Introduction

Overview of Google Workspace for Financial Services

In the dynamic and ever-evolving world of financial services, Google Workspace for Financial Services emerges as a transformative force, empowering financial institutions and professionals to navigate the complexities of the modern financial landscape with agility and efficiency. This comprehensive suite of cloud-based tools and services transcends mere productivity, serving as a catalyst for innovation and transformation within the financial realm.

At the heart of Google Workspace for Financial Services lies a deep understanding of the unique needs and challenges faced by financial institutions and professionals. From streamlining operations and enhancing collaboration to fostering data-driven decision-making and ensuring robust security, Google Workspace provides a holistic solution that addresses the multifaceted demands of the financial industry.

Benefits of using Google Workspace for Financial Services

The adoption of Google Workspace for Financial Services brings a multitude of benefits to financial institutions and professionals, empowering them to operate with greater efficiency, effectiveness, and security. Among the key benefits include:

- Streamlined Operations and Enhanced Productivity: Google Workspace automates repetitive tasks, streamlines workflows, and facilitates seamless collaboration, enabling financial teams to work smarter and achieve more in less time.

- Real-time Data Analysis and Insights: Financial institutions gain immediate access to real-time financial data and leverage advanced analytics tools to extract valuable insights, enabling informed decision-making and risk mitigation.

- Robust Financial Management Capabilities: Google Workspace seamlessly integrates with financial management tools, providing a comprehensive platform for managing financial data, tracking performance metrics, and ensuring compliance with regulatory requirements.

- Enhanced Security and Data Protection: Google Workspace safeguards sensitive financial data with industry-leading security measures, ensuring compliance with data privacy regulations and building client trust.

Empowered Financial Professionals with Continuous Learning: Google Workspace fosters a culture of continuous learning, providing access to on-demand training resources, online communities, and the latest financial trends and technologies, empowering financial professionals to stay at the forefront of their field.

Emerging trends in Google Workspace for Financial Services

As the financial landscape continues to evolve, Google Workspace remains at the forefront of innovation, incorporating cutting-edge tools and features to empower financial institutions and professionals. Some of the emerging trends in Google Workspace for Financial Services include:

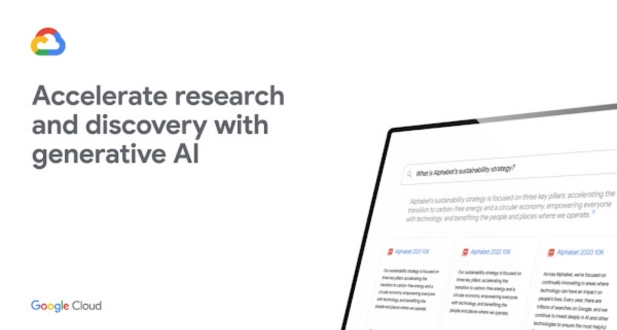

- AI-powered Financial Tools: Leverage AI-driven tools for financial data analysis, fraud detection, and risk management, enhancing decision-making and mitigating risks.

- Integrated Financial Data Platforms: Consolidate financial data from disparate sources into a unified platform, providing a holistic view of financial performance and enabling data-driven insights.

- Regulatory Compliance Automation: Automate regulatory compliance processes, ensuring adherence to complex financial regulations and reducing compliance costs.

- Enhanced Customer Engagement and Communication: Utilize secure client portals, real-time communication channels, and personalized data insights to foster deeper client relationships and deliver exceptional customer experiences.

- Data-driven Financial Insights for Strategic Decision-Making: Transform financial data into actionable insights, enabling data-driven strategic decision-making and risk management.

By staying abreast of these emerging trends and embracing innovation, Google Workspace empowers financial institutions and professionals to adapt to the ever-changing financial landscape and position themselves for long-term success.

Enhancing Financial Collaboration and Communication

In the intricate world of financial services, seamless communication and collaboration are paramount for success. Google Workspace for Financial Services empowers financial institutions and professionals to foster a culture of open communication and collaboration, enabling them to work together more effectively, share sensitive financial information securely, and deliver exceptional results to clients.

Streamlined Communication with Clients and Team Members

Google Workspace facilitates seamless communication across all levels of the organization, breaking down silos and ensuring that vital information flows freely. With its suite of integrated communication tools, including Gmail, Calendar, Chat, and Meet, financial teams can engage in real-time discussions, share updates, and schedule meetings with ease.

