing Employee Benefits and Deductions

QuickBooks extends its functionality to include the management of employee benefits and deductions, contributing to a holistic approach to workforce administration. The system enables businesses to record and track various benefits such as health insurance, retirement contributions, and other perks. This comprehensive overview allows for better decision-making regarding employee compensation packages.

QuickBooks facilitates the automatic calculation and application of deductions, ensuring compliance with tax regulations and other legal requirements. This feature streamlines the payroll process and helps prevent errors in salary disbursement. Businesses can customize deduction categories to match their specific needs, providing flexibility in managing employee finances while maintaining precision and compliance. Overall, QuickBooks’ capability to manage employee benefits and deductions contributes to a more efficient and error-resistant payroll and HR management system.

Payroll Processing with QuickBooks

Payroll processing is a crucial aspect of managing a company’s finances, and QuickBooks provides a robust platform to streamline this task efficiently. QuickBooks offers a user-friendly interface that simplifies the complex process of running payroll, allowing businesses to manage employee compensation seamlessly.

Running Payroll in QuickBooks

QuickBooks offers a step-by-step process for running payroll, making it accessible even for those without extensive accounting knowledge. Users can input employee hours, earnings, and deductions, and the software automatically calculates gross and net pay, as well as taxes. The platform also enables the direct deposit of paychecks, reducing the need for manual transactions and minimizing errors in the payment process.

Hourly vs. Salary Employees

One of the key features in QuickBooks is its ability to distinguish between hourly and salary employees. This differentiation is vital as it affects how payroll is calculated. For hourly employees, QuickBooks can accurately track worked hours and calculate wages based on the established pay rate. On the other hand, for salaried employees, the system can automate payroll calculations based on their fixed salaries.

Overtime and Bonus Calculations

QuickBooks simplifies the often complex task of calculating overtime and bonuses. The software can automatically identify overtime hours, apply the appropriate pay rates, and factor in any bonuses owed to employees. This functionality not only saves time but also helps ensure accurate and compliant compensation, reducing the risk of errors and legal issues related to payroll calculations.

Handling Time-Off and Leaves

Efficiently managing time off and leaves is critical for maintaining accurate payroll records. QuickBooks allows users to input and track employee absences, whether it’s vacation time, sick leave, or other types of leave. The system then adjusts payroll calculations accordingly, ensuring that employees are compensated accurately based on their attendance and leave balances.

QuickBooks provides a comprehensive solution for payroll processing, encompassing various aspects such as hourly and salary distinctions, overtime, bonuses, and time-off management. By leveraging the capabilities of QuickBooks in these areas, businesses can enhance their payroll efficiency, reduce errors, and ensure compliance with relevant labor regulations.

Tax Compliance and Reporting:

