A point-of-sale system is a crucial part of any neighbourhood pharmacy. Your POS software is in charge of operating and managing the day-to-day operations of your business, from checking patients out to monitoring financial reporting. But if you don’t have a complete and fully integrated POS solution, both your company and your clients suffer.

The perfect POS system provides a smooth experience for employees and customers for your pharmacy. It gives you the resources and talents to run your company and consistently come to wise conclusions. The advantages of an integrated POS solution for your neighbourhood pharmacy are considerable. Learn how to find the best integrated POS system by reading on.

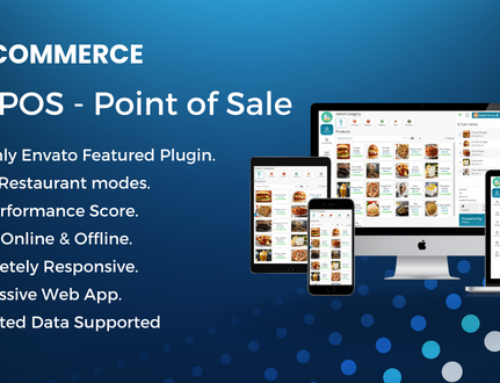

Advanced powerful, flexible, multi-store Pos system for retailers and wholesalers.

Multi-store- Now you have 1 or 100 stores with this application you can manage all in one app.

Multi payment- Get payments in cash or with cards we can now handle all for you.

Pos system- Weather you are retailler or wholesaler with us you can manage both.

Inventory- Uploading your existing inventory in bulk using CSV file.

Accounting- Managing financial accounting in a simplified way like never before.

User roles- Create users with role base access to limit the options from access.

Features:

- Point of sale- At a point of sale, also known as a point of buy, consumers have their purchases totaled up. At the point of sale, a consumer is considered to be doing one of three things: purchasing an item from your stand or booth; completing an online checkout; or walking up to your checkout counter.

- Offer Discounts- It provides discounts, and consumers are drawn to discounts, and they have a tendency to promote them via word-of-mouth, which is an effective approach to reach new customers while maintaining control over client acquisition expenditures.

- Credit sales- Additionally, it provides credit sales, which may be paid for at a later time.

- View invoices and manage it- It makes it easier for you to handle the specifics of your invoices and gives you the ability to examine and print your transaction postings.

- Seperate Pos for return items- If you are sending back a number of different things, be sure that each one is packaged and sent back with its own individual return label and mailing label.

- Asign multiple roles- Individually assigning several responsibilities to a user is possible, as is inheriting multiple functions from a team or teams that the user is joined to.

- Add medicines and manage it- The medications will be managed, and the appropriate remedy will be provided.

- Upload medicines through CSV- The data that is necessary for MPF analyses may be found in the medical CSV files. Before you can run MPF analytics, you must ensure that all of the medical CSV files have been uploaded into HDFS.

- Add stock and pending stock- It will help us to add both new stocks and pending stocks which are yet to sale.

- Add categories- In addition to this, the application will create categories and will organize itself according to the classes.

- Report for the expired stock- The program is designed to report on merchandise that has passed, making it more straightforward for you to do your task.

- Out-of-stock alert notification- You will also receive the notification notice if the product is out of stock, which is among the most excellent features, so that you may replenish the stock.

- Stock reports- It delivers an accurate report on the stock and produces the best possible outcome.

- Sales report- A document that summarises a company’s sales operations is referred to as a sales report. This type of report is also referred to as a sales analysis report.

- Return report- The Returns Reports contain information regarding items that were returned along with the reasons for their return, customers who had returns, as well as a summary of the overall number of returned lines.

- User profile- A user’s settings and the information they have entered about themselves are compiled into a user profile.

- Add supplier and manage it- The term “supplier management” refers to the procedures enabling an organisation to locate, qualify, onboard, transact, and engage with the appropriate suppliers.

- Supplier payments- It also helps you examine whether payments to suppliers are made on schedule at the appropriate intervals.

- Add banks- It will also include banks, providing further benefits.

- Add Cheques and manage them- Cheque management will be simplified with the assistance of this program.

- Add Deposits and manage them- In addition to that, it offers management of deposits.

- Bank book- It maintains a record of all the deposits and withdrawals that are processed via the bank. The bank book is a book that records deposits, withdrawals, and other transactions that take place at the bank.

