Introduction of Fresh Books Freelancer Accounting Services:

Freelancing has become a prominent feature of the modern workforce, largely due to the rise of the gig economy. This shift has empowered individuals to offer their skills and services independently, breaking away from traditional employment structures. As freelancers navigate this dynamic landscape, they encounter various challenges, particularly in managing their finances effectively.

Brief Overview of the Freelancing Landscape:

Rise of freelancing in the gig economy:

The gig economy has witnessed a surge in recent years, driven by factors such as technological advancements, increased connectivity, and a changing attitude towards work. Freelancers, or independent workers, now contribute significantly to various industries, offering a diverse range of services, from graphic design and writing to programming and consulting.

Challenges faced by freelancers in managing finances:

Despite the freedom and flexibility freelancing offers, it comes with its own set of financial challenges. Irregular income, unpredictable workloads, and the absence of employee benefits can make it challenging for freelancers to maintain financial stability. This section explores these challenges and highlights the importance of financial management for freelancers.

The Role of Accounting in Freelancing:

Importance of accurate financial records:

Effective financial management is crucial for freelancers to sustain their businesses and personal lives. Maintaining accurate financial records helps freelancers track income and expenses, plan for taxes, and assess the overall health of their businesses. This involves creating a system for invoicing, expense tracking, and organizing financial documents.

Tax implications for freelancers:

Freelancers face unique tax considerations compared to traditional employees. Understanding tax obligations, deductions, and potential credits is essential for freelancers to avoid financial pitfalls. This section delves into the key tax implications, including the need to set aside funds for taxes, keeping abreast of changing tax laws, and possibly seek professional accounting advice.

Freelancers operate in a dynamic and evolving landscape, and effective financial management is paramount for their success. This overview provides insights into the challenges faced by freelancers and emphasizes the vital role of accounting in navigating the intricacies of the freelance economy.

FreshBooks: An Overview

Introduction to FreshBooks

- Background and History:

FreshBooks was founded in 2003 by Mike McDerment in Toronto, Canada. The company was created to address the challenges that small businesses and self-employed individuals face in managing their finances. Over the years, FreshBooks has evolved and grown, becoming a popular choice for those seeking a streamlined and user-friendly accounting solution.

- Mission and Vision:

The mission of FreshBooks is to empower small business owners and freelancers by providing them with easy-to-use accounting tools that save time and enhance productivity. The vision is centered around simplifying financial tasks, allowing users to focus on their core business activities without the burden of complex accounting processes.

Features and Benefits

- User-friendly Interface:

FreshBooks boasts an intuitive and user-friendly interface, making it accessible for individuals with varying levels of accounting knowledge. The platform’s design emphasizes simplicity and efficiency, ensuring that users can navigate and utilize its features without a steep learning curve.

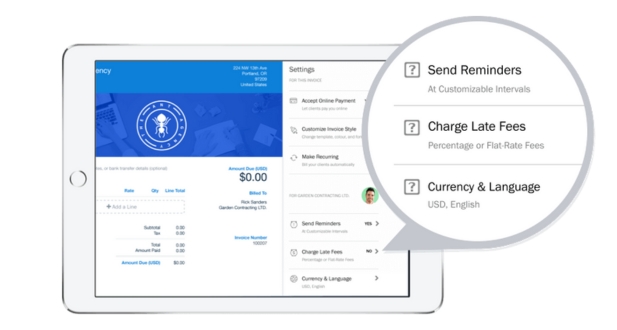

- Invoicing and Expense Tracking:

One of the core functionalities of FreshBooks is its robust invoicing system. Users can create professional-looking invoices with customizable templates, automate recurring invoices, and easily track client payments. The expense tracking feature allows users to record and categorize expenses, facilitating accurate financial records.

- Time Tracking and Project Management:

FreshBooks includes tools for time tracking, enabling users to log billable hours for client projects. This feature is particularly beneficial for service-based businesses and freelancers who charge clients based on time worked. Additionally, the platform offers basic project management features to help users organize tasks and deliverables.

