The Significance of Bookkeeping Cleanup

Accuracy and Compliance:

- Decision-Making:

Accurate financial records are the foundation for informed decision-making. Business leaders rely on up-to-date and precise financial information to assess the health of their company, make strategic choices, and allocate resources effectively.

Timely and accurate financial data enables management to identify areas of strength and weakness, facilitating the development of strategies to capitalize on opportunities and mitigate risks.

- Regulatory Requirements and Tax Obligations:

Compliance with regulatory standards and tax obligations is paramount for any business. Organized bookkeeping ensures that financial records adhere to legal requirements and standards set by regulatory bodies.

Properly maintained records simplify the tax filing process, reducing the likelihood of errors or omissions. This, in turn, helps prevent potential legal issues, fines, or penalties associated with non-compliance.

Improved Financial Analysis:

- Enhanced Organization:

Organized bookkeeping is essential for a clear and comprehensive view of a company’s financial health. Categorizing and documenting financial transactions in an orderly manner allows for efficient retrieval and analysis of data.

A well-organized financial system enables the identification of key financial metrics and performance indicators, aiding in the evaluation of the company’s overall financial position.

- Trend Identification:

Accurate and organized financial records facilitate the identification of financial trends over time. Analyzing trends helps businesses anticipate future financial challenges, capitalize on opportunities, and make proactive adjustments to their strategies.

Comparing historical financial data enables businesses to assess the impact of decisions and market conditions, contributing to a more informed and forward-thinking financial strategy.

- Strategic Decision-Making:

Informed financial analysis is crucial for strategic decision-making. Business leaders can rely on accurate financial data to evaluate the feasibility of new initiatives, assess the return on investment, and allocate resources efficiently.

By understanding the financial implications of various options, organizations can make decisions that align with their long-term goals and contribute to sustainable growth.

- Efficient Auditing:

Audit Preparedness:

Well-maintained financial records streamline the audit preparation process. Auditors can more efficiently review and validate financial transactions when records are organized, reducing the time and resources required for the audit.

Businesses that regularly conduct internal audits benefit from a continuous improvement cycle, addressing potential issues before they become significant audit concerns.

Risk Reduction:

Accurate bookkeeping reduces the risk of discrepancies, errors, or fraudulent activities being overlooked. This not only ensures compliance but also safeguards the company’s reputation and financial integrity.

By minimizing the risk of audit findings, businesses can avoid penalties, legal complications, and damage to their relationships with stakeholders.

The significance of bookkeeping cleanup extends beyond simple record-keeping; it serves as a fundamental element in maintaining financial health, complying with regulations, making informed decisions, and facilitating efficient auditing processes. Businesses that prioritize meticulous bookkeeping position themselves for sustained success and resilience in a dynamic business environment.

Introduction to FreshBooks:

Key Features and Benefits:

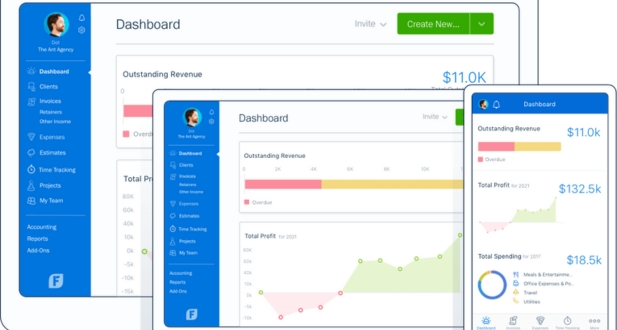

FreshBooks is a cloud-based accounting software designed for small businesses and freelancers. Its key features include invoicing, expense tracking, time tracking, project management, and financial reporting. The software is known for its simplicity and user-friendly interface, making it easy for individuals with varying levels of accounting expertise to manage their finances effectively.

One significant benefit is the automation of tasks such as invoicing and expense tracking, which saves time and reduces the likelihood of errors. Additionally, FreshBooks provides insights into the financial health of the business through customizable reports.

User-Friendly Interface for Small Businesses:

The intuitive design of FreshBooks caters to the needs of small businesses. The dashboard is streamlined, allowing users to access essential features without navigating through complex menus. This simplicity is particularly beneficial for entrepreneurs who may not have an extensive background in accounting, enabling them to efficiently manage their financial operations.

