Introduction: ALL IN ONE DIGITAL BANKING SYSTEM

This bank is an advanced professional banking system that comes equipped with all of the capabilities required to launch a banking management application based on the Laravel framework. It is primarily designed for those individuals who wish to launch their businesses within the realm of digital banking systems. It has Standard Banking services such as DPS, FDR, and Wire Transfers in addition to many others.

It is an excellent option for you if you are seeking for a Complete Professional Banking System, which is exactly what this product offers. This bank is able to effortlessly manage Unlimited Users, Transactions, Deposits, Withdrawals, FDR, DPS, Money transfers, Manage Beneficiaries, more Accounts transfers, and many more necessary Features for a Great Banking System. It supports a number of different payment gateways, a number of different languages, a number of different currencies, a number of different staff members, and plenty of advanced systems such as secret login, KYC consent, two-factor authentication, module management, and a number of other features.

It is guaranteed that this bank will bring you success in the digital banking business, and it will also reduce the amount of money you need to spend on marketing. In addition, you won’t need any coding skills to use this bank. Therefore, let’s get your banking system up and running by visiting the bank.

Admin Dashboard Features

Standard Dashboard:

The administrative dashboard provides a thorough overview of the system’s main indicators, which enables the administrator to efficiently monitor and administer the digital banking application.

Features of Advanced Menu Builder:

Because of this functionality, the application’s admin is able to personalize and adjust the application’s menu layout, which results in users having a more streamlined and straightforward experience when navigating the application.

User Management:

The administrator has the ability to manage user accounts, which includes registering users, authenticating users, and authorizing users. This function gives the administrator the ability to manage user profiles, access levels, and permissions.

Bank Plan Management:

The administrator has the ability to design and administer a variety of banking plans, which include setting the characteristics, interest rates, and terms that apply to the various kinds of accounts and services that the digital banking application provides.

KYC Management that is Smart:

A sophisticated Know Your Customer (KYC) procedure may now be put into action by the administrator thanks to this functionality. It makes the gathering, verification, and management of user identification and authentication data easier to do so that it complies with regulatory standards.

Module Management in relation to KYC:

The administrator is able to handle the many modules that are associated with the KYC procedures, which allows for the effective management and processing of user identification documents, as well as verification status and compliance checks.

Money Management for User Withdrawals:

The administrator has the ability to monitor and handle withdrawal requests made by users, thereby ensuring that users’ funds are withdrawn from their accounts in a secure and timely manner.

Withdraw Method Handling:

This function enables the administrator to establish and manage a variety of withdrawal methods, which in turn provides users with a handy array of alternatives for removing funds from their accounts.

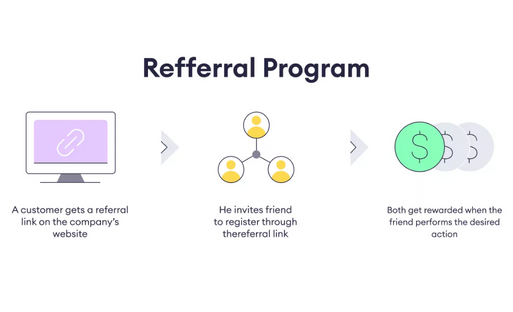

Features for Referral Bonus Management:

The administrator has the ability to create and administer referral incentive programmes, which reward users for bringing in new clients to the digital banking application. This feature promotes user involvement and contributes to their overall growth.

Loan Management, Including All Types:

The admin of the digital banking programme has the ability to handle and manage the various kinds of loans that are available. This includes determining the terms of the loan, including interest rates and repayment schedules, as well as processing applications for loans.

Types of DPS Management include:

The administrator has the ability to handle all of the different Deposit Protection Scheme (DPS) accounts that the program has to offer. With the help of this tool, the administrator can establish and manage DPS programs, keep track of deposits, and offer assistance to users who are taking part in the scheme.

