Introduction

Beyond the Predetermined Path: Why Custom Reports Matter

QuickBooks offers a plethora of built-in reports, each providing valuable insights into different aspects of your business. However, these standard reports often paint a broad picture, neglecting the unique nuances and intricate details that define your specific journey. This is where custom reports step in, empowering you to:

- Craft a Customized Map: Move beyond the limitations of pre-defined reports and design reports tailored to your specific business needs. Imagine zooming in on your unique financial landscape, highlighting key metrics and revealing hidden patterns invisible to the generic map.

- Drill Down to the Core: Uncover insights beyond the surface. Go beyond basic sales figures and delve deeper into profitability, customer behavior, or inventory trends. Imagine dissecting your financial data like a skilled geologist, extracting the precious gems of actionable insights hidden within its layers.

- Answer Burning Questions: Have a burning question about your customer base, inventory management, or marketing ROI? Custom reports provide the answer. Craft reports that directly address your specific concerns, eliminating guesswork and fueling informed decision-making.

Steering Your Ship with Precision: The Advantages of Custom Reports in QuickBooks

The benefits of custom reports extend far beyond mere data exploration. They act as a potent navigational tool, propelling your business towards success:

- Enhanced Decision-Making: With tailored reports at your fingertips, you can make informed decisions based on accurate, relevant data. Imagine confidently charting your course, avoiding costly detours and seizing lucrative opportunities hidden in the financial data.

- Addressing Unique Business Requirements: Every business is a unique ecosystem with its own set of challenges and opportunities. Custom reports cater to these specificities, allowing you to track progress towards your individual goals and optimize strategies based on your unique financial terrain.

- Improved Efficiency and Productivity: Say goodbye to sifting through mountains of irrelevant data. Custom reports present only the information you need, streamlining your analysis and freeing up valuable time for strategic action. Imagine streamlining your financial analysis like a well-oiled machine, focusing your energy on driving growth and achieving your objectives.

Custom reports are not just about data manipulation; they are about empowering you to understand your business at its core. By harnessing the power of tailored insights, you can transform your financial data into a strategic asset, guiding your business towards a future of informed decisions, optimized strategies, and unbridled success.

Creating Custom Reports in QuickBooks

Imagine stepping into a workshop filled with financial building blocks – invoices, transactions, customer data, and more. QuickBooks custom reports transform you into an architect, empowering you to design and construct precisely the report that showcases your business landscape with exquisite detail. Let’s dive into the nitty-gritty, equipping you with the tools and know-how to craft your own financial masterpieces:

Charting Your Course: Navigating the Report Center

Your journey beins at the Report Center, your gateway to QuickBooks’ vast data repository. Here’s how to find your starting point:

- Open the Reports menu: This is where the magic happens! Depending on your QuickBooks version, click “Reports” or navigate to the “Company” menu and select “Reports.”

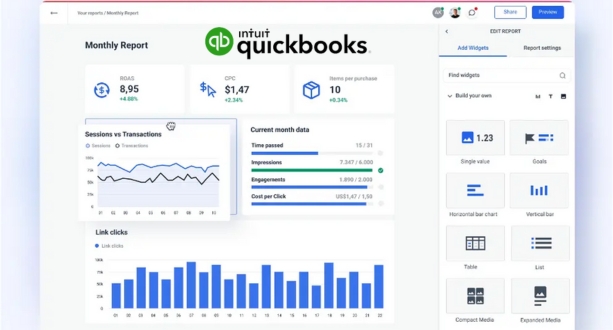

- Explore the dashboard: You’ll be greeted by a plethora of pre-built reports, categorized by function (e.g., Sales, Expenses, Customers). Feel free to browse these as inspiration, but remember, your true power lies in customization.

Brick by Brick: Customization Options

Now, let’s get your hands dirty with some construction! With a click of the “Create New Report” button, you’ll unlock a universe of possibilities:

- Selecting Data Fields: Imagine picking out the perfect bricks for your financial edifice. Choose from a dizzying array of data fields like revenue, expenses, customer demographics, or inventory levels. Think of it as selecting ingredients for a delicious financial recipe.

