Introduction to QuickBooks Software Updates and Maintenance

Symphony of Progress: Unveiling the Importance of QuickBooks Software Updates and Maintenance

Imagine your QuickBooks as a finely-tuned orchestra, meticulously arranged to deliver financial clarity and control. But just like any instrument, your software needs regular maintenance and updates to perform at its best. This section delves into the crucial role of QuickBooks software updates and maintenance, ensuring your financial symphony resonates with accuracy, security, and the latest advancements.

The Importance of Regular Updates: Harmonizing Performance and Security

Updating your QuickBooks software isn’t just a technical formality; it’s a commitment to keeping your financial data safe and in perfect pitch. Here’s why regular updates are vital:

- Enhancing Software Performance and Security:

- Bug Fixes: Updates address bugs and glitches that can disrupt your workflow, corrupt data, or cause unexpected crashes. By staying up-to-date, you ensure smooth operation and minimize performance hiccups.

- Enhanced Security: Updates often patch security vulnerabilities that hackers can exploit. Keeping your software current minimizes the risk of cyberattacks and protects your sensitive financial information.

- Compatibility with Other Software: Updates ensure compatibility with the latest versions of other software you might use, like operating systems or bank apps, preventing integration issues and streamlining your workflow.

- Introducing New Features and Improvements:

- Enhanced Functionality: Updates often introduce new features and functionalities that can improve your efficiency and productivity. From streamlined reporting tools to automated tasks, staying current grants you access to the latest advancements in financial management.

- Improved User Experience: Updates frequently refine the user interface and navigation, making QuickBooks easier to use and understand. This translates to faster completion of tasks and a more enjoyable experience for yourself and your team.

- Compliance with Regulations: Updates may include modifications to comply with changing regulations and reporting requirements. Staying current guarantees you’re always operating within the legal framework, avoiding potential compliance issues.

Frequency of QuickBooks Updates

Now that you understand the importance of updates, let’s explore the ideal rhythm for keeping your QuickBooks in tune:

- Understanding the Release Schedule:

- Automatic Updates: QuickBooks offers automatic update options, ensuring you receive new versions as soon as they’re released. This is the most convenient approach for staying current.

- Manual Updates: You can also download and install updates manually through the QuickBooks Help Center. This option provides greater control over the update timing, but requires proactive monitoring.

- Release Schedule: QuickBooks releases updates on a regular schedule, typically with major updates quarterly and minor updates more frequently. Familiarize yourself with the schedule to plan your update strategy.

- Importance of Staying Current with the Latest Version:

- Security Risks: Delaying updates leaves your software vulnerable to known security vulnerabilities, increasing the risk of data breaches and financial losses.

- Compatibility Issues: Using outdated versions may lead to compatibility issues with other software, hindering data exchange and workflow efficiency.

- Missed Feature Enhancements: By delaying updates, you miss out on the latest features and improvements that can benefit your business and streamline your daily tasks.

By embracing the melody of regular updates, you ensure your QuickBooks software continues to perform flawlessly, keeping your financial data secure, optimized, and ready to harmonize with your business goals.

Understanding QuickBooks Software Components

Imagine your QuickBooks as a finely tuned orchestra, where each instrument plays a vital role in creating the financial symphony. But unlike a traditional orchestra, QuickBooks has both internal components and external integrations that contribute to its overall performance. This section delves into the core software components and add-ons, helping you understand their roles and ensuring your financial melody resonates with clarity and accuracy.

Core Software Components

Let’s first explore the essential instruments that make up the core of your QuickBooks software:

- Overview of the Main QuickBooks Application:

- Company File: This is the central repository for all your financial data, including transactions, accounts, customers, vendors, and reports. Think of it as the sheet music for your financial performance.

- Chart of Accounts: This organizes your financial activities into categories like income, expenses, assets, liabilities, and equity. It’s the framework that defines how your data is classified and reported.

- Lists: These store information about customers, vendors, employees, and other key entities in your business. They’re the rolodex of your financial contacts.

- Transactions: These record every financial event, from sales and purchases to payments and adjustments. They’re the individual notes that make up your financial melody.

- Reports: These summarize and analyze your financial data, providing insights into your business performance. They’re the conductor’s tools for interpreting the symphony of your finances.

- Identifying Integral Components for Functionality:

- Preferences: This section allows you to customize your QuickBooks experience, setting up company information, fiscal year, and user permissions. It’s the tuning fork that ensures everyone plays in harmony.

- Company Settings: These define your company’s financial practices, like sales tax rates, payment terms, and inventory management methods. They’re the musical style that defines your financial performance.

