Understanding the Basics of QuickBooks Budgeting and Forecasting:

Budgeting is a fundamental aspect of financial management that involves creating a plan for how to allocate and manage resources effectively. It serves as a roadmap for an individual, family, or organization to achieve financial goals, ensuring financial stability and success. Let’s delve deeper into the importance of budgeting.

Importance of Budgeting:

Establishing Financial Goals:

One of the primary purposes of budgeting is to help individuals and organizations set clear financial goals. By outlining specific objectives, such as saving for a home, education, or retirement, budgeting provides a structured approach to achieving these aspirations. This process encourages a disciplined and focused financial mindset, aligning spending habits with long-term objectives.

Allocating Resources Efficiently:

A well-crafted budget enables the efficient allocation of resources. By categorizing income and expenses, individuals and organizations can prioritize their financial commitments. This ensures that essential needs are met, such as housing, utilities, and groceries, while also allowing for discretionary spending. Allocating resources efficiently helps prevent overspending and fosters a more sustainable financial lifestyle.

Monitoring and Controlling Expenses:

Budgeting serves as a tool for monitoring and controlling expenses. Regularly tracking income and expenditures allows for a clear understanding of financial patterns. This awareness enables timely adjustments to spending habits, identifying areas where costs can be reduced or eliminated. By having a detailed overview of financial transactions, individuals and organizations can make informed decisions to stay within their financial means.

Planning for Growth and Expansion:

For businesses, budgeting is crucial for planning and facilitating growth and expansion. It involves allocating funds strategically, considering investments in marketing, technology, and infrastructure. By forecasting revenue and expenses, businesses can make informed decisions about scaling operations, entering new markets, or launching new products. Budgeting plays a pivotal role in shaping the financial trajectory of an organization and supporting its long-term sustainability.

Understanding the basics of budgeting is vital for anyone seeking financial stability and success. It empowers individuals and organizations to establish clear financial goals, allocate resources efficiently, monitor and control expenses, and plan for growth and expansion. By incorporating budgeting into financial practices, individuals and businesses can navigate the complexities of their financial landscapes with confidence and purpose.

QuickBooks Budgeting and Forecasting

QuickBooks Budgeting Features:

QuickBooks offers robust budgeting features that empower businesses to manage their finances with precision and foresight. Let’s delve into the key aspects of QuickBooks budgeting in more detail.

