QuickBooks Customization and Configuration

QuickBooks serves as a versatile and powerful tool for businesses seeking efficient financial management. It goes beyond basic bookkeeping, offering a comprehensive suite of features to address the diverse needs of various enterprises. Whether you’re a freelancer tracking individual transactions or a large corporation managing complex financial workflows, QuickBooks is tailored to provide