Introduction:

Introduction of Fresh Books Construction Industry Finance

The introduction sets the stage for understanding the critical role of financial management in the construction industry. It provides an overview of the construction sector, highlighting its significance and impact on the economy. Additionally, it addresses the unique financial challenges that construction businesses often encounter.

Overview of the Construction Industry:

- Importance and Impact on the Economy:

The construction industry plays a pivotal role in driving economic growth. It encompasses various sectors, including residential, commercial, and infrastructure development. The construction of buildings and infrastructure not only provides employment opportunities but also contributes significantly to the overall GDP of a country. Understanding the economic importance of the construction industry is crucial for appreciating the need for effective financial management within this sector.

- Unique Financial Challenges Faced by Construction Businesses:

Construction businesses face distinct financial challenges that set them apart from other industries. These challenges may include project-specific cash flow fluctuations, high upfront costs, dependence on external funding, and sensitivity to economic cycles. An in-depth exploration of these challenges helps lay the foundation for understanding why efficient financial management is essential for sustainable growth and success.

The Need for Efficient Financial Management:

- Cash Flow Management:

Effective cash flow management is paramount in the construction industry. Construction projects often involve staggered payments, and delays in payment from clients can disrupt the cash flow. Conversely, timely payments to suppliers and subcontractors are essential for project continuity. Financial management strategies, such as creating realistic payment schedules, negotiating favorable payment terms, and implementing efficient invoicing processes, become critical for maintaining a healthy cash flow.

- Project Budgeting and Cost Control:

Construction projects are notorious for their complexity and the potential for cost overruns. Detailed project budgeting, including accurate cost estimations and contingency planning, is essential to prevent financial setbacks. Moreover, continuous monitoring and control mechanisms must be in place to identify and address deviations from the budget promptly. Robust financial management practices help construction companies stay within budget constraints and enhance overall project profitability.

- Compliance with Industry Regulations:

The construction industry is subject to numerous regulations and standards, including safety, environmental, and financial regulations. Adhering to these regulations is not only a legal requirement but also crucial for maintaining a positive reputation and securing future projects. Efficient financial management involves ensuring compliance with all relevant industry regulations, from accounting standards to safety protocols, to mitigate risks and maintain the integrity of the business.

Understanding FreshBooks

Introduction to FreshBooks:

FreshBooks is a cloud-based accounting software designed to simplify financial management for businesses of all sizes. Established in [insert year], the platform has evolved to become a trusted solution for entrepreneurs and small to medium-sized enterprises. Its user-friendly interface and innovative features have contributed to its widespread adoption in various industries.

Brief History and Evolution:

FreshBooks originated as a straightforward invoicing tool, providing a streamlined solution for businesses to manage their billing processes. Over the years, it has undergone significant transformations, incorporating advanced features to meet the diverse needs of its user base. The software’s evolution reflects its commitment to staying ahead of industry trends and technological advancements.

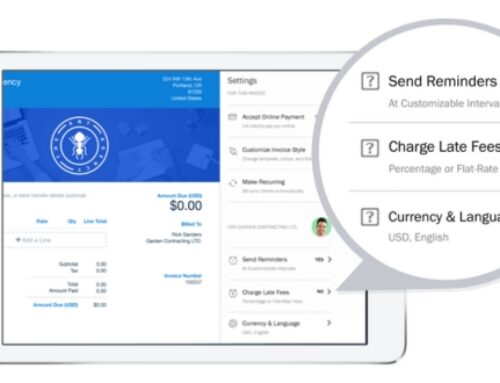

Key Features and Functionalities:

FreshBooks boasts a range of features that set it apart in the competitive landscape of accounting software. Its intuitive invoicing system, expense tracking capabilities, and robust reporting tools contribute to efficient financial management. Moreover, the platform emphasizes user-friendly design, making it accessible for individuals with varying levels of financial expertise.

Tailored Solutions for Construction Businesses:

In addition to serving a broad spectrum of businesses, FreshBooks offers tailored solutions specifically catering to the unique requirements of construction businesses.