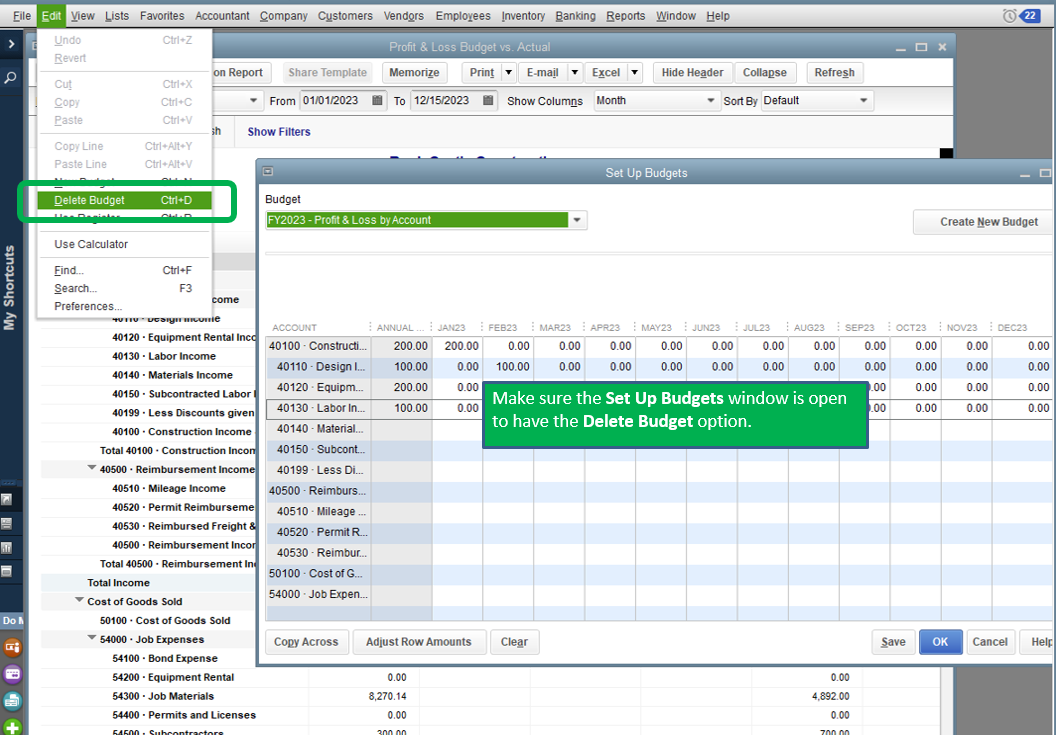

Creating a Budget:

One of QuickBooks‘ standout features is its intuitive and user-friendly interface for creating budgets. Users can seamlessly initiate the budgeting process, guiding them through the necessary steps to establish a comprehensive financial plan. Whether setting up an annual budget or planning for a specific project, QuickBooks provides a structured framework that ensures users can articulate their financial goals effectively.

Customizing Budget Categories:

Recognizing that businesses vary widely in their structures and operations, QuickBooks allows for the customization of budget categories. This flexibility enables users to tailor their budgets to align precisely with their organizational needs. Whether it’s operating expenses, marketing costs, or project-specific allocations, businesses can categorize their budgets in a way that mirrors their unique financial landscape.

Setting Budget Amounts:

Precision in financial planning is crucial, and QuickBooks acknowledges this by providing a straightforward process for setting budget amounts. Users can input specific figures for each budget category, reflecting their revenue projections, expense estimates, and other financial considerations. This granular control ensures that budgets are not only comprehensive but also accurate, laying the foundation for effective financial management.

Copying Budgets for Multiple Periods:

To streamline the budgeting process and enhance efficiency, QuickBooks allows users to copy budgets for multiple periods. This feature is particularly valuable for businesses with recurring expenses or revenue patterns. By replicating budgets across different time frames, users can save time and effort while maintaining consistency in their financial planning. This not only simplifies the budgeting workflow but also enables businesses to adapt their financial strategies seamlessly to changing market conditions.

QuickBooks’ budgeting features are designed to empower businesses of all sizes with comprehensive, customizable, and efficient tools for financial planning. Whether creating a budget, customizing categories, setting amounts, or copying budgets for multiple periods, QuickBooks provides a dynamic platform that aligns with the diverse needs of modern businesses.

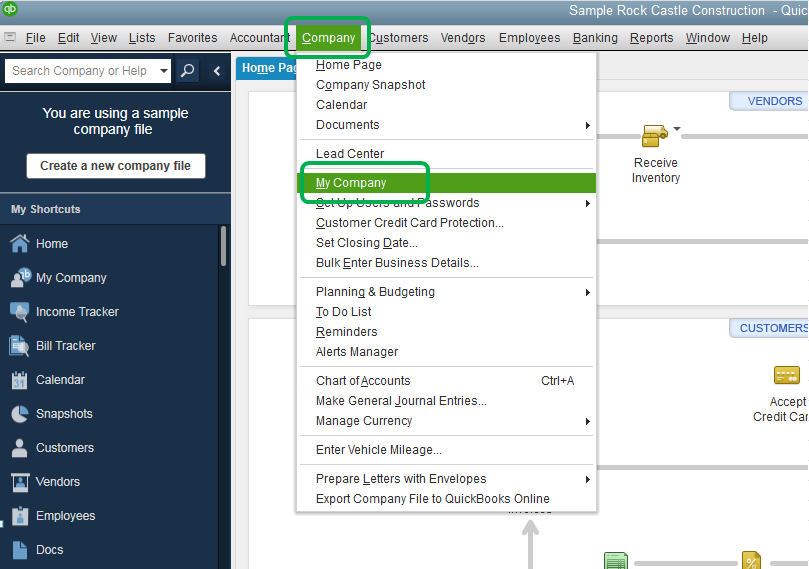

Navigating QuickBooks Budgeting Tool

Navigating QuickBooks Budgeting Tools can be a comprehensive process that involves several key steps. In this overview, we’ll break down the process into distinct sections to provide a more detailed understanding.