- Customization Options:

FreshBooks understands that businesses have unique needs, and therefore, it provides customization options. Users can tailor invoices, estimates, and other documents to align with their brand identity. Customization extends to categorizing expenses, creating personalized reports, and adapting the platform to suit specific business requirements.

- Reporting and Analytics:

To support informed decision-making, FreshBooks offers reporting and analytics tools. Users can generate various financial reports, including profit and loss statements, expense reports, and client revenue summaries. These insights help businesses track performance, identify trends, and plan for future growth.

Accounting for Freelancers

Common Accounting Challenges for Freelancers:

- Income Tracking:

Freelancers often struggle to keep track of their income, especially when dealing with multiple clients and various payment methods. This challenge can lead to errors in financial reporting and taxation.

- Expense Management:

Freelancers incur various business-related expenses, such as supplies, equipment, and software subscriptions. Managing and categorizing these expenses accurately is crucial for financial planning and tax deductions.

- Invoicing and Payment Tracking:

Creating and sending invoices, as well as tracking payments, can be time-consuming and prone to errors. Late payments and invoice disputes are common issues that freelancers face, affecting their cash flow.

- Tax Preparation:

Freelancers often find tax preparation complex and time-consuming due to the need to track income, expenses, and deductions accurately. Filing taxes incorrectly can lead to penalties and financial setbacks.

How FreshBooks Addresses These Challenges:

- Seamless Invoicing:

FreshBooks provides a user-friendly platform for creating and sending professional invoices. Freelancers can customize invoices with their branding, set up recurring invoices for retainer clients, and automate late payment reminders. This helps freelancers maintain a steady cash flow and reduces the likelihood of payment delays.

- Expense Tracking and Categorization:

FreshBooks simplifies expense management by allowing freelancers to easily capture and categorize expenses. Users can snap pictures of receipts using the mobile app, making it convenient to track business expenses on the go. Proper categorization ensures accurate financial reporting and simplifies tax preparation.

- Time Tracking for Billing Accuracy:

For freelancers who bill clients based on time worked, FreshBooks offers time tracking features. This allows freelancers to log their work hours accurately and bill clients accordingly. This feature not only ensures billing accuracy but also provides insights into project profitability.

- Tax Time Made Easy:

FreshBooks eases the burden of tax preparation by providing detailed financial reports. These reports include income statements, expense reports, and tax summaries, making it simpler for freelancers to organize their financial data for tax filing. The platform also integrates with accounting software, further streamlining the tax preparation process.

FreshBooks addresses the challenges faced by freelancers by offering a comprehensive accounting solution that covers income tracking, expense management, invoicing, payment tracking, and tax preparation. Its user-friendly interface and automation features help freelancers save time, reduce errors, and maintain better control over their financial activities.

Tips and Tricks for Maximizing FreshBooks

Optimization Strategies:

Setting up FreshBooks for efficiency:

Customization: Tailor FreshBooks to your business needs by customizing settings, invoice templates, and categories. Ensure that your account reflects your specific industry and workflow.

Automation: Take advantage of automation features such as recurring invoices, automatic expense categorization, and payment reminders. This helps streamline your financial processes, saving time and reducing errors.

Leveraging advanced features:

Expense Tracking: Make use of FreshBooks’ expense tracking tools to accurately monitor and categorize your business expenses. This can provide valuable insights into your financial health.

Time Tracking: If your business bills clients based on hours worked, use FreshBooks’ time tracking features to record billable hours efficiently. This can contribute to more accurate invoicing.

Integrations with Third-Party Tools:

Seamless integration with other apps and services:

Payment Gateways: Integrate FreshBooks with popular payment gateways to facilitate smooth transactions and ensure prompt payments from clients.

CRM Systems: Connect FreshBooks with Customer Relationship Management (CRM) tools to enhance client management and maintain a comprehensive overview of your business relationships.

Project Management Tools: If your workflow involves project management, integrate FreshBooks with project management tools to seamlessly synchronize project-related data and financial information.

