Introduction to QuickBooks Expense Tracking:

Overview of QuickBooks:

QuickBooks is a comprehensive accounting software that has played a significant role in transforming how businesses manage their financial transactions. Its history and evolution can be traced back to the early 1980s when Scott Cook and Tom Proulx founded Intuit, the company behind QuickBooks. Over the years, QuickBooks has undergone several iterations, each bringing new features and improvements to address the evolving needs of businesses.

The software is available in various versions and editions, catering to different business sizes and industries. From the basic QuickBooks Online for small businesses to the more advanced QuickBooks Enterprise for larger enterprises, the software offers scalability to meet the diverse accounting requirements of users.

Key Features of QuickBooks:

- User-friendly Interface:

One of QuickBooks’ standout features is its user-friendly interface. The software is designed to be accessible to individuals with varying levels of accounting expertise, making it suitable for small business owners and finance professionals alike. The intuitive layout and navigation streamline the accounting process, allowing users to manage their financial data efficiently.

- Customization Options:

QuickBooks recognizes that each business is unique, and therefore, it provides extensive customization options. Users can tailor the software to match their specific industry, business model, and reporting preferences. Customizable templates, charts of accounts, and other features allow businesses to create a tailored accounting environment that aligns with their individual needs.

- Multi-user Collaboration:

QuickBooks facilitates collaborative work environments by offering multi-user access. This feature enables different team members to simultaneously work on the financial data, improving efficiency and coordination within the organization. It is especially valuable for businesses with multiple departments or teams involved in financial management.

- Integration with Banking and Financial Institutions:

QuickBooks streamline financial processes by integrating seamlessly with banking and financial institutions. Users can connect their bank accounts directly to QuickBooks, allowing for automatic synchronization of transactions. This not only reduces manual data entry but also helps in maintaining accurate and up-to-date financial records. Integration with financial institutions enhances the accuracy and efficiency of tasks such as bank reconciliation and expense tracking.

QuickBooks has evolved into a powerful and versatile tool for businesses, offering a range of features that simplify accounting processes. Its user-friendly interface, customization options, support for multi-user collaboration, and seamless integration with banking institutions make it a valuable asset for businesses seeking efficient and reliable financial management solutions.

Recording Expenses in QuickBooks:

QuickBooks is a powerful accounting software that enables businesses to efficiently manage their financial transactions. One crucial aspect of financial management is recording expenses, which can be done through various methods to ensure accuracy and streamline the process.