- Project Tracking and Invoicing:

For construction businesses, effective project tracking is crucial. FreshBooks enables users to monitor project progress, track expenses, and generate detailed invoices. The platform’s project management tools facilitate seamless collaboration among team members, ensuring that construction projects stay on schedule and within budget.

- Expense Management:

Managing expenses is a fundamental aspect of any business, and this is particularly true for construction companies dealing with multiple costs associated with materials, equipment, and labor. FreshBooks streamlines expense management, allowing construction businesses to categorize and track expenses effortlessly. This ensures accurate financial records and helps in making informed decisions.

- Time Tracking and Payroll Integration:

Time is a valuable resource in the construction industry, and FreshBooks recognizes this by offering robust time-tracking features. Employees can log their hours directly into the system, facilitating accurate payroll processing. Integration with payroll systems further automates this process, reducing the administrative burden on construction businesses.

- Reporting and Analytics:

FreshBooks goes beyond basic financial tracking by providing comprehensive reporting and analytics tools. Construction businesses can generate customized reports to gain insights into their financial performance, project profitability, and overall business health. These analytics empower decision-makers to identify areas for improvement, optimize resource allocation, and enhance overall efficiency.

Financial Challenges in the Construction Industry

Cash Flow Management:

- Irregular Income Cycles:

Construction projects often have unpredictable payment schedules. Payments may be tied to project milestones, and delays can occur due to various reasons such as changes in scope, weather conditions, or unforeseen issues. This irregularity in income can make it challenging for construction companies to maintain a steady cash flow.

- Managing Accounts Receivable and Payable:

Balancing accounts receivable (money owed to the company) and accounts payable (money owed by the company) is crucial. Late payments from clients can impact cash flow, making it difficult to meet immediate financial obligations like paying suppliers, salaries, and other operational expenses.

Project Budgeting and Cost Control:

- Overcoming Budget Overruns:

Construction projects are susceptible to budget overruns due to various factors, including changes in project scope, unexpected site conditions, or fluctuations in material and labor costs. Effective budgeting requires thorough initial estimates, continuous monitoring, and proactive management to mitigate the risk of exceeding allocated funds.

- Allocating Resources Efficiently:

Efficient resource allocation involves optimizing the use of labor, equipment, and materials. Poor resource management can lead to increased costs and project delays. Project managers need to balance the allocation of resources to ensure that each aspect of the project receives the necessary resources without unnecessary overspending.

Compliance and Regulatory Challenges:

- Tax Regulations in the Construction Industry:

Construction companies must navigate complex tax regulations, including income taxes, sales taxes, and payroll taxes. Understanding and adhering to tax laws are essential to avoid legal issues and financial penalties. Changes in tax codes or regulations can also impact the financial planning of construction projects.

- Legal and Contractual Obligations:

The construction industry is heavily regulated, and adherence to legal and contractual obligations is paramount. Contractual disputes, legal challenges, or non-compliance with regulations can lead to financial losses. Construction companies need to invest in legal counsel and ensure that contracts are well-drafted to protect their interests and avoid costly litigation.

The financial challenges in the construction industry are multifaceted and require a strategic approach to financial management, meticulous budgeting, efficient resource allocation, and a thorough understanding of legal and regulatory frameworks. Construction companies that effectively address these challenges can enhance their financial stability and ensure the successful execution of projects.

Advantages of Implementing FreshBooks in Construction Finance

Enhanced Efficiency:

- Streamlined Invoicing and Payment Processes:

FreshBooks facilitates the automation of invoicing, reducing manual tasks and accelerating the billing cycle. This can lead to quicker payment turnaround times and improved cash flow.

- Automated Expense Tracking and Management:

The platform automates the tracking and management of expenses, ensuring accuracy and efficiency in recording financial transactions. This not only saves time but also minimizes the risk of errors associated with manual data entry.

Improved Project Management:

- Real-Time Project Tracking:

FreshBooks provides real-time insights into project progress, allowing construction finance teams to monitor developments, identify potential issues, and make informed decisions promptly. This contributes to better project control and the ability to address challenges proactively.