For client communication, Google Workspace provides secure and professional channels, such as encrypted email and video conferencing, allowing financial professionals to engage with clients in a trusted and transparent manner. This fosters stronger client relationships, builds trust, and enhances the overall client experience.

Secure Client Portals for Sharing Sensitive Financial Information

Financial institutions handle a vast amount of sensitive client information, and safeguarding this data is of utmost importance. Google Workspace addresses this need with secure client portals, providing a dedicated space for sharing confidential documents, exchanging messages, and collaborating on financial matters.

Client portals offer several benefits:

- Enhanced Security: Client portals utilize industry-leading security measures, such as encryption and access controls, to protect sensitive financial information.

- Centralized Document Management: Client portals serve as a centralized repository for storing and sharing financial documents, ensuring easy access and organization.

- Real-time Communication and Collaboration: Client portals enable real-time communication and collaboration between financial professionals and clients, facilitating efficient problem-solving and decision-making.

- Transparency and Trust: Client portals foster transparency and trust by providing clients with secure access to their financial information and ongoing updates.

Real-time Collaboration on Financial Documents and Reports

Financial decisions often rely on accurate and up-to-date financial data. Google Workspace enables real-time collaboration on financial documents and reports, ensuring that all stakeholders have access to the most current information and can contribute to the decision-making process effectively.

With Google Docs, Sheets, and Slides, financial teams can work simultaneously on financial documents, reports, and presentations, making edits, providing feedback, and incorporating suggestions in real time. This collaborative approach streamlines the review and approval process, expedites decision-making, and ensures that financial documents are accurate and up-to-date.

By providing a suite of secure and collaborative communication tools, Google Workspace for Financial Services empowers financial institutions and professionals to foster a culture of open communication, streamline collaboration, and deliver exceptional results to their clients.

Empowering Financial Professionals with Data-Driven Insights

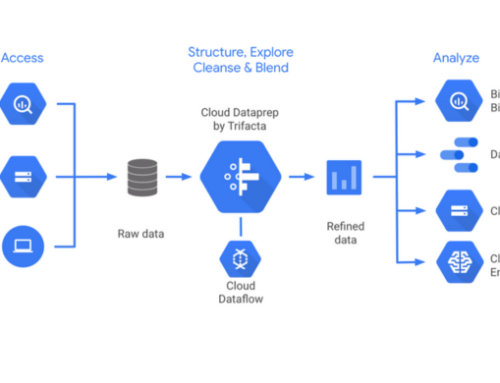

In the data-driven world of financial services, extracting insights from vast amounts of financial data is crucial for making informed decisions, identifying opportunities, and mitigating risks. Google Workspace for Financial Services empowers financial professionals with the tools and capabilities to harness the power of data analytics, transforming financial data into actionable insights that drive business success.

Leveraging Data Analytics for Financial Decision-Making

Google Workspace integrates seamlessly with powerful data analytics tools, enabling financial professionals to analyze financial data from multiple sources, identify trends and patterns, and extract meaningful insights. These insights can be used to inform a wide range of financial decisions, including:

- Investment Strategies: Analyze market data, identify undervalued assets, and make informed investment decisions to optimize returns.

- Risk Management: Identify potential risks, assess their impact, and develop mitigation strategies to protect the financial institution’s assets and reputation.

- Customer Segmentation and Targeting: Analyze customer behavior and preferences to segment the customer base, develop targeted marketing campaigns, and enhance customer engagement.

- Fraud Detection and Prevention: Analyze transaction data to identify anomalies and potential fraudulent activities, preventing financial losses and protecting customers.

- Performance Evaluation and Forecasting: Track financial performance, identify areas for improvement, and develop forecasts to guide future business decisions.

Obtaining Market Trends and Customer Behaviour Insights

Financial institutions that can effectively understand customer behavior and market trends are well-positioned to gain a competitive edge. Google Workspace provides financial professionals with the tools to analyze customer data, identify patterns and trends, and gain a deeper understanding of their customers’ needs and preferences.

By analyzing customer transaction data, financial institutions can identify spending habits, preferences, and potential areas for cross-selling or upselling. This information can be used to develop personalized marketing campaigns, enhance customer service, and build stronger customer relationships.