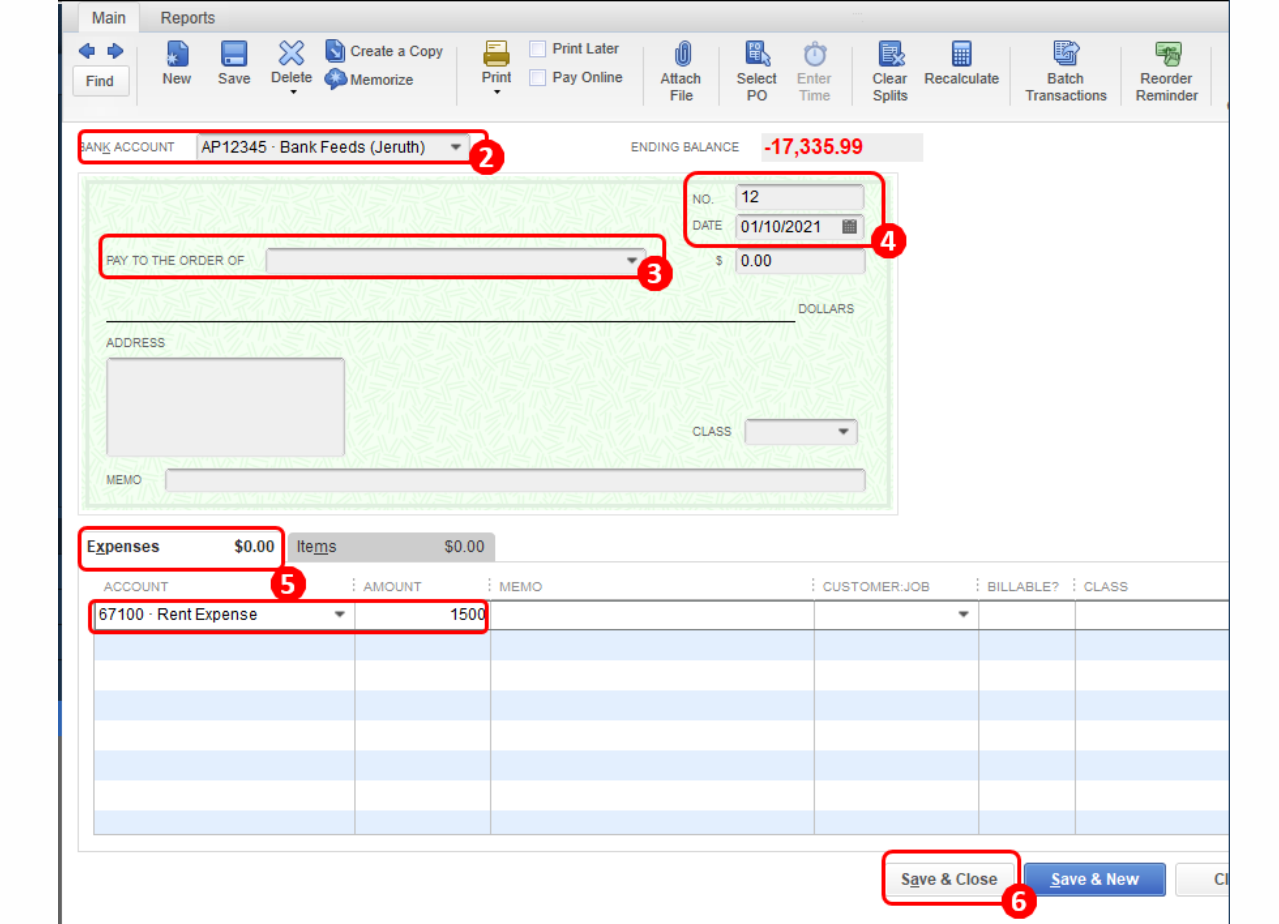

Manual Entry of Expenses:

Single Expense Entry:

The manual entry of expenses involves inputting individual transactions one by one. This method is useful for recording isolated expenses, providing a detailed breakdown of each transaction. It ensures a granular view of spending, facilitating precise tracking and analysis

Batch Entry for Multiple Expenses:

In contrast, businesses often incur numerous expenses at once. QuickBooks allows users to perform batch entry for multiple expenses, saving time and effort. This is especially beneficial for routine expenditures, enabling users to input several transactions simultaneously.

Importance of Accurate Data Input:

Accurate data input is crucial for reliable financial reporting and decision-making. Errors in expense recording can lead to financial discrepancies and misinformed business choices. Therefore, meticulous attention to detail during manual entry is essential to maintain the integrity of financial records.

Importing Expenses:

Importing Bank and Credit Card Transactions:

QuickBooks facilitates the import of bank and credit card transactions, automating the data entry process. This feature helps reduce manual errors and ensures that all transactions are recorded promptly. It also provides a real-time overview of financial activities.

Streamlining the Import Process:

Efficiency is a key consideration in business operations. QuickBooks streamlines the import process, allowing businesses to synchronize their financial data seamlessly. This feature not only saves time but also enhances accuracy by minimizing the need for manual intervention.

Addressing Common Import Issues:

Despite the automation, challenges may arise during the import process, such as mismatched transactions or errors in categorization. QuickBooks offers tools to address these issues, providing users with the ability to reconcile and correct discrepancies, maintaining the accuracy of financial records.

Capturing Receipts:

Utilizing Mobile Apps for Receipts:

In an era of digitalization, capturing receipts electronically has become commonplace. QuickBooks offers mobile apps that allow users to snap pictures of receipts using their smartphones. This feature simplifies the expense tracking process, eliminating the need for manual entry of paper receipts.

Attaching Receipts to Expense Entries:

To enhance transparency and documentation, QuickBooks enables users to attach receipts directly to expense entries. This creates a comprehensive and organized record-keeping system, facilitating easy retrieval and validation during audits or financial reviews.

Ensuring Compliance and Audit Trail:

Accurate recording of expenses and proper documentation contribute to regulatory compliance. QuickBooks helps businesses maintain an audit trail by recording every transaction and associated receipt. This not only ensures compliance with financial regulations but also provides a robust system for internal and external audits.