FDR Management encompasses all types:

The administrator is able to manage Fixed Deposit Receipt (FDR) accounts, which includes managing the various types of FDR plans, interest rates, and maturity dates. This feature makes it easier to manage FDR accounts and the transactions that are associated with them.

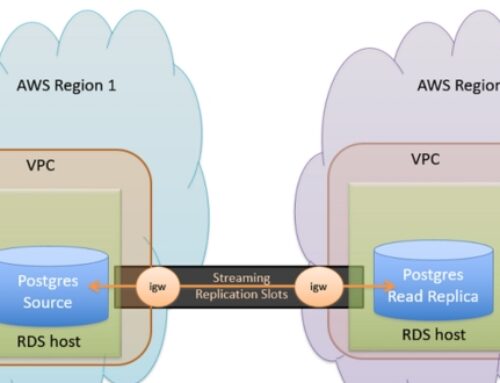

Ability to deal with other banks:

The administrative assistant is able to manage relationships and transactions with various financial institutions. This feature makes it possible for the digital banking application to communicate and share information with other financial institutions in a safe and seamless manner, as well as to transfer money between those institutions.

Money Transfer Management Types:

Within the framework of the program, the administrator has the ability to take care of a wide variety of monetary transactions, such as wire transfers, external transactions to other financial institutions, internal transactions between accounts, and more.

Transfers between one’s own and other banks Managing Opportunity:

The administrator is able to manage transfers not just within the digital banking application’s own bank but also transfers to banks located outside of the application. This function ensures that the transfer of funds between accounts both inside and outside of the application is done in a streamlined and secure manner.

Wire Transfer and Wire Transfer Bank Management:

Within the digital banking application, the administrator has the ability to handle wire transfers as well as the bank details associated with wire transfers. Because of this capability, the processing and management of wire transfer transactions may be done quickly and effectively.

Setting and managing financial requests:

Money requests can be initiated by users, and the administrator can establish and manage the settings governing money requests at their discretion. Because of this functionality, user-initiated requests for financial assistance can be efficiently handled and processed.

Detailed view of all transactions:

The administrator of the digital banking application has access to a full view of all of the transactions that have taken place within the application, including specific information such as the transaction type, amount, date, and parties involved.

User Deposit Management:

The administrator has the ability to handle user deposits, which includes viewing deposit details, validating transactions, and responding to requests or problems relating to deposits.

Standard Blog and Blog Category Management:

Within the application, the administrator has the ability to administer both a conventional blog and blog categories. This feature enables the creation, modification, and organization of blog entries and categories with the purpose of posting content that is relevant to the user’s interests.

Breadcrumb management, the logo, the favicon, the loader:

The administrator has the ability to manage various aspects of the application’s branding, including the application’s logo, its favicon, its loading animation, and its breadcrumb navigation. Because of this capability, the application may be customized to fit your needs while maintaining a unified brand.

Modern Website Content and Module Management:

The admin has the ability to manage the content as well as the modules that are presented on the website for the application. This includes keeping the content of the website up to date and organized, as well as adding or removing modules and ensuring that users have an experience that is both interesting and useful.

Setting for the error banner and footer:

The administrator has the ability to alter the appearance of the website’s footer, which includes the text, links, and other information that appears there. In addition, the administrator has the ability to configure error banners or messages in order to provide critical information to users in the form of alerts or notifications.

Manages all Home Page sections:

The administrator has the ability to modify and personalize all aspects of the home page, including the layout, the content, and the items that are featured. This feature makes it possible to create a customized and aesthetically pleasing presentation of the homepage.

Handling for all section headings:

The application’s administrator has the ability to modify the headings and titles of the app’s various parts. This feature offers customization and optimization of section titles, which improves user engagement and navigation.

Email Templates and Email Configurations:

Within the application, the administrator has the ability to manage email templates and other settings. This involves the creation of email templates for notification purposes, the definition of preferences about the sending of emails, and the maintenance of efficient connection with users.