Enhancing workflow with complementary tools:

Receipt Scanning Apps: Consider integrating receipt scanning apps with FreshBooks to simplify expense tracking. This allows you to effortlessly capture and categorize receipts, minimizing manual data entry.

Analytics and Reporting Tools: Connect FreshBooks with analytics and reporting tools to gain deeper insights into your financial performance. This can aid in making informed business decisions.

By implementing these optimization strategies and integrating FreshBooks with third-party tools, you can significantly enhance your overall workflow, improve efficiency, and make the most out of the platform for your specific business needs. Regularly explore updates and new features provided by FreshBooks to stay abreast of enhancements that can further optimize your financial processes.

Future Trends in Freelancer Accounting

The future trends in freelancer accounting are closely tied to technological advancements, which are rapidly transforming the way accounting processes are conducted. Here’s an elaboration on how technology is shaping the future of freelancer accounting, along with some predictions for the next decade:

Automation and AI Integration:

Current State: Automation is already playing a significant role in repetitive and rule-based tasks such as data entry and invoice processing.

Future Trend: AI integration is expected to become more sophisticated, handling complex tasks like expense categorization, tax calculations, and financial analysis. This will allow freelancers to focus more on strategic aspects of their business.

Cloud-Based Accounting Software:

Current State: Many freelancers already use cloud-based accounting software for its accessibility and collaboration features.

Future Trend: The trend is likely to continue, with more advanced features being integrated, such as real-time collaboration, enhanced security measures, and seamless integration with other business tools.

Blockchain for Security and Transparency:

Current State: Blockchain is gaining traction in various industries for its security and transparency benefits.

Future Trend: Freelancer accountants may start utilizing blockchain for secure and transparent financial transactions, reducing the risk of fraud and ensuring the integrity of financial records.

Data Analytics for Business Insights:

Current State: Data analytics tools are already used for financial reporting and trend analysis.

Future Trend: Advanced data analytics will provide freelancers with deeper insights into their financial health, helping them make informed decisions, identify growth opportunities, and optimize their financial strategies.

Cybersecurity Measures:

Current State: With an increasing reliance on technology, cybersecurity is a growing concern for freelancers.

Future Trend: Advanced cybersecurity measures will be crucial to protect sensitive financial data. This includes biometric authentication, encrypted communication channels, and continuous monitoring to detect and prevent cyber threats.

Regulatory Compliance Tools:

Current State: Freelancers often face challenges in keeping up with changing tax regulations and compliance requirements.

Future Trend: Technology will play a vital role in providing automated updates and tools that help freelancers stay compliant with tax laws and regulations, reducing the risk of penalties.

Virtual Reality (VR) for Remote Collaboration:

As remote work becomes more prevalent, VR may be incorporated into accounting processes, allowing freelancers to collaborate in virtual spaces, conduct virtual meetings, and share financial information in an immersive and secure environment.

Personalized Financial Advice through AI:

AI-powered virtual assistants may provide personalized financial advice to freelancers based on their individual business data, helping them make informed decisions and optimize their financial strategies.

The future of freelancer accounting is marked by the integration of advanced technologies, providing freelancers with more efficient, secure, and insightful tools to manage their finances. As we move into the next decade, these trends are likely to reshape the landscape of freelance accounting, making it more dynamic and technologically advanced.

Utilizing FreshBooks Effectively

Set Up Properly:

Accurate Business Information: Ensure that all relevant business information, such as contact details, business name, and address, is correctly inputted into FreshBooks. This information is crucial for generating professional invoices and maintaining accurate records.

Tax Rates: Set up and configure tax rates according to your local tax regulations. This ensures that your invoices automatically include the appropriate taxes, reducing the risk of errors and non-compliance.

Payment Gateways: Configure payment gateways within FreshBooks to streamline the payment process. This makes it convenient for clients to settle invoices promptly.

Leverage Automation:

Recurring Invoices: Set up recurring invoices for clients with retainer agreements. This saves time by automating the invoicing process and ensures a consistent and timely billing cycle.

Expense Tracking: Connect your bank accounts to FreshBooks to automate expense tracking. This not only reduces the manual effort required for data entry but also helps maintain accurate financial records.

