Introducing FreshBooks: Streamlining Tech Startup Finances

Launching a tech startup is exhilarating. The rush of innovation, the thrill of building something from scratch, the potential to disrupt entire industries – it’s all intoxicating. But amidst the excitement, one crucial element can often get lost in the shuffle: finance. In the whirlwind of coding sprints and product launches, ensuring your financial health can feel like an afterthought.

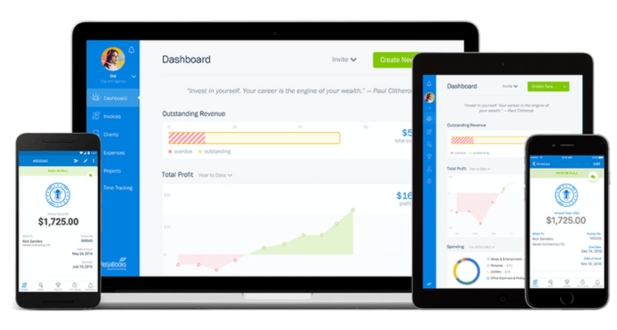

This is where FreshBooks enters the scene, not just as an accounting tool, but as your startup finance partner. Imagine a platform that simplifies your financial chaos, freeing you to focus on what you do best – building your tech empire.

Let’s dive into FreshBooks‘ key features and how they can specifically streamline your startup’s finances:

- Effortless Invoicing:

- Say goodbye to clunky, time-consuming invoice creation. FreshBooks lets you craft professional invoices in minutes, with customizable templates and branding options.

- Automate recurring invoices and reminders, ensuring you never miss a payment.

- Track invoice status in real-time, and accept online payments securely through various channels like Stripe and PayPal.

- No more chasing down clients: FreshBooks sends payment reminders and late payment fees automatically, keeping your cash flow flowing smoothly.

- Painless Expense Tracking:

- Ditch the shoebox of receipts. Capture expenses on the go with the FreshBooks mobile app, snapping photos or uploading documents directly.

- Categorize expenses effortlessly, with pre-defined categories or custom options to suit your startup’s needs.

- Set expense limits and budgets to stay on top of spending and avoid budget overruns.

- Generate comprehensive expense reports to gain insights into spending patterns and identify areas for optimization.

- Seamless Payment Management:

- Accept online payments securely through FreshBooks, eliminating the need for third-party payment gateways.

- Manage payroll with ease, even for a growing team, with integrations with popular payroll providers like Gusto.

- Automate vendor payments to save time and streamline your accounts payable process.

- Say goodbye to manual bank reconciliation. FreshBooks automatically imports bank transactions, saving you hours of tedious work.

- Powerful Financial Reporting:

- Gain real-time insights into your financial performance with intuitive dashboards and customizable reports.

- Track income, expenses, and cash flow at a glance, uncovering trends and identifying potential issues early on.

- Generate investor-ready financial reports with ease, showcasing your startup’s financial health and potential.

- Drill down into specific areas like project profitability, customer spending patterns, and marketing campaign ROI.

- Scalability and Integrations:

- FreshBooks grows with your startup. From solo founder to a thriving team, the platform seamlessly scales to meet your needs.

- Connect FreshBooks with your existing tools and services through powerful integrations with popular platforms like Zapier, Shopify, and project management software.

- Automate workflows to further streamline your operations and save time.

FreshBooks isn’t just software; it’s a paradigm shift. It empowers tech startups to ditch the financial spreadsheets and embrace a cloud-based, user-friendly approach to managing their finances.

Imagine this:

- No more late nights spent on manual bookkeeping.

- Full transparency and real-time insights into your financial health.

- The freedom to focus on building your product, not chasing invoices.

FreshBooks is the key that unlocks your startup’s financial potential. It’s your trusted partner in navigating the complexities of startup finance, allowing you to focus on what matters most – building your tech dream.