Group Email Sending:

The administrator has the option to send mass emails to certain user groups or user segments that have been targeted specifically. Because of this capability, it is now possible to communicate and make announcements effectively to a huge number of users all at once.

Opportunity for Users to Communicate Directly:

The messaging function of the application allows the administrator to have direct conversations with other users. This makes it possible to have personalized interactions, respond to questions or concerns raised by users, and to provide prompt help.

Currency Management:

The administrator has the ability to manage the application’s currencies, which includes the ability to add or remove currencies, set exchange rates, and ensure that the application’s currency conversions for financial transactions are accurate and up to date.

Current Payment Gateway Management:

The application’s administrator has the ability to manage the application’s integration and setup of the most recent payment gateways. Users have many options that are both safe and convenient to choose from when it comes to conducting financial transactions thanks to this functionality.

Advanced Role Management System:

The application’s administrator has the ability to design and administer a variety of roles within the system, each of which can be assigned a unique set of rights and access levels. This feature ensures that the application’s data and other functionalities can only be accessed in a secure and controlled manner.

Staff Management:

Accounts of the staff and their rights within the program can be managed by the admin. This includes making additions or deletions to the personnel, determining roles and responsibilities for each individual, and ensuring that all internal activities run smoothly.

Management of Standard KYC Forms:

Within the application itself, the admin has the ability to administer the standard KYC form, which ensures the precise gathering, verification, and validation of user identifying and authentication data.

Admin Panel and Website Management Languages:

The administrator has the ability to manage the languages that are supported by the website as well as the admin panel. This enables localization as well as multilingual support, which is useful for catering to users who come from a variety of locations and have a variety of linguistic preferences.

Manages website fonts:

The administrator has the ability to manage the font styles and typography that are being utilized on the website. This helps to maintain a layout that is uniform and aesthetically pleasing throughout the application.

Settings for Menu Page Activations:

The administrator of the application has the ability to configure and activate menu pages within the application, create the navigation structure, and enable or deactivate particular pages or features as necessary.

Handling of Google Analytics for SEO Tools:

In order to improve the application’s search engine exposure and user experience, the administrator has the ability to integrate and manage Google Analytics for SEO purposes. This allows for the tracking of website traffic, user behavior, and performance data.

Management of social links and website meta keywords:

Within the application, the admin has the ability to adjust meta keywords and social media links, which improves search engine optimization and makes it possible for users to engage with the digital banking application through social media platforms.

Manages Sitemaps:

The administrator has the ability to manage sitemaps, which are XML files that provide information to search engines regarding the website structure and content of the application. The search engine indexing and visibility are both boosted as a result of this functionality.

Subscriber Management:

Within the program itself, the admin has the ability to manage subscriptions to various newsletters and updates. This includes adding new subscribers or removing existing ones, as well as sending out newsletters or notifications and keeping a database of subscribers updated.

Clear Cache Opportunity:

It is possible for the administrator to flush the application’s cache, which will improve its overall efficiency while also guaranteeing that users have access to the most recent data and changes.

Features for changing passwords and profile settings:

The admin is able to control their own profile settings, which includes the ability to update personal information, change passwords, and maintain the security and integrity of their admin account.

User Dashboard

Standard Dashboard with a Lot of Information:

The user dashboard offers a detailed and useful summary of the user’s banking activity as well as account information. It displays relevant information such as account balances, transaction histories, forthcoming payment dates, and other crucial pieces of information.

Banking Price Plan:

The program provides the user with access to a number of different banking price plans, all of which may be explored and chosen from by the user. These plans might offer a variety of account types, features, and pricing tiers to users in order to satisfy their individual requirements for banking services.

Loan Plan and Complete Loan History:

Users are able to get information about the various loan plans that are offered and check the history of their own loans. Users are able to monitor the status of their loan applications, as well as their repayment schedules and outstanding sums, thanks to this tool.