Additionally, Google Workspace enables financial professionals to monitor market trends, analyze competitor strategies, and identify emerging opportunities or threats. This proactive approach allows financial institutions to stay ahead of the curve, adapt to changing market dynamics, and make informed decisions that align with their strategic goals.

Utilizing Data Visualization Tools for Effective Financial Reporting

Effective communication of financial data is essential for stakeholders to understand the financial health of the organization and make informed decisions. Google Workspace provides data visualization tools that transform raw data into visually compelling charts, graphs, and dashboards, making it easy to communicate financial insights effectively.

Financial professionals can use data visualization tools to create custom reports, presentations, and dashboards that summarize financial performance, highlight key metrics, and showcase trends and patterns in a clear and concise manner. These visualizations can be shared with stakeholders, including investors, executives, and clients, enabling them to quickly grasp the financial status of the organization and make informed decisions.

By empowering financial professionals with data-driven insights, Google Workspace for Financial Services helps financial institutions make informed decisions, identify opportunities, mitigate risks, and deliver exceptional results to their clients.

Ensuring Compliance and Data Security

In the highly regulated environment of financial services, compliance and data security are paramount. Google Workspace for Financial Services prioritizes data security and compliance, providing financial institutions with the tools and capabilities to safeguard sensitive financial information, adhere to regulatory requirements, and protect their clients’ trust.

Meeting Regulatory Compliance Requirements with Robust Data Security Features

Google Workspace is built with a deep understanding of the complex regulatory landscape of financial services. It provides a suite of robust data security features that enable financial institutions to meet regulatory compliance requirements, including:

- Data Encryption: All data stored in transit and at rest is encrypted using industry-standard encryption algorithms, ensuring that sensitive financial information remains protected even in the event of a breach.

- Access Controls: Granular access controls allow financial institutions to restrict access to sensitive data based on user roles and permissions, ensuring that only authorized personnel can access critical information.

- Data Loss Prevention (DLP): DLP tools help prevent the accidental or intentional disclosure of sensitive data by identifying and blocking unauthorized data transfers or access attempts.

- Audit Logging: Comprehensive audit logging provides a detailed record of all user activity within Google Workspace, enabling financial institutions to track access to sensitive data and investigate potential security incidents.

- Regulatory Compliance Certification: Google Workspace is certified to meet numerous industry-specific compliance standards, including HIPAA, PCI DSS, and SOC 2, providing financial institutions with assurance that their data is protected to the highest standards.

Protecting Sensitive Financial Data with Advanced Security Controls

Google Workspace goes beyond basic data security measures to provide financial institutions with advanced security controls that protect sensitive financial data from a wide range of threats:

- Threat Detection and Prevention: Google’s advanced security infrastructure continuously monitors and analyzes network traffic to detect and prevent cyberattacks, including malware, phishing attempts, and unauthorized access attempts.

- Data Backup and Recovery: Regularly scheduled data backups ensure that financial institutions can recover their data in the event of a system failure or cyberattack, minimizing downtime and business disruption.

- Security Awareness Training: Google provides security awareness training to help financial professionals identify and avoid common security threats, such as phishing emails and social engineering attacks.

Implementing Access Control Measures and Data Encryption

Google Workspace’s access control measures and data encryption capabilities empower financial institutions to safeguard sensitive financial information and adhere to regulatory requirements:

- Role-based Access Control (RBAC): RBAC allows financial institutions to assign specific roles and permissions to users, ensuring that only authorized personnel have access to sensitive data based on their job functions.

- Two-factor Authentication (2FA): 2FA adds an extra layer of security by requiring users to verify their identity with a second factor, such as a code sent to their mobile phone, in addition to their password.

- Data Encryption at Rest: All data stored in Google Workspace is encrypted at rest using industry-standard encryption algorithms, protecting sensitive information even if storage devices are compromised.

- Data Encryption in Transit: All data transferred between Google Workspace applications and servers is encrypted in transit using TLS 1.3, ensuring that sensitive information remains protected during transmission.

Fostering Financial Innovation and Transformation

In the ever-evolving world of financial services, innovation is not merely a buzzword but a necessity for survival and success. Google Workspace for Financial Services serves as a catalyst for innovation, empowering financial institutions to embrace new technologies, explore emerging trends, and transform their operations to meet the demands of the digital age.