Why Financial Management Matters for Tech Startups

The Financial Imperative for Tech Startups: Why You Can’t Afford to Ignore the Numbers

The tech startup world is a thrilling vortex of innovation, passion, and audacious ideas. But amidst the code sprints, product launches, and visions of billion-dollar unicorns, one crucial element often gets relegated to the backburner – finance. In the heady rush of building the next big thing, it’s tempting to treat financial management as an afterthought, a necessary evil to be endured, not embraced.

This, however, is a recipe for disaster. For tech startups, financial discipline is not just an option; it’s an imperative. Neglecting your financial health can have dire consequences, derailing even the most promising ventures and leaving founders scrambling to pick up the pieces.

So, why is financial management so crucial for tech startups? Let’s delve into the heart of the matter:

- The Bootstrapping Balancing Act:

Most startups begin life bootstrapped, relying on personal savings, angel investments, and sheer grit to get off the ground. In this resource-constrained environment, every dollar counts. Accurate financial data is your compass, guiding you towards efficient resource allocation, informed spending decisions, and maximizing the impact of your limited capital.

- Navigating the Fundraising Rollercoaster:

For many startups, securing funding is a crucial milestone. But investors don’t just throw money at ideas; they want to see a clear path to profitability, a demonstrably strong financial foundation, and a team capable of managing resources responsibly. Solid financial records and meticulous reporting are your key to unlocking the doors of venture capital and building investor confidence.

- Taming the Revenue Rollercoaster:

Tech startups often experience unpredictable revenue streams, with periods of explosive growth followed by dips and valleys. Without accurate financial data and forecasting tools, you’re flying blind, vulnerable to cash flow crunches, missed opportunities, and even insolvency. Financial management helps you anticipate these fluctuations, adjust your spending accordingly, and ensure you have the runway needed for sustained growth.

- Scaling with Smarts, Not Stumbles:

Rapid growth can be exhilarating, but it can also be treacherous. Without a strong financial backbone, scaling can lead to operational inefficiencies, bloated expenses, and a loss of control. Financial management helps you scale smartly, building a sustainable financial infrastructure that can handle the demands of a growing team, expanding operations, and evolving market dynamics.

- Beyond Compliance, Building a Culture of Financial Awareness:

While compliance with financial regulations is essential, it’s just the tip of the iceberg. True financial management goes beyond ticking boxes; it’s about embedding a culture of financial awareness and accountability within your startup. This means empowering your team to understand financial metrics, make informed spending decisions, and contribute to your overall financial health.

The Risks of Neglecting Finance:

Ignoring your finances might seem easier in the short term, but the consequences can be crippling:

- Missed Opportunities: Without accurate data and projections, you might miss out on key partnerships, lucrative deals, or strategic investments.

- Funding Roadblocks: Investors are wary of startups with shaky finances. Neglecting financial management can shut the door on potential funding and limit your growth potential.

- Operational Inefficiencies: Out-of-control expenses, bloated overhead, and poor resource allocation can drain your resources and hinder your ability to compete effectively.

- Reputational Damage: Financial mismanagement can erode trust with investors, partners, and even customers, damaging your reputation and hindering future growth.

Embracing Financial Management: The Startup Advantage:

By prioritizing financial management, you unlock a treasure trove of benefits:

- Informed Decision-Making: Accurate data empowers you to make strategic choices about resource allocation, product development, marketing, and future investments.

- Enhanced Investor Confidence: Transparent and well-managed finances inspire investor trust, opening doors to funding opportunities and partnerships.

- Improved Operational Efficiency: Streamlined processes, controlled spending, and efficient resource allocation boost your bottom line and fuel sustainable growth.

- Reduced Risk and Increased Resilience: Proactive financial planning helps you weather market fluctuations, adapt to unforeseen challenges, and emerge stronger amidst adversity.

Conclusion:

Financial management is not just about numbers and spreadsheets; it’s about building a strong foundation for your tech startup’s success. It’s about taking control of your present and paving the way for a bright future. By embracing financial discipline and utilizing smart tools like FreshBooks, you can navigate the complexities of the tech startup world with confidence, resilience, and a clear path to achieving your dreams.

