Fresh Books Medical Practice Bookkeeping and the Unique Challenges of Medical Practice Bookkeeping:

Regulatory Compliance:

- Healthcare Regulations:

The healthcare industry is highly regulated, and medical practices must comply with various laws and regulations. This includes laws at the federal, state, and local levels.

Examples of federal regulations include the Affordable Care Act (ACA) and the Medicare Access and CHIP Reauthorization Act (MACRA). Understanding and adhering to these regulations is crucial for financial management.

- Importance of HIPAA in Bookkeeping:

The Health Insurance Portability and Accountability Act (HIPAA) is a critical component of medical practice bookkeeping.

HIPAA mandates the protection of patient health information (PHI) and sets standards for electronic healthcare transactions. Bookkeepers need to ensure that financial records and transactions comply with HIPAA regulations to safeguard patient confidentiality.

Billing Complexity:

- Medical Billing Intricacies:

Medical billing involves translating healthcare services into universal billing codes for insurance claims.

Different medical specialties may have unique billing codes and procedures. Bookkeepers need to be familiar with Current Procedural Terminology (CPT) codes and International Classification of Diseases (ICD) codes to accurately process claims.

- Challenges of Insurance Claims and Reimbursements:

Navigating the complex landscape of insurance claims is a major challenge. Each insurance company may have different requirements and procedures for claim submission.

Delays in claim processing and reimbursement can impact a medical practice’s cash flow. Bookkeepers play a crucial role in ensuring that claims are submitted accurately and promptly to optimize revenue.

Expense Tracking:

- Specific Medical Practice Expenses:

Medical practices have unique expenses, including overhead costs, equipment purchases, licensing fees, and personnel expenses.

Keeping track of these specific expenses is essential for understanding the financial health of the practice and making informed business decisions.

- Importance of Accurate Expense Tracking for Tax Purposes:

Accurate expense tracking is not only crucial for financial management but also for tax compliance.

By meticulously recording and categorizing expenses, bookkeepers enable medical practices to maximize deductions and comply with tax regulations. This involves understanding tax codes and regulations specific to healthcare businesses.

Exploring FreshBooks as a Medical Practice Bookkeeping Solution:

Introduction to FreshBooks:

FreshBooks stands out as a robust solution for medical practice bookkeeping, offering a comprehensive platform designed to simplify financial management for healthcare professionals. Established as a cloud-based accounting software, FreshBooks has evolved over the years to cater to the specific needs of various businesses, including medical practices. The transition to cloud technology enhances accessibility and collaboration, allowing healthcare providers to manage their finances securely from any location. This introductory section aims to highlight FreshBooks’ adaptability and innovation in addressing the unique challenges faced by medical practitioners in maintaining accurate and efficient bookkeeping.

User-Friendly Interface:

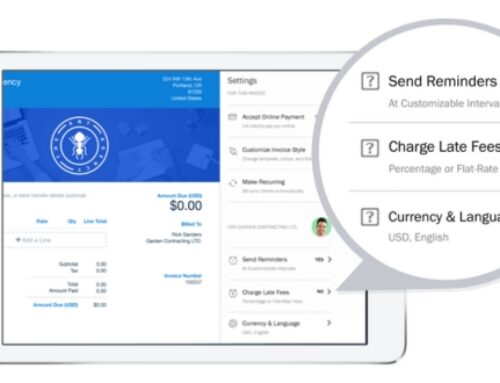

Navigating FreshBooks is an intuitive experience, featuring a user-friendly dashboard that empowers medical professionals to efficiently manage their financial affairs. This section delves into the key features available on the platform, emphasizing how they contribute to a seamless user experience. Customization options are explored, showcasing how FreshBooks can be tailored to meet the specific needs of medical practices. Whether it’s tracking patient transactions, managing expenses, or monitoring revenue streams, the platform provides a visually appealing and easily navigable interface, ensuring healthcare providers can focus on patient care rather than grappling with complex financial tools.

Invoicing and Billing with FreshBooks:

FreshBooks excels in simplifying the invoicing and billing processes for medical services. This section examines the tools available for creating professional invoices, considering the specific requirements of medical billing. It explores how FreshBooks facilitates the integration of billing with insurance claims, streamlining the often intricate reimbursement process. Additionally, the platform’s capability to track payments is highlighted, emphasizing its importance in ensuring timely and accurate revenue recognition for medical practices. By offering a comprehensive invoicing and billing solution, FreshBooks becomes an indispensable asset in managing the financial aspects of healthcare services.

