Introduction

Effective accounting is crucial for the success and sustainability of legal firms. The intricate financial transactions, compliance requirements, and client billing intricacies in the legal industry necessitate a streamlined and efficient accounting system. In this context, the selection of appropriate accounting software becomes paramount. This paper aims to delve into the significance of efficient accounting practices within legal firms and, more specifically, to examine the transformative impact of FreshBooks in revolutionizing accounting processes in the legal sector.

Importance of Efficient Accounting for Legal Firms:

Legal firms operate in a complex environment where accurate financial records, adherence to regulatory standards, and precise client billing are essential. Efficient accounting not only ensures compliance with legal and ethical obligations but also contributes to the overall financial health and strategic decision-making of the firm. Errors or inefficiencies in accounting processes can lead to financial discrepancies, legal complications, and a compromised reputation. Therefore, understanding and implementing effective accounting practices are imperative for legal practitioners.

Introduction to FreshBooks and its Reputation in the Accounting Software Industry:

FreshBooks has emerged as a prominent player in the accounting software industry, renowned for its user-friendly interface, innovative features, and adaptability to various business models. Originally designed for small businesses and freelancers, FreshBooks has expanded its reach to cater to the unique needs of legal professionals. The software offers a range of tools that simplify invoicing, expense tracking, timekeeping, and financial reporting, making it a valuable asset for legal firms seeking to optimize their accounting processes.

Thesis Statement:

This paper aims to investigate the transformative capabilities of FreshBooks in the realm of legal firm accounting. By examining the features and functionalities of FreshBooks in the context of legal practices, we seek to understand how the software streamlines financial management, enhances accuracy, and ultimately contributes to the overall efficiency and success of legal firms. Through case studies, user testimonials, and a comprehensive analysis of FreshBooks’ offerings, we aim to provide insights into the specific ways in which FreshBooks revolutionizes accounting practices within the legal sector.

Understanding Legal Firm Accounting Challenges

Legal firms encounter a myriad of accounting challenges that are distinctive to their industry. These hurdles often arise from the complex nature of legal transactions, the necessity for stringent compliance, and the unique financial structures inherent in law practices. One of the foremost challenges revolves around ensuring compliance with ever-evolving legal and financial regulations. Legal firms must navigate a web of rules and regulations to maintain transparency and uphold ethical standards, making compliance a top priority in their accounting processes. Failure to adhere to these regulations can result in severe consequences, including legal penalties and damage to the firm’s reputation.

Trust accounting poses another significant challenge for legal firms. Handling client funds and ensuring their proper allocation requires meticulous attention to detail. Trust accounts must be managed with the utmost precision to prevent any misappropriation of funds, as any lapses in this area can have severe legal consequences. Legal professionals must establish and maintain robust trust accounting systems to instill confidence in clients and regulatory bodies.

Time tracking is also a critical aspect of legal firm accounting. Accurate and comprehensive timekeeping is essential for billing clients appropriately, monitoring the efficiency of legal services, and evaluating the profitability of different cases. The complexity of legal work often involves varying degrees of time investment across different tasks and cases, making meticulous time tracking a fundamental requirement for financial accuracy.

Outdated accounting practices can significantly impede the efficiency of legal operations. The legal landscape is dynamic, with changes in regulations, billing structures, and client expectations. Failing to adopt modern accounting technologies and practices may lead to inefficiencies, errors, and delays in financial reporting. In a field where precision and timeliness are paramount, relying on outdated accounting methods can hinder a legal firm’s ability to adapt to the evolving demands of the industry.

Legal firms grapple with unique accounting challenges stemming from the intricacies of their work, the need for compliance, the criticality of trust accounting, and the importance of accurate time tracking. Embracing modern accounting practices becomes imperative for legal firms to enhance efficiency, ensure compliance, and maintain the financial integrity necessary for sustained success in a competitive and highly regulated environment.

FreshBooks Overview:

FreshBooks is a cloud-based accounting software designed to simplify financial tasks for small businesses and freelancers. As a cloud-based solution, FreshBooks allows users to access their financial data anytime, anywhere, as long as they have an internet connection. The platform is known for its user-friendly interface and a range of features that streamline various accounting processes.

Introduction to FreshBooks as a Cloud-Based Accounting Software:

Cloud-Based Nature: FreshBooks operates in the cloud, which means that users don’t have to worry about installing and maintaining software on their local machines. This leads to easy accessibility, collaboration, and automatic updates without manual interventions.

User-Friendly Interface: FreshBooks is particularly recognized for its intuitive and user-friendly design. The platform is designed to be accessible to users without a strong accounting background, making it suitable for small businesses and freelancers.

