QuickBooks Mobile App Setup

Focus Keywords

Introduction to QuickBooks Mobile App Setup: Unleashing Productivity in Your Pocket

In today’s fast-paced business world, agility and accessibility are no longer luxuries, but necessities. That’s where QuickBooks Mobile App steps in, revolutionizing the way you manage your finances – right from your smartphone or tablet. Let’s delve into the evolution of QuickBooks on mobile platforms and explore the key benefits that await you as you unlock this pocket-sized power tool for financial management.

The Evolution of QuickBooks Mobility: From Desktops to Fingertips

Remember the days chained to your desk, navigating spreadsheets and reports? QuickBooks recognized the need for mobility in a dynamic financial landscape and embraced the shift towards mobile technology. The QuickBooks Mobile App is the culmination of this transformation, offering convenient on-the-go access to your company’s financial data, empowering you to manage your business remotely without compromising efficiency or accuracy.

Mobile accessibility is no longer a “nice-to-have” but a vital element for modern businesses. Whether you’re a solopreneur juggling tasks on the go or a multi-location venture needing seamless communication, the QuickBooks Mobile App bridges the gap between physical borders and financial data. Imagine capturing receipts while at a vendor, sending invoices instantly after closing a deal, or monitoring key financials during a client meeting – all seamlessly from your mobile device.

Key Benefits of Using the QuickBooks Mobile App: Unlock a More Agile and Informed Business

The QuickBooks Mobile App isn’t just about convenience; it’s about empowering you to make informed decisions, streamline workflows, and collaborate effectively with your team, all at your fingertips. Here are just a few ways the app unlocks agility and insight:

- On-the-go Financial Management:

- Capture expenses instantly: Snap pictures of receipts and automatically upload them for expense tracking, eliminating the need for manual data entry and the clutter of paper trails.

- Invoicing and payments made simple: Create and send professional invoices directly from your phone, accept payments online, and track outstanding balances on the go.

- Monitor cash flow in real-time: Gain instant insights into your financial health with key metrics like income, expenses, and profits readily available at a glance.

- Real-time Access to Business Data:

- Say goodbye to data silos: Get instant access to your QuickBooks data, including customer information, inventory levels, and transaction history, wherever you are.

- Stay informed with reports and dashboards: View critical financial reports and customized dashboards on your mobile device, allowing you to make data-driven decisions anytime, anywhere.

- Improved visibility for better budgeting: Track project budgets and stay on top of spending with real-time expense tracking and budget alerts.

- Enhanced Collaboration among Team Members:

- Streamline approvals and workflows: Approve invoices, purchase orders, and other requests directly from your phone, keeping your team moving forward even when you’re not at your desk.

- Communicate and collaborate with ease: Share reports, notes, and updates with your team, fostering transparency and seamless collaboration on financial tasks.

- Centralized platform for document management: Access important documents like invoices, receipts, and contracts directly from the app, ensuring your team has the latest information at their fingertips.

The QuickBooks Mobile App is more than just a mobile version of its desktop counterpart; it’s a powerful tool that unlocks a new level of agility, data-driven decision-making, and collaborative efficiency for your business.

Getting Started with QuickBooks Mobile App: Unlocking Financial Freedom on Your Device

Now that you’ve glimpsed the transformative potential of the QuickBooks Mobile App, let’s dive into the practical steps to bring this powerful tool to life. This section will guide you through the seamless setup process, ensuring you can unlock the app’s full potential and experience financial freedom on your mobile device.

Downloading and Installing the App: Your Gateway to Mobile Financial Management

Accessing the app is just a few clicks away, regardless of your preferred mobile platform:

- iOS Devices:

Open the App Store and search for “QuickBooks Mobile App.”

Choose the version compatible with your iOS device and QuickBooks software.

Tap “Get” and follow the on-screen instructions to download and install the app.

- Android Devices:

Visit Google Play and search for “QuickBooks Mobile App.”

Ensure your device meets the minimum system requirements specified in the app description.

Tap “Install” and follow the on-screen prompts to complete the installation process.

Compatibility and System Requirements:

Before embarking on your mobile journey, ensure your device and software meet the minimum compatibility requirements:

- iOS: Compatible with iPhone, iPad, and iPod touch devices running iOS 13.0 or later.

- Android: Compatible with Android devices running OS 5.0 or later.