- Efficient Resource Allocation:

With the ability to track project expenses and allocate resources efficiently, FreshBooks enables construction businesses to optimize their resource usage. This ensures that resources are allocated appropriately, reducing waste and enhancing overall project profitability.

Financial Reporting and Analytics:

- Customizable Reports for Informed Decision-Making:

FreshBooks offers customizable financial reports, allowing construction finance professionals to tailor insights based on specific needs. This customization empowers decision-makers with relevant data for strategic planning and performance evaluation.

- Predictive Analytics for Future Financial Planning:

By leveraging predictive analytics tools, FreshBooks assists construction businesses in forecasting future financial trends. This foresight enables proactive decision-making, risk mitigation, and the development of robust financial strategies to navigate uncertainties.

Future Trends and Developments in Construction Finance

Integration of AI and Automation:

- AI-driven Financial Forecasting:

Construction projects involve complex financial planning and budgeting. AI can analyze historical project data, current market trends, and various external factors to provide accurate financial forecasts.

Machine learning algorithms can adapt and improve predictions over time by learning from past project outcomes, helping construction companies make more informed financial decisions.

- Automation of Routine Financial Tasks:

Many financial tasks in construction involve repetitive processes, such as invoice processing, payroll management, and expense tracking. Automation can significantly reduce the time and resources spent on these routine tasks.

Automated systems can enhance accuracy by minimizing human error, ensuring compliance with financial regulations, and allowing finance professionals to focus on more strategic aspects of project finance.

Blockchain in Construction Finance:

- Enhancing Transparency and Security in Transactions:

Blockchain technology can provide an immutable and transparent ledger of financial transactions, ensuring that every financial activity related to a construction project is recorded securely and cannot be altered.

This increased transparency can build trust among stakeholders, including contractors, subcontractors, and financiers, as they can independently verify financial transactions in real-time.

- Smart Contracts for Streamlined Project Management:

Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, can automate and streamline various aspects of construction project management.

In construction finance, smart contracts can automate payment processes, trigger payments upon the completion of predefined project milestones, and facilitate more efficient dispute resolution by enforcing contractual terms through code.

- Risk Management through Predictive Analytics:

AI can play a crucial role in predicting and mitigating financial risks associated with construction projects. By analyzing historical project data and external factors, predictive analytics can identify potential risks, allowing project stakeholders to take proactive measures.

- Real-time Financial Monitoring:

AI and automation enable real-time monitoring of project financials. This allows construction companies to have a dynamic view of their financial health, respond promptly to changes, and make data-driven decisions throughout the project lifecycle.

- Collaborative Financial Platforms:

Integrated AI and automation systems can facilitate collaboration among different stakeholders in construction finance. These platforms can enable seamless communication, data sharing, and financial coordination among project teams, financial institutions, and other relevant parties.

Tips for Successful Implementation and Integration

Planning and Preparation:

- Assessing Business Needs and Requirements:

Before implementing FreshBooks for construction workflows, it’s crucial to conduct a thorough assessment of the business needs and requirements. This involves understanding the specific challenges and processes within the construction industry that the software will address.

Identify key stakeholders and gather input from various departments to ensure that the solution meets the diverse needs of the organization.

- Customizing FreshBooks for Specific Construction Workflows:

FreshBooks, like any software, may need customization to align with specific construction workflows. This involves tailoring the solution to accommodate the unique processes and requirements of the construction industry.

Work closely with the IT team or FreshBooks support to configure the software to streamline project management, invoicing, and other relevant tasks in the construction context.

Training and Onboarding:

- Training Employees for Seamless Adoption:

Develop a comprehensive training program to ensure that employees are well-versed in using FreshBooks. This may include training sessions, workshops, or online tutorials.

Training should cover the basics of navigation, data entry, and any specialized features relevant to construction workflows. Consider providing hands-on training with real-world scenarios to enhance practical understanding.

- Providing Ongoing Support for Users:

Implementation doesn’t end with training; continuous support is crucial. Establish a support system that includes help desks, online forums, and documentation for quick reference.

