Introduction:

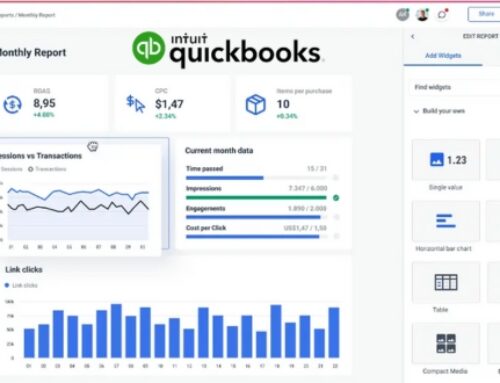

Fortifying Your Finances: Data Security in the QuickBooks Universe

In today’s digital era, where every click leaves a footprint and every transaction generates data, financial information has become a prime target for cybercriminals. The evolving cybersecurity landscape, with its ever-sophisticated threats, presents a constant challenge for individuals and businesses alike. In this context, ensuring robust data security for your financial information becomes paramount, especially when navigating the complex world of financial management software.

Understanding the Importance of Data Security in Financial Management:

The significance of data security in financial management cannot be overstated. Sensitive financial data, including bank account details, transaction histories, and personal information, is a treasure trove for malicious actors. Data breaches can result in:

- Financial losses: Identity theft, unauthorized access to funds, and fraudulent transactions can cause significant financial hardship.

- Reputational damage: Businesses that experience data breaches face public scrutiny, loss of customer trust, and potential legal repercussions.

- Operational disruption: Cyberattacks can disrupt critical financial operations, hindering business productivity and causing costly downtime.

QuickBooks as a Secure Financial Management Solution:

Recognizing the gravity of these threats, QuickBooks prioritizes data security and offers a comprehensive suite of features designed to protect your financial information. Here are some key aspects that underscore QuickBooks’ commitment to security:

- Multi-layered Security: QuickBooks employs a robust security architecture, including encryption of data at rest and in transit, intrusion detection and prevention systems, and regular vulnerability assessments.

- Access Control: Granular access controls allow you to manage user permissions, ensuring only authorized individuals have access to sensitive data.

- Compliance: QuickBooks adheres to stringent data protection regulations like GDPR and CCPA, ensuring your data is handled responsibly and in accordance with legal requirements.

- Regular Updates: QuickBooks constantly releases updates and security patches to address any emerging vulnerabilities and keep your data protected against the latest threats.

- User Education: QuickBooks provides resources and educational materials to help users understand best practices for data security and protect their financial information.

Beyond these built-in features, here are some additional steps you can take to further strengthen your data security within QuickBooks:

- Use strong passwords and enable two-factor authentication.

- Regularly back up your data to a secure location.

- Be vigilant about phishing attempts and suspicious activity.

- Keep your QuickBooks software updated with the latest patches.

By understanding the importance of data security and leveraging the robust security features offered by QuickBooks, you can confidently navigate the complexities of financial management with peace of mind, knowing that your valuable financial information is protected.

QuickBooks Data Security Features:

Guarding Your Financial Fortress

QuickBooks employs a multi-layered approach to data security, incorporating various measures to protect your sensitive financial information. Let’s delve into some of the key features that form the cornerstone of its security architecture:

Multi-Factor Authentication (MFA): Adding Extra Layers of Protection

Consider MFA as a virtual security guard stationed at your QuickBooks login portal. It requires more than just a password to gain entry, significantly reducing the risk of unauthorized access. Here’s how it works:

- Enabling MFA: QuickBooks offers various MFA options, including text messages, phone calls, or authenticator apps. Once enabled, users must provide their password plus a unique code generated through their chosen method.

Benefits of MFA:

- Thwarts Password-Related Breaches: Even if someone acquires your password, they’ll be blocked without the additional verification code.

- Protects Against Phishing Attempts: MFA safeguards against phishing scams that attempt to steal login credentials.