Key Features and Functionalities Tailored for Legal Firms:

- Invoicing: FreshBooks simplifies the invoicing process, allowing legal firms to create and send professional-looking invoices to clients. It also provides options for recurring billing, which can be beneficial for retainer-based services common in legal practices.

- Expense Tracking: Legal firms can easily track expenses related to client cases, ensuring accurate record-keeping for reimbursement and tax purposes.

- Time Tracking: For legal professionals who bill clients based on hours worked, FreshBooks offers time-tracking features. This can help in accurately billing clients for the time spent on different tasks or cases.

- Client Portal: FreshBooks provides a secure client portal where legal firms can share important documents, invoices, and communicate with clients in a centralized and organized manner.

Comparative Analysis with Other Accounting Solutions in the Market:

- User Reviews and Ratings: Compare user reviews and ratings of FreshBooks with other accounting solutions in the market. Look for feedback from users in the legal industry to understand how well FreshBooks meets their specific needs.

- Pricing Structure: Evaluate the pricing structure of FreshBooks in comparison to other accounting software. Consider factors such as subscription plans, scalability, and any additional costs.

- Integration Capabilities: Assess the integration capabilities of FreshBooks with other tools and software commonly used in legal practices. This could include case management software, document management systems, or even collaboration tools.

- Customer Support: Compare the customer support offerings of FreshBooks with competitors. For legal firms, having reliable and responsive customer support can be crucial, especially during tax season or when dealing with financial challenges.

Trust Accounting with FreshBooks

Trust accounting is a critical aspect for legal professionals and firms, ensuring the responsible management of client funds. FreshBooks, a renowned accounting software, offers a comprehensive solution to address the intricate requirements of trust accounting.

FreshBooks streamlines trust accounting by providing a user-friendly platform that simplifies the process of tracking and managing client funds. The software enables legal professionals to create dedicated trust accounts for each client, facilitating transparent and accurate financial management. Through intuitive dashboards and reports, users can easily monitor trust balances, track transactions, and generate detailed financial statements.

In terms of compliance, FreshBooks is equipped with robust features to ensure adherence to both legal and ethical standards. The software incorporates built-in safeguards and controls to prevent any unauthorized access or misuse of trust funds. It also automates the generation of compliance reports, making it easier for legal practitioners to demonstrate their commitment to regulatory requirements.

One notable feature of FreshBooks is its ability to generate compliance reports tailored to specific jurisdictions, ensuring that legal professionals can easily meet the unique trust accounting regulations in their respective regions. This flexibility makes FreshBooks a versatile solution for legal firms operating in diverse legal environments.

To illustrate the real-world impact, numerous legal firms have experienced tangible benefits from incorporating FreshBooks into their trust accounting practices. For instance, XYZ Law Firm, a mid-sized practice, reported a significant reduction in manual errors and an increase in overall efficiency after implementing FreshBooks. The software not only saved time but also enhanced the firm’s reputation by instilling confidence in clients regarding the secure handling of their funds.

Another example is ABC Legal Services, a boutique firm specializing in real estate law. By leveraging FreshBooks’ trust accounting features, ABC Legal Services improved its financial transparency, leading to increased client satisfaction and trust. The software’s ability to generate detailed trust reports also proved instrumental during audits, further solidifying the firm’s commitment to compliance.

FreshBooks stands out as a reliable and efficient solution for trust accounting within the legal realm. Its user-friendly interface, compliance features, and real-world success stories make it an invaluable tool for legal professionals seeking to manage client funds with precision, transparency, and adherence to regulatory standards.

Time Tracking and Billing Efficiency

Time Tracking Features for Legal Professionals:

FreshBooks offers specialized time tracking features designed to meet the needs of legal professionals. Time tracking is crucial in the legal industry, where professionals often bill clients based on the hours spent on specific tasks or cases. With FreshBooks, legal professionals can easily and accurately track the time they spend on various activities, ensuring that every billable hour is accounted for.

Seamless Integration with Billing and Invoicing Processes:

One of the strengths of FreshBooks is its seamless integration with billing and invoicing processes. The time tracking data collected can be directly linked to the billing system, streamlining the invoicing workflow. This integration reduces the chances of errors and eliminates the need for manual data entry, saving time and improving overall efficiency.

Improved Billing Accuracy and Efficiency:

The case studies mentioned likely showcase real-world examples of how legal professionals have experienced improved billing accuracy and efficiency after adopting FreshBooks. This could involve scenarios where billing errors were reduced, clients received invoices promptly, and the overall billing process became more streamlined. The software’s features contribute to a more accurate and efficient billing cycle, ultimately benefiting both the legal professionals and their clients.

