Introduction: QuickBooks and the Modern Landscape of Outsourced Accounting

In the ever-evolving world of business, accounting has undergone a dramatic transformation. From the days of laborious manual bookkeeping to the sleek efficiency of cloud-based solutions, the way businesses manage their finances has become increasingly streamlined and accessible. One of the most significant trends driving this shift is the rise of outsourced accounting, a practice that has revolutionized the way businesses handle their financial operations. This introductory section delves into the fascinating evolution of outsourced accounting, highlighting the crucial role of QuickBooks in powering modern and collaborative financial management.

Understanding the Evolution of Outsourced Accounting:

- Historical Shift Towards Outsourcing:

Traditionally, businesses relied on internal accounting teams to manage their finances. However, the complexities of modern accounting and the increasing pressure to reduce operational costs led to a gradual shift towards outsourcing. Initially, this involved delegating tasks to offshore providers in search of lower costs. While cost savings remained a key driver, the focus has evolved towards specialization and expertise. Businesses began recognizing the value of partnering with qualified accounting firms that could offer a wider range of services and deeper financial insights, often exceeding the capabilities of internal teams.

- The Cloud Revolution:

The rise of cloud technology has been a game-changer for outsourced accounting. Cloud-based accounting solutions like QuickBooks Online have eliminated the need for expensive on-premise software and hardware, making it easier for businesses to collaborate with their outsourced accounting providers. Secure online access allows for real-time data sharing and collaboration, fostering transparency and trust between businesses and their accounting partners. This level of accessibility has transformed the way outsourced accounting services are delivered, paving the way for flexible, scalable, and efficient solutions.

The Role of QuickBooks in Modern Accounting Outsourcing:

- A Catalyst for Efficient Collaboration:

QuickBooks has emerged as a powerful catalyst for efficient and collaborative outsourced accounting. Its intuitive interface, user-friendly features, and robust data management capabilities make it a perfect fit for both businesses and accounting professionals. Clients can easily upload and manage their financial data, track expenses, and access real-time reports, while their accounting partners can seamlessly integrate with the platform to perform tasks, generate reports, and provide valuable financial insights. This seamless integration fosters a collaborative environment where both parties work in sync to achieve optimal financial management.

- Key Features for Outsourcing Success:

QuickBooks offers a plethora of features that make it an ideal solution for outsourced accounting:

- Multiple User Access: Different levels of access can be granted to both clients and accounting professionals, ensuring data security while facilitating efficient collaboration.

- Automated Data Entry: Features like bank feeds and automatic transaction categorization save time and minimize manual data entry, reducing the risk of errors and streamlining workflows.

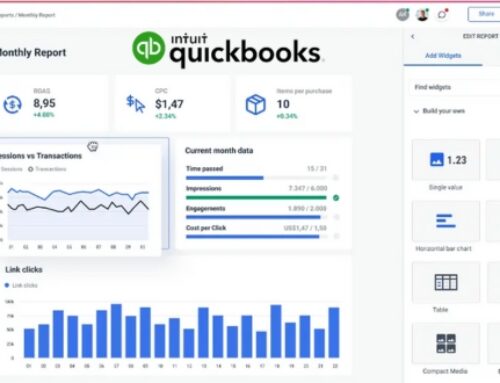

- Customizable Reports: Accounting professionals can generate customized reports and dashboards for clients, providing them with clear insights into their financial health.

- Mobile Accessibility: QuickBooks apps allow for on-the-go access to financial data, enabling both clients and their accountants to stay connected and informed anytime, anywhere.

- Integrations: QuickBooks integrates seamlessly with various third-party applications and platforms, further expanding its capabilities and streamlining the accounting workflow.

Conclusion:

The confluence of outsourced accounting and cloud-based solutions like QuickBooks has created a powerful synergy for businesses of all sizes. By leveraging the expertise of qualified accounting professionals and the efficiency of QuickBooks, businesses can achieve unparalleled financial control, gain valuable insights, and free up valuable resources to focus on their core operations. As technology continues to evolve, the future of outsourced accounting promises even greater levels of automation, collaboration, and data-driven insights, ushering in a new era of financial management for businesses across the globe.

Benefits of Outsourced Accounting with QuickBooks: A Recipe for Efficiency and Growth

In today’s dynamic business landscape, agility and efficiency are paramount. Managing complex financial operations while navigating growth demands can be a daunting task for many businesses. Enter outsourced accounting with QuickBooks, a powerful combination that unlocks a plethora of benefits for businesses of all sizes. This section delves into the key advantages of outsourcing with QuickBooks, focusing on cost efficiency, access to expertise, and the ability to refocus on core business functions.