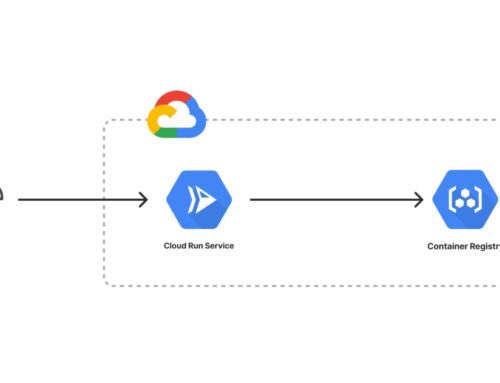

Embracing Innovation to Enhance Financial Services

Google Workspace provides financial institutions with the tools and resources to embrace innovation and drive transformation across their organizations. By leveraging the power of cloud-based technologies, financial institutions can enhance their services, streamline processes, and deliver exceptional customer experiences.

One of the key drivers of innovation in financial services is the adoption of artificial intelligence (AI) and machine learning (ML). Google Workspace integrates seamlessly with AI and ML tools, enabling financial institutions to:

Analyze vast amounts of financial data to identify patterns, trends, and anomalies, gaining insights that inform decision-making and risk management.

Automate repetitive tasks, such as fraud detection, risk assessment, and customer onboarding, freeing up financial professionals to focus on higher-value activities.

Develop personalized financial products and services tailored to individual customer needs and preferences, enhancing customer satisfaction and loyalty.

Utilizing AI-powered Tools for Financial Analysis and Automation

AI-powered tools are revolutionizing the way financial institutions operate, providing new levels of efficiency, accuracy, and insights. Google Workspace integrates seamlessly with AI and ML tools, enabling financial institutions to:

Identify and mitigate financial risks with greater precision, using AI-powered tools to analyze market data, customer behavior, and regulatory changes.

Enhance fraud detection by analyzing transaction patterns and identifying anomalies that may indicate fraudulent activity, reducing losses and protecting customers.

Automate customer service interactions using AI-powered chatbots and virtual assistants, providing 24/7 support and resolving customer inquiries promptly.

Personalize financial recommendations for customers based on their financial profiles, goals, and risk tolerance, enhancing customer engagement and satisfaction.

Exploring Emerging Technologies for Financial Process Improvement

Financial institutions are constantly exploring emerging technologies to improve their processes, enhance security, and deliver exceptional customer experiences. Google Workspace provides a platform for experimentation and innovation, enabling financial institutions to:

Leverage blockchain technology to secure and streamline cross-border transactions, reducing costs and increasing transparency.

Utilize voice banking solutions to provide convenient and personalized banking services through voice assistants and smart devices.

Adopt augmented reality (AR) and virtual reality (VR) technologies to enhance customer onboarding, product demonstrations, and investment education.

Explore the potential of open banking to create innovative financial products and services in collaboration with third-party providers.

By embracing innovation and exploring emerging technologies, Google Workspace empowers financial institutions to transform their operations, adapt to the ever-changing financial landscape, and position themselves for long-term success.

Case Studies and Success Stories

Case Study 1: Financial Institution Implements Google Workspace to Enhance

Collaboration and Customer Service

Challenge: A leading global financial institution sought to enhance collaboration across its geographically dispersed teams, streamline customer service interactions, and improve overall employee productivity.

Solution: The institution implemented Google Workspace, including Gmail, Calendar, Chat, and Meet, to facilitate seamless communication and collaboration among team members across different locations and departments. Additionally, the institution deployed Google Workspace’s secure client portals to provide customers with 24/7 access to their financial information and enable real-time communication with financial professionals.

Results:

Enhanced Collaboration and Communication: Google Workspace’s integrated communication tools enabled real-time collaboration across teams, breaking down silos and fostering a culture of open communication.

Improved Customer Service: Secure client portals provided customers with convenient access to their financial information and enabled real-time communication with financial professionals, significantly improving customer satisfaction.

Increased Employee Productivity: Google Workspace’s cloud-based tools and streamlined workflows allowed employees to work more efficiently and effectively, boosting overall productivity.

Case Study 2: Financial Services Firm Leverages Google Workspace to Streamline Financial Reporting and Gain Data-driven Insights

Challenge: A mid-sized financial services firm struggled to consolidate and analyze its vast trove of financial data, leading to inefficiencies in financial reporting and decision-making.