Setting Up QuickBooks for Expense Tracking:

Setting Up QuickBooks for Expense Tracking involves several key steps that ensure accurate financial record-keeping and streamlined business operations. This process can be divided into three main sections: Installation and Setup, Chart of Accounts, and Vendor Management.

Installation and Setup:

To begin, ensure your system meets QuickBooks’ System Requirements. This step is crucial for smooth functioning and optimal performance. Once the requirements are met, proceed with the Installation Process, which involves downloading and installing the QuickBooks software on your computer. After installation, the next step is Company File Creation, where you establish the digital hub for your financial data. This file serves as the central repository for all your company’s financial information.

Chart of Accounts:

The Chart of Accounts is the backbone of effective expense tracking. Start by Creating Expense Accounts tailored to your business needs. This involves setting up categories such as utilities, office supplies, or travel expenses. Customizing Accounts for Specific Needs is the next step, allowing you to create sub-accounts or add specific details to match your company’s unique requirements. Finally, Organizing Accounts for Clarity is essential for easy navigation and reporting. Group related accounts together to enhance visibility and make financial analysis more straightforward.

Vendor Management:

Efficient Vendor Management is crucial for tracking and categorizing expenses accurately. Begin by Adding Vendors to your QuickBooks system. This step involves inputting vendor contact details and other pertinent information. Managing Vendor Information is the next stage, where you can update and maintain vendor details to ensure accuracy in your records. The final step in this section is Linking Vendors to Expenses. This helps attribute expenses to specific vendors, providing a comprehensive view of your financial transactions and facilitating better decision-making.

The process of Setting Up QuickBooks for Expense Tracking involves meticulous attention to detail in each of the three main sections. By following these steps, businesses can establish a robust financial management system that enhances accuracy, efficiency, and overall financial control.

Advanced Expense Tracking Features:

Class Tracking

Class tracking is a sophisticated expense tracking feature that allows businesses to categorize and segment their expenses based on different classes or categories. This feature is particularly useful for companies with diverse operations, multiple departments, or various cost centers. Understanding class tracking involves recognizing the need for detailed expense segmentation to gain insights into specific aspects of the business.

Implementing Class Tracking for Segmentation involves setting up and defining different classes or categories relevant to the organization’s structure. For example, a company with multiple product lines might create classes for each product to track expenses individually. This segmentation provides a more granular view of expenditures, aiding in better financial analysis and decision-making.

Analyzing Expenses by Class allows businesses to review and assess their financial data in a more detailed and organized manner. By generating reports that break down expenses based on classes, management can identify areas of high and low spending, allocate resources more efficiently, and ultimately optimize the company’s overall financial performance.

Project-Based Expense Tracking

Project-based expense tracking is a feature designed for businesses engaged in various projects, where expenses need to be specifically allocated and monitored for each project. This feature is crucial for project management and ensures accurate cost accounting for individual initiatives.

Setting up Projects involves creating distinct project profiles within the expense tracking system. Each project is assigned a unique identifier and relevant details, facilitating clear identification and differentiation between different initiatives.

Assigning Expenses to Projects allows businesses to link specific costs directly to the corresponding projects. This ensures that expenses are accurately attributed to the correct initiative, providing transparency and accountability in financial reporting.

Monitoring Project Expenses and Profitability involves tracking and analyzing expenses related to each project in real-time. By evaluating project-specific financial data, businesses can assess the profitability of each initiative, make informed decisions on resource allocation, and identify areas for cost optimization.

Mileage Tracking

Mileage tracking is a specialized feature aimed at businesses and individuals who frequently travel for work-related purposes. This feature helps in recording and managing expenses associated with vehicle mileage, offering both convenience and financial benefits.

Enabling Mileage Tracking involves activating this feature within the expense tracking system. Once enabled, users can log and track their mileage for business-related travel, ensuring accurate documentation of this deductible expense.

Recording and Reimbursing Mileage Expenses entails documenting the distance traveled for work, which can be used for reimbursement purposes. This feature streamlines the reimbursement process for employees who use their vehicles for business-related travel.