Cost Efficiency and Scalability:

Outsourcing accounting with QuickBooks offers significant cost savings compared to maintaining an in-house team. You eliminate the need for employee salaries, benefits, and software licenses, while gaining access to skilled professionals without the overhead. QuickBooks further enhances cost efficiency through:

- Automation: Features like automated data entry, bank feeds, and online payments reduce manual work and minimize errors, saving time and money.

- Scalability: You can easily adjust your service level based on your needs, paying only for the services you require. This flexibility helps manage fluctuating workloads and avoids the costs associated with overstaffing or understaffing an in-house team.

- Reduced Errors: Professional accountants ensure accurate and compliant financial records, minimizing the risk of costly penalties and audits.

Access to Expertise:

Outsourcing with QuickBooks grants access to a team of experienced accounting professionals with diverse skills and knowledge. These experts can handle complex tasks like tax preparation, budgeting, and financial analysis, providing insights and guidance that go beyond basic bookkeeping. QuickBooks facilitates this expertise through:

- Collaboration Tools: Secure online access and real-time data sharing enable seamless collaboration between your business and your accounting team.

- Customization: QuickBooks can be customized to meet your specific needs and industry requirements, ensuring your accounting processes are optimized for efficiency and accuracy.

- Reporting and Analytics: QuickBooks generates insightful reports and dashboards that provide valuable financial data, allowing your team to make informed business decisions.

Focus on Core Business Functions:

By outsourcing accounting with QuickBooks, you free up your internal team to focus on their core competencies and drive business growth. This shift offers several benefits:

- Increased Productivity: Employees can spend more time on activities that generate revenue and contribute directly to your bottom line.

- Improved Morale: Relieved of the burden of complex accounting tasks, your team experiences reduced stress and can focus on their areas of expertise.

- Enhanced Strategic Decision Making: With accurate and timely financial insights from your outsourced accounting team, you can make informed strategic decisions about your business.

QuickBooks as the Secret Ingredient:

QuickBooks plays a crucial role in maximizing the benefits of outsourced accounting. Its user-friendly interface, powerful features, and robust data management capabilities make it the perfect platform for collaboration and efficiency. Clients can easily access and share financial information, while accounting professionals can seamlessly perform tasks and generate reports, ensuring everyone is on the same page.

Real-World Impact:

Imagine a small manufacturing company struggling to keep up with their growing financial needs. By outsourcing their accounting with QuickBooks, they can:

- Reduce their annual accounting costs by 20%.

- Gain access to a team of experienced accountants who specialize in manufacturing tax regulations.

- Free up their internal team to focus on product development and sales, leading to a 15% increase in revenue within a year.

This is just one example of how outsourced accounting with QuickBooks can empower businesses of all sizes to achieve greater efficiency, gain valuable insights, and ultimately, thrive in the competitive market.

Conclusion:

Outsourcing accounting with QuickBooks is not just a cost-saving measure; it’s a strategic investment in your business’s future. By leveraging the expertise of qualified accountants and the power of QuickBooks, you can unlock a new level of financial control, free up valuable resources, and focus on what matters most – driving your business towards success.

Setting Up QuickBooks for Outsourced Accounting: A Recipe for Seamless Collaboration

Outsourcing accounting with QuickBooks offers a wealth of advantages, but a successful partnership hinges on a smooth and secure setup. This section delves into the key steps involved in configuring QuickBooks for seamless collaboration with your outsourced accounting team, ensuring efficient data flow, enhanced security, and a productive working relationship.

Configuring QuickBooks for Collaboration:

- User Roles and Permissions: Define granular user roles for your outsourced team members, granting access based on their specific responsibilities. This ensures data security and prevents unauthorized modifications, while still allowing your team to perform their duties effectively.

- Company Settings: Customize company settings to match your accounting practices, including chart of accounts, fiscal year, and tax settings. This eliminates potential confusion and ensures consistent financial reporting.

- Chart of Accounts Mapping: Map your existing chart of accounts to the one used by your outsourced team to ensure smooth data integration and prevent duplicate entries.

- Preferences and Automation: Configure preferences for automated data entry, bank feeds, and online payments to streamline workflows and minimize manual tasks.

Integrating External Systems with QuickBooks:

- Identify Data Sources: Analyze your current financial systems and identify data sources that need to be integrated with QuickBooks. This could include bank accounts, payroll platforms, CRM systems, and e-commerce platforms.

- Compatibility and Data Mapping: Ensure all systems are compatible with QuickBooks and establish clear data mapping rules to guarantee accurate and consistent data flow.