- Compliant with Regulations: MFA aligns with industry best practices and compliance requirements for sensitive data protection.

Encryption Protocols: Shielding Data from Prying Eyes

Encryption transforms your financial data into an unreadable code, ensuring its confidentiality even if intercepted by unauthorized individuals. QuickBooks employs encryption in two critical areas:

- Data in Transit: Information exchanged between your device and QuickBooks servers is encrypted using secure protocols like Transport Layer Security (TLS), safeguarding it during transmission.

- Data at Rest: Data stored within QuickBooks servers is also encrypted, ensuring its protection even if servers are compromised. QuickBooks adheres to industry-standard encryption practices, such as 256-bit Advanced Encryption Standard (AES).

Access Controls and User Permissions: Defining Digital Boundaries

Not everyone in your organization needs access to every piece of financial data. QuickBooks empowers you to establish granular access controls, ensuring only authorized individuals can view or modify specific information:

- Customizing Access Levels: Create different user roles with varying permissions, tailoring access to specific tasks or data sets. For example, you might grant accountants full access to financial data while restricting sales representatives to customer information only.

- Data Privacy Through Permission Settings: Prevent unauthorized access to sensitive information, such as payroll data or bank account details, by restricting access to authorized individuals only.

- Audit Trails and Activity Logs: Monitor user activity and track changes made to financial data, enabling you to identify potential security issues or unauthorized access attempts.

By effectively combining these security features, QuickBooks constructs a multi-layered defense system around your financial data, safeguarding it from a multitude of threats. By understanding and utilizing these features, you can confidently manage your finances within a secure environment, knowing your sensitive information is well-protected.

Compliance with Data Protection Regulations:

Navigating the Regulatory Landscape

Data protection regulations play a crucial role in safeguarding individuals’ privacy and ensuring responsible handling of sensitive information. QuickBooks demonstrates its commitment to data security by adhering to several prominent regulations, providing you with the confidence that your financial data is managed in compliance with legal requirements.

General Data Protection Regulation (GDPR): Protecting Data Across Borders

The GDPR, a comprehensive data protection regulation enacted in the European Union, has global implications for businesses handling personal data of EU citizens. Here’s how QuickBooks addresses GDPR requirements:

- Data Subject Rights: QuickBooks empowers users to exercise their GDPR rights, including accessing, rectifying, erasing, or restricting the processing of their personal data.

- Data Minimization: QuickBooks adheres to the principle of data minimization, collecting and storing only the necessary personal data for specified purposes.

- Security Measures: The robust security features discussed earlier, such as encryption and access controls, align with GDPR’s requirements for protecting personal data.

- Data Processing Agreements: QuickBooks provides data processing agreements (DPAs) to customers, establishing a clear legal framework for data processing activities and ensuring compliance with GDPR obligations.

Health Insurance Portability and Accountability Act (HIPAA): Safeguarding Sensitive Health Information

In the United States, HIPAA regulates the handling of protected health information (PHI), ensuring its confidentiality and security. While QuickBooks isn’t specifically designed for healthcare organizations, it offers features that can support HIPAA compliance when used appropriately:

- Access Controls: Granular access controls allow you to restrict access to PHI to authorized individuals only, minimizing the risk of unauthorized disclosure.

- Audit Trails: Track who accessed PHI and when, aiding in compliance audits and investigations of potential breaches.

- Encryption: Encrypt PHI both at rest and in transit to protect it from unauthorized access, even if intercepted.

- Business Associate Agreements (BAAs): QuickBooks provides BAAs to customers who handle PHI, establishing a contractual agreement to uphold HIPAA requirements.

- It’s important to note that achieving full HIPAA compliance within QuickBooks often requires additional organizational measures and careful configuration of the software to align with specific HIPAA rules.

Payment Card Industry Data Security Standard (PCI DSS): Securing Financial Transactions

PCI DSS, a set of security standards established by major card brands, ensures the protection of payment card data during processing and storage. QuickBooks Online adheres to PCI DSS standards, providing a secure environment for handling cardholder information:

- Vulnerability Scanning and Patching: QuickBooks regularly scans its systems for vulnerabilities and promptly applies security patches to address potential risks.

