Introduction:

Financial management plays a crucial role in the success and sustainability of businesses across various industries, and the restaurant and hospitality sector is no exception. This introduction will provide an overview of the importance of financial management in this industry, with a focus on FreshBooks as a relevant tool for managing financial aspects.

Background of FreshBooks:

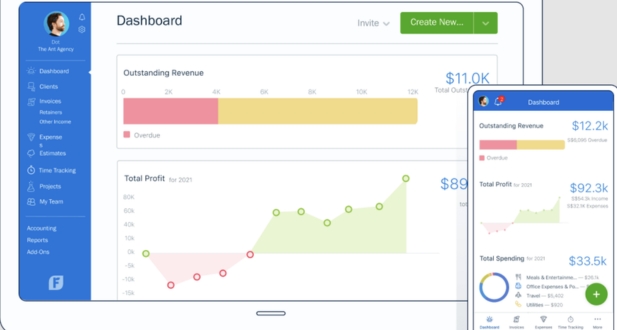

FreshBooks is a cloud-based accounting software designed to streamline financial management for small businesses and freelancers. It offers features such as invoicing, expense tracking, time tracking, and reporting, making it a comprehensive solution for managing finances efficiently. FreshBooks caters to various industries, including the restaurant and hospitality sector, where financial management is paramount for operational success.

Importance of Financial Management in the Restaurant and Hospitality Industry:

- Cost Control: Restaurants and hospitality businesses often operate on thin profit margins. Effective financial management helps control costs, from procurement and inventory management to labor expenses. It allows businesses to identify areas where costs can be optimized, contributing to overall profitability.

- Budgeting and Forecasting: Financial management tools like FreshBooks enable businesses to create budgets and forecasts. This is crucial for planning and allocating resources effectively, especially in the volatile and competitive restaurant industry. Accurate financial projections help businesses make informed decisions and set realistic goals.

- Cash Flow Management: Maintaining a healthy cash flow is vital for the sustainability of any business. In the restaurant and hospitality industry, where there are seasonal fluctuations and unpredictable demand, managing cash flow becomes even more critical. FreshBooks assists in tracking cash inflows and outflows, ensuring businesses have the liquidity to meet their obligations.

- Compliance and Reporting: The restaurant and hospitality sector is subject to various financial regulations and reporting requirements. Failure to comply with these regulations can result in penalties and legal issues. Financial management tools like FreshBooks help businesses stay organized and ensure compliance with tax regulations and financial reporting standards.

- Decision-Making Support: Timely and accurate financial information is essential for making informed business decisions. FreshBooks provides real-time insights into the financial health of a restaurant or hospitality business, allowing managers to make strategic decisions that positively impact the bottom line.

Effective financial management is indispensable for the success and sustainability of businesses in the restaurant and hospitality industry. Tools like FreshBooks play a crucial role in streamlining financial processes, enhancing cost control, and providing valuable insights to support informed decision-making.

Challenges in Restaurant and Hospitality Finance:

The restaurant and hospitality industry is known for its unique financial challenges, stemming from the dynamic nature of the business. One significant challenge is the high level of competition, which often leads to thin profit margins. Restaurants and hotels must constantly innovate to stay ahead, investing in marketing, technology, and employee training. These financial demands can strain resources, making effective financial management crucial for sustainability.

Another challenge is the sensitivity of the industry to external factors such as economic downturns, global events, and health crises. Fluctuations in customer demand can have an immediate impact on revenue, requiring businesses to be adaptable and financially resilient. Moreover, the seasonal nature of the hospitality sector adds complexity to financial planning, as establishments must navigate peak and off-peak periods with varying staffing and inventory needs.

Operational costs, including rent, utilities, and labor, are significant concerns in restaurant and hospitality finance. Managing these costs efficiently while maintaining service quality is a delicate balancing act. The industry’s reliance on perishable goods and the need for fresh ingredients also contribute to inventory management challenges, as waste reduction becomes a critical aspect of financial sustainability.

Unique Financial Needs of the Industry:

The unique financial needs of the restaurant and hospitality sector extend beyond day-to-day operational costs. Capital-intensive investments in equipment, interior design, and technology are essential for creating an appealing and competitive atmosphere. Renovations and updates are often necessary to keep establishments current and meet evolving customer expectations.

Furthermore, the industry’s heavy dependence on customer satisfaction places a premium on customer experience investments. Establishing loyalty programs, implementing feedback systems, and providing exceptional service requires financial resources. Managing cash flow becomes crucial, as businesses strive to strike a balance between short-term financial stability and long-term growth initiatives.

Common Financial Management Issues:

Financial management in the restaurant and hospitality sector is rife with challenges. One common issue is inadequate budgeting and financial planning. Without accurate forecasting, businesses may struggle to allocate resources efficiently, leading to overspending or shortages in critical areas. Effective budgeting requires a deep understanding of the industry’s seasonal trends, market dynamics, and operational nuances.