Calculating Mileage Deductions for Taxes is a valuable aspect of mileage tracking for businesses. By maintaining accurate records of mileage, individuals and businesses can calculate and claim deductions on their taxes, reducing overall tax liability. This feature promotes compliance with tax regulations and helps maximize potential savings for users.

Analyzing and Reporting Expenses:

Analyzing and Reporting Expenses is a crucial aspect of financial management for businesses. This process involves various steps and tools to ensure accurate tracking, analysis, and planning for expenses. In this context, two main components can be highlighted: Expense Reports and Budgeting/Forecasting.

Expense Reports:

Expense Reports play a pivotal role in providing insights into a company’s spending patterns. Customizing these reports is essential to tailor them according to specific business needs. This customization may include categorizing expenses, adding specific fields, or modifying the layout for better clarity. By customizing reports, businesses can extract relevant information efficiently.

Generating Standard Reports is another significant aspect. Standard reports provide a structured overview of expenses, allowing businesses to identify key financial metrics. These reports can be generated periodically, such as monthly or quarterly, to facilitate consistent and regular analysis of spending patterns. Standard reports serve as a baseline for comparison and decision-making.

Analyzing Expense Trends is a critical step in understanding the financial health of a business. This involves reviewing historical expense data to identify trends, patterns, and potential areas for cost optimization. Analyzing trends enables proactive decision-making and strategic planning to control and manage expenses effectively.

Budgeting and Forecasting:

Creating Budgets in QuickBooks is an essential practice for financial planning. Budgets set the framework for expected expenses, providing a guideline for spending within specified limits. QuickBooks, as an accounting software, allows businesses to create detailed budgets based on historical data, industry standards, and specific business goals.

Monitoring Budget vs. Actuals is a continuous process that involves comparing planned expenses with actual spending. This real-time tracking helps businesses identify variances and make timely adjustments to ensure financial goals are met. Monitoring budget vs. actuals is a proactive approach to maintaining financial discipline and accountability.

Forecasting Future Expenses is a forward-looking aspect of financial management. By using historical data and current trends, businesses can project future expenses. Forecasting assists in anticipating potential financial challenges and opportunities, enabling businesses to develop strategies for sustainable growth. QuickBooks provides tools for businesses to create accurate and informed financial forecasts.

The analysis and reporting of expenses through tools like Expense Reports, Budgeting, and Forecasting are integral components of effective financial management. These processes empower businesses to make informed decisions, optimize spending, and achieve long-term financial sustainability.

Integrations and Add-ons:

Third-Party Integrations

In the realm of financial management, third-party integrations play a pivotal role in streamlining operations. Syncing QuickBooks with other software is a prime example of this synergy. Businesses often utilize diverse software applications for various functions, such as project management, customer relationship management (CRM), or payroll. Integrating QuickBooks with these platforms ensures seamless data flow and reduces manual data entry, minimizing errors and saving valuable time. This interoperability enhances overall efficiency and provides a comprehensive view of financial data.

Furthermore, third-party integrations extend beyond basic functions, enhancing expense-tracking capabilities. By integrating QuickBooks with specialized expense-tracking software, organizations can gain granular insights into their spending patterns. This not only facilitates accurate financial reporting but also aids in identifying cost-saving opportunities. The choice of integrations should be guided by the specific needs of the business, emphasizing compatibility and scalability.

When evaluating add-ons, several considerations come into play. Factors such as cost, ease of implementation, and ongoing support are crucial. It’s essential to choose add-ons that seamlessly align with the existing workflow, ensuring a smooth integration process. Additionally, regular updates and compatibility with future QuickBooks versions should be taken into account to future-proof the financial management system.

Cloud-Based Expense Management

Cloud-based expense management has emerged as a transformative solution for organizations seeking flexibility, accessibility, and scalability. The benefits of cloud integration are manifold. It enables real-time collaboration, allowing multiple users to access and update financial data simultaneously, irrespective of their geographical location. This is particularly advantageous for businesses with distributed teams or remote workforce, fostering a collaborative and efficient working environment.

Security concerns are a natural consideration when entrusting financial data to the cloud. However, contemporary cloud-based expense management platforms implement robust security measures. Encryption protocols, multi-factor authentication, and regular security audits are standard practices to safeguard sensitive financial information. Businesses must choose reputable cloud service providers and stay informed about the security features implemented by the chosen platform.