- Banking and Reconciliation: These tools connect your QuickBooks to your bank accounts, automate transactions, and reconcile discrepancies. They ensure the financial instruments are in tune with reality.

- Security and Access: These features control user access, data encryption, and backups. They’re the security measures that keep your financial performance safe and protected.

Add-ons and Integrations

While the core components provide the foundation, your financial symphony can be enriched by adding external instruments, known as add-ons and integrations:

- Importance of Updating Third-Party Integrations:

- Enhanced Functionality: Add-ons can add new features to your QuickBooks, like payroll processing, inventory management, or project accounting. They expand your musical repertoire with new instruments.

- Streamlined Workflow: Integrations connect your QuickBooks with other software, like CRM systems, marketing tools, or e-commerce platforms. They allow different instruments to play together seamlessly.

- Improved Efficiency: By automating tasks and eliminating manual data entry, add-ons and integrations can save you time and effort, allowing you to focus on conducting the financial orchestra.

- Ensuring Compatibility with the Latest QuickBooks Version:

- Compatibility Issues: Outdated add-ons or integrations can cause compatibility issues with the latest QuickBooks version, leading to errors, crashes, and data corruption. It’s like using instruments that are out of tune with the rest of the orchestra.

- Security Risks: Outdated software can be vulnerable to security vulnerabilities, putting your financial data at risk. It’s like leaving your instruments exposed to the elements, risking damage and discord.

- Missed Feature Enhancements: You might miss out on new features and functionalities offered by updated add-ons and integrations. It’s like neglecting to learn new techniques or expand your musical repertoire.

By understanding the core components of your QuickBooks software and the role of add-ons and integrations, you can create a harmonious financial orchestra that plays with precision, efficiency, and a touch of personalized flair.

Navigating the QuickBooks Update Process

Your QuickBooks is a finely tuned orchestra, constantly evolving to adapt to new features and enhance your financial performance. But just like any instrument, it needs regular updates to stay in perfect pitch. This section delves into the practical steps of navigating the QuickBooks update process, ensuring your financial symphony resonates with accuracy and efficiency.

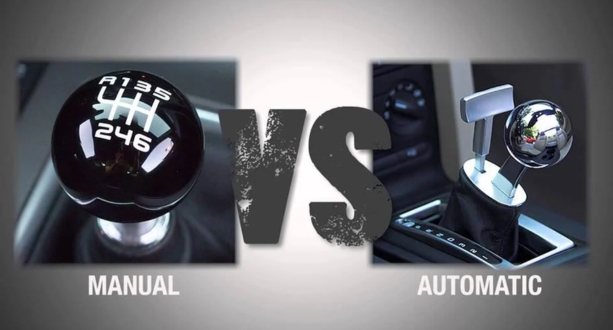

Manual vs. Automatic Updates:

When it comes to updates, you have two main options, each with its own advantages:

- Choosing the Right Update Method for Your Business:

- Automatic Updates: Ideal for those who prioritize convenience and want to ensure they always have the latest version. Updates happen automatically without requiring manual intervention. This is like having the conductor automatically tune the instruments before each performance.

- Manual Updates: Offer more control over the timing and specific updates you install. This is suitable for cautious users or those with complex workflows who prefer to test updates before implementation. This is like the conductor personally testing each instrument before integrating it into the orchestra.

- Configuring Automatic Update Settings:

- QuickBooks Help Center: Access the “Updates” section to configure automatic update settings. Choose the frequency (immediate, weekly, monthly) and types of updates to install (minor, major, all).

- Tailoring the Tempo: Consider your business needs and workflow when choosing the frequency. More frequent updates may be disruptive for some, while infrequent updates might leave you vulnerable to security risks or miss out on new features.

Step-by-Step Guide to Updating QuickBooks

Whether you choose automatic or manual updates, knowing the specific steps is crucial for a smooth transition:

- Checking for Available Updates:

- Automatic Updates: The QuickBooks icon will display a notification when updates are available. Click on it to see details and initiate the update process.

- Manual Updates: Open the “Help” menu, select “Update QuickBooks,” and then “Check for Updates.” The system will identify any available updates.

- Downloading and Installing Updates Seamlessly:

- Review the Release Notes: Before installing, review the release notes to understand the specific changes and potential impacts on your workflow.

- Backup Your Data: Always take a backup of your company file before any major update to safeguard your data in case of unforeseen issues.

- Follow the On-Screen Instructions: The update process is typically straightforward. Follow the on-screen instructions, close QuickBooks, and allow the update to complete.

- Verify Update Completion: Once finished, restart QuickBooks and confirm the new version is installed. Check for any new features or changes in functionality.