- Refining the Focus: Don’t get overwhelmed by data overload! Narrow down your scope by utilizing filters and date ranges. For example, focus on specific product categories, customer segments, or time periods to unearth granular insights. Think of zooming in on a specific section of your financial landscape.

- Crafting the Layout: This is where your artistic flair comes into play! Arrange your chosen data fields like paint strokes on a canvas. Utilize columns, rows, charts, and graphs to tell your financial story in a visually compelling way. Remember, clarity and presentation are key for impactful reports.

Beyond the Basics:

As your comfort level grows, explore advanced customization options like:

- Formulas and Calculations: Transform raw data into actionable insights by creating custom formulas. Calculate profit margins, track key performance indicators, or analyze trends over time. Think of adding spices and sauces to your financial dish, enhancing its flavor and complexity.

- Grouping and Sorting: Organize your data like a librarian meticulously arranging books on shelves. Group data by customers, products, or locations to identify patterns and relationships you might have missed previously. Think of highlighting specific sections of your financial landscape for closer examination.

- Exporting and Sharing: Share your financial masterpiece with the world! Export your reports to Excel, PDF, or other formats for further analysis or collaboration. Think of presenting your financial blueprint to key stakeholders to guide strategic decisions.

Crafting compelling custom reports is an iterative process. Don’t be afraid to experiment, tweak your reports, and refine them as you gain deeper insights into your business data. With each click and customization, you’ll be carving a clearer path towards informed decision-making, optimized strategies, and ultimately, financial success.

Types of Custom Reports

Now that you’ve mastered the art of constructing custom reports in QuickBooks, let’s delve into the treasure trove of possibilities this powerful tool unlocks. Imagine your financial data as a vast, uncharted island – each custom report a map leading to hidden insights and valuable knowledge. Let’s explore some key report types that act as your compass on this financial adventure:

Unveiling the Financial Fort Knox: Customizing Profit and Loss and Balance Sheets

These reports form the bedrock of your financial understanding, offering a bird’s-eye view of your financial health. With customization, you can transform them into laser-focused tools:

- Crafting a Personalized P&L: Go beyond the standard format. Drill down into specific product lines, departments, or customer segments to pinpoint profit drivers and identify areas for improvement. Imagine zooming in on specific sections of your financial island, revealing hidden gems of profitability and potential bottlenecks.

- Building a Bespoke Balance Sheet: Tailor this report to showcase your unique assets, liabilities, and equity structure. Analyze trends in inventory levels, track changes in accounts receivable, or monitor debt repayment progress. Think of customizing your financial island’s map to highlight key landmarks like resource reserves, debt mountains, and investment streams.

Charting the Revenue River: Uncovering Sales and Revenue Insights

Sales and revenue are the lifeblood of any business. Custom reports transform them from mere numbers into a dynamic story of customer behavior and market trends:

- Generating Granular Sales Reports: Dive deeper than total sales figures. Analyze sales by product, customer, region, or channel. Identify top-selling items, track performance of marketing campaigns, or compare sales across different territories. Imagine building dams and levees to channel your revenue river, revealing its hidden tributaries and potential overflows.

- Mapping Revenue Trends: Visualize sales patterns over time. Identify seasonal fluctuations, track the impact of promotions, or forecast future revenue growth. Imagine charting the course of your revenue river, anticipating its ebbs and flows, and preparing for potential storms or sunny skies.

Navigating the Expense Maze: Tailored Reports for Cost Control

Expenses are often seen as necessary evils, but with custom reports, you can transform them into strategic allies:

- Tailoring Expense Reports: Categorize expenses by department, project, or type. Identify areas of overspending, track compliance with budgets, or analyze the cost-effectiveness of different initiatives. Imagine building bridges and pathways within your financial island, optimizing the flow of resources and identifying potential cost traps.

- Demystifying Cost Structures: Analyze the breakdown of your costs – raw materials, labor, overhead. Identify hidden cost drivers, explore alternative suppliers or optimize production processes. Imagine dissecting the composition of your financial island’s soil, uncovering the hidden elements driving your overall expense landscape.

The types of custom reports you create are as diverse and unique as your business itself. This is just a glimpse into the vast potential that awaits. Experiment with different data fields, layouts, and filters to unearth hidden trends, optimize your operations, and make informed decisions that propel your business towards financial prosperity.