Expense Tracking and Reporting:

Effective expense tracking is crucial for medical practices to maintain financial transparency and optimize resource allocation. This section focuses on how FreshBooks simplifies the process of tracking expenses related to medical supplies, equipment, and overhead costs. It explores the platform’s features for categorizing and recording expenses, ensuring that medical practitioners can monitor their financial health with precision. Furthermore, FreshBooks’ reporting capabilities are highlighted, demonstrating its ability to generate detailed financial reports. These reports offer valuable insights into the financial performance of the medical practice, empowering healthcare professionals to make informed decisions and strategize for future growth.

FreshBooks and Regulatory Compliance in Medical Practices:

HIPAA Compliance:

- FreshBooks’ commitment to data security:

FreshBooks is a cloud-based accounting software that acknowledges the importance of data security, especially in industries dealing with sensitive information like healthcare. The platform employs robust security measures to protect the confidentiality, integrity, and availability of user data. This includes encryption, secure data centers, and regular security audits.

- Steps to ensure HIPAA compliance while using FreshBooks:

Data Encryption: FreshBooks uses encryption protocols to secure data both in transit and at rest. This ensures that any patient information or sensitive data entered into the system is protected from unauthorized access.

Access Controls: FreshBooks provides role-based access controls, allowing medical practices to restrict access to sensitive information only to authorized personnel. This aligns with HIPAA’s requirements for controlling access to patient data.

Audit Trails: The platform maintains detailed audit trails, logging activities within the system. This is crucial for tracking any changes to patient records and ensuring accountability, a key component of HIPAA compliance.

Business Associate Agreement (BAA): FreshBooks understands the importance of a BAA in the healthcare industry. By signing a BAA with FreshBooks, medical practices can ensure that the service provider is also committed to maintaining the security and privacy of patient information, which is a requirement under HIPAA.

Tax Season Preparation:

- Leveraging FreshBooks for accurate tax documentation:

FreshBooks simplifies the process of tax documentation for medical practices. It provides features that help in tracking income, and expenses, and generating reports necessary for tax filing. The platform allows users to categorize expenses, record income, and track deductions, making it easier for medical practices to have a clear financial picture during tax season.

- Integrating FreshBooks with tax preparation software:

To streamline the tax preparation process further, FreshBooks can be integrated with popular tax preparation software. This integration ensures seamless transfer of financial data, minimizing manual data entry errors and saving time during tax season. Medical practices can export relevant financial information directly into tax software, improving accuracy and efficiency in the preparation of tax documents.

Real-World Implementation of FreshBooks in Medical Practices:

Success Stories:

One of the most compelling aspects of integrating FreshBooks into medical practices lies in the success stories shared by healthcare professionals who have experienced tangible benefits. In-depth interviews with these practitioners provide valuable insights into how FreshBooks has streamlined their financial processes. For instance, a small clinic in a suburban area witnessed a significant reduction in billing errors and late payments after adopting FreshBooks. The ease of use and automation features not only saved time for the administrative staff but also contributed to enhanced patient satisfaction.

Furthermore, case studies serve as concrete examples of the positive impact FreshBooks can have on medical practices. These studies delve into specific scenarios, illustrating how the software has improved overall efficiency and ensured regulatory compliance. For instance, a multi-specialty clinic achieved seamless integration of FreshBooks with electronic health records (EHRs), resulting in a reduction of billing inaccuracies and an increase in revenue collection. These success stories and case studies collectively paint a vivid picture of FreshBooks as a transformative tool in the healthcare financial landscape.

Challenges and Solutions:

Implementing FreshBooks in medical practices may come with its set of challenges, ranging from resistance to change among staff to the complexities of adapting the software to specific healthcare billing requirements. Addressing these challenges head-on is crucial for the successful adoption of FreshBooks. Common hurdles, such as staff training and system integration issues, can be effectively navigated with strategic solutions.