- Access Controls: Strict access controls limit access to payment card data to authorized personnel only, reducing the risk of unauthorized access or theft.

- Encryption: Payment card data is encrypted both at rest and in transit, safeguarding it from interception.

- Regular Security Assessments: QuickBooks undergoes regular security assessments by independent third-party auditors to validate its compliance with PCI DSS standards.

By adhering to these comprehensive regulations, QuickBooks demonstrates its commitment to responsible data handling and provides a secure foundation for users to manage their financial information with confidence, knowing that their data is protected in accordance with legal requirements and industry best practices.

Best Practices for User Data Security: Building a Culture of Awareness

While QuickBooks provides robust security features and adheres to stringent regulations, effective data protection ultimately requires a collaborative effort. By implementing best practices for user data security, you can create a culture of awareness within your organization and significantly reduce the risk of breaches or unauthorized access.

Secure Password Practices: The First Line of Defense

Strong passwords are the gatekeepers of your financial data; treat them with the respect they deserve. Here are some best practices to implement:

- Create Strong Passwords: Avoid easily guessable patterns or personal information. Use a combination of uppercase and lowercase letters, numbers, and special characters. Aim for at least 12 characters in length.

- Unique Passwords for Each Account: Don’t recycle passwords across different accounts. A compromised password on one platform could grant access to your QuickBooks data as well.

- Regular Password Updates: Don’t set and forget. Update your passwords at least every three months, and consider immediate changes if you suspect any compromise.

- Two-Factor Authentication: Enable two-factor authentication (2FA) for added security. This requires an additional verification step beyond your password, significantly reducing the risk of unauthorized access.

- Password Managers: Consider using a password manager to securely store and manage your passwords.

Regular Software Updates: Keeping Your Guard Up

Software updates are more than just new features; they often contain critical security patches that address vulnerabilities and protect you from evolving threats. Make sure you follow these update practices:

- Enable Automatic Updates: Whenever possible, enable automatic updates for QuickBooks to ensure you receive the latest security patches as soon as they become available.

- Check for Updates Regularly: Even with automatic updates, it’s good practice to manually check for updates periodically to ensure you haven’t missed any critical releases.

- Install Updates Promptly: Don’t delay installing updates. Vulnerabilities can be exploited quickly, so promptly installing patches is crucial.

- Stay Informed about Security Advisories: Monitor QuickBooks security advisories and notifications to stay aware of potential threats and recommended actions.

Employee Training on Data Security: Building a Culture of Awareness

Educating your employees about data security best practices is essential for creating a robust defense system. Here are some steps to take:

- Conduct Regular Training Sessions: Organize regular training sessions on data security topics, covering password hygiene, phishing awareness, social engineering tactics, and responsible data handling within QuickBooks.

- Provide Resources and Materials: Make readily available resources and materials, such as security guides, cheat sheets, and online tutorials, for employees to refer to and refresh their knowledge.

- Open Communication and Reporting: Encourage an open communication environment where employees feel comfortable reporting suspicious activity or potential security breaches immediately.

- Lead by Example: Set a positive example by adhering to data security best practices yourself and demonstrating their importance within the organization.

By implementing these best practices, you can significantly enhance your overall data security posture within QuickBooks. Remember, data security is an ongoing process, not a one-time event. By fostering a culture of awareness and vigilance, you can empower your employees to become active participants in protecting your valuable financial information.

QuickBooks Cloud Security:

Trusting Your Finances to the Cloud

In today’s digital landscape, the cloud has become the preferred platform for managing various aspects of our lives, including finances. QuickBooks, recognizing this shift, offers a robust cloud-based solution for your financial management needs. However, entrusting your sensitive financial data to the cloud might raise concerns about security.