Advanced Customization Techniques

Delving Deeper: Mastering Advanced Customization Techniques in QuickBooks Reports

Imagine navigating your financial jungle with a basic machete – you can clear some paths, but complex terrain remains shrouded in mystery. This is where advanced customization techniques in QuickBooks reports step in, transforming you into a master explorer, equipped with a compass, a magnifying glass, and a trusty Swiss army knife. Let’s delve into these powerful tools and reveal the hidden gems within your financial data:

Sifting Through the Nuggets: Filters and Criteria

Think of filters and criteria as your treasure-hunting tools, allowing you to sift through mountains of data and unearth specific insights:

- Applying Filters for Specific Data Sets: Don’t get bogged down by irrelevant information! Utilize filters to narrow your focus. For example, filter sales reports by product category, customer segment, or date range to isolate key trends and patterns. Imagine wielding a sieve, separating gold dust from the pebbles in your financial stream.

- Setting Criteria for Targeted Information: Go beyond simple filters and define precise criteria for the data you seek. For example, create a report showing only invoices exceeding a certain amount or transactions involving a specific vendor. Think of using a metal detector to pinpoint buried treasure within your financial landscape.

Crafting Your Own Metrics: Custom Formulas and Calculations

Raw data is like unpolished gemstones – beautiful, but their true potential lies hidden beneath the surface. Custom formulas and calculations act like polishing tools, revealing the brilliance within:

- Creating Custom Metrics: Don’t settle for pre-defined metrics! Craft your own formulas to analyze your business in a unique way. Calculate customer lifetime value, track inventory turnover rate, or measure return on investment for marketing campaigns. Imagine shaping raw data into exquisite gems that showcase the true value and performance of your business.

- Utilizing Formulas for Data Analysis: Go beyond simple calculations and unlock the power of advanced formulas. Utilize functions like averages, medians, and standard deviations to identify outliers, analyze trends, and make informed predictions. Think of wielding a magnifying glass to examine the intricate facets of your financial data, revealing hidden patterns and insights.

Beyond the Basics:

As your expertise grows, explore these advanced techniques:

- Conditional Formatting: Highlight key data points and trends by applying different colors, fonts, or borders based on specific criteria. Think of using paint to accentuate the most valuable gems within your financial treasure chest.

- Custom Report Groups and Summations: Organize your data into meaningful categories and subtotals to gain a holistic understanding of your business performance. Imagine building shelves and display cases within your financial museum, showcasing your data in a clear and organized manner.

- Linking Reports: Create relationships between different reports to analyze data from multiple perspectives and uncover deeper connections. Think of building bridges between your financial islands, allowing you to seamlessly navigate and cross-reference insights across different reports.

Remember, advanced customization techniques are not about complexity; they are about unlocking the full potential of your financial data. By mastering these tools, you can transform your QuickBooks reports from static snapshots into dynamic dashboards, guiding your business towards strategic decision-making, optimized performance, and ultimate financial success.

Exporting and Sharing Custom Reports

Sharing the Financial Bounty: Exporting and Automating Your Custom Reports

Now that you’ve unearthed a treasure trove of insights through custom QuickBooks reports, it’s time to share your discoveries and collaborate with your crew! Think of it as presenting your meticulously mapped financial island to key stakeholders, ensuring everyone navigates the terrain with confidence. This section equips you with the tools to export, share, and automate your reports, maximizing their impact and streamlining your workflow.

Setting Sail for Collaboration: Export Options

Just like a pirate captain distributes his loot, you can share your custom reports in various formats to suit your audience:

- Exporting to Excel or PDF: These familiar formats offer flexibility and ease of sharing. Export reports for further analysis in spreadsheets or distribute them electronically for review and discussion. Think of sending your financial maps in durable parchment scrolls or easily transportable treasure chests.

- Sharing Reports with Stakeholders: Utilize QuickBooks’ built-in sharing features. Send reports directly to email addresses, grant access to specific users, or embed reports within websites or dashboards. Think of convening a pirate council and sharing your discoveries with your trusted allies.

Automating the Journey: Scheduling and Automation

Why chart the course every time you need a report? Set sail with automation features and keep your financial ship running smoothly:

- Setting Up Scheduled Report Deliveries: No need to manually generate reports. Schedule automatic delivery at regular intervals, ensuring key stakeholders receive the latest insights directly. Think of setting your financial maps on autopilot, delivering them to your crewmates at predetermined ports of call.