Exploring cloud-based expense management platforms opens up new possibilities for businesses to optimize their financial workflows. These platforms often come equipped with advanced features such as automated receipt scanning, intelligent categorization of expenses, and customizable reporting tools. The scalability of cloud solutions allows businesses to adapt to changing needs seamlessly, making them a valuable asset in dynamic business environments. As organizations continue to embrace digital transformation, cloud-based expense management remains a key enabler of efficiency and agility in financial operations.

Troubleshooting and Best Practices:

Common Issues and Solutions:

One of the primary challenges encountered in expense tracking systems revolves around data syncing problems. This can manifest as discrepancies between different modules or platforms, hindering the accuracy of financial records. To address this, thorough testing of data syncing mechanisms and the implementation of robust synchronization protocols are crucial. Additionally, creating a comprehensive troubleshooting guide for users can expedite issue resolution.

Error messages can be a source of frustration for users. Establishing a clear system of error messages and providing detailed resolutions can significantly enhance user experience. Regularly updating the list of common error messages and their solutions helps in staying ahead of potential issues and ensures a smoother workflow for both administrators and end-users.

Performance optimization is paramount for the seamless functioning of expense tracking systems. Identifying bottlenecks, such as slow loading times or processing delays, requires a proactive approach. Regular performance audits and fine-tuning of the system’s architecture can prevent these issues. Collaborating with IT experts to implement caching mechanisms and optimizing database queries are effective strategies to enhance overall system performance.

Best Practices for Efficient Expense Tracking:

Efficient expense tracking goes beyond troubleshooting; it involves establishing proactive measures to streamline processes. Regular data backup is a fundamental practice to prevent data loss due to system failures or unforeseen events. Automated backup schedules and secure storage protocols should be in place to safeguard critical financial information.

Employee training and compliance are integral components of efficient expense tracking. Providing comprehensive training programs ensures that users understand the system’s functionalities and adhere to best practices. Incorporating compliance checks within the system helps maintain accuracy and regulatory adherence in expense reporting, reducing the risk of errors and potential legal issues.

Continuous software updates are essential for staying ahead of security vulnerabilities and benefiting from enhanced features. Implementing a regular update schedule ensures that the expense tracking system remains robust and up-to-date. This practice not only improves system security but also enhances user experience by incorporating the latest advancements in technology.

Troubleshooting common issues and implementing best practices for efficient expense tracking are crucial for maintaining the reliability and effectiveness of expense management systems. Addressing syncing problems, providing clear error messages, optimizing performance, conducting regular data backups, ensuring employee training and compliance, and staying current with software updates collectively contribute to a seamless and productive expense tracking environment.

Conclusion:

QuickBooks Expense Tracking is a powerful tool that empowers businesses to manage their finances with precision. From the initial setup to advanced features like class tracking and project-based expense management, mastering QuickBooks can revolutionize how organizations handle their expenses. By following the tips and best practices outlined in this guide, businesses can streamline their financial processes, make informed decisions, and ultimately achieve greater financial success in today’s competitive landscape.