Let’s delve into the security measures that safeguard your data within the QuickBooks cloud infrastructure:

Cloud Infrastructure Security: Building a Fortress in the Sky

QuickBooks cloud security is built upon a multi-layered foundation, ensuring the protection of your financial data at every stage:

- Physical Security: QuickBooks data centers are located in secure facilities with 24/7 physical security measures, including access control systems, video surveillance, and intrusion detection systems.

- Network Security: Advanced network security protocols and firewalls safeguard against unauthorized access and cyberattacks. Regular vulnerability assessments and penetration testing identify and address potential security gaps.

- Data Encryption: Your data is encrypted at rest and in transit using industry-standard encryption algorithms, such as AES-256, rendering it unreadable to unauthorized individuals.

- Disaster Recovery: Robust disaster recovery plans and redundant data backups ensure business continuity even in the event of unexpected outages or natural disasters. Your data remains safe and accessible even in the face of unforeseen challenges.

- Compliance with Regulations: QuickBooks adheres to stringent data protection regulations like GDPR and CCPA, ensuring your data is handled responsibly and in accordance with legal requirements.

Beyond these core security measures, QuickBooks continuously invests in research and development to stay ahead of evolving cyber threats. Their security team monitors the threat landscape and updates their systems and protocols proactively to address emerging vulnerabilities.

Benefits of Cloud Security for Financial Management:

- Enhanced Security: Cloud-based security often surpasses the capabilities of individual on-premises systems, providing advanced data protection and regular vulnerability assessments.

- Accessibility: Access your financial data from anywhere with an internet connection, offering flexibility and convenience.

- Scalability: Easily adjust your storage and processing needs as your business grows, eliminating the need for costly hardware upgrades.

- Automatic Updates: Security patches and updates are automatically applied to the cloud infrastructure, ensuring you’re always protected against the latest threats.

- Reduced Costs: Cloud-based solutions often offer lower upfront and ongoing costs compared to maintaining on-premises systems.

Remember: While QuickBooks takes comprehensive measures to secure your data, certain user-driven practices can further strengthen your cloud security posture:

- Use strong passwords and enable two-factor authentication.

- Be vigilant about phishing attempts and suspicious activity.

- Keep your QuickBooks software updated.

- Limit access to sensitive data to authorized users only.

By understanding the robust security measures employed by QuickBooks and implementing best practices on your end, you can confidently entrust your financial data to the cloud, ensuring its protection and enjoying the benefits of a secure and accessible financial management solution.

Incident Response and Data Recovery:

Navigating Challenges with Confidence

While robust security measures significantly reduce the risk of data breaches, no system is entirely impermeable. Having a well-defined incident response plan and understanding QuickBooks’ data recovery features can empower you to quickly and effectively address any potential security incidents, minimizing damage and ensuring business continuity.

QuickBooks Incident Response Plan: Preparedness is Key

An incident response plan serves as a roadmap for navigating security incidents, outlining clear steps and assigned responsibilities to swiftly contain and remediate threats. Here’s how to approach creating your plan:

- Identify Potential Threats: Assess your vulnerabilities and potential risks, including unauthorized access, phishing attacks, malware infections, or data breaches.

- Define Response Procedures: Establish a step-by-step protocol for each type of incident, detailing actions to take upon detection, containment strategies, and communication protocols.

- Assign Roles and Responsibilities: Designate clear roles and responsibilities for team members, ensuring everyone knows their responsibilities during an incident.

- Communication Channels: Establish clear communication channels to effectively relay information among team members, external stakeholders, and affected users.

- Testing and Refinement: Regularly test your plan through simulations and tabletop exercises to identify and address any gaps or inefficiencies.

QuickBooks Data Recovery Features:

In the unfortunate event of a data breach, QuickBooks offers several features to assist in recovery and minimize downtime:

- Automatic Backups: QuickBooks automatically backs up your data at regular intervals to secure cloud servers. These backups can be used to restore lost or corrupted data.