Budget Overview:

One of the initial steps in navigating QuickBooks Budgeting Tools is accessing the budget center. This centralized hub serves as the command center for all budget-related activities. Users can easily create, modify, and manage budgets from this interface. It acts as a user-friendly platform, streamlining the budgeting process for businesses of all sizes.

Once inside the budget center, users are presented with the ability to review budget vs. actual reports. This feature is crucial for assessing the financial health of a company. By comparing the planned budget to the actual financial performance, users can identify areas of success and potential areas for improvement. QuickBooks generates detailed reports, allowing for a comprehensive analysis of financial data.

Analyzing variances and discrepancies is another essential aspect of the budgeting process within QuickBooks. The system provides tools to meticulously examine the differences between budgeted and actual figures. Understanding these variances is crucial for making informed decisions and adjusting future budgets accordingly. Users can identify trends, anomalies, and potential financial risks by delving into these variances.

To enhance the user experience and facilitate a deeper understanding, QuickBooks incorporates graphical representations of budget data. Visualizations such as charts and graphs provide an intuitive way to interpret financial information. These graphical representations make it easier for users to communicate insights and trends to stakeholders who may not have an in-depth understanding of financial data. It adds a layer of accessibility to the budgeting process, making it more inclusive for all members of a business team.

Navigating QuickBooks Budgeting Tools involves accessing the budget center, reviewing budget vs. actual reports, analyzing variances and discrepancies, and utilizing graphical representations. Each of these components plays a crucial role in the overall budgeting process, providing users with a comprehensive toolkit for effective financial management.

Budgeting by customer, class, and location

Budgeting by customer, class, and location is a strategic financial approach that involves segmenting budgets to facilitate detailed analysis. This method recognizes that different aspects of a business may have unique financial requirements and performance indicators. By breaking down budgets into specific customer segments, product classes, and geographical locations, companies can gain a more comprehensive understanding of their financial landscape.

One key advantage of this approach is the ability to manage multiple budgets effectively. Rather than relying on a single, overarching budget, organizations can create tailored budgets for each customer segment, product class, and location. This allows for a more nuanced and targeted allocation of resources, ensuring that financial planning aligns with the specific needs and characteristics of each segment of the business.

Tracking performance across different dimensions is another crucial aspect of budgeting by customer, class, and location. By monitoring financial metrics within each segmented category, organizations can identify trends, assess the effectiveness of strategies, and make informed decisions to optimize performance. This level of granularity provides a clearer picture of how different parts of the business contribute to overall financial health.

Furthermore, budgeting by customer, class, and location enhances granularity to meet specific business needs. It allows companies to customize their financial planning based on the unique challenges and opportunities associated with different customer groups, product classes, and geographical locations. This flexibility is particularly valuable in industries where diverse customer preferences, product categories, or regional variations significantly impact financial outcomes.

Budgeting by customer, class, and location is a sophisticated financial management approach that involves breaking down budgets into distinct segments. This method empowers organizations to manage multiple budgets efficiently, track performance across various dimensions, and enhance granularity to address specific business needs. By adopting this approach, businesses can achieve a more precise and tailored approach to financial planning, leading to improved overall performance and strategic decision-making.

Advanced Budgeting Strategies:

In today’s dynamic business environment, advanced budgeting strategies are essential for organizations to adapt and thrive. Two noteworthy approaches are Rolling Forecasts and Zero-Based Budgeting, each offering distinct advantages in managing financial resources.

Rolling Forecasts:

One cutting-edge budgeting strategy is the implementation of Rolling Forecasts. Unlike traditional static budgets, rolling forecasts provide a dynamic approach to financial planning. This method involves continuous updates based on real-time data, allowing organizations to adapt swiftly to changing business landscapes. By adjusting forecasts based on market trends and emerging opportunities or challenges, companies can proactively make informed decisions.

The integration of rolling forecasts into financial planning ensures that budgetary allocations are aligned with current organizational priorities. This adaptability is particularly crucial in industries where market conditions evolve rapidly. By embracing dynamic forecasting, companies gain a competitive edge by staying ahead of the curve and avoiding potential pitfalls.