Solution: The firm implemented Google Workspace, including Google Docs, Sheets, and Slides, to create a centralized platform for storing and sharing financial data. Additionally, the firm integrated Google Workspace with data visualization tools to transform raw data into actionable insights.

Results:

Streamlined Financial Reporting: Google Workspace’s collaborative tools enabled the firm to streamline financial reporting processes, reducing the time required to generate and distribute reports.

Data-driven Insights: Data visualization tools provided the firm with a clear and concise understanding of its financial performance, enabling informed decision-making and risk management.

Improved Financial Performance: The firm’s ability to analyze its financial data effectively led to improved financial performance, including increased profitability and reduced risk exposure.

These case studies demonstrate the transformative power of Google Workspace for Financial Services, enabling financial institutions to collaborate more effectively, streamline operations, gain data-driven insights, and deliver exceptional results to their clients.

Future Outlook

In the ever-evolving landscape of financial services, the transformative impact of Google Workspace plays a pivotal role in shaping the future of the industry. As financial institutions navigate the complexities of a digital era, Google Workspace emerges as a strategic partner, offering innovative solutions and adaptability to meet the evolving needs of the financial sector.

The transformative impact of Google Workspace is evident in its ability to streamline communication, collaboration, and data management within financial organizations. The suite of collaborative tools, including Gmail, Google Drive, and Google Meet, facilitates seamless interaction among teams, fostering a more connected and efficient working environment. This interconnectedness enhances communication not only within the organization but also with clients, ensuring a more responsive and client-centric approach.

Furthermore, Google Workspace provides a secure and compliant platform, addressing the stringent regulatory requirements inherent in the financial services sector. The suite’s advanced security measures, administrative controls, and commitment to data protection contribute to the safeguarding of sensitive financial information. Two-factor authentication (2FA) adds an extra layer of security, ensuring that only authorized personnel can access critical data.

As financial institutions increasingly embrace digital transformation, Google Workspace serves as a catalyst for innovation. The suite’s flexibility and adaptability empower financial professionals to leverage emerging technologies, stay ahead of market trends, and deliver innovative financial services. The integration of third-party applications through the Google Workspace Marketplace further expands the suite’s functionality, allowing financial organizations to tailor their tools to specific needs and workflows.

Looking ahead, Google Workspace is poised to continue playing a vital role in helping financial services organizations embrace innovation and navigate the dynamic landscape. The suite’s commitment to continuous improvement, security, and collaboration positions it as a strategic asset for financial institutions striving to stay competitive, compliant, and technologically advanced in the years to come. Embracing innovation with Google Workspace ensures that financial services organizations are well-positioned to meet the challenges and opportunities of the evolving financial landscape.

Conclusion

Google Workspace emerges as a game-changer in the realm of financial services, offering a comprehensive suite of tools that not only meet the immediate needs of the industry but also propel it toward a dynamic and innovative future. The suite’s transformative impact lies in its ability to seamlessly integrate collaboration, security, and adaptability, addressing the multifaceted challenges faced by financial institutions.

Google Workspace’s role in financial services is not just about efficiency and security; it’s about fostering a culture of innovation. By providing a platform that supports real-time collaboration, secure data handling, and compliance with industry regulations, Google Workspace allows financial professionals to focus on what they do best – delivering exceptional financial services.

As the financial landscape evolves, Google Workspace stands as a reliable partner, facilitating digital transformation and ensuring that financial institutions stay at the

Yes, Google Workspace adheres to rigorous security and compliance standards, making it suitable for the financial services sector. The suite includes features that help organizations meet regulatory requirements.

Google Workspace provides real-time collaboration tools like Google Docs, Sheets, and Meet, allowing financial professionals to work together seamlessly, whether in the office or remotely. This enhances communication and accelerates decision-making processes.

Absolutely. Google Workspace is highly customizable, allowing financial institutions to adapt tools and features to their unique workflows. This flexibility ensures that the suite aligns with the specific needs of financial services.

Google Workspace incorporates advanced security features, including two-factor authentication (2FA), encryption, and robust access controls. These measures are designed to safeguard sensitive financial information and ensure data integrity.

Google Workspace fosters innovation by providing a collaborative platform that encourages creative thinking and problem-solving. Its integration with third-party applications and continuous updates also ensures financial institutions stay at the forefront of technological advancements.