Cloud-Based Accessibility:

Advantages of Cloud-Based Accounting:

FreshBooks operates on a cloud-based platform, offering several advantages. Cloud-based accounting allows users to store and access financial data over the internet rather than relying on local servers. This enhances collaboration, as multiple users can access the data simultaneously from different locations.

Additionally, cloud-based solutions like FreshBooks provide automatic updates, ensuring that users always have access to the latest features and security patches without the need for manual installations. This accessibility is particularly valuable for businesses with remote teams or on-the-go entrepreneurs.

Accessing Financial Data Anytime, Anywhere:

One of the key benefits of FreshBooks being cloud-based is the ability to access financial data anytime, anywhere. Users can log in from various devices, including smartphones and tablets, making it convenient for business owners who need to manage their finances while on the move. This flexibility enhances the speed of decision-making and ensures that financial data is readily available whenever it is needed.

FreshBooks Cleanup Tools:

Explanation of Cleanup Tools:

FreshBooks offers a set of cleanup tools designed to streamline the bookkeeping process. These tools are specifically crafted to assist users in organizing and reconciling their financial data efficiently. Common features include data categorization, reconciliation assistance, and identification of discrepancies.

Simplifying the Cleanup Process:

The cleanup tools in FreshBooks simplify the often tedious task of bookkeeping cleanup. By automating or guiding users through the process of reconciling accounts, categorizing expenses, and identifying errors or discrepancies, these tools save time and reduce the likelihood of errors. This is especially valuable for small businesses that may not have dedicated accounting staff, allowing them to maintain accurate and up-to-date financial records without a significant time investment.

Getting Started with FreshBooks Cleanup:

-

Reviewing Existing Data:

Assessing the current state of financial records: Start by thoroughly examining your existing financial records in FreshBooks. This involves reviewing transactions, invoices, expenses, and other relevant data. Identify any inconsistencies, discrepancies, or errors in the records.

Identifying areas that require cleanup: Once you’ve assessed the financial records, pinpoint specific areas that need cleanup. This may include outdated or incorrect entries, incomplete transactions, or improperly categorized expenses. Understanding the scope of the cleanup helps in planning and executing the process more effectively.

-

Reconciling Accounts:

The importance of reconciling bank and credit card accounts: Reconciliation is a critical step in maintaining accurate financial records. It involves comparing your FreshBooks records with bank and credit card statements to ensure they match. This process helps identify any missing or duplicated transactions, making your financial data more reliable and reducing the risk of errors.

Step-by-step guide to reconciliation in FreshBooks: Provide detailed instructions on how to reconcile accounts within the FreshBooks platform. This may involve navigating to the reconciliation section, importing bank statements, matching transactions, and resolving discrepancies. Offering a step-by-step guide ensures users can confidently perform this crucial task.

-

Addressing Duplicate Entries:

Common causes of duplicate entries: Explain the common reasons for duplicate entries, such as manual errors, system glitches, or importing data multiple times. Understanding the root causes helps users prevent future occurrences and promotes cleaner data management practices.

Using FreshBooks tools to identify and eliminate duplicates: Highlight specific tools and features within FreshBooks that can assist in identifying and resolving duplicate entries. This may include search functionalities, filters, or dedicated duplicate detection features. Provide a walkthrough on how users can leverage these tools effectively to streamline the cleanup process.

Organizing Financial Data:

Organizing financial data is crucial for businesses to maintain a clear and accurate record of their transactions, income, and expenses. This process involves several key steps to ensure that financial information is easily accessible, understandable, and useful for decision-making. Let’s elaborate on the three main aspects mentioned:

Categorizing Transactions:

Chart of Accounts:

A chart of accounts is a comprehensive list of all the accounts used by a company to record its financial transactions.

It typically includes assets, liabilities, equity, revenue, and expense accounts, each assigned a unique account code for easy reference.

Creating a well-defined chart of accounts ensures that every financial transaction can be accurately categorized into the appropriate account.

Income and Expense Categories:

Streamlining income and expense categories involves organizing revenue and cost items into logical groups.

This simplifies financial reporting and analysis by providing a clear overview of where money is coming from and where it’s going.

For example, expense categories might include utilities, rent, office supplies, and employee salaries.

Utilizing Tags and Labels:

Role of Tags:

Tags are metadata labels that can be attached to transactions to provide additional information or context.