Time Tracking: Utilize the time tracking feature to automate billing for hourly work. This ensures that you are accurately compensated for the time spent on different projects.

Utilize Integrations:

Payment Gateways: Integrate FreshBooks with popular payment gateways to facilitate seamless online payments. This provides clients with various options for settling invoices, improving overall transaction efficiency.

Project Management Tools: Explore integrations with project management tools to synchronize project details and streamline workflow. This helps in maintaining a cohesive overview of projects and their financial aspects.

Tax Software: Integration with tax software can simplify the process of tax preparation and filing. This ensures compliance with tax regulations and minimizes the risk of errors in financial reporting.

Stay Informed with Reports:

Financial Reports: Regularly review financial reports provided by FreshBooks to gain insights into your freelance business’s financial health. Track income trends, analyze expenses, and identify areas for potential cost savings or revenue growth.

Informed Decision-Making: Use the information gathered from reports to make informed business decisions. This could involve adjusting pricing strategies, allocating resources more efficiently, or identifying opportunities for business expansion.

Collaborate Through the Client Portal:

Streamlined Communication: Encourage clients to use the client portal for communication. It provides a professional platform for transactions, feedback, and project details.

Transparent Collaboration: The client portal facilitates transparent collaboration, allowing clients to view project progress, provide feedback, and make payments. This transparency strengthens client relationships and fosters efficient communication.

FreshBooks for Tax Preparation

Simplifying Tax Processes:

Comprehensive Reports: FreshBooks generates detailed financial reports, including tax summaries. These summaries provide a consolidated view of income, expenses, and other relevant financial information. Freelancers can easily access and review these reports, helping them gather the necessary data required for tax filing.

User-Friendly Interface: The platform’s interface is designed to be intuitive, making it accessible for freelancers who may not have an extensive background in accounting. This user-friendly approach allows users to navigate through their financial data effortlessly, reducing the complexity associated with tax preparation.

Automated Processes: FreshBooks automates various accounting processes, such as expense tracking and income categorization. This automation not only saves time for freelancers but also ensures that financial data is accurately recorded and readily available for tax purposes.

Integration with Tax Software:

Data Syncing: FreshBooks allows freelancers to sync their financial data directly with compatible tax software. This ensures that there is consistency and accuracy in the information transferred between the two platforms, minimizing the risk of errors during the tax preparation process.

Time Savings: Manual data entry between accounting and tax software can be time-consuming and prone to errors. The integration streamlines this process, saving freelancers valuable time that they can allocate to other aspects of their business.

Reduced Stress: The collaboration between FreshBooks and tax software reduces the stress associated with tax season. Freelancers can have confidence that their financial data is accurately transferred and can focus on reviewing and finalizing their tax returns with greater peace of mind.

Conclusion

In the world of freelancing, where time is money, having a reliable accounting solution is invaluable. FreshBooks not only addresses the unique financial challenges freelancers face but also empowers them to focus on their craft. This comprehensive guide has provided an in-depth exploration of FreshBooks freelancer accounting services, from its features and benefits to user testimonials and comparisons. As freelancers continue to navigate the dynamic landscape of their careers, having a trusted ally like FreshBooks can make all the difference in achieving financial success and peace of mind.

FreshBooks simplifies accounting tasks for freelancers by providing tools for easy invoicing, expense tracking, and time management. It helps streamline financial processes and ensures accurate and timely billing.

Yes, FreshBooks is designed to manage multiple clients. Freelancers can organize their clients, projects, and invoices in one place, making it easy to track and manage different aspects of their business.

Yes, FreshBooks is well-suited for sole proprietors and small businesses. Its user-friendly interface and features cater to the specific needs of freelancers and entrepreneurs with modest accounting requirements.

FreshBooks allows freelancers to create professional-looking invoices quickly. Users can customize invoices with their branding, set up recurring invoices, and even accept online payments through various payment gateways.

Yes, FreshBooks includes expense tracking features. Freelancers can capture and categorize expenses, attach receipts, and monitor spending to ensure accurate financial records.