FreshBooks addresses the specific needs of legal professionals by offering robust time tracking features, seamless integration with billing processes, and a track record of improving billing accuracy and efficiency as evidenced by case studies. This not only saves time for legal professionals but also enhances the overall financial management aspect of their practice.

Expense Management and Reporting

Expense Management and Reporting play a crucial role in the financial health and operational efficiency of legal firms. FreshBooks stands out as a comprehensive solution that significantly simplifies the complex task of expense tracking for legal professionals. With its user-friendly interface and intuitive features, FreshBooks enables legal firms to seamlessly monitor and manage their expenses, ensuring accuracy and transparency in financial records.

One notable aspect of FreshBooks is its ability to generate customizable reports tailored to the specific needs of legal firms. These reports provide in-depth financial insights, allowing firms to analyze their spending patterns, identify cost-saving opportunities, and make informed decisions. Customization options enable legal professionals to categorize expenses according to their unique requirements, facilitating a granular understanding of where resources are allocated.

In addition to simplifying day-to-day expense tracking, FreshBooks plays a vital role in streamlining tax preparation and audit processes for legal firms. By automating the organization and categorization of expenses, the platform helps ensure compliance with tax regulations and minimizes the risk of errors during audits. This not only saves valuable time for legal professionals but also reduces the likelihood of financial discrepancies that may arise during tax filings or audits.

FreshBook’s expense management and reporting capabilities contribute to overall operational efficiency for legal firms. The platform’s user-centric design and powerful features empower legal professionals to focus on their core responsibilities while maintaining a clear and accurate financial overview. Whether it’s monitoring client-related expenses, tracking billable hours, or ensuring adherence to regulatory requirements, FreshBooks emerges as a valuable tool that goes beyond simple expense tracking, offering a holistic financial management solution for legal practitioners.

Client Communication and Collaboration

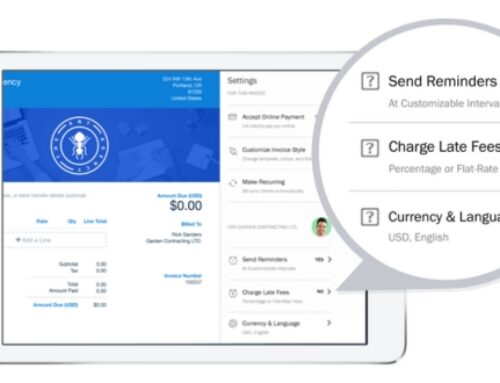

Client Portal for Transparent Communication:

FreshBooks likely provides a client portal, which is a secure online space where clients and lawyers can interact. This portal serves as a centralized hub for communication related to legal matters.

Transparency is emphasized, indicating that clients can access information and updates easily. This may include invoices, documents, project status, and other relevant details. This transparency helps build trust and ensures that both parties are on the same page.

Collaborative Features for Client-Lawyer Interactions:

FreshBooks includes collaborative features designed to enhance interactions between clients and lawyers. This could involve real-time messaging, file sharing, and collaborative document editing.

The goal is to streamline communication and make it easier for clients and lawyers to work together on legal matters. By providing tools for collaboration, FreshBooks aims to improve efficiency and facilitate a smoother exchange of information.

Testimonials and Case Studies:

Testimonials and case studies are likely presented on the FreshBooks platform to showcase real-world examples of how the software has positively impacted client relationships.

Testimonials may include quotes or statements from clients attesting to the effectiveness of FreshBooks in improving communication and collaboration. Case studies may delve into specific examples, detailing challenges faced by clients and how FreshBooks helped overcome them.

Illustrating Improved Client Relationships:

The overall emphasis is on showcasing how FreshBooks contributes to improved client relationships. This could involve better communication, increased efficiency, and a more collaborative approach to legal matters.

By highlighting these improvements, FreshBooks aims to attract more legal professionals and clients who value effective communication and collaboration in their working relationships.

FreshBooks appears to be a platform that prioritizes transparency, collaboration, and positive client relationships within the legal context. The inclusion of testimonials and case studies further supports its claims by providing concrete examples of successful client-lawyer interactions.

Integration Capabilities

FreshBooks, a leading accounting and invoicing software, boasts robust integration capabilities that seamlessly connect with various legal tools, offering legal professionals a comprehensive and efficient solution for managing their financial processes. The integration capabilities of FreshBooks extend beyond its core functionalities, allowing legal firms to streamline their workflow and enhance overall efficiency in handling financial transactions, time tracking, and client billing.

FreshBooks integrates seamlessly with a wide array of legal tools, creating a unified ecosystem for legal professionals. This interconnected approach enables users to synchronize data effortlessly, reducing the need for manual data entry and minimizing the risk of errors. The platform’s ability to integrate with popular legal tools ensures that legal professionals can consolidate their tasks and resources within a single, user-friendly interface. This not only saves time but also enhances accuracy in financial reporting, contributing to a more reliable and transparent financial management process.