Employee turnover is another prevalent issue, impacting both operational efficiency and financial stability. High turnover rates result in recruitment and training costs, while experienced staff may demand higher wages. This emphasizes the importance of human resource management in financial planning, including strategies for employee retention and talent development.

The industry’s increasing reliance on technology presents both opportunities and challenges. While technology can enhance efficiency and customer experience, the initial investment and ongoing maintenance costs can strain budgets. Balancing the adoption of technology with other financial priorities requires careful consideration and strategic planning to ensure a positive return on investment.

The Role of FreshBooks in Restaurant and Hospitality Finance

FreshBooks is an accounting software platform that plays a significant role in managing finances for businesses across various industries, including the restaurant and hospitality sectors. The software is designed to simplify and streamline accounting processes, making it easier for businesses to manage their financial transactions, invoicing, expenses, and more.

Overview of FreshBooks Accounting Software:

User-Friendly Interface:

FreshBooks offers a user-friendly interface that is easy to navigate, making it accessible for business owners, managers, and staff members with varying levels of accounting expertise. The platform is designed to simplify complex financial tasks.

Invoicing and Billing:

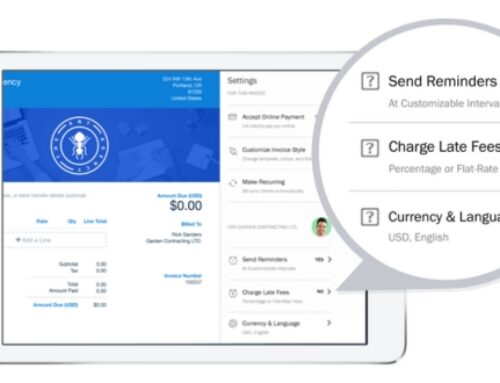

One of the key features of FreshBooks is its invoicing and billing capabilities. Businesses in the restaurant and hospitality industry can easily create professional-looking invoices, customize them to reflect their brand, and send them to clients or customers. This is crucial for tracking sales and ensuring timely payments.

Expense Tracking:

FreshBooks allows users to track expenses efficiently. In the restaurant and hospitality sector, where costs such as ingredient purchases, equipment maintenance, and utility bills need to be closely monitored, the expense tracking feature becomes invaluable. Users can capture receipts, categorize expenses, and generate comprehensive reports.

Time Tracking:

For businesses that bill clients or customers based on hours worked, FreshBooks provides time tracking capabilities. This is especially useful for hospitality businesses where staff may work on hourly wages or when tracking the time spent on specific projects.

Financial Reporting:

FreshBooks offers a range of financial reporting tools that help businesses gain insights into their financial performance. This includes profit and loss statements, balance sheets, and other relevant reports that are crucial for decision-making.

Integration with Payment Gateways:

The platform integrates with various payment gateways, facilitating smooth and secure transactions. This is essential for businesses in the restaurant and hospitality industry that often deal with point-of-sale transactions and online payments.

Tailored Features for the Industry:

Menu Costing:

FreshBooks may offer features or integrations specific to the restaurant industry, such as menu costing tools. This allows businesses to analyze the cost of ingredients, helping them set menu prices that ensure profitability.

Inventory Management:

Some accounting software, including FreshBooks, may integrate with inventory management systems. This is crucial for restaurants and hospitality businesses to keep track of stock levels, manage reordering, and prevent wastage.

Tip Tracking:

For businesses in the hospitality sector where tipping is common, FreshBooks might offer features for tip tracking. This helps in accurate reporting and distribution of tips among staff.

Compliance and Tax Assistance:

FreshBooks may assist businesses in adhering to tax regulations and industry-specific compliance requirements. This can include features that simplify tax calculations and ensure accurate financial reporting.

Streamlining Bookkeeping Processes with FreshBooks

In the dynamic landscape of modern business, effective bookkeeping is crucial for maintaining financial health and ensuring smooth operations. FreshBooks, a leading accounting software, plays a pivotal role in streamlining bookkeeping processes for businesses of all sizes. One of its key features is the ability to automate financial transactions, which significantly reduces the manual workload and minimizes the risk of errors.

Automation is achieved through FreshBooks’ user-friendly interface, allowing businesses to set up recurring transactions, invoice reminders, and payment schedules effortlessly. By automating routine financial tasks, businesses can focus more on strategic decision-making and customer relations rather than spending valuable time on repetitive bookkeeping chores.

Moreover, FreshBooks offers seamless integration with Point-of-Sale (POS) systems, enhancing the overall efficiency of financial operations. This integration enables businesses to synchronize sales data, track transactions in real time, and gain a comprehensive understanding of their revenue streams. By bridging the gap between sales and accounting, FreshBooks ensures accurate and up-to-date financial records, which is essential for making informed business decisions.