They are valuable for tracking specific details such as project names, client names, or product lines.

Tags enable businesses to filter and analyze transactions based on customized criteria, offering a more granular view of financial data.

Customizing Labels:

Customizing labels involves tailoring tags to match the specific needs and terminology of a business.

For example, a business working on multiple projects might use project-specific tags to differentiate expenses related to each project.

Custom labels enhance the flexibility of the financial management system, making it more adaptable to the unique requirements of the business.

Client and Vendor Management:

Organizing Client Information:

In tools like FreshBooks, client management involves maintaining a comprehensive database of client information.

This includes client contact details, project specifics, billing history, and any other relevant information.

Effective client organization ensures accurate invoicing, streamlined communication, and improved customer relationship management.

Streamlining Vendor Details:

Vendor management involves maintaining accurate records of suppliers, service providers, and other entities the business transacts with.

This includes vendor contact information, payment terms, and transaction history.

Streamlining vendor details aids in efficient expense tracking, helps negotiate better terms, and ensures compliance with payment obligations.

Automation and Integration

Streamlining Recurring Transactions:

- Setting up Recurring Invoices and Expenses:

Businesses often deal with recurring transactions such as monthly subscriptions, utility bills, or salaries. Automation tools allow the creation of templates for invoices and expenses that repeat regularly.

This reduces the manual effort required each time a recurring transaction occurs. The system can automatically generate and send invoices or record expenses at specified intervals.

- Automating Routine Financial Tasks:

Automation can be applied to various financial tasks, including reconciliation, data entry, and reporting. For instance, regular data entries for sales, purchases, or payroll can be automated to occur at scheduled times.

By automating routine tasks, businesses can minimize errors, save time, and ensure consistency in financial data management.

Integration with Bank Feeds:

- Enhancing Data Accuracy:

Bank feed integration involves linking the financial software directly with the bank, allowing for real-time data updates. This ensures that the financial records are up-to-date and accurate, reducing the risk of errors that may occur with manual data entry.

Automated bank feeds also reconcile transactions automatically, matching them with corresponding entries in the financial records.

- Troubleshooting Common Integration Issues:

Despite the benefits, integration with bank feeds may encounter issues such as connection problems, data discrepancies, or synchronization errors. Troubleshooting involves identifying and resolving these issues promptly.

Regular monitoring of integration processes, updating software, and addressing connectivity issues are essential for maintaining a seamless flow of financial data.

The integration of automation in financial processes, especially concerning recurring transactions and bank feeds, brings efficiency, accuracy, and time savings to businesses. By leveraging technology to handle routine tasks and ensuring seamless integration with bank feeds, organizations can streamline their financial operations and focus on strategic decision-making rather than being bogged down by manual data entry and reconciliation.

Advanced Reporting and Analytics:

Generating Custom Reports:

Tailored to Business Needs: FreshBooks allows users to create custom reports that are specifically designed to meet the unique requirements of their business. This flexibility is crucial as different businesses may have distinct metrics and key performance indicators (KPIs) that they want to track.

Analyzing Financial Data for Strategic Insights: The ability to generate custom reports means businesses can analyze their financial data in a more granular way. This goes beyond basic financial statements and allows for a deeper understanding of trends, patterns, and outliers. These insights can then be used to make informed strategic decisions.

Cash Flow Management:

Monitoring and Managing Cash Flow: Cash flow is a critical aspect of financial management for any business. FreshBooks provides tools to actively monitor and manage cash flow. This includes tracking money coming in and going out, ensuring timely invoicing and payment, and identifying potential cash flow bottlenecks.

Utilizing Reports to Forecast Future Financial Scenarios: FreshBooks’ reporting and analytics features enable businesses to not only understand their current financial situation but also forecast future scenarios. By leveraging historical data and generating predictive reports, businesses can anticipate cash flow trends, identify potential challenges, and make proactive decisions to optimize their financial position.

FreshBooks Advanced Reporting and Analytics features empower businesses to go beyond basic financial tracking. Custom reports provide tailored insights, and effective cash flow management is supported through active monitoring and the ability to forecast future scenarios. This comprehensive approach enables businesses to make data-driven decisions that contribute to their financial health and long-term success.