- Create and Return purchases and manage it- A purchase return occurs when a buyer (either an individual or a business) returns products that they have bought to the seller in exchange for a refund or store credit, depending on the policy of the seller. This can take place at any time after the purchase has been made.

- Wholes POS for retialers- POS systems designed for wholesale businesses provide a variety of specific capabilities, such as those that consider regular vendor shipments, barcodes, and integrated inventory management.

- Create Brands, Brand sector, Units, Regions,Town, and Store locations and manage it- This application also has the capability to handle the creation of brands, brand sectors, units, regions, towns, and store locations.

- Expenses- It is responsible for managing the costs.

- Customer and supplier ledger- All transactions that pertain to each and every supplier are recorded in the Supplier ledgers. This includes all invoices created and paid for from the beginning.

- Chart of accounts- A chart of accounts, also known as a COA, is a type of organisational tool that is used in finance that offers an index of all of the funds in an accounting system. This offers a clear view into the company’s financial dealings.

- Journal voucher and opening balance- The opening balance of a ledger account is the debit or credit balance of a ledger account that is carried forward from the previous accounting period to the next accounting period. At the start of a new accounting period, this entry will be the first to be recorded in a ledger account.

- General Journal, Income Statement, Trail Balance, Ledger Account- It is responsible for the General Journal, the Income Statement, the Trail Balance, and the Ledger account.

- Add requested items- This program offers a user interface based on the web, and it may be used to add additional things to a request.

- Add Users and manage it- It not only works it but also adds users.

- Printer settings- Displays the printer settings window that is connected to the printer that has been selected.

- Top Customer Report- It compiles a report on the most valuable customers.

- Top Salesman Report- In addition to this, it compiles a report on your organisation’s top salesmen in order to provide you with information on sales rates.

- Brands report- It provides the brand report so that you are aware of the position that your product holds in the market.

- Sections report- The fundamental organisational component of an account is called a report section. Fields, text, and images are all acceptable content for sections.

- Store-wise report- You are able to evaluate and analyse the Key Performance Indicators (KPIs) of your brick-and-mortar businesses with the assistance of Store Reporting.

- SKU-wise report- The SKU Profitability Report provides you with an estimate of the historical profitability of each of your SKUs, allowing you to better evaluate the state of your company and come to informed conclusions regarding restocking.

- Bank Collection- A collection item is submitted to a bank for deposit that the bank would not, under its processes, provisionally credit to the depositor’s account or which the bank cannot (due to rules or law of regulation) provisionally credit to a depositor’s account. This type of thing is also known as a noncash item.

- Directly add to stock from purchase- In addition to this, you can directly contribute to the store by making a purchase.

- Directly reduce to stock from purchase return- It makes it easier to lower the store immediately from purchase returns.

- Purchase Order- A purchase order is a sort of business document that serves as the first official offer made by a buyer to a supplier. It details the product types, quantities, and pricing that have been agreed upon.

- Multi-Store- One of the numerous retail businesses that are operated under the same ownership and management is referred to as a multiple shops. It provides assistance in the management of the multi-store.

- Account holder opening balances- An opening balance is the amount of money that was in your checking account on the first day that you used accounting software.

- Bank expense- It will provide you with a report of the expenses you incurred from the bank.

- Debit Voucher- A debit voucher is a document that serves as evidence that a monetary transaction has taken place. A payment voucher is another name for a debit voucher. It is evident that the company has made payments to its vendors and any other relevant third parties.

- Add Services for other incomes- It makes it easier for you to add services for various sources of money.

- Service base sales receipt- A receipt of sales is issued for the purchase of goods by a consumer from a retailer or vendor. In most cases, the quantity of products may be seen printed on the receipt.

- Dynamic Taxes- The goal of a dynamic tax study is to determine how different tax policies might influence the actions of different types of taxpayers. Instead of focusing just on the direct consequences of a policy, it investigates the knock-on effects such policies have.

- Advance sales, Purchases, taxes reports- You’ll need to utilize the Advance Return for Tax on Sales/Purchases (RFUMSV00) application in order to generate tax reports (tax books) that correspond to the different forms of VAT.

- Upload Stock- Create photographs and movies of the highest possible quality for our customers to download. Submit. You may upload your stock using our user-friendly platform, and you will also receive advice on how to be successful.

- Edit receipts- Additionally, the ability to alter receipts is provided by this program.