Troubleshooting Update Issues: Tuning Out Discordant Notes

Even the most skilled conductor might encounter unexpected challenges. Here’s how to handle common update issues:

- Common Challenges and Their Solutions:

- Update Download Errors: Check your internet connection, restart your computer, or ensure sufficient disk space. If issues persist, consult QuickBooks support.

- Installation Errors: Close other running programs, disable antivirus software temporarily, or consider a clean install of QuickBooks.

- Data File Compatibility Issues: If encountering compatibility issues with older company files, consult QuickBooks support for upgrade options or data conversion assistance.

- Seeking Assistance from QuickBooks Support:

- QuickBooks Help Center: Access the “Help” menu and search for solutions to your specific issue. The knowledge base offers extensive resources and troubleshooting tips.

- Community Forums: Connect with other QuickBooks users and experts on the official QuickBooks community forums to share experiences and find solutions.

- Phone or Chat Support: For personalized assistance, contact QuickBooks support through phone or online chat. Trained professionals can offer specific guidance and address complex issues.

By navigating the QuickBooks update process with careful planning and a proactive approach, you can maintain a smoothly operating financial orchestra, ready to adapt to new features and enhance your business performance. In the next section, we’ll explore additional strategies for optimizing your QuickBooks data and ensuring the accuracy and integrity of your financial melody.

Unleashing the Benefits of Staying Current with QuickBooks Updates

Think of your QuickBooks as a finely tuned orchestra, where every instrument must resonate perfectly to deliver a clear and compelling financial melody. Updates act as meticulous fine-tuning, ensuring your software performs at its peak and empowers informed decisions. This section delves into the diverse benefits of keeping QuickBooks updated, ensuring your financial symphony plays with accuracy, security, and an ever-expanding repertoire.

Strengthening the Firewall: Improved Security Measures

Just like a castle guard diligently watches for breaches, regular QuickBooks updates bolster your financial security in critical ways

- Patching Vulnerabilities to Protect Data: Updates address known security vulnerabilities, those cracks in the castle wall that hackers might exploit. By staying current, you patch these vulnerabilities, shielding your sensitive financial data from unauthorized access and potential breaches.

- Ensuring Compliance with Industry Standards: Financial regulations and reporting requirements evolve constantly. Updates ensure your QuickBooks software keeps pace, adhering to the latest security protocols and industry standards. This not only safeguards your data but also protects you from potential compliance issues and legal repercussions.

Imagine: A hacker eyeing your data like a hungry wolf. By updating, you raise the drawbridge, strengthen the walls, and equip your financial castle with the latest security technology. Your data thrives in a secure and compliant environment, free from unwarranted intrusions.

Expanding the Score: Enhanced Features and Functionality

Updates are not just about closing gaps; they’re about opening doors to new possibilities:

- Exploring New Tools and Capabilities: Updates often introduce powerful new features and functionalities, like enhanced reporting tools, automated tasks, or integrations with other software. It’s like receiving new instruments for your financial orchestra, broadening your repertoire and expanding your capacity to analyze, manage, and interpret your financial data.

- Optimizing User Experience for Efficiency: Updates can streamline workflows, simplify navigation, and refine the user interface. It’s like the conductor polishing the music stands and adjusting the lighting, making your financial performance smoother, faster, and more enjoyable for everyone involved.

Imagine: You discover a new instrument in your QuickBooks update, a tool that automates tedious tasks or generates insightful reports you never knew existed. Your daily financial routine becomes a harmonious journey of exploration and discovery, leading to greater efficiency and deeper understanding of your business performance.

Keeping the Instruments Talking: Compatibility with Third-Party Applications

In a vibrant financial ensemble, instruments must communicate seamlessly. Updates ensure your QuickBooks harmonizes with external tools:

- Ensuring Seamless Integration with External Tools: Many businesses rely on a symphony of software integrations, from CRM systems to e-commerce platforms. Updates guarantee that your QuickBooks remains compatible with these external instruments, preventing communication breakdowns and disruptions in your workflow.

- Avoiding Disruptions in Workflow: Outdated versions can lead to compatibility issues with other software, causing glitches, data discrepancies, and frustrating workflow disruptions. Updates act like a skilled translator, ensuring everyone communicates clearly and efficiently, allowing your financial melody to flow uninterrupted.

Imagine: You update QuickBooks and suddenly, your financial data flows effortlessly into your marketing platform, creating targeted campaigns based on real-time insights. Your business operations become a well-coordinated ensemble, where each instrument plays its part in perfect harmony, driven by accurate and up-to-date financial data.