Providing insights into these challenges and offering practical tips for overcoming them is paramount. For example, a guide may outline a step-by-step approach to training staff members, emphasizing the user-friendly interface of FreshBooks and the time-saving benefits it brings. Additionally, addressing concerns about compliance with healthcare regulations, the guide can highlight how FreshBooks ensures data security and meets industry standards.

By exploring both success stories and challenges, this comprehensive approach aims to equip medical practitioners with the knowledge needed to make informed decisions about implementing FreshBooks in their practices. The goal is not only to showcase the advantages but also to acknowledge potential obstacles and empower healthcare professionals to navigate them successfully, ultimately optimizing the use of FreshBooks in the medical field.

Future Trends in Medical Practice Bookkeeping and FreshBooks:

In the rapidly evolving landscape of medical practice bookkeeping, technological advancements play a pivotal role in shaping the way healthcare professionals manage their finances and streamline administrative processes. As we delve into the future trends, it becomes apparent that emerging technologies are influencing medical practice management significantly. This includes the integration of artificial intelligence, automation, and data analytics, which can enhance the efficiency and accuracy of bookkeeping tasks. For instance, AI algorithms can automate data entry, categorization, and reconciliation processes, reducing the likelihood of errors and saving valuable time for medical practitioners.

FreshBooks, as a leading accounting software, stands at the forefront of adapting to and embracing these technological advancements. The platform consistently evolves to incorporate the latest features and functionalities that align with the changing needs of medical professionals. By staying abreast of emerging technologies, FreshBooks not only ensures the compatibility of its software with the latest innovations but also provides healthcare practitioners with tools that can simplify complex financial tasks, allowing them to focus more on patient care.

In the realm of user feedback and updates, FreshBooks demonstrates a commitment to understanding and addressing the unique challenges faced by medical practitioners in managing their finances. By actively analyzing user feedback, the platform gains valuable insights into the specific pain points and requirements of its users within the healthcare sector. This user-centric approach enables FreshBooks to make informed decisions about updates and enhancements that cater to the evolving needs of medical professionals.

Anticipating future updates and enhancements based on user needs is a crucial aspect of FreshBooks’ strategy. The platform’s responsiveness to user feedback ensures that it remains a relevant and indispensable tool for medical practitioners. Whether it involves refining existing features, introducing new functionalities, or improving the overall user experience, FreshBooks’ commitment to meeting the demands of its user base contributes to the ongoing refinement of medical practice bookkeeping processes.

The future of medical practice bookkeeping is intricately tied to technological advancements and user-centric developments. FreshBooks, through its proactive approach to embracing technology and responding to user feedback, is poised to play a pivotal role in shaping the landscape of medical bookkeeping, providing healthcare professionals with the tools they need to navigate the complexities of financial management in their practices.

Integrating FreshBooks with Other Healthcare Management Systems:

Integrating FreshBooks, a popular cloud-based accounting and invoicing software, with healthcare management systems, specifically Electronic Health Records (EHR) and Practice Management Software, can bring about several advantages. Let’s delve deeper into each aspect:

Electronic Health Records (EHR) Integration:

- Benefits of Integration:

Streamlined Processes: By integrating FreshBooks with EHR systems, healthcare providers can streamline their workflows. It enables the automatic transfer of patient billing and payment information, reducing the need for manual data entry and minimizing errors.

Billing Accuracy: The integration ensures that billing information in FreshBooks aligns accurately with patient records in the EHR system. This reduces billing errors and enhances the overall accuracy of financial transactions related to healthcare services.

Efficient Revenue Cycle Management: Seamless integration helps in managing the entire revenue cycle more efficiently. From capturing patient data to invoicing and payment collection, the integration ensures a smooth flow of information between clinical and financial systems.

- Ensuring Seamless Data Flow:

Patient Information Consistency: Integration guarantees that patient information is consistent across both EHR and FreshBooks. This consistency is crucial for accurate billing, insurance claims, and financial reporting.

Real-time Updates: Any updates or changes made in the EHR system are reflected in FreshBooks in real-time. This ensures that billing information is always current and reduces the risk of outdated or mismatched data.

Practice Management Software Integration:

- Complementing Practice Management Software:

Holistic Data Management: FreshBooks, when integrated with practice management software, provides a comprehensive solution for healthcare practices. It covers both the financial aspects (billing, invoicing, expenses) and operational aspects (scheduling, appointment management, patient communication) in a unified platform.