Zero-Based Budgeting:

Another advanced budgeting strategy is Zero-Based Budgeting (ZBB). This method takes a radical approach by resetting budgets to zero at the beginning of each fiscal year. Unlike incremental budgeting, where past budgets serve as a baseline, ZBB requires a thorough evaluation of the necessity of every expense. This approach encourages a cost-conscious decision-making culture, as each expenditure must be justified based on current needs and strategic priorities.

Zero-based budgeting is a powerful tool for aligning budgets with strategic objectives. By scrutinizing every line item and eliminating unnecessary expenses, organizations can ensure that financial resources are allocated efficiently and effectively. This strategic alignment fosters a culture of financial discipline and ensures that budgetary decisions contribute directly to the achievement of organizational goals.

Both Rolling Forecasts and Zero-Based Budgeting represent sophisticated approaches to financial planning. While Rolling Forecasts enhance adaptability and responsiveness to market dynamics, Zero-Based Budgeting promotes fiscal discipline and strategic alignment. Implementing a combination of these advanced budgeting strategies allows organizations to navigate uncertainties while optimizing the allocation of financial resources for sustained success.

QuickBooks Forecasting Capabilities:

QuickBooks, a widely used accounting software, offers robust forecasting capabilities that empower businesses to make informed financial decisions. This includes leveraging historical data analysis as a foundational element of its forecasting features.

Historical Data Analysis:

One key aspect of QuickBooks forecasting is its ability to analyze historical financial data. By delving into past performance, the software helps businesses identify trends and patterns. This retrospective analysis is crucial for understanding the financial trajectory of a company, providing valuable insights into revenue streams, expenditure patterns, and overall financial health. QuickBooks goes beyond basic data analysis, incorporating sophisticated algorithms to extract meaningful information from historical performance. This, in turn, enhances the accuracy of forecasts by basing predictions on concrete, data-driven insights.

Cash Flow Forecasting:

QuickBooks excels in cash flow forecasting, a vital component for businesses to maintain financial stability. The software enables users to project both cash inflows and outflows over a specified period. This functionality is instrumental in managing working capital effectively, as it allows businesses to anticipate and plan for upcoming financial commitments. By forecasting cash flows, QuickBooks aids in avoiding cash flow gaps and shortages, thereby preventing potential disruptions to daily operations. Moreover, the integration of cash flow forecasts with budgeting features provides a comprehensive financial overview, aligning short-term and long-term financial goals.

QuickBooks stands out for its forecasting capabilities, leveraging historical data analysis to provide a solid foundation for predictions. The software’s cash flow forecasting features further contribute to effective financial management, allowing businesses to navigate challenges and capitalize on opportunities with greater confidence. By integrating historical insights and forward-looking projections, QuickBooks supports businesses in making strategic and well-informed financial decisions.

Integration with QuickBooks Ecosystem:

Integration with the QuickBooks ecosystem is crucial for businesses looking to streamline their financial processes and enhance overall efficiency. This integration can be broadly categorized into two main components: QuickBooks Online and Desktop Integration, and Third-Party App Integration.

QuickBooks Online and Desktop Integration:

- Seamless Data Synchronization:

One of the primary advantages of integrating with QuickBooks is achieving seamless data synchronization between different platforms. Whether using QuickBooks Online or Desktop, this integration ensures that financial data is consistently updated in real-time. This synchronization eliminates the need for manual data entry, reducing the risk of errors and saving valuable time.

- Real-Time Updates Across Platforms:

Integration facilitates real-time updates, allowing teams to access the most current financial information instantly. This real-time visibility enhances decision-making processes, as stakeholders can make informed choices based on the latest data. QuickBooks integration ensures that all team members are on the same page, fostering collaboration and improving overall organizational efficiency.

- Enhancing Collaboration Among Team Members:

The integration of QuickBooks promotes collaboration among team members by providing a unified platform for financial data. Team members can easily access, share, and collaborate on financial information, fostering a more transparent and collaborative work environment. This collaborative approach helps to streamline communication and ensures that everyone is working with the same up-to-date information.