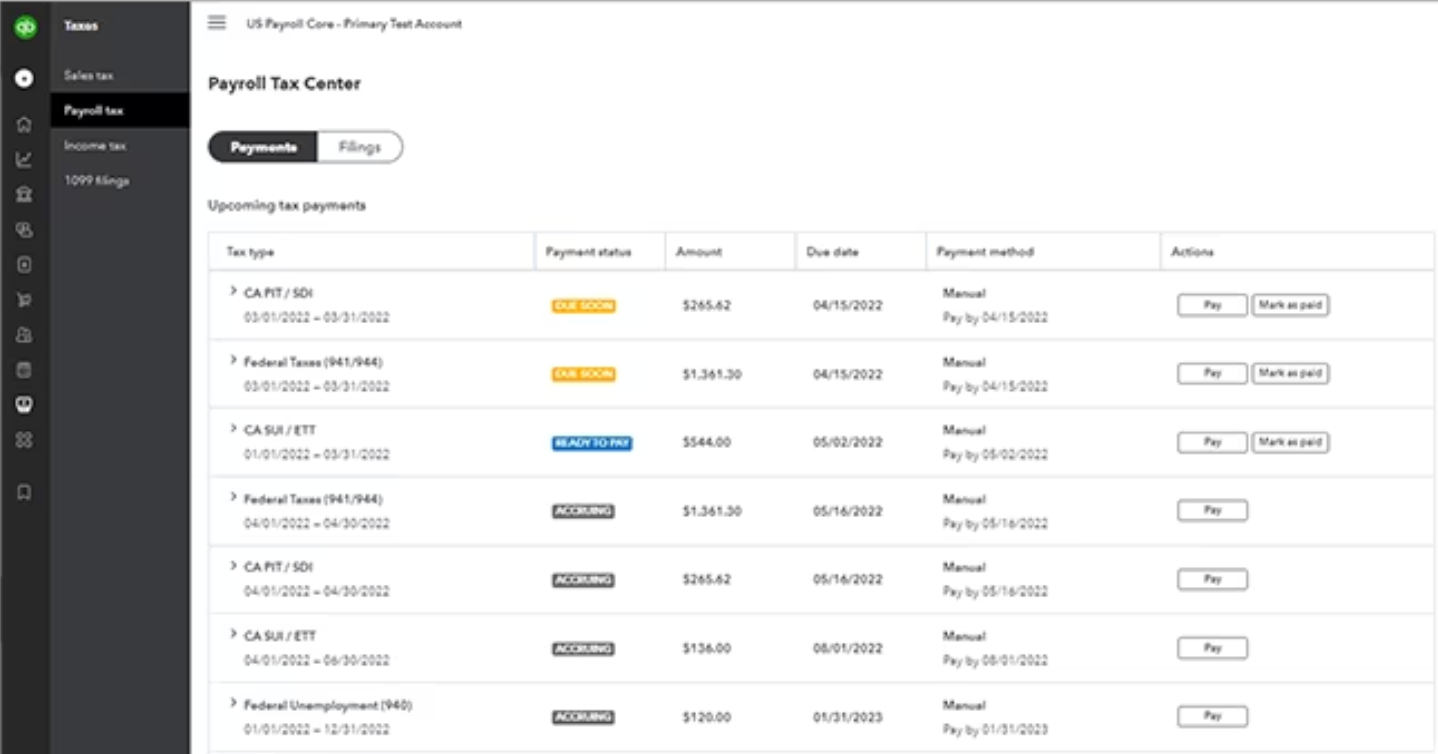

Tax compliance and reporting are critical aspects of financial management for businesses. Ensuring adherence to federal and state tax regulations is essential to avoid penalties and legal issues. In the context of payroll, this involves accurately calculating and withholding taxes from employee salaries, including federal and state income taxes, Social Security, and Medicare taxes. Compliance also extends to timely reporting and filing of tax-related documents, such as W-2 and 1099 forms. Accurate record-keeping and staying abreast of changes in tax laws are integral components of effective tax compliance.

Tax Setup in QuickBooks Payroll:

Setting up taxes in QuickBooks Payroll is a pivotal step in ensuring accurate and efficient payroll processing. This involves configuring the software to automatically calculate the correct tax deductions based on federal and state tax rates. Additionally, QuickBooks Payroll allows for customization to accommodate various tax obligations specific to different regions and industries. The tax setup process includes defining employee tax exemptions, allowances, and other variables that impact tax calculations. A thorough and accurate tax setup lays the foundation for seamless payroll operations and compliance.

Federal and State Tax Filings:

Submitting timely and accurate tax filings to both federal and state authorities is a crucial responsibility for businesses. Federal tax filings involve reporting income, deductions, and tax liability to the Internal Revenue Service (IRS), while state tax filings vary based on individual state requirements. QuickBooks Payroll simplifies this process by generating reports and summaries that facilitate easy submission of necessary information. Ensuring compliance with filing deadlines is imperative to avoid penalties and maintain a positive relationship with tax authorities.

Generating W-2 and 1099 Forms:

At the end of the fiscal year, businesses must provide employees and contractors with W-2 and 1099 forms, respectively, detailing their earnings and tax withholdings. QuickBooks Payroll streamlines this process by automatically generating these forms based on the data entered throughout the year. Accuracy is paramount to avoid discrepancies and potential legal issues. Generating W-2 and 1099 forms efficiently contributes to the overall efficiency of year-end payroll tasks and ensures that all necessary documentation is provided to employees and contractors for their tax filings.

Year-End Payroll Tasks:

Year-end payroll tasks encompass a comprehensive review and reconciliation of payroll data for the entire fiscal year. This includes verifying the accuracy of employee earnings, tax withholdings, and benefits. QuickBooks Payroll aids in this process by providing detailed reports and summaries for analysis. Year-end tasks also involve reconciling payroll tax liabilities, ensuring compliance with the latest tax laws, and making any necessary adjustments. Completing these tasks in a timely manner is essential for generating accurate financial reports and smoothly transitioning into the new fiscal year. Additionally, businesses may use this opportunity to assess and plan for changes in payroll processes, tax rates, and compliance requirements for the upcoming year.

Integration with Accounting:

Efficient integration with accounting systems is crucial for businesses aiming to streamline their financial processes. In this context, seamless integration with QuickBooks Accounting stands out as a key feature. QuickBooks is a widely used accounting software that helps businesses manage their financial data effectively. The integration ensures a smooth flow of information between payroll and accounting, eliminating the need for manual data entry and reducing the likelihood of errors.

Seamless Integration with QuickBooks Accounting:

The emphasis on seamless integration with QuickBooks Accounting implies a user-friendly and automated connection between the payroll system and the accounting software. This functionality allows for the automatic transfer of payroll data, such as employee wages, taxes, and deductions, directly into QuickBooks. By eliminating the need for manual data input, businesses can save time and reduce the risk of inaccuracies, contributing to more reliable financial reporting and compliance.