Managing inventory and accurately calculating the Cost of Goods Sold (COGS) is another critical aspect of effective bookkeeping. FreshBooks provides robust features to track inventory levels, monitor stock movement, and automatically update the COGS based on real-time data. This not only helps in maintaining optimal stock levels but also ensures that the financial statements accurately reflect the cost of producing goods or services.

FreshBooks’ user-friendly platform further simplifies the inventory management process, allowing businesses to categorize products, set reorder points, and generate detailed reports on stock performance. By centralizing inventory management within the accounting system, FreshBooks eliminates the need for separate software solutions, providing a cohesive and integrated approach to bookkeeping.

FreshBooks emerges as a powerful tool for streamlining bookkeeping processes, offering automation of financial transactions, seamless integration with Point-of-Sale systems, and efficient management of inventory and Cost of Goods Sold. This not only enhances operational efficiency but also empowers businesses to maintain accurate financial records, make informed decisions, and ultimately thrive in today’s competitive business environment.

Efficient Invoicing and Payment Processing

Customizable Invoices for Clients and Vendors:

- Branding and Personalization: Efficient invoicing starts with creating professional and branded invoices that reflect your business identity. You should be able to customize the layout, color scheme, and add your company logo and contact details for a personalized touch.

- Itemized Details: The invoices should allow you to list products or services with detailed descriptions, quantities, rates, and applicable taxes. This ensures transparency and clarity for both you and your clients or vendors.

Online Payment Options:

- Multiple Payment Gateways: To streamline the payment process, it’s essential to offer various online payment options. This may include credit/debit cards, bank transfers, or digital wallets. Providing multiple gateways caters to the diverse preferences of your clients and expedites the payment collection process.

- Integration with Accounting Software: Seamless integration with accounting software is crucial. This integration reduces manual data entry, minimizes errors, and ensures that your financial records are up-to-date.

Tracking and Managing Receivables:

- Real-Time Tracking: An efficient invoicing system should enable real-time tracking of the invoicing and payment status. This allows you to monitor which invoices have been sent, viewed, paid, or are overdue.

- Automated Reminders: Automation features for sending payment reminders can help you stay on top of your receivables. Automated reminders can be scheduled at specific intervals and can significantly improve the chances of timely payments.

- Aging Reports: The system should generate aging reports, providing a clear overview of outstanding invoices categorized by their aging (e.g., 30 days, 60 days, 90 days). This helps in prioritizing follow-ups and assessing the overall health of your accounts receivable.

Budgeting and Expense Management

Budgeting and expense management play pivotal roles in ensuring the financial stability and success of individuals, businesses, and organizations alike. By creating and monitoring budgets, individuals can gain a comprehensive understanding of their financial standing and allocate resources effectively. A well-crafted budget serves as a roadmap, outlining income sources, anticipated expenses, and financial goals. It acts as a proactive tool, allowing individuals to plan for the future, whether it involves saving for major purchases, investing, or building an emergency fund.

Expense tracking is a crucial component of financial health, providing a detailed analysis of spending patterns and habits. Utilizing expense tracking tools or apps allows individuals and businesses to categorize expenditures, identify areas of overspending, and make informed decisions to optimize their financial resources. This process not only enhances financial awareness but also facilitates the identification of potential cost-cutting measures. Understanding where money is being spent enables individuals to make informed choices, aligning their expenditures with their priorities and financial objectives.

Insights gained from expense tracking contribute to effective cost control strategies. Businesses, in particular, benefit from a granular understanding of their operational expenses. Monitoring and analyzing expenses help identify inefficiencies, redundant costs, or areas where resources can be reallocated for better returns on investment. This data-driven approach empowers organizations to make informed decisions, whether it involves renegotiating contracts, streamlining processes, or implementing cost-saving initiatives. By harnessing these insights, businesses can enhance their overall financial performance and resilience in a competitive market.

Budgeting and expense management are integral aspects of financial planning, providing individuals and businesses with the tools needed to navigate economic challenges and achieve long-term financial success. Creating and monitoring budgets, tracking expenses, and gaining insights for cost control contribute to a holistic approach in managing finances, fostering a financially sound and sustainable future.

Future Trends in Restaurant and Hospitality Finance

Technological Advancements:

- Digital Transformation: The restaurant and hospitality industry is undergoing a significant digital transformation. This includes the integration of point-of-sale (POS) systems, mobile ordering, and contactless payment solutions. These advancements not only enhance customer convenience but also streamline operations and improve overall efficiency.

- Data Analytics: Restaurants are increasingly leveraging data analytics to gain insights into customer preferences, optimize menu offerings, and improve inventory management. This data-driven approach enables businesses to make informed decisions, reduce waste, and enhance the overall customer experience.