Conquer Key Financial Tasks with FreshBooks: Your All-in-One Startup Finance Superhero

Juggling the myriad responsibilities of a tech startup can feel like an Olympic feat blindfolded. Marketing, product development, team management – the list goes on, and amidst the chaos, one crucial element often gets relegated to the sidelines: finances.

But fear not, intrepid entrepreneur! FreshBooks isn’t just accounting software; it’s your financial superhero, ready to swoop in and conquer every financial task with superhuman efficiency. Let’s dive into how FreshBooks empowers you to:

- Invoice Like a Pro:

Say goodbye to clunky invoice templates and manual calculations. FreshBooks lets you craft professional invoices in minutes, with customizable templates, branding options, and even automatic generation from quotes.

- Tame the Recurring Invoice Beast:

Recurring invoices? Automate them with FreshBooks. Set it and forget it, ensuring you never miss a payment and keep your cash flow flowing smoothly.

- Track Invoice Status with Eagle Eyes:

No more chasing down clients! FreshBooks tracks your invoice status in real-time, sending automated reminders and even accepting online payments through secure channels like Stripe and PayPal.

- Expense Tracking Made Easy:

Ditch the shoebox of receipts! Capture expenses on the go with the FreshBooks mobile app, snapping photos or uploading documents with ease.

- Categorize Like a Champion:

Forget messy spreadsheets. FreshBooks lets you categorize expenses effortlessly with predefined categories or custom options, giving you a clear picture of your spending patterns.

- Budget Like a Boss:

Set expense limits and budgets to stay on track and avoid overspending. FreshBooks sends alerts and helps you make informed financial decisions before it’s too late.

- Payments: A Seamless Symphony:

Accept online payments securely through FreshBooks, eliminating the need for third-party gateways and simplifying your workflow.

- Payroll Perfection with Integrations:

Managing payroll can be a complex beast. FreshBooks integrates seamlessly with popular payroll providers like Gusto, making payroll a breeze, even for a growing team.

- Automate Vendor Payments for Efficiency:

No more manual checks and tedious paperwork. Automate vendor payments with FreshBooks, saving you time and ensuring timely payments.

- Reporting: Insights at Your Fingertips:

Gain real-time insights into your financial performance with FreshBooks’ intuitive dashboards and customizable reports. Track income, expenses, and cash flow at a glance, identifying trends and potential issues early on.

- Investor-Ready Reports in a Flash:

Impress investors with professional, investor-ready reports generated effortlessly with FreshBooks. Showcase your financial health and potential, paving the way for funding opportunities.

- Growth Hacking with Financial Data:

FreshBooks isn’t just about recording; it’s about unveiling hidden opportunities. Analyze your data to identify cost-saving areas for reinvestment, optimize pricing strategies, and even predict future revenue streams for informed planning.

FreshBooks isn’t just software; it’s your financial partner in crime. It empowers you to conquer every financial task with ease and confidence, freeing you to focus on what you do best – building your tech empire.

Beyond FreshBooks: Building a Sustainable Financial Foundation for Your Tech Startup

FreshBooks is your trusty sidekick, conquering day-to-day financial tasks and slaying invoice dragons with ease. But while FreshBooks is a powerful tool, remember, building a truly sustainable financial foundation for your tech startup requires more than just software. It’s about embracing a holistic approach that integrates best practices, expert guidance, and a culture of financial awareness.

- Budgeting and Forecasting: Navigating the Financial Maze:

FreshBooks provides invaluable data and insights, but transformation comes from using that data to chart your course. Develop realistic budgets that reflect your business goals and resource constraints, and don’t shy away from forecasting future revenue and expenses. This proactive approach allows you to anticipate challenges, adjust your sails, and avoid financial storms.