Plans and History of DPS Displayed:

The Deposit Protection Scheme (DPS) plan options that are currently available through the application are displayed on the user dashboard. Users have the ability to access their own DPS histories, which may include active DPS plans and the details associated with them.

DPS List for Running and Matured:

Users have access to a list of all of their active DPS plans, as well as a list of all of their plans that have either met their completion date or have matured. This tool enables easy management of DPS investments as well as gives transparency for those investments.

Presentation of FDR Plans and History:

Fixed Deposit Rate (FDR) plans that are currently available for investment are displayed on the user dashboard. Users are also able to review their FDR history, which includes any active FDR plans and the accompanying details for those plans.

FDR Running and Closed List:

Users have the ability to access a list of all of their active FDR plans, as well as plans that have been closed or are now complete. With the use of this function, consumers are able to keep tabs on their FDR investments and record their earnings.

Send a Request for Money:

Within the program, users have the ability to initiate and send requests for financial assistance to other users or contacts. The procedure of obtaining funds is made easier, and convenient money transfers are made possible, thanks to this function.

Receive Request Money:

Within the programme itself, users are able to receive requests for financial assistance from other users or connections. Users are given the ability to quickly reply to payment requests and successfully complete transactions as a result of this feature.

Standard Deposit Method and Deposit History:

Users have the ability to make deposits into their accounts utilizing the application’s default deposit system, which is made available to them. They also have the ability to view their deposit history, which includes information on all of their prior deposits.

Wire Transfer Advantage:

Users have access to the many advantages of using wire transfers for the purpose of making safe and effective money transfers. Users are given the capability to launch wire transfers to other accounts, both within the same financial institution and to accounts held at other financial institutions.

A sophisticated Send Money Feature:

The user dashboard has a sophisticated feature that allows users to send money to other users or contacts. This tool enables a streamlined and safe process for transferring money, in addition to providing access to extra options and features.

Beneficiary Management:

Users are able to maintain their lists of beneficiaries or recipients, making financial dealings more straightforward and expedient. They have the ability to add, update, or remove beneficiaries according to their needs, which simplifies the process of delivering money to recipients who receive it frequently.

Other Bank Transfer Possibilities:

Users have the ability to move money to accounts housed at financial institutions other than their own. Because of this functionality, users are able to conduct secure and convenient transfers across different banks.

The complete transfer history:

Users have access to a detailed history of all of their previous financial transfers, including information about the transaction dates, amounts, and recipients. Users are able to keep a record of their transfer activity for future reference and reconciliation thanks to this functionality.

Money Withdrawals & Withdrawal History:

Users have the ability to withdraw money from their accounts at any time. They also have the ability to view their withdrawal history, which contains a record of all of their previous withdrawals and the details associated with each one.

Two-Factor Authentication Security:

Two-factor authentication, often known as 2FA, is a security mechanism that is included into the user dashboard. By forcing users to give a second form of verification whenever they log in to their accounts or complete particular transactions, this additional layer of protection increases the account’s overall level of safety.

User Referral System:

Users have the opportunity to engage in a referral program that is made available by the application. Because of this function, users are able to invite their loved ones, friends, and acquaintances to become members of the banking platform, with the possibility of earning incentives or advantages for successful referrals.

Calculation of Referral Commissions:

The referral commissions that have been received from successful referrals are calculated and displayed on the user dashboard. Users are able to analyze the efficiency of their referral efforts as well as track the earnings from their referrals.

Standard Support Ticket:

The user dashboard allows users to submit support requests or make queries about the service. Users are given the opportunity to communicate with the customer support team in order to seek assistance, report problems, or request information.

Detailed information on each transaction:

Within the application, users have the ability to get a comprehensive summary of all of their transactions. This provides a detailed account of previous transactions by including information such as the dates of the transactions, the types of transactions, the sums, and the people involved.

Change your password and edit your profile settings:

Through the user dashboard, users are able to make changes to their personal information and adjust the settings of their profiles. They also have the ability to alter the passwords associated with their accounts, which enhances both the customization and security of those accounts.