- QuickBooks Software: The app seamlessly integrates with QuickBooks Online, QuickBooks Self-Employed, and QuickBooks Desktop versions 2016 and later.

Remember, the latest versions of both the app and your QuickBooks software are recommended for optimal performance and security.

Logging In and Setting Up Your Account: Bridging the Gap between Mobile and Desktop

With the app downloaded, it’s time to connect your mobile world with your existing QuickBooks data:

- Secure Login Procedures:

Launch the app and choose the appropriate QuickBooks software you’re using (e.g., QuickBooks Online, QuickBooks Desktop).

Enter your existing QuickBooks login credentials, ensuring a secure connection and access to your financial information.

If you haven’t already, create a strong and unique PIN or enable fingerprint/facial recognition for additional security on your mobile device.

- Account Configuration for Seamless Integration:

Once logged in, the app will guide you through a brief setup process, prompting you to choose the company you want to manage on your mobile device.

You can choose to sync all your company data or select specific data sets for mobile access, ensuring efficient performance and optimal data usage.

Familiarize yourself with the app’s interface and explore its various features, including expense tracking, invoice creation, and real-time financial reports.

Tip: Consider enabling automatic data synchronization to ensure your mobile app and desktop software are always in sync, providing you with the latest financial information at your fingertips.

By following these simple steps, you’ve successfully downloaded, installed, and configured the QuickBooks Mobile App.

Navigating the QuickBooks Mobile App Interface: Your Pocket-Sized Financial Command Center

With the app downloaded and configured, it’s time to explore the intuitive interface and discover how it empowers you to manage your finances on the go. Let’s dive deep into the functionalities and customization options available, transforming your mobile device into a powerful financial command center.

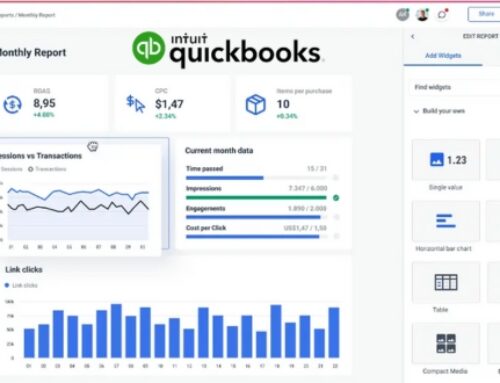

Overview of the Dashboard: Your Financial Snapshot at a Glance

The dashboard serves as your central hub, offering a clear and concise snapshot of your financial health. Here’s what you can expect:

- Key Metrics: Track essential financial indicators like income, expenses, profit, and bank balances in real-time.

- Recent Transactions: View a list of your latest transactions, including invoices, payments, and expenses, for quick reference.

- Due Dates and Reminders: Stay on top of deadlines with upcoming invoice due dates and payment reminders displayed prominently.

- Quick Actions: Access frequently used features like creating invoices, capturing expenses, and recording payments with just a few taps.

Customization Options for a Personalized Experience:

- Rearrange Dashboard Widgets: Drag and drop widgets to prioritize the information most relevant to you.

- Choose Your Theme: Select from different themes to personalize the app’s appearance and create a comfortable working environment.

- Set Up Notifications: Decide which notifications you want to receive, ensuring you stay informed about important financial events without information overload.

Accessing Core Features: Streamlining Your Financial Tasks on the Go

The QuickBooks Mobile App empowers you to manage key financial tasks directly from your mobile device:

- Invoicing and Payment Tracking:

- Create and Send Invoices: Craft professional invoices on the go and send them directly to clients via email or text message.

- Track Payments and Outstanding Balances: Monitor invoice status, track payments received, and send reminders for overdue payments.

- Accept Payments Securely: Integrate with online payment gateways to accept payments directly through the app, streamlining your cash flow.

- Expense Management and Receipt Capturing:

- Capture Expenses Instantly: Snap pictures of receipts with your phone’s camera and automatically upload them into the app for expense tracking.

- Categorize Expenses Easily: Choose from pre-defined expense categories or create your own for detailed tracking and budgeting.

- Track Mileage Automatically: Utilize the app’s built-in mileage tracker to record business trips and simplify expense reporting.

- Customer and Vendor Management:

- Access Customer Information: View customer details, contact information, and transaction history directly from the app.

- Create and Manage Quotes: Generate and send quotes to potential clients, streamlining the sales process from your mobile device.