- Third-Party Integrations: Utilize third-party add-ons and integrations to seamlessly connect QuickBooks with your chosen systems, expanding functionality and automating data transfer.

Training and Onboarding for Outsourced Teams:

- Initial Training: Provide comprehensive training for your outsourced team on QuickBooks features, navigation, and specific workflows relevant to your business. This can be done through online tutorials, live webinars, or personalized training sessions.

- Documentation and Resources: Develop detailed documentation on your accounting processes, chart of accounts, and preferred reporting formats. This ensures clarity and consistency, minimizing the need for back-and-forth communication.

- Ongoing Support and Communication: Establish clear communication channels and schedules for regular updates, questions, and feedback. This fosters a collaborative environment and ensures timely resolution of any issues that may arise.

Real-World Example:

Imagine a growing retail chain that outsources its accounting. By following these steps, they can:

- Set up user roles for the outsourced team, granting access to accounts receivable and payable functions while restricting sensitive information.

- Integrate their point-of-sale system with QuickBooks to automatically import sales data, eliminating manual entry and improving data accuracy.

- Train their outsourced team on QuickBooks features and specific sales tax regulations, ensuring compliance and avoiding potential penalties.

Additional Tips:

- Start with a Clean Slate: If you are migrating from an older accounting system, ensure all data is transferred accurately and the chart of accounts is properly mapped before onboarding your outsourced team.

- Schedule Regular Reviews: Conduct periodic reviews of your accounting processes and data flow to identify areas for improvement and ensure continued alignment with your business needs.

- Embrace Technology: Utilize the latest technology and automation tools available in QuickBooks to further streamline collaboration and boost efficiency.

By carefully configuring QuickBooks for collaboration, integrating external systems, and providing thorough training and support, you can create a solid foundation for a successful and productive outsourced accounting partnership. Remember, open communication, clear expectations, and a collaborative mindset are key ingredients for a thriving relationship that empowers your business to reach its full potential.

Security Measures in Outsourced Accounting with QuickBooks: Protecting Your Financial Fortress

In the dynamic world of outsourced accounting, trust and security are paramount. While QuickBooks offers powerful tools for collaboration and efficiency, it’s crucial to implement robust security measures to safeguard your sensitive financial data. This section delves into the essential security considerations for outsourced accounting with QuickBooks, ensuring data confidentiality and regulatory compliance.

Ensuring Data Confidentiality:

- QuickBooks Security Features:

- User Access Controls: Granular user roles and permissions within QuickBooks limit access to specific data and functions, minimizing the risk of unauthorized exposure.

- Data Encryption: QuickBooks encrypts data at rest and in transit, ensuring its protection both on your devices and during transmission to your outsourced accounting team.

- Multi-Factor Authentication: Implementing two-factor authentication adds an extra layer of security, requiring additional verification for login attempts.

- Audit Logs: QuickBooks maintains detailed audit logs, providing a clear record of user activity and data changes, aiding in anomaly detection and potential security breaches.

- Secure Data Transmission and Storage:

- Secure Communication Protocols: Utilize encrypted communication channels like HTTPS and VPNs for data transmission between your systems and your outsourced team’s.

- Cloud Storage Security: Choose a reputable cloud storage provider with robust security measures and data backup policies for added peace of mind.

- Regular Data Backups: Regularly back up your QuickBooks data to a secure offsite location, ensuring business continuity in case of accidental data loss or cyberattacks.

Compliance with Industry Regulations:

- QuickBooks’ Role in Compliance:

- Industry-Specific Features: QuickBooks offers features tailored to specific industries like healthcare and retail, helping businesses comply with relevant regulations.

- Tax Compliance Tools: QuickBooks automates tax calculations and filing, reducing the risk of errors and ensuring compliance with tax laws.

- Audit Trail and Reporting: QuickBooks provides detailed audit trails and reports that can be used to demonstrate compliance to authorities during audits.

- Strategies for Regulatory Adherence:

- Data Privacy Regulations: Familiarize yourself with data privacy regulations like GDPR and CCPA, and implement policies and procedures to ensure compliance in data handling and storage.

- Cybersecurity Protocols: Develop a comprehensive cybersecurity policy outlining data security measures, employee training, and incident response procedures.

- Regular Risk Assessment: Conduct regular risk assessments to identify and mitigate potential security vulnerabilities in your systems and outsourced accounting processes.

Collaboration is Key:

Open communication and collaboration are crucial for maintaining security in outsourced accounting. Clearly communicate your data security expectations and policies to your outsourced team. Regularly review and update your security measures together to ensure continued compliance and address emerging threats.

Real-World Example:

Imagine a healthcare company outsourcing its accounting. By following these steps, they can:

- Implement user roles in QuickBooks, restricting access to patient financial data for non-authorized personnel.