Time and Cost Savings: The integration reduces the time and effort required to manage separate systems for financial and practice management. It minimizes the chances of errors that may occur when manually transferring data between different platforms.

- Enhancing Overall Operational Efficiency:

Centralized Information: Bringing together financial and operational data into a single platform enhances overall operational efficiency. Healthcare providers can access comprehensive information without switching between multiple applications.

Improved Decision-Making: Having integrated data allows for better analysis and reporting. Healthcare administrators can make informed decisions based on a holistic view of both financial and operational performance.

Integrating FreshBooks with healthcare management systems, whether EHR or practice management software, facilitates seamless exchange of data, reduces errors, enhances accuracy, and improves the overall efficiency of healthcare administration and financial management processes.

Best Practices for Medical Practice Bookkeeping with FreshBooks:

Regular Data Entry and Updates:

Consistent Data Entry Schedule:

Set up a regular schedule for data entry to ensure that financial transactions are recorded promptly. This helps in maintaining an up-to-date and accurate financial picture of the medical practice.

Categorization and Coding:

Ensure that all transactions are properly categorized and coded. This includes accurately classifying expenses, revenues, and any other financial activities specific to the medical practice.

Bank Reconciliations:

Perform regular bank reconciliations to match the transactions recorded in FreshBooks with those in the actual bank statements. This helps identify any discrepancies and ensures the accuracy of financial records.

Documenting Expenses:

Encourage detailed documentation of expenses. This not only helps in accurate bookkeeping but also aids in tax preparation and compliance.

Staff Training:

Comprehensive Training Program:

Develop a comprehensive training program for medical staff and administrative personnel on using FreshBooks. Cover basic functionalities, data entry procedures, and any specific features relevant to medical practice finances.

Ongoing Support:

Provide ongoing support for staff members. Address any questions or issues promptly, and periodically offer refresher courses to keep everyone updated on any new features or changes in the software.

Access Control:

Implement access controls to restrict staff access to only relevant financial information. This ensures data security and prevents unauthorized personnel from making changes to critical financial records.

Regular Audits and Reviews:

Scheduled Audits:

Establish a regular schedule for internal audits. This involves a thorough examination of financial records to identify any errors, inconsistencies, or

potential areas for improvement.

Documentation Review:

Review documentation procedures to ensure that all financial transactions are properly documented. This includes invoices, receipts, and any supporting documents for expenses or income.

Compliance Checks:

Conduct periodic checks to ensure compliance with relevant accounting standards and regulations. This is crucial for avoiding legal issues and maintaining the financial integrity of the medical practice.

Continuous Improvement:

Use the insights gained from audits to implement continuous improvement in bookkeeping processes. This may involve updating procedures, providing additional training, or adopting new features in FreshBooks that can enhance efficiency and accuracy.

Conclusion:

As medical practices continue to evolve, the need for efficient bookkeeping solutions becomes paramount. FreshBooks, with its user-friendly interface, robust features, and commitment to compliance, emerges as a valuable asset for medical professionals seeking to streamline their financial management processes. This comprehensive guide aims to provide insights into Best Practices for Medical Practice Bookkeeping with FreshBooks:o the unique challenges of medical practice bookkeeping and how FreshBooks can be a game-changer in addressing these challenges. By embracing innovative solutions like FreshBooks, medical practitioners can focus more on patient care while ensuring the financial health of their practices.

FreshBooks allows you to create and send professional invoices, track billable hours, and manage medical billing efficiently. It may also integrate with medical billing codes to facilitate accurate invoicing.

FreshBooks aims to comply with relevant financial and data security regulations. Users should check for updates and features that ensure compliance with healthcare-specific regulations such as HIPAA (Health Insurance Portability and Accountability Act).

Yes, FreshBooks typically allows users to categorize and track expenses related to medical supplies, equipment, and other business-related costs, helping to maintain a clear overview of financial transactions.

Depending on the software’s capabilities, FreshBooks may have integrations with EHR systems to facilitate seamless data transfer between medical practice management and bookkeeping.

FreshBooks may offer payroll features or integrate with payroll services, allowing medical practices to manage payroll efficiently and ensure accurate compensation for staff.