- Fundraising Strategies: Fuelling Your Growth Engine:

Investors want to see a clear path to profitability. Craft a compelling fundraising strategy that showcases your market potential, financial projections, and how you’ll utilize the funds. FreshBooks helps you generate investor-ready reports that impress and build confidence. Remember, funding isn’t just about money; it’s about finding partners who believe in your vision.

- Building Your Financial Brain Trust:

FreshBooks is your loyal assistant, but even superheroes need a team. Consider hiring financial expertise, whether it’s an accountant for bookkeeping and compliance, a bookkeeper for daily tracking, or a financial advisor for strategic guidance. Choose the right fit for your needs, leveraging their knowledge to optimize your financial decisions.

- Fostering a Culture of Financial Awareness:

Financial health isn’t just for the CFO. Empower your team to understand basic financial concepts and their role in the startup’s success. Encourage discussions about budgets, spending patterns, and financial goals. This transparency fosters accountability, ownership, and ultimately, a more sustainable financial future.

- Leveraging FreshBooks for Investor-Ready Reporting:

FreshBooks is more than just a transaction tracker; it’s your investor reporting powerhouse. Generate professional reports that showcase your income, expenses, and cash flow in a clear, concise manner. Use data visualizations to tell your financial story, highlighting key metrics and trends that demonstrate the health and potential of your startup.

Remember, building a sustainable financial foundation is a continuous journey, not a destination. FreshBooks equips you with the tools and data, but it’s your commitment to best practices, expert guidance, and a culture of financial awareness that truly propels your tech startup towards long-term success.

Here are some additional tips to consider:

- Regularly review and adjust your financial plans. As your business grows and market dynamics shift, your financial strategy needs to adapt.

- Automate as much as possible to save time and reduce manual errors.

- Stay up-to-date on relevant financial regulations and tax laws.

- Communicate openly with your team and investors about your financial performance.

- Celebrate financial successes and learn from setbacks.

By embracing a holistic approach to your finances, leveraging the power of FreshBooks, and constantly seeking improvement, you can build a tech startup with a rock-solid financial foundation, ready to weather any storm and achieve its full potential.

FreshBooks for Tech Startups: Supercharge Your Growth with These Power Moves

While FreshBooks simplifies your daily financial tasks, mastering its full potential can elevate your tech startup to new heights. Here are some advanced strategies to unlock FreshBooks’ hidden gems and propel your growth:

- Unleash the Power of Automation:

Recurring Billing on Steroids: Beyond basic recurring invoices, FreshBooks lets you automate late fees, discounts, and even multi-stage payments. Imagine automatically sending clients a reminder email with a late fee attached, saving you time and ensuring prompt payments.

Custom Workflows: Craft automated workflows that streamline your financial processes. For example, automatically categorize expenses based on keywords in receipts or send approval requests for invoices exceeding a certain amount.

Zapier Integration: Connect FreshBooks to a vast ecosystem of apps like CRM platforms, project management tools, and marketing automation software. Automate data exchange between platforms, eliminating manual data entry and boosting efficiency.

- Dive Deep with Advanced Reporting:

Customizable Dashboards: Design your own dashboards to visualize key metrics at a glance. Track your burn rate, monitor project profitability, and gauge customer acquisition costs – all in one centralized location.

Dive Deeper with Drill-Down Reports: Don’t settle for surface-level insights. FreshBooks allows you to drill down into specific data points, uncovering hidden trends and opportunities. Analyze spending patterns by department, track customer lifetime value, and identify top-performing sales channels.

Predictive Analytics: Leverage FreshBooks’ forecasting capabilities to predict future revenue and expenses. This data-driven approach empowers you to make informed decisions about hiring, inventory levels, and future investments.

- Collaborate and Connect for Seamless Operations:

Team Roles and Permissions: Grant specific access levels to team members based on their roles. This ensures data security while enabling efficient collaboration. Allow finance managers to manage accounts and generate reports, while granting limited access to sales reps for expense tracking.