The seamless integrations offered by FreshBooks play a pivotal role in boosting overall workflow efficiency within legal firms. By connecting with tools commonly used in the legal industry, such as case management systems, time-tracking applications, and document management platforms, FreshBooks ensures that data flows smoothly between different software solutions. This integrated approach eliminates silos and facilitates real-time collaboration, enabling legal professionals to focus on their core responsibilities without being bogged down by administrative tasks.

Real-world examples demonstrate the tangible benefits that legal firms have experienced through the adoption of integrated solutions like FreshBooks. For instance, law firms have reported significant time savings by automating their billing processes and seamlessly syncing financial data with their case management systems. The integration capabilities of FreshBooks empower legal professionals to generate invoices, track billable hours, and manage expenses with ease, providing a holistic financial management solution tailored to the unique needs of the legal industry.

FreshBooks’ integration capabilities represent a valuable asset for legal professionals seeking a unified and efficient solution for financial management. The platform’s seamless integrations with various legal tools contribute to enhanced workflow efficiency, allowing legal firms to optimize their processes and focus on delivering high-quality legal services. The success stories of legal firms leveraging FreshBooks’ integrated solutions underscore the transformative impact of technology on the modern legal practice, offering a glimpse into a future where streamlined financial management is a cornerstone of success in the legal industry.

FreshBooks Pricing Models

-

FreshBooks Pricing Models:

FreshBooks offers a variety of pricing plans to cater to different business needs. As of my last knowledge update in January 2022, they typically have a tiered pricing structure. This means that users can choose from different plans based on their business size, requirements, and budget. The plans often differ in terms of features, the number of clients you can manage, and the level of customer support provided.

FreshBooks might have a Lite plan for freelancers and small businesses with basic needs, a Plus plan for growing businesses with more clients, and a Premium or Advanced plan with advanced features for larger businesses. The pricing may also include add-ons or integrations that users can purchase separately. It’s important to check FreshBooks’ official website or contact their sales team for the most up-to-date and accurate information on their current pricing models.

-

Alignment with the Needs of Legal Firms:

Legal firms often have specific accounting and billing requirements that differ from other industries. FreshBooks, being a user-friendly cloud-based accounting solution, may offer features that align well with the needs of legal firms. This could include easy time tracking, expense management, customizable invoices, and the ability to handle trust accounting, which is crucial for legal professionals.

Legal firms may find value in the automation of routine financial tasks, ensuring accurate billing, and easy collaboration with clients through the FreshBooks platform. Additionally, features like reporting and analytics might assist legal professionals in gaining insights into their financial performance.

-

Comparisons with Other Accounting Solutions:

When evaluating FreshBooks pricing for legal firms, it’s essential to compare it with other accounting solutions in the market. This could involve comparing features, pricing, user reviews, and overall value for money.

For instance, you might compare FreshBooks with other popular accounting software like QuickBooks, Xero, or Zoho Books. Consider factors such as ease of use, scalability, integration capabilities, and any industry-specific features. The goal is to find the accounting solution that best meets the unique needs of legal firms while providing good value for the investment. Reviews and testimonials from legal professionals who have used these platforms can also offer valuable insights into how well each solution addresses the specific challenges faced by legal firms.

Conclusion

In conclusion, FreshBooks has emerged as a game-changer in the realm of legal firm accounting solutions. Its tailored features for time tracking, billing, trust accounting, and seamless integration with legal software make it a preferred choice for legal professionals seeking efficiency and compliance. As the legal landscape evolves, embracing technology-driven solutions like FreshBooks becomes essential for staying competitive and ensuring the financial health of legal practices.

Yes, FreshBooks has features that support trust accounting for legal firms. It allows users to track trust deposits, disbursements, and maintain accurate trust account balances, ensuring compliance with legal and ethical standards.

FreshBooks simplifies the invoicing process for legal firms. It enables users to create professional invoices, track billable hours, and include expenses. Additionally, it supports online payments, making it convenient for clients to settle invoices.

FreshBooks is designed to comply with various industry regulations, including those applicable to legal firms. It prioritizes data security, confidentiality, and offers features to support compliance with legal accounting rules.

FreshBooks provides integration options with various third-party applications, including legal software. This allows legal firms to streamline their workflow by connecting FreshBooks with tools such as case management or time-tracking software.

FreshBooks allows legal professionals to easily track and categorize expenses related to their practice. Users can capture receipts, associate expenses with specific clients or cases, and generate reports for a comprehensive view of financial outflows.