- Manage Vendor Relationships: Track vendor information, purchases, and outstanding bills, ensuring smooth communication and payment processes.

These are just a few of the powerful features available within the QuickBooks Mobile App. As you explore its functionalities further, you’ll discover tools for managing inventory, generating reports, and gaining valuable insights into your business performance – all from the palm of your hand.

Remember: The app’s interface is designed to be user-friendly and intuitive. Don’t hesitate to experiment with different features and customize the app to fit your specific needs and preferences.

Mobile Invoicing and Payment Features: Get Paid Faster with QuickBooks Mobile App

The QuickBooks Mobile App isn’t just about keeping track of your finances; it’s about getting paid faster and managing your cash flow efficiently. Let’s delve deeper into the powerful mobile invoicing and payment features, empowering you to send professional invoices, accept payments securely, and stay on top of outstanding balances – all from your smartphone or tablet.

Creating Invoices on the Mobile App: Professional Invoicing Made Easy

Say goodbye to clunky desktop software and embrace mobile invoice creation:

Step-by-Step Guide:

- Select “Create Invoice” from the app’s home screen.

- Choose the customer you’re invoicing from your existing contact list.

- Add items or services with descriptions, quantities, and prices.

- Apply discounts or taxes as needed.

- Customize the invoice layout with your logo, branding colors, and messaging.

- Preview the invoice before sending it electronically via email or text message.

Customization Options for Professional-Looking Invoices:

- Branding and Design: Upload your company logo, choose fonts and colors, and add custom messages to create invoices that reflect your brand identity.

- Payment Options: Include clear and prominent payment instructions, offering your customers various options like online payments, bank transfers, or checks.

- Terms and Conditions: Add terms and conditions to your invoices, outlining payment deadlines, late fees, and dispute resolution procedures.

Accepting Payments: Get Paid Faster with Secure Options

The QuickBooks Mobile App integrates seamlessly with popular payment gateways, allowing your customers to pay you quickly and securely:

- Supported Gateways: Choose from popular options like PayPal, Stripe, Square, and more, depending on your region and preferences.

- Secure Transactions: All payment information is encrypted and processed through secure servers, ensuring data protection and peace of mind.

- Instant Notifications: Receive instant notifications when a payment is received, keeping you updated on your cash flow in real-time.

Ensuring Secure and Efficient Payment Processing:

- Clearly Display Payment Options: Make it easy for your customers to choose their preferred payment method by prominently displaying available options on your invoices.

- Offer Recurring Payments: If applicable, enable recurring payment options for subscriptions or ongoing services to streamline billing and collection.

- Send Payment Receipts: Automatically send payment receipts to your customers after each transaction, fostering transparency and building trust.

Automated Reminders and Late Payment Tracking: Stay on Top of Your Cash Flow

The QuickBooks Mobile App helps you stay ahead of overdue payments with smart features:

- Automated Reminders: Schedule automatic email or text message reminders for outstanding invoices, gently nudging your customers to settle their dues.

- Late Payment Tracking: View a clear list of overdue invoices, track the amount owed, and monitor aging periods for effective collection efforts.

- Customizable Templates: Create and customize reminder templates with different messaging and escalation options to suit your communication style.

By leveraging the mobile invoicing and payment features, you can:

- Simplify and expedite invoice creation.

- Get paid faster with secure and convenient payment options.

- Minimize late payments with automated reminders and tracking.

- Improve your cash flow and gain greater control over your finances.

The QuickBooks Mobile App is constantly evolving, adding new features and functionalities to enhance your invoicing and payment experience. Stay informed about updates and explore the app’s capabilities to unlock its full potential for efficient financial management on the go.

Expense Management and Receipt Capture: Streamlining Your Finances on the Go

The QuickBooks Mobile App takes the burden out of expense management, allowing you to capture receipts, track expenses, and maintain accurate financial records – all from your mobile device. Let’s dive into the powerful features that transform your phone into a pocket-sized expense tracking powerhouse.

Capturing Receipts Using Mobile Devices: Say Goodbye to Paper Clutter

No more scrambling for receipts or filling out expense reports manually. The app offers various ways to capture receipts quickly and efficiently:

- Snap and Upload: Simply snap a picture of your receipt with your phone’s camera. The app automatically uploads the image and extracts key information like date, vendor, amount, and even tax details.

- Email Forwarding: Forward your receipts directly to the app’s designated email address. It will automatically process the information and integrate it into your expense records.