Tracking Payroll Expenses:

Accurate tracking of payroll expenses is a critical aspect of financial management for any organization. The payroll system’s integration with accounting facilitates real-time monitoring of payroll-related expenditures. This includes tracking individual employee salaries, benefits, and other associated costs. Such detailed tracking not only ensures transparency in financial records but also empowers businesses to make informed decisions regarding budgeting, resource allocation, and overall financial planning.

Reconciling Payroll Transactions:

The reconciliation of payroll transactions is a pivotal step in maintaining financial accuracy and integrity. Seamless integration allows for the automatic reconciliation of payroll transactions within the accounting system. This means that the payroll data, once integrated, is cross-checked against the corresponding entries in QuickBooks. Any discrepancies or errors can be promptly identified and addressed, reducing the risk of financial discrepancies during audits and ensuring that the financial statements accurately reflect the company’s payroll-related transactions.

The integration with accounting, particularly with QuickBooks, offers businesses a comprehensive solution to manage payroll processes efficiently. From automating data transfer to real-time tracking and reconciliation, these features contribute to a more streamlined and error-free financial workflow, enabling organizations to focus on their core operations with confidence in the accuracy of their financial records.

Advanced Features and Customization in QuickBooks Payroll

QuickBooks Payroll offers a range of advanced features and customization options to meet the diverse needs of businesses. One notable aspect is the ability to create custom payroll items. This feature allows businesses to tailor their payroll setup to match specific requirements, such as bonuses, commissions, or other unique compensation structures. By customizing payroll items, companies can accurately reflect their unique payroll processes and ensure precise calculations for employee compensation.

Additionally, the advanced features in QuickBooks Payroll extend to job costing capabilities. Job costing is crucial for businesses that operate on projects or jobs, enabling them to allocate labor costs accurately and track expenses associated with each project. QuickBooks Payroll’s job costing feature integrates seamlessly with other accounting functions, providing a comprehensive solution for businesses that need to manage their finances in a project-oriented manner.

Custom Payroll Items in QuickBooks Payroll

One of the standout features in QuickBooks Payroll is the ability to create custom payroll items. This feature empowers businesses to define and set up unique payroll elements that go beyond the standard salary or hourly wage. Companies can create custom items for bonuses, commissions, or any other form of compensation specific to their industry or business model.

For instance, a sales-driven organization can establish custom payroll items for sales incentives, allowing for accurate and transparent compensation calculations. The flexibility to customize payroll items ensures that businesses can adapt their payroll processes to reflect the intricacies of their workforce structure, ultimately streamlining payroll management and reducing the margin for error in compensation calculations.

Job Costing in QuickBooks Payroll

QuickBooks Payroll goes a step further in catering to businesses with complex financial structures by incorporating job costing functionality. Job costing is particularly beneficial for companies engaged in projects, contracts, or services where tracking costs and expenses associated with each job is essential.

With job costing in QuickBooks Payroll, businesses can assign labor costs, overhead, and other expenses to specific jobs or projects. This level of granularity provides a comprehensive view of how resources are allocated, ensuring accurate financial reporting and helping businesses make informed decisions about resource allocation and project profitability.

Multi-State Payroll Processing in QuickBooks Payroll

Another advanced feature in QuickBooks Payroll is its capability for multi-state payroll processing. As businesses expand and operate in multiple states, managing payroll can become complex due to varying tax regulations and compliance requirements. QuickBooks Payroll simplifies this challenge by offering tools that facilitate the processing of payroll for employees working in different states.

This multi-state functionality ensures compliance with state-specific tax laws and regulations, reducing the risk of errors in payroll processing. It also streamlines the administrative burden associated with managing a geographically dispersed workforce, providing businesses with the flexibility and tools needed to navigate the complexities of multi-state payroll processing efficiently

Conclusion

In conclusion, mastering payroll management with QuickBooks is not just a necessity; it’s a strategic advantage for businesses. This comprehensive guide equips businesses with the knowledge and skills needed to harness the power of QuickBooks Payroll, ensuring accuracy, compliance, and efficiency in managing one of the most critical aspects of business operations. As we look ahead, the future of payroll management promises continued innovation, and businesses embracing these advancements will position themselves for sustained success.

Yes, QuickBooks Payroll can generate detailed pay stubs for employees. These pay stubs include information such as gross pay, deductions, and net pay. Employees can access their pay stubs through the online portal.

QuickBooks Payroll helps businesses stay compliant with federal and state labor laws by automatically updating tax tables and calculations. It also provides alerts for upcoming tax deadlines.

The frequency of running payroll depends on your business needs. QuickBooks Payroll allows you to run payroll as often as needed, whether it’s weekly, bi-weekly, monthly, or another schedule that suits your payroll cycle.

QuickBooks Payroll seamlessly integrates with QuickBooks accounting software. This integration ensures that payroll data is accurately reflected in your financial reports without manual entry.

QuickBooks Payroll simplifies year-end tasks by generating W-2 and 1099 forms, providing year-end summaries, and assisting with other year-end reporting requirements. The system guides you through the necessary steps to complete these tasks accurately.