By prioritizing updates, you transform your QuickBooks from a static software package into a dynamic and evolving financial instrument. Embrace the melody of progress, explore the potential of new features, and keep your data singing in perfect pitch.

QuickBooks Maintenance Best Practices

Your QuickBooks is a finely tuned orchestra, weaving a harmonious melody of your financial performance. But just like any instrument, it needs regular care and maintenance to stay in perfect pitch. This final section delves into best practices for maintaining your QuickBooks data, ensuring its accuracy, integrity, and optimal performance, keeping your financial symphony playing flawlessly.

Safeguarding the Melody: Regular File Backups

Before we delve into refining the notes, let’s ensure none are lost:

- Importance of Data Backups before Updates: Updates, while vital, can sometimes introduce unforeseen glitches. Regular backups act as a safety net, preserving your precious financial data in case of unexpected issues. Think of them as sheet music copies stored in a fireproof vault, ready to restore the performance if needed.

- Utilizing QuickBooks Backup Features: QuickBooks offers convenient backup features directly within the software. Schedule automatic backups, choose the backup location, and rest assured your data is secure. Alternatively, manually back up your company file regularly for added peace of mind.

Remember: Backup is not an option; it’s a necessity. Treat your data with the reverence it deserves by implementing a robust backup routine, ensuring your financial melody can always be recovered and replayed, even if unforeseen interruptions occur.

Refining the Performance: Database Optimization

Just like a conductor polishes the instruments, database optimization fine-tunes your QuickBooks for peak performance:

- Cleaning Up and Optimizing the Company File: Over time, your company file accumulates clutter like unused lists, inactive accounts, and outdated transactions. This can bloat the size, slow down performance, and hinder data accuracy. Run the QuickBooks “Rebuild Data” tool periodically to clean up, optimize, and streamline your data, keeping your financial orchestra playing with agility and precision.

- Resolving Performance Issues through Optimization: If you experience sluggishness, crashes, or other performance issues, consider additional optimization techniques like consolidating transactions, archiving old data, or disabling unnecessary features. Analyze the bottlenecks and apply targeted optimization strategies to restore your financial symphony to its original vibrancy.

Imagine: QuickBooks feels sluggish, reports take ages to generate, and navigating the software becomes a frustrating exercise. By regularly optimizing your database, you remove the digital cobwebs, improve responsiveness, and ensure your financial data flows like a clear and crisp melody, ready to be analyzed and interpreted efficiently.

By incorporating these best practices, you transform your QuickBooks from a mere repository of data into a well-maintained and optimized instrument. Embrace the responsibility of a conductor, regularly back up your data, and fine-tune your database for optimal performance. With dedication and attention to detail, you can ensure your financial orchestra plays a harmonious and accurate melody, guiding your business towards informed decisions and ultimate success.

Phasing Out Legacy Versions and Embracing the Future of QuickBooks

Your QuickBooks software, like a trusty instrument in your financial orchestra, has served you faithfully for years. But just as musical styles evolve, so do software versions, and at some point, facing the inevitable becomes necessary: transitioning from legacy versions to newer, more robust iterations. This section guides you through the process of phasing out unsupported versions, mitigating risks, and planning a smooth upgrade to unlock the full potential of QuickBooks’ latest offerings.

Phasing Out Unsupported Versions: Farewell to the Past, Embrace the Future

While clinging to the familiar holds a certain comfort, using unsupported QuickBooks versions can expose you to significant risks:

- Risks Associated with Using Outdated Software:

- Security Vulnerabilities: Unsupported versions lack critical security patches, leaving your data vulnerable to cyberattacks, malware, and potential financial losses. Imagine your financial instruments exposed to the elements, susceptible to wear and tear, jeopardizing the entire performance.

- Compliance Issues: Changing regulations and reporting requirements may not be reflected in outdated versions, putting you at risk of non-compliance and potential legal repercussions. It’s like playing with outdated sheet music, discordant with the current standards and leading to disharmony.

- Limited Functionality: You miss out on the latest features and functionalities that can streamline workflows, enhance data analysis, and improve your overall financial management. It’s like ignoring new instruments, restricting your musical repertoire and limiting the expressive potential of your financial orchestra.

- Planning for a Smooth Transition to Newer Versions:

- Acknowledge the Inevitable: Understand that phasing out unsupported versions is not a choice, but a necessity for secure and efficient financial management. Proactive planning ensures a smooth transition, minimizing disruptions and maximizing the benefits of the upgrade.

- Assess Your Needs and Options: Evaluate your current workflow, data requirements, and desired features. Research the latest QuickBooks versions, compare their functionalities, and choose the one that best aligns with your business needs. Think of it as selecting a new instrument that complements your existing repertoire and expands your musical possibilities.