- Utilize secure cloud storage with HIPAA-compliant data protection measures.

- Train their outsourced team on HIPAA regulations and data handling procedures.

- Conduct regular risk assessments to identify potential vulnerabilities in their accounting systems and data flow.

Additional Tips:

- Invest in Security Awareness Training: Educate your employees and outsourced team members on cybersecurity best practices to prevent human error and phishing attacks.

- Stay Updated on Security Threats: Keep yourself informed about the latest cybersecurity threats and vulnerabilities, updating your security measures accordingly.

- Consider Cybersecurity Insurance: Invest in cybersecurity insurance to mitigate financial losses in case of a security breach.

By prioritizing data confidentiality and adhering to industry regulations, you can create a secure environment for outsourced accounting with QuickBooks. Remember, security is an ongoing process, not a one-time solution. By fostering a collaborative and security-conscious culture, you can safeguard your financial data and build a trusting and productive relationship with your outsourced accounting team.

Challenges and Solutions in Outsourced Accounting: Embracing the Bumpy Road to Success

While outsourcing accounting with QuickBooks offers a wealth of benefits, the journey isn’t always smooth. Overcoming communication barriers and managing time zone differences can pose challenges, but with the right strategies and tools, these bumps can be transformed into stepping stones for a successful partnership.

Overcoming Communication Barriers:

Challenges:

- Cultural and language differences: Misunderstandings can arise due to varying communication styles and language nuances.

- Timely communication: Asynchronous schedules can lead to delays in responses and project completion.

- Information silos: Lack of clear communication can create isolated pockets of knowledge within teams.

Solutions:

- Define clear expectations: Establish communication protocols upfront, outlining preferred contact methods, response times, and escalation procedures.

- Embrace technology: Utilize video conferencing, instant messaging, and collaboration tools within QuickBooks to foster real-time communication and document sharing.

- Promote cultural understanding: Encourage open communication about cultural differences and encourage both teams to adapt their communication styles.

QuickBooks Advantage:

- Shared Files and Notes: Securely share documents and leave notes within QuickBooks, ensuring everyone is on the same page.

- Activity Feed: Stay updated on recent actions and changes within QuickBooks, promoting real-time transparency.

- Custom Reports and Dashboards: Generate tailored reports and dashboards that provide a clear and concise overview of key financial data for both teams.

Managing Time Zone Differences:

Challenges:

- Schedule conflicts: Overlapping work hours may be limited, making synchronous communication difficult.

- Delayed responses: Time zone shifts can lead to extended wait times for replies and resolutions.

- Disruptions to workflow: Waiting for responses from the other team can disrupt workflows and deadlines.

Solutions:

- Staggered schedules: Consider overlapping a portion of your schedules to facilitate direct communication on critical matters.

- Asynchronous collaboration: Utilize tools within QuickBooks to leave detailed instructions, assign tasks with clear deadlines, and track progress collaboratively.

- Cross-training: Train key members in both teams on overlapping functions, allowing them to cover for one another during off-hours.

QuickBooks Advantage:

- Automated Workflows: Schedule automated tasks and reports to run even when your team is offline, ensuring progress continues.

- Remote Access: Securely access and update QuickBooks data from anywhere, offering flexibility to work during your preferred hours.

- Version Control: Track changes and maintain different versions of files within QuickBooks, allowing seamless collaboration across time zones.

Embrace the Journey:

Remember, successful outsourced accounting is a journey, not a destination. By approaching challenges with a collaborative spirit, utilizing the right tools like QuickBooks, and adapting your communication styles, you can transform these hurdles into opportunities for growth and solidify a productive and beneficial partnership.

Quality Control and Performance Monitoring: Keeping Your Financial Compass Steady

In the realm of outsourced accounting, ensuring quality and tracking performance are critical for navigating towards financial success. This section delves into essential quality control measures and key performance indicators (KPIs) you can leverage with QuickBooks to keep your outsourced accounting partnership on the right course.

Implementing Quality Control Measures:

- Developing Protocols:

- Define accuracy standards: Establish clear expectations for data entry, calculations, and reporting accuracy.

- Implement checklists and review processes: Create detailed checklists for routine tasks and establish regular review procedures for completed work.

- Utilize test data: Introduce test data periodically to verify data integrity and identify potential errors before they impact real financial statements.

- QuickBooks Reporting Features:

- Audit Trail: Leverage QuickBooks’ audit trail to track user activity and changes, ensuring accountability and identifying potential discrepancies.

- Custom Reports: Generate customized reports to monitor specific metrics like account balances, transaction types, and journal entries, highlighting potential anomalies.