- Automation and Robotics: Automation is becoming more prevalent in the hospitality sector, from automated kitchen equipment to robotic servers. These technologies not only reduce labor costs but also contribute to a more seamless and efficient service delivery.

Industry-Specific Features and Innovations:

- Personalized Experiences: With the help of technology, restaurants and hotels can offer personalized experiences to their guests. This includes personalized menus based on dietary preferences, targeted promotions, and customized services that cater to individual needs.

- Sustainability Initiatives: The industry is witnessing a growing focus on sustainability. Restaurants and hotels are adopting eco-friendly practices, sourcing locally, and implementing waste reduction measures. This not only aligns with consumer preferences but also contributes to a positive brand image.

- Immersive Technologies: Virtual and augmented reality are being explored to enhance customer engagement. For example, restaurants may use augmented reality menus, allowing customers to visualize dishes before ordering, or hotels may offer virtual tours of their facilities to prospective guests.

FreshBooks’ Roadmap for the Future:

- Enhancements in Financial Management: FreshBooks, being a cloud-based accounting software, may be expected to introduce more features for financial management tailored to the unique needs of the restaurant and hospitality industry. This could include integrations with POS systems, payroll management, and real-time financial reporting.

- Mobile Accessibility: As mobile usage continues to rise, FreshBooks might focus on enhancing its mobile platform to provide on-the-go access for restaurant and hospitality business owners. This could involve developing a user-friendly mobile app or optimizing the existing interface for mobile devices.

- Integration with Emerging Technologies: To stay relevant, FreshBooks may explore integrations with emerging technologies, such as artificial intelligence for automated financial analysis, blockchain for secure transactions, or machine learning for predictive financial modeling.

Real-world Applications of FreshBooks in Restaurants and Hospitality

FreshBooks, a versatile accounting and invoicing software, has found significant relevance in the dynamic and fast-paced environment of the restaurant and hospitality industry. Its real-world applications in this sector have proven to be transformative, simplifying financial management processes and enhancing overall operational efficiency.

One notable aspect of FreshBooks’ success in restaurants and hospitality is the numerous case studies showcasing its effective implementation. These case studies often highlight how FreshBooks streamlines invoicing, expense tracking, and financial reporting for businesses in the industry. For instance, a case study may detail how a restaurant improved its cash flow management by using FreshBooks to automate invoice generation and payment tracking, resulting in reduced administrative burden and quicker financial insights.

In addition to case studies, testimonials from industry professionals further underscore the positive impact of FreshBooks. Restaurant owners, managers, and financial professionals share their experiences of using the software and how it has facilitated smoother financial operations. Testimonials may focus on specific features of FreshBooks that have proven invaluable, such as its user-friendly interface, customizable invoicing options, or seamless integration with other business tools commonly used in the hospitality sector.

The success stories and testimonials collectively emphasize the adaptability of FreshBooks to the unique challenges and demands of the restaurant and hospitality industry. Its ability to address pain points in financial management and provide practical solutions has positioned it as a go-to tool for businesses aiming to streamline their operations and achieve financial transparency.

Moreover, FreshBooks’ impact extends beyond just financial management. Its user-friendly interface and accessibility make it a valuable asset for businesses of varying sizes within the industry. Whether a small boutique hotel or a bustling restaurant chain, FreshBooks offers scalable solutions that can be tailored to meet the specific needs and scale of each business.

FreshBooks has proven to be a game-changer in the realm of restaurant and hospitality management, as evidenced by real-world case studies and the endorsements of industry professionals. Its features, coupled with success stories, make it a compelling choice for businesses seeking efficient and effective financial management solutions in the ever-evolving landscape of the hospitality sector.

Conclusion

FreshBooks stands as a versatile and robust financial management tool that caters specifically to the intricate needs of the restaurant and hospitality industry. As businesses strive for efficiency, accuracy, and compliance, the integration of FreshBooks emerges as a strategic move to navigate the complexities of finance. This comprehensive guide has explored the myriad features, implementation strategies, success stories, challenges, and future trends, providing a roadmap for restaurateurs and hospitality professionals seeking financial excellence in their operations.

FreshBooks offers various integrations, but specific integrations depend on the POS system you use. Check the FreshBooks integration marketplace or contact their support to see if your POS system is supported.

FreshBooks allows you to upload receipts, track expenses, and manage vendor bills. You can capture receipts using the mobile app, categorize expenses, and keep all your financial data organized in one place.

FreshBooks provides features to help you stay compliant with tax regulations. It allows you to generate reports, track expenses, and categorize transactions, making it easier to prepare for tax season.

FreshBooks itself doesn’t offer full payroll services, but it integrates with third-party payroll solutions. You can export financial data to these services, streamlining the payroll process.

FreshBooks allows you to customize your invoices to include tips or gratuities. You can add a separate line for tips or include them in the total amount.