- Develop a Transition Plan: Outline a clear timeline for the upgrade, including tasks like data backup, user training, and potential customization. Enlist the support of your IT team or QuickBooks experts to ensure a seamless transition and minimize downtime.

Remember: Upgrading is not a one-time event; it’s a strategic move towards a more secure, efficient, and feature-rich financial management system. By acknowledging the risks, planning ahead, and executing a smooth transition, you turn the inevitable into an opportunity for growth and enhanced financial control.

Now, let’s explore the potential avenues for navigating the upgrade process:

Upgrading Paths: Tailoring the Journey to Your Needs

There are several paths to consider when upgrading your QuickBooks:

- Direct Upgrade: This is the most straightforward option, installing the latest version directly on your existing system. It’s suitable for users comfortable with technology and familiar with the basic upgrade process. However, it might require additional data conversion and potential compatibility issues with older hardware.

- Cloud Migration: This option involves moving your data and software to the cloud-based QuickBooks Online platform. It offers greater accessibility, automatic updates, and scalability. This is ideal for businesses seeking enhanced flexibility and collaboration, especially those with remote teams or frequent travel needs.

- Professional Assistance: For complex data structures or customized workflows, consider seeking the expertise of QuickBooks professionals. They can guide you through the upgrade process, handle data conversion, and ensure a seamless transition with minimal disruption to your operations.

Embracing the Future: The Rewards of Upgrading

By successfully navigating the upgrade process, you unlock a world of benefits:

- Enhanced Security: Newer versions boast robust security features, protecting your financial data from evolving cyber threats and ensuring peace of mind. Think of it as upgrading the security system of your financial castle, deterring potential intruders and safeguarding your valuable data.

- Streamlined Workflows: New features and functionalities can automate tasks, improve data analysis, and optimize your daily financial routines. Imagine new instruments that simplify complex maneuvers, making your financial performance smoother and more efficient.

- Improved Collaboration: Cloud-based options offer real-time access and collaboration, enabling teamwork and fostering better financial decision-making across your organization. Think of it as expanding the orchestra, allowing everyone to contribute and create a harmonious financial melody.

- Compliance Confidence: Updated software adheres to the latest regulations and reporting requirements, minimizing the risk of non-compliance and potential legal consequences. Imagine playing with the latest sheet music, ensuring your financial performance aligns with the current standards and resonates with accuracy.

Remember: Upgrading is not just a technical necessity; it’s an investment in your financial future. By embracing the new, you unlock enhanced security, streamlined workflows, improved collaboration, and greater insights into your business performance. New features often provide powerful data analysis tools, generating comprehensive reports and dashboards that reveal hidden trends, inform strategic decisions, and empower you to navigate the financial landscape with confidence. Imagine your instruments whispering secrets, revealing hidden melodies within your data, and guiding you towards informed financial decisions that resonate with success.

Planning for Major QuickBooks Updates

Major QuickBooks updates, like a grand orchestral premiere, require meticulous preparation to ensure a seamless performance. Here’s how to navigate these significant software changes:

Understanding Major Version Releases:

- Research Release Notes: Dive into the official release notes to understand the key changes, new features, and potential compatibility issues. Think of it as previewing the new sheet music, familiarizing yourself with the melody and potential challenges before the performance.

- Test Drive the Beta: If available, consider participating in the beta testing program to experience the update firsthand and identify any potential roadblocks. Imagine rehearsing the new piece with your instruments, ironing out any kinks before the grand premiere.

Communicating Updates to Team Members:

- Organize Training Sessions: Schedule training sessions for team members to learn about the new features and functionalities. Think of it as providing your musicians with practice sessions and ensuring everyone is comfortable with the new instruments.

- Create Reference Materials: Develop clear and concise reference materials, like cheat sheets or tutorials, for quick access during the transition. Imagine distributing laminated sheet music for easy reference during the performance, ensuring everyone stays on track.

By planning ahead and fostering a collaborative environment, you can transform major QuickBooks updates from daunting challenges into opportunities for growth and improved financial performance.

Conclusion

In conclusion, prioritizing regular updates and proactive maintenance is crucial for maximizing QuickBooks performance. By staying current with the latest software versions, users can benefit from enhanced security measures, improved features, and seamless integration with third-party applications. Implementing best practices, such as regular backups and database optimization, ensures a smooth and efficient experience. Embracing a proactive approach to software management not only safeguards data but also empowers users with the latest tools, contributing to a robust and optimized QuickBooks environment.