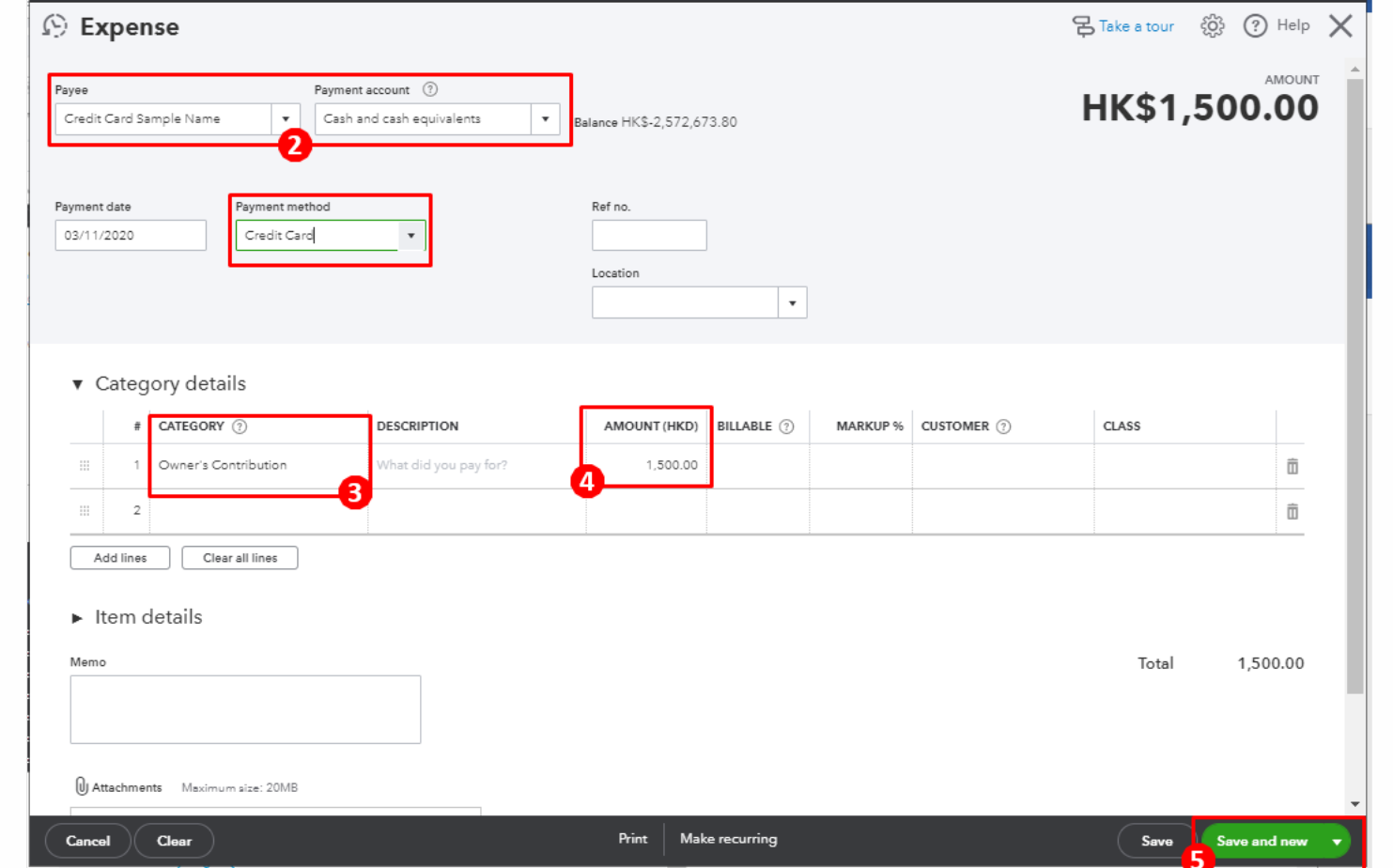

To enter expenses in QuickBooks, go to the “Expenses” or “Transactions” tab, select “New Expense,” and fill in the required details such as date, payee, and category. You can also attach receipts for documentation.

QuickBooks is primarily designed for business expenses. It’s recommended to keep personal and business expenses separate for accurate financial reporting. However, you can create separate accounts for personal use within QuickBooks.

QuickBooks uses a system of accounts and categories to classify expenses. Users can customize expense categories based on their business needs. Common categories include office supplies, utilities, travel, and meals.

Yes, QuickBooks allows you to connect your bank and credit card accounts for automatic expense tracking. This feature helps streamline the process by importing transactions directly into QuickBooks.

QuickBooks offers a mileage tracking feature where you can record your business-related trips and calculate mileage expenses. Enter the starting and ending locations, and QuickBooks will calculate the distance and expenses based on the standard mileage rate.

Yes, QuickBooks allows you to set up recurring expenses for regular payments like rent, utilities, or subscriptions. This feature helps automate the entry of repetitive expenses, saving time and ensuring accuracy.

Absolutely. QuickBooks provides various reports such as Profit and Loss, Expense Reports, and customized reports that allow you to analyze and track your business expenses over time. These reports can be essential for budgeting and financial planning.

QuickBooks takes security seriously and employs robust measures to protect user data. This includes encryption, multi-factor authentication, and regular security updates. Users are also encouraged to follow best practices for securing their accounts.

Yes, QuickBooks offers mobile apps for iOS and Android devices. Users can track and manage expenses on the go, capture receipts using their device’s camera, and stay updated on their financial activities anytime, anywhere.