- Utilizing the Full Potential of the QuickBooks Ecosystem:

Integration allows businesses to leverage the full potential of the QuickBooks ecosystem. Whether utilizing features in QuickBooks Online or taking advantage of the robust capabilities of QuickBooks Desktop, integration ensures that businesses can make the most of the tools available. This comprehensive utilization of the QuickBooks ecosystem contributes to improved efficiency and effectiveness in financial management.

Third-Party App Integration:

- Expanding Functionality with Add-ons:

In addition to native QuickBooks capabilities, businesses can expand their functionality by integrating third-party applications. These add-ons can provide specialized features, catering to specific business needs. Whether it’s advanced reporting, inventory management, or customer relationship management, third-party app integration enhances the overall capabilities of QuickBooks, tailoring the solution to the unique requirements of the business.

- Integrating Industry-Specific Tools:

Different industries have unique requirements, and third-party app integration allows businesses to incorporate industry-specific tools seamlessly. This ensures that businesses can adhere to industry standards and regulations while maintaining a cohesive and efficient financial management system. Integration with industry-specific tools enhances precision and compliance in financial operations.

- Streamlining Workflows with Complementary Applications:

Third-party app integration enables businesses to streamline workflows by integrating complementary applications. Whether it’s connecting payment processing systems, expense management tools, or project management platforms, integration ensures a smooth flow of data across various business functions. This streamlining of workflows contributes to increased productivity and operational efficiency.

- Maximizing the Value of QuickBooks Through Integration:

Third-party app integration plays a crucial role in maximizing the value of QuickBooks. By incorporating specialized tools and applications that align with business goals, organizations can create a customized and powerful financial management system. This integration strategy ensures that businesses get the most out of their investment in QuickBooks, optimizing processes and driving overall business success.

Overcoming Common Challenges:

Data Accuracy and Consistency:

Ensuring the accuracy and consistency of data is paramount for effective decision-making. Implementing best practices for data input is a foundational step. This involves establishing standardized procedures and guidelines for data entry, minimizing the risk of errors. Regular audits and reconciliations further contribute to maintaining data integrity. These periodic checks help identify and rectify any discrepancies, ensuring that the data remains reliable over time. Addressing discrepancies promptly is crucial to prevent the propagation of errors and to uphold the trustworthiness of the information. Additionally, investing in staff training programs for accurate data entry equips the team with the necessary skills, fostering a culture of data precision within the organization.

Adapting to Market Changes:

In the dynamic landscape of business, adapting to market changes is a constant challenge. Employing flexible budgeting strategies is key to navigating uncertainties. This involves creating budgets that can be adjusted easily in response to changing circumstances. Scenario planning is another valuable tool, enabling organizations to anticipate and prepare for various potential scenarios.

By aligning budgets with market dynamics, businesses can better allocate resources based on current trends and demands. Quick adjustment to changing economic conditions is a critical aspect of adaptability. This requires a proactive approach, with the ability to reassess and reallocate resources promptly to stay resilient in the face of market fluctuations. Successful adaptation to market changes demands agility and a strategic mindset, enabling organizations to thrive in volatile environments.

Success Stories of Businesses Using QuickBooks for Budgeting:

QuickBooks has proven to be a powerful tool for businesses seeking to enhance their budgeting processes. Numerous success stories highlight the transformative impact it has had on organizations across various industries.

Increased Financial Visibility:

One common theme among businesses utilizing QuickBooks for budgeting is the significant improvement in financial visibility. The software’s robust features allow businesses to gain a comprehensive understanding of their financial landscape. Real-time updates and detailed financial reports enable stakeholders to monitor cash flow, expenses, and revenue with greater accuracy and efficiency. This enhanced visibility empowers organizations to make informed decisions, identify potential financial risks, and seize new opportunities.

Streamlined Budgeting Processes:

Businesses often grapple with complex and time-consuming budgeting procedures. QuickBooks addresses this challenge by providing a streamlined and user-friendly platform for budget creation and management. Users can easily input, track, and analyze financial data, reducing the manual effort required in traditional budgeting methods. Automation features, such as recurring transactions and budget templates, contribute to increased efficiency, freeing up valuable time for strategic planning and analysis.