- Point-in-Time Restore: Choose a specific point in time to restore your data, minimizing the potential loss of recent transactions or updates.

- User Access Control: During an incident, you can revoke user access to prevent further data compromise and limit the scope of the attack.

- Audit Trails: Track user activity and data modifications to identify the source of the incident and facilitate forensic investigations.

- Professional Support: QuickBooks offers dedicated support services to guide you through the incident response and data recovery process.

Remember:

- Early Detection is Crucial: Prompt identification and reporting of potential security incidents are crucial for effective response and minimizing damage.

- Communication is Key: Open and transparent communication with team members, stakeholders, and authorities is essential to maintain trust and manage the situation effectively.

- Learn from the Experience: Analyze the incident thoroughly, identify vulnerabilities, and update your response plan to prevent similar occurrences in the future.

By proactively developing an incident response plan and leveraging QuickBooks’ data recovery features, you can approach security challenges with confidence. Remember, preparedness is key in mitigating the impact of security incidents and safeguarding your valuable financial data.

Conclusion

In the ever-evolving landscape of digital finance, where the stakes of data security and compliance are higher than ever, QuickBooks emerges as a sentinel, ensuring businesses navigate the complexities with robust protection and unwavering adherence to regulations.

Guardianship Through Multi-Factor Authentication:

QuickBooks stands at the forefront of security with its implementation of Multi-Factor Authentication (MFA). This sophisticated defense mechanism requires users to undergo multiple layers of verification before gaining access, a crucial deterrent against unauthorized access. By fortifying user accounts with MFA, QuickBooks significantly reduces the risk of data breaches, providing businesses with a resilient defense against evolving cyber threats.

Encryption as the Bedrock of Confidentiality:

The sanctity of financial transactions and sensitive information is preserved through QuickBooks’ commitment to industry-leading encryption protocols. These protocols, both during data transit and at rest, form an impenetrable shield around financial data. QuickBooks ensures that confidential information remains confidential, fostering a secure environment where businesses can trust that their financial data is shielded from prying eyes.

Access Controls: Tailoring Security to Business Needs:

Recognizing the diverse roles within organizations, QuickBooks places a powerful tool in the hands of businesses — granular access controls. With the ability to customize user permissions, businesses can limit data exposure to only those who require it for their specific roles. This tailored approach not only safeguards against internal threats but also aligns with best practices in data protection, offering businesses the flexibility to structure access based on their unique organizational needs.

Regulatory Adherence as a Pillar of Trust:

QuickBooks doesn’t merely meet security standards; it surpasses them. Aligning with major data protection regulations such as GDPR, HIPAA, and PCI DSS, QuickBooks ensures that businesses operating in various sectors can confidently use its platform without compromising regulatory compliance. This commitment to adherence not only exemplifies QuickBooks’ dedication to data protection but also instills trust in users that their financial data is managed in accordance with the highest industry standards.

A Culture of Security Through Education:

QuickBooks recognizes that security is not just about technology; it’s also about people. By encouraging businesses to conduct regular training sessions on data security, QuickBooks empowers users to be active participants in maintaining a secure environment. Educated staff members become allies in the ongoing battle against potential threats, creating a culture where everyone understands the importance of safeguarding financial data.

Cloud Security for Unparalleled Accessibility:

As businesses increasingly turn to cloud-based financial management, QuickBooks ensures that the transition is not just seamless but also fortified against potential threats. The cloud infrastructure supporting QuickBooks adheres to stringent security measures, providing businesses with a reliable and secure platform for accessing financial data remotely. This commitment to cloud security enables businesses to harness the benefits of mobility without compromising on data protection.

In conclusion, QuickBooks goes beyond being a financial management tool; it stands as a fortress of security and a champion of compliance. With Multi-Factor Authentication, encryption, access controls, regulatory adherence, educational initiatives, and robust cloud security, QuickBooks empowers businesses to navigate the digital realm with confidence, knowing that their financial data is safeguarded by a comprehensive and vigilant guardian.