Client Portal: Simplify communication and empower clients with a self-service portal. They can view invoices, make payments, and download statements, reducing your workload and improving customer satisfaction.

Integrations for a Connected Ecosystem: FreshBooks seamlessly integrates with popular tools like Gusto for payroll, Shopify for e-commerce, and Dropbox for document management. Streamline your workflows, reduce data silos, and achieve operational excellence.

- Go Beyond Invoicing: Master FreshBooks’ Hidden Gems:

Project Costing: Track project-related expenses and income in detail. Identify profitable projects, optimize resource allocation, and deliver accurate client quotes.

Inventory Management: FreshBooks integrates with inventory management tools, providing real-time stock levels and preventing overselling. This ensures smooth operations and reduces the risk of stockouts.

Time Tracking: Integrate time tracking software to automatically capture employee work hours and associate them with specific projects. This data helps you improve project estimates, optimize billing, and ensure fair compensation for your team.

- FreshBooks for Fundraising Success:

Investor-Ready Reports: Generate professional financial reports with FreshBooks, including income statements, balance sheets, and cash flow statements. Impress potential investors with transparency and a clear picture of your financial health.

Pitch Deck Integration: Embed your FreshBooks data directly into your investor pitch deck. Visualize key metrics like growth rate, profitability, and customer acquisition costs to tell a compelling story about your startup’s potential.

Prepare for Due Diligence: FreshBooks helps you organize and present your financial information efficiently during the due diligence process. This reduces investor concerns and accelerates the fundraising journey.

Remember, FreshBooks is a powerful tool, but it’s your expertise and creativity that unlock its true potential. By implementing these advanced strategies, you can transform FreshBooks from a simple accounting software into a strategic growth engine for your tech startup.

Here are some additional tips:

- Stay up-to-date on FreshBooks’ latest features and updates. The platform constantly evolves, offering new functionalities to help you stay ahead of the curve.

- Seek out training and resources provided by FreshBooks. They offer webinars, tutorials, and documentation to help you master the platform.

- Connect with other FreshBooks users and experts. Online communities and forums offer valuable insights and best practices.

By embracing a proactive approach and continuously exploring new ways to leverage FreshBooks, you can empower your tech startup to achieve sustainable growth and become a force to be reckoned with in your industry.

Conclusion: Unleash Your Tech Startup’s Potential with FreshBooks

Imagine a world where invoices fly out, expenses categorize themselves, and reports sing a sweet symphony of financial clarity. This isn’t a tech startup utopia; it’s the reality you unlock with FreshBooks, your financial partner in crime, ready to catapult your tech venture to stratospheric heights.

FreshBooks isn’t just software; it’s a game-changer, a financial revolution disguised as a friendly interface. It’s the unseen force behind those seemingly overnight success stories, the silent hero empowering tech startups to conquer financial chaos and unlock their true potential.

Forget the days of spreadsheet purgatory. With FreshBooks, you automate the mundane, leaving you free to focus on what matters most – building your tech empire. Craft professional invoices in minutes, track expenses on the go, and manage payments with ease. No more chasing down clients; FreshBooks does the heavy lifting, leaving you with more time to code, innovate, and dream big.

But FreshBooks is more than just a taskmaster; it’s a financial whisperer, revealing hidden insights in your data. Dive deep into reports, uncovering trends, optimizing spending, and predicting future revenue streams. Make informed decisions based on real-time data, not gut instinct. Impress investors with investor-ready reports that showcase your financial health and potential.

FreshBooks isn’t just for the CFO; it’s for everyone. Build a culture of financial awareness within your team, empower them to understand the numbers, and foster a sense of shared responsibility for your financial success. Together, you’ll build a tech startup with a rock-solid financial foundation, ready to weather any storm and conquer the market.

Don’t settle for financial mediocrity. Embrace the power of FreshBooks and unlock the full potential of your tech startup. Remember, the future is bright, and your finances are in good hands.