- Automating Report Generation: Take it one step further and automate the entire reporting process. Define custom criteria and filters, and watch as QuickBooks automatically generates reports based on your specifications. Think of having your financial island generate treasure maps on its own, saving you precious time and effort.

Remember, sharing and automating your custom reports are not just about convenience; they are about fostering collaboration and driving informed action. By utilizing these features effectively, you can:

- Empower your team: Provide stakeholders with the data they need to make informed decisions, regardless of their technical expertise.

- Improve communication and transparency: Share financial insights openly, fostering trust and collaboration within your organization.

- Save time and resources: Automate routine tasks and focus your energy on strategic analysis and interpretation of your data.

So, raise the anchor, share your financial maps, and set sail for a future of collaborative decision-making and optimized performance. With QuickBooks’ powerful reporting tools and automation features, your business is poised to navigate the financial seas with confidence and reap the rewards of your custom report treasures!

Troubleshooting Common Issues

Even the most seasoned financial adventurer encounters rough waters occasionally. This section equips you with the tools to navigate common issues and ensure your custom report voyage remains smooth sailing. Remember, unexpected errors are not harbingers of doom, but opportunities to refine your course and deepen your understanding of QuickBooks’ reporting capabilities.

Charting the Calm After the Storm: Error Messages and Solutions

Let’s tackle some common error scenarios and chart a course towards resolution:

- Data Access Issues: “Insufficient permissions” or “Data unavailable” messages can crop up. Double-check user roles and access levels, ensure data sources are properly connected, and verify if the report timeframe falls within available data ranges.

- Formula Mishaps: Custom formulas can be powerful, but they can also be temperamental. Review your formulas for typos, syntax errors, or incompatible data types. Utilize QuickBooks’ formula builder for assistance.

- Filter Fatigue: Overly complex filters can inadvertently exclude relevant data. Simplify your filters, test them incrementally, and ensure they align with your desired report scope.

Remember, error messages are often cryptic clues, not pronouncements of failure. Approach them with a calm and analytical mindset, consult QuickBooks’ extensive documentation and error code guides, and leverage online resources to decipher their meaning and find solutions.

Embracing the Collective Wisdom: Support Resources

Somezimes, even the most skilled navigator needs a guiding star. Fortunately, QuickBooks offers a wealth of support resources to help you weather any reporting storm:

- QuickBooks Help Center: This comprehensive online portal is your first mate, offering searchable articles, video tutorials, and detailed FAQs on all aspects of QuickBooks reporting.

- Community Forums: Connect with a vibrant community of QuickBooks users and experts. Share your specific challenges, learn from others’ experiences, and benefit from the collective wisdom of the QuickBooks ecosystem.

- Direct Support: If all else fails, reach out to QuickBooks’ dedicated customer support team. Trained professionals are available to answer your questions, troubleshoot complex issues, and guide you towards a successful resolution.

Remember, seeking support is not a sign of weakness; it’s a testament to your commitment to continuous learning and improvement. By utilizing these resources effectively, you can transform challenges into opportunities to deepen your understanding of QuickBooks reporting and navigate any future obstacle with confidence.

Case Studies: Real-Life Applications

Now that you’ve mastered the art of crafting and navigating your own financial islands, let’s set sail on the high seas of real-world examples! Witness how custom reports have transformed the journeys of different businesses, helping them overcome challenging landscapes and reach prosperous shores:

Case Study 1: Identifying Cost Killers – An E-commerce Adventure

The Challenge: An online furniture retailer was struggling with razor-thin margins and declining profits. They suspected hidden cost inefficiencies but lacked the data to pinpoint the culprits.

The Solution: Custom reports revealed the true cost breakdown of each product, highlighting exorbitant shipping charges from specific vendors. Additionally, detailed expense reports unmasked inefficiencies in marketing campaigns and warehouse operations.

The Outcome: Armed with these insights, the retailer renegotiated shipping contracts, optimized marketing strategies, and streamlined warehouse processes. The result? A 20% reduction in overall costs and a significant boost in profitability.