Encourage users to provide feedback and address any issues promptly. Regularly update training materials to incorporate new features or improvements in the software.

Best Practices for Implementing FreshBooks in Construction Finance

Onboarding and Training:

- Staff Training Programs:

Develop comprehensive training programs to ensure that all staff members involved in construction finance are well-versed in using FreshBooks.

Training should cover basic functionalities, advanced features relevant to construction finance, and troubleshooting common issues.

Consider providing ongoing training sessions to keep the team updated on any new features or updates to the software.

- Transitioning from Legacy Systems:

Create a structured plan for migrating data from existing legacy systems to FreshBooks.

Conduct thorough data validation and reconciliation to ensure accuracy during the transition.

Provide ample support during the transition period to address any challenges or concerns raised by the users.

Customization and Configuration:

- Tailoring FreshBooks for Construction-Specific Needs:

Identify and understand the specific requirements of construction finance within your organization.

Customize FreshBooks settings, templates, and reports to align with the unique needs of construction projects, such as tracking expenses related to materials, labor, and equipment.

Utilize FreshBooks’ custom fields and tags to capture project-specific information.

- Integration with Other Construction Management Tools:

Explore and implement integrations between FreshBooks and other construction management tools that your organization uses (e.g., project management software, time tracking tools).

Seamless integration can improve workflow efficiency by reducing manual data entry and ensuring data consistency across various platforms.

Verify compatibility and conduct thorough testing to ensure the smooth flow of information between FreshBooks and other tools.

Financial Reporting and Analytics

Customizable Construction Financial Reports:

Project Profitability Reports: These reports likely provide a detailed analysis of the financial performance of each construction project. This may include information on project costs, revenue, profit margins, and key performance indicators. Customizability implies that stakeholders can tailor these reports to their specific needs, focusing on the metrics that matter most to them.

Cash Flow Statements: Cash flow statements are crucial for assessing the inflow and outflow of cash within a construction project. This includes tracking expenses, and revenue, and ensuring that there is sufficient liquidity to meet financial obligations. Customizable cash flow statements can be adapted to highlight specific cash-related concerns or priorities.

Balance Sheets and Income Statements: These financial statements provide a snapshot of the project’s financial health. A customizable approach allows users to drill down into specific aspects, whether it’s assets and liabilities on the balance sheet or revenue and expenses on the income statement. This flexibility is valuable for tailoring reports to different stakeholders’ needs.

Data-Driven Decision-Making:

Identifying Profitable Projects: The system likely utilizes data analytics to assess and identify which construction projects are the most profitable. This involves analyzing historical and real-time data to determine key factors contributing to profitability, allowing for strategic decision-making in project selection and resource allocation.

Adjusting Budgets in Real-Time: This feature suggests a dynamic approach to budget management. Real-time adjustments imply that the system can respond promptly to changes in project conditions, costs, or unexpected events. By leveraging data-driven insights, stakeholders can make informed decisions on budget adjustments, ensuring that financial plans remain aligned with project realities.

Conclusion

The construction industry’s financial landscape is evolving, and FreshBooks offers a tailored solution to address the unique challenges faced by construction companies. By streamlining project-based invoicing, automating expense tracking, integrating time tracking and payroll, and providing robust financial reporting and analytics, FreshBooks empowers construction businesses to achieve greater financial success.

Yes, FreshBooks is equipped to handle project-based invoicing, making it suitable for construction businesses. Users can create and send invoices specific to each construction project, making it easier to track income and expenses related to individual jobs.

FreshBooks allows users to track construction-related expenses by categorizing them, attaching receipts, and generating expense reports. This helps construction businesses keep a detailed record of project costs and overall financial health.

FreshBooks offers integrations with various project management tools, allowing construction businesses to sync financial data with project progress. This helps in maintaining consistency between financial records and project updates.

Yes, FreshBooks offers user roles and permissions, allowing construction businesses to control access for different team members. This feature is beneficial for managing collaboration while maintaining financial data security.

FreshBooks includes time tracking features, enabling construction teams to log hours spent on different tasks or projects. This helps in accurate billing for client projects and efficient payroll management.