Collaborative Bookkeeping:

Multi-User Access:

Setting up Multiple Users: In collaborative bookkeeping, it’s crucial to have a system that allows multiple users to work on financial data simultaneously. This involves creating user accounts for each team member involved in bookkeeping.

Managing Permissions and Access Levels: Not all users need the same level of access. For instance, a junior accountant might only need access to input data, while a financial manager might require full access to all financial records. Implementing granular permission settings ensures that each user can only access the information relevant to their role. This enhances security and prevents unauthorized access.

Communication Tools:

Utilizing FreshBooks Communication Features: FreshBooks, being a cloud-based accounting software, often includes communication features that streamline collaboration. This can include commenting on specific transactions, attaching documents, or leaving notes for other team members directly within the platform. This minimizes the need for external communication tools and keeps all relevant information centralized.

Enhancing Transparency in Financial Processes: Transparent communication is vital in collaborative bookkeeping. By using communication tools effectively, team members can discuss financial transactions, clarify doubts, and provide insights, fostering a collaborative environment. This transparency not only improves the accuracy of financial records but also helps in resolving any discrepancies or issues promptly.

Collaborative bookkeeping involves setting up a system where multiple users can work together efficiently. This requires not only the technical setup of multi-user access but also the implementation of communication tools to enhance collaboration and transparency in financial processes. This approach not only improves the accuracy and efficiency of bookkeeping but also facilitates better teamwork among individuals responsible for financial management.

Troubleshooting and Support:

Common Issues and Solutions:

Addressing common challenges in bookkeeping cleanup:

This involves identifying and resolving issues that commonly arise during the process of cleaning up bookkeeping records. Examples of challenges might include duplicate entries, misclassified transactions, or reconciliation discrepancies.

Solutions could include providing step-by-step guides on how to merge or delete duplicate entries, offering best practices for reclassifying transactions, or providing troubleshooting tips for reconciliation problems.

Troubleshooting errors and discrepancies:

This section involves helping users identify and fix specific errors or discrepancies in their bookkeeping. This could cover a range of issues such as mismatched balances, incorrect categorization of expenses, or issues with bank reconciliations.

The content could include diagnostic steps to identify the root cause of the problem and then guide users through the process of correcting the errors. This might involve double-checking entries, verifying source documents, or ensuring proper synchronization with bank feeds.

FreshBooks Support Resources:

Accessing help articles, tutorials, and forums:

This part focuses on the self-help resources available to users. Help articles could cover a wide array of topics, from basic functionalities to advanced features. Tutorials might provide step-by-step instructions for common tasks.

Forums or community spaces could be platforms where users share their experiences, ask questions, and provide solutions. This collaborative environment allows users to benefit from the collective knowledge of the community.

Contacting FreshBooks support for personalized assistance:

This section emphasizes the availability of direct support from FreshBooks. Users encountering issues beyond what’s covered in the general resources can seek personalized assistance.

Contact methods might include phone support, email, live chat, or a ticketing system. Users should be informed about response times and the type of information they need to provide when seeking help. This ensures a smoother and more efficient support experience.

Conclusion:

In conclusion, efficient bookkeeping cleanup and organization are integral to the success of any business. FreshBooks, with its user-friendly interface and robust features, offers a comprehensive solution for businesses looking to streamline their financial processes. By following the step-by-step guide provided in this article, businesses can ensure accurate records, compliance with regulations, and improved financial decision-making. Stay organized, embrace automation, and leverage the power of FreshBooks to achieve financial success in your business.

Regular bookkeeping cleanup ensures that your financial records are accurate and up-to-date. It helps in identifying errors, reconciling accounts, and providing a clear picture of your business’s financial health, making it easier for decision-making.

FreshBooks typically uses a systematic approach, reviewing transactions, reconciling accounts, and categorizing expenses accurately. They may also provide guidance on best practices for ongoing bookkeeping.

Yes, FreshBooks can assist in organizing your financial documents. This may include setting up a system for document storage, categorizing receipts, and ensuring that all relevant documents are easily accessible.

FreshBooks Bookkeeping Cleanup is suitable for businesses of various sizes and industries. Whether you’re a freelancer, small business owner, or a larger enterprise, the service can help maintain organized and accurate financial records.

FreshBooks Bookkeeping Cleanup can be both one-time and ongoing. Some businesses may require a one-time cleanup to address existing issues, while others may choose to engage in ongoing bookkeeping services for continuous support.