- Variance Reports: Utilize variance reports to compare actual results against budgets or forecasts, pinpointing areas for improvement.

Key Performance Indicators (KPIs) in Outsourced Accounting:

- Identifying KPIs:

- Accuracy: Track error rates in data entry, calculations, and reporting to gauge overall accuracy.

- Timeliness: Monitor the turnaround time for tasks like payroll processing, account reconciliations, and financial reports.

- Cost-effectiveness: Compare outsourced accounting costs to previous in-house expenses and track savings achieved through outsourcing.

- Customizing QuickBooks Reports:

- KPIs Dashboard: Create a custom dashboard within QuickBooks that displays key metrics in real-time, providing a quick overview of performance.

- Trend Analysis: Generate reports that track KPIs over time, identifying areas of improvement and potential areas of concern.

- Comparative Analysis: Compare your outsourced accounting performance against industry benchmarks or internal targets for continuous improvement.

Communication is Key:

Regular communication with your outsourced accounting team is crucial for effective quality control and performance monitoring. Discuss your KPIs, share reports, and provide feedback to ensure everyone is aligned and working towards shared goals.

Real-World Example:

Imagine a manufacturing company outsourcing its accounting. By implementing these steps, they can:

- Develop a checklist for monthly account reconciliations to ensure accuracy.

- Utilize QuickBooks variance reports to identify discrepancies between production costs and budgeted figures.

- Track the turnaround time for payroll processing and financial reporting through custom reports.

- Regularly discuss performance metrics with their outsourced team and adjust workflows based on their findings.

Effective quality control and performance monitoring are not one-time efforts but continuous processes. By implementing robust measures, utilizing QuickBooks features, and fostering open communication, you can maintain a steady course towards financial success in your outsourced accounting journey.

Choosing the Right Outsourced Accounting Partner: Finding Your Financial Compass

Selecting the right outsourced accounting partner is like choosing a financial compass – it guides your business towards financial stability and growth. Here are some key criteria to consider:

Expertise:

Industry experience: Look for a partner with proven expertise in your specific industry, ensuring they understand your unique accounting needs and challenges.

Qualifications: Verify the team’s accounting certifications and professional affiliations, ensuring they possess the necessary skills and knowledge.

Reputation:

Client testimonials and reviews: Research the partner’s past performance and reputation, seeking feedback from previous and current clients.

Industry awards and recognitions: Look for partners recognized for their excellence in accounting services or QuickBooks proficiency.

Compatibility:

Communication style and cultural fit: Ensure the partner aligns with your communication preferences and company culture for a smooth working relationship.

Technology compatibility: Verify their proficiency in QuickBooks and other relevant software platforms to ensure seamless data integration and collaboration.

QuickBooks Expertise:

- Certified QuickBooks ProAdvisors: Prioritize partners with certified QuickBooks ProAdvisors on their team, guaranteeing in-depth knowledge and expertise in the platform.

- Customizable solutions: Look for partners who can customize their services and adapt to your specific QuickBooks needs and workflows.

Finding the right outsourced accounting partner is an investment in your business’s future. By carefully evaluating these criteria and focusing on QuickBooks expertise, you can confidently choose a compass that guides your financial journey towards success.

Conclusion: Optimizing Financial Management with QuickBooks Outsourced Accounting

In conclusion, leveraging QuickBooks for outsourced accounting is a strategic move that can revolutionize financial management for businesses. The benefits of cost efficiency, scalability, and access to expertise make outsourcing with QuickBooks a powerful solution. As businesses increasingly embrace remote collaboration, QuickBooks provides the necessary tools to streamline processes and enhance collaboration between in-house and outsourced teams.

Setting up QuickBooks for outsourced accounting involves configuring the platform for seamless collaboration, integrating external systems, and ensuring proper training for outsourced teams. The security measures embedded in QuickBooks, along with its compliance features, ensure that sensitive financial data remains confidential and in adherence to industry regulations.

While challenges such as communication barriers and time zone differences may arise, QuickBooks offers features that facilitate effective communication and asynchronous collaboration. Quality control and performance monitoring are critical aspects, and QuickBooks’ reporting features play a pivotal role in maintaining accuracy and compliance.

Selecting the right outsourced accounting partner is crucial, and businesses should consider factors such as expertise, reputation, and QuickBooks proficiency when making this decision.

In essence, QuickBooks transforms outsourced accounting from a mere delegation of tasks to a strategic partnership that optimizes financial management. As businesses navigate the complexities of modern financial landscapes, embracing QuickBooks for outsourced accounting becomes a catalyst for efficiency, collaboration, and sustained success.