Case Study 2: Unearthing Customer Gems – A Restaurant Renaissance

The Challenge: A local restaurant chain longed to attract new customers and retain existing ones, but traditional marketing efforts yielded disappointing results. They needed to understand their customer base on a deeper level.

The Solution: Custom reports analyzed sales data by customer demographics, dining habits, and preferred menu items. These insights revealed untapped potential – young professionals gravitated towards specific lunchtime dishes, while families favored weekend brunches.

The Outcome: The restaurant tailored their marketing campaigns to specific customer segments, highlighting popular dishes and offering targeted promotions. They also adjusted their menus and opening hours based on customer preferences. The result? A 30% increase in new customers and a 15% rise in repeat business.

These are just glimpses into the transformative power of custom reports. In countless businesses across diverse industries, custom reports have become the compass guiding informed decisions, optimizing operations, and ultimately propelling them towards financial success. As you embark on your own reporting journey, keep these real-world examples close at hand as reminders of the immense potential that awaits beneath the surface of your financial data.

Best Practices for Effective Custom Reporting

Now that you’ve equipped yourself with the tools and skills to navigate your financial island with confidence, let’s polish your compass and refine your reporting practices to ensure they remain relevant and impactful. Remember, just as a captain meticulously charts their course based on shifting tides and changing winds, so too must you adapt your custom reports to the evolving needs of your business.

Keeping the Map Fresh: Regularly Reviewing and Updating Reports

Think of your custom reports as living documents, not static snapshots. Regularly review and update them to ensure they remain aligned with your business goals:

- Periodic Audits: Schedule regular reviews, quarterly or annually, to assess your reports’ effectiveness. Are they still providing the insights you need? Have your business objectives shifted?

- Adaptive Approach: Don’t be afraid to modify your reports as your business evolves. Adjust filters, add new data fields, or experiment with different layouts to keep pace with changing requirements.

- Feedback Loop: Incorporate feedback from stakeholders. Listen to their needs, address any concerns, and refine your reports to ensure they provide the information that truly matters.

Sharpening Your Skills: Training and Skill Development

Remember, the more skilled you are, the more effectively you can leverage your reporting tools. Invest in training and development to hone your custom report crafting skills:

- Mastering the Tools: Explore advanced features offered by QuickBooks like conditional formatting, custom groups, and report linking. Utilize online tutorials, training manuals, and certification courses to deepen your understanding.

- Community Knowledge: Tap into the collective wisdom of the QuickBooks community. Join forums, attend webinars, and connect with other users to learn best practices and gain new perspectives.

- Continuous Learning: Embrace a growth mindset. Stay up-to-date with the latest reporting trends, explore new tools and technologies, and never stop learning to unlock the full potential of custom reporting.

By actively reviewing and updating your reports, coupled with ongoing skill development, you can ensure your custom reporting practices remain relevant, efficient, and a powerful tool for driving informed decisions and navigating your business towards continued success.

Conclusion: Empowering Businesses with the Compass of Custom Reports

Imagine navigating a financial landscape shrouded in fog, relying solely on intuition and guesswork. This is the reality many businesses face, struggling to make informed decisions without clear insights into their data. But within QuickBooks lies a powerful tool, a torch that illuminates the path – custom reports.

Through the art of crafting tailored reports, you transform raw data into a vibrant map, revealing hidden patterns, pinpointing opportunities, and guiding your business towards strategic choices. You become the architect of your financial island, charting a course towards optimized operations, maximized profitability, and ultimately, sustained success.

Remember, custom reports are not just about numbers; they are about unlocking the potential within your business. They empower you to:

- Make informed decisions: By dissecting data with precision, you can identify trends, anticipate challenges, and capitalize on emerging opportunities.

- Optimize performance: Drill down to granular details, pinpoint areas for improvement, and streamline processes for increased efficiency and cost savings.

- Collaborate effectively: Share your financial insights with stakeholders, foster transparency, and align your team’s efforts towards shared goals.

As you embark on your custom reporting journey, remember this: the power lies not just in the tools, but in your curiosity, your creativity, and your unwavering commitment to continuous improvement. So, set sail with confidence, explore the uncharted territories of your data, and let custom reports guide you towards a future of financial clarity and unwavering success.