- Scan and Import: Use the app’s built-in scanner to scan paper receipts. The app will extract relevant data and eliminate the need for manual entry.

Automatic Data Extraction and Categorization:

The app’s intelligent technology goes beyond just capturing images. It automatically extracts key information from your receipts, including:

- Date and Vendor: No more deciphering faded receipts. The app accurately identifies the date and vendor name, saving you time and effort.

- Amount and Tax: Say goodbye to manual calculations. The app automatically reads the amount and tax information, ensuring accurate expense tracking.

- Category Suggestions: The app suggests relevant expense categories based on the extracted information, helping you organize your expenses efficiently.

Linking Expenses to Transactions: Accuracy and Clarity in Financial Records

The captured receipts are more than just images; they become valuable data points linked to your financial transactions. Here’s how the app helps:

- Attach to Invoices or Reimbursements: Associate captured receipts with specific invoices or reimbursements, ensuring clear documentation and audit-proof records.

- Project and Client Tracking: Link expenses to specific projects or clients, providing valuable insights into project costs and client profitability.

- Mileage Tracking: Utilize the app’s built-in mileage tracker to automatically record business trips and seamlessly integrate mileage expenses into your financial records.

Ensuring Accuracy in Financial Record-Keeping:

The app’s automatic data extraction and linking features minimize manual data entry, reducing the risk of errors and inconsistencies. This ensures accurate and reliable financial records, crucial for efficient budgeting, tax preparation, and financial reporting.

Additional Benefits:

- Reduced Paper Clutter: Ditch the paper trail and embrace the convenience of digital receipts. Your phone becomes your central hub for all expense documentation.

- Real-time Expense Tracking: Monitor your expenses in real-time and stay on top of your budget with instant updates as you capture receipts.

- Improved Reporting and Analysis: Gain valuable insights into your spending patterns by analyzing categorized expenses and generating reports on specific projects, clients, or time periods.

By leveraging the expense management and receipt capture features of the QuickBooks Mobile App, you can transform your financial management. You’ll save time, minimize errors, gain valuable insights, and ultimately, achieve greater control over your business finances, all from the palm of your hand.

Collaborative Features for Teams on the Go: Stay Connected, Stay Productive

The QuickBooks Mobile App isn’t just for solopreneurs; it’s also a powerful tool for collaborative finance management within teams. Let’s explore the features that empower your team to work together seamlessly, stay informed, and keep your financial operations running smoothly, even when you’re all on the go.

Multi-User Access and Permissions: Sharing the Financial Responsibility

Granting access to the app to your team members unlocks a world of collaborative possibilities:

- Adding Users: Easily add new users by inviting them through email or phone number, ensuring everyone on your team has the access they need.

- Customizing Permissions: Control the level of access each user has. Assign roles like “viewer,” “editor,” or “approver” to restrict or grant access to specific features and functions, safeguarding sensitive information.

- Audit Trails and Track Changes: Monitor user activity and track changes made to data within the app. This enhances accountability and ensures transparency within your team.

Communication within the App: Real-time Collaboration in Your Pocket

The app fosters seamless communication and collaboration, keeping your team on the same page:

- In-App Messaging: Chat directly with colleagues within the app, discuss invoices, expenses, and other financial matters without switching to another platform.

- Comments and Notes: Leave comments and notes on invoices, receipts, and transactions for real-time feedback and clarifications, eliminating confusion and delays.

- Notifications and Alerts: Stay informed about important updates with real-time notifications for actions like invoice approvals, expense submissions, and payment receipts.

Benefits of Collaborative Features:

- Improved Efficiency: Streamline workflows and reduce bottlenecks by assigning tasks and collaborating on financial processes directly within the app.

- Enhanced Visibility: Gain a holistic view of your finances with everyone’s contributions readily accessible.

- Reduced Errors: Shared responsibility and real-time communication minimize errors and miscommunication, leading to more accurate financial data.

- Increased Team Communication: Foster a culture of collaboration and open communication, empowering your team to work together effectively.

Remember: The specific collaborative features and access levels available may vary depending on your QuickBooks subscription plan. Explore the options and choose the one that best suits your team’s needs and security requirements.

By leveraging the collaborative features of the QuickBooks Mobile App, you can empower your team to work together seamlessly, stay informed, and ultimately achieve greater financial success.

Security Measures and Best Practices: Safeguarding Your Mobile Finances

While the QuickBooks Mobile App empowers you with on-the-go financial management, safeguarding your sensitive financial information should always be a top priority. Let’s explore essential security measures and best practices to ensure your mobile financial fortress remains impenetrable.

Implementing Two-Factor Authentication: Adding an Extra Layer of Defense

Think of two-factor authentication as a double lock on your financial data. In addition to your password, it requires an additional verification step, significantly reducing the risk of unauthorized access. Here’s how it works:

- Enable the Feature: Choose from various options like receiving a one-time code via text message or using a secure authentication app.

- Additional Verification: When logging in, enter your password and the code received through your chosen method, confirming your identity and granting access.

Benefits of Two-Factor Authentication:

- Enhanced Security: Even if someone acquires your password, they cannot access your data without the additional verification code, significantly reducing the risk of unauthorized access.

- Peace of Mind: Knowing your financial information is protected with an extra layer of security allows you to manage your finances with confidence, even on the go.

- Ease of Use: Most two-factor authentication methods are simple and convenient, requiring just a few extra taps or a quick text message response.

Regular Updates and Maintenance: Keeping Your Financial Fortress Strong

Just like any software, the QuickBooks Mobile App needs regular care and attention to maintain optimal performance and security:

- App Updates: Ensure you’re always running the latest version of the app. Updates often include security patches and bug fixes, addressing potential vulnerabilities and protecting your data.

- Device Security: Keep your mobile device’s operating system updated with the latest security patches and consider using a strong password or biometric lock to further protect your device and the app.

- Data Backup: Regularly back up your QuickBooks data to a secure cloud location. This ensures you have a copy of your information in case of accidental data loss or device malfunction.

- Suspicious Activity: Be vigilant and report any suspicious activity within the app, such as unauthorized login attempts or unfamiliar transactions, to QuickBooks immediately.

Remember: Security is an ongoing process. By proactively implementing these measures and best practices, you can create a robust security posture for your mobile finances and ensure your financial data remains safe and secure, even as you manage your business on the go.

Future Updates and Features: Unleashing the Potential of Your Mobile Financial Hub

The QuickBooks Mobile App is constantly evolving, striving to empower users with even more features and functionalities. Let’s take a peek into the exciting future of your mobile financial command center:

Upcoming Enhancements in QuickBooks Mobile App:

- Enhanced Analytics and Reporting: Gain deeper insights into your finances with advanced reporting tools and data visualization dashboards, allowing you to make data-driven decisions easily on the go.

- Integrated Budgeting and Forecasting: Track your progress against budgets, create custom forecasts, and receive alerts for potential deviations, ensuring you stay on track with your financial goals.

- Inventory Management on the Go: Manage your inventory levels, track stock movements, and receive low-stock alerts directly from your mobile device, streamlining your operations and preventing unexpected inventory shortages.

- Bill Pay Automation: Schedule automatic bill payments for eligible bills, simplifying your financial workflow and eliminating the risk of late payments and associated penalties.

- Expanded Integrations: Connect with more third-party apps and services you rely on, creating a seamless ecosystem for managing your business finances from a single platform.

Staying Informed about the Latest Updates:

- QuickBooks Blog: Follow the official QuickBooks blog for updates on new features, product releases, and helpful tips for using the app effectively.

- In-App Notifications: The app will notify you about available updates and new features, ensuring you stay informed and can leverage the latest functionalities.

- QuickBooks Support: Contact QuickBooks support through various channels for assistance with any questions or concerns you may have about the app and its features.

By keeping an eye on future developments, you can ensure you’re always making the most of your QuickBooks Mobile App experience. Embrace the continuous evolution and unlock the full potential of your mobile financial hub.

Conclusion: Embracing Mobile Efficiency with QuickBooks

In conclusion, the QuickBooks Mobile App is the key to unlocking unparalleled efficiency and flexibility for businesses on the move. By seamlessly integrating financial management with mobile accessibility, QuickBooks empowers users to stay connected and make informed decisions wherever they go. The ability to create invoices, track expenses, and collaborate with teams on the fly ensures a dynamic and responsive approach to business. With robust security measures like two-factor authentication, businesses can trust in the safety of their financial data. As technology evolves, QuickBooks continues to enhance its mobile app, promising a future of even greater convenience and functionality. Embrace the power of QuickBooks Mobile, streamline your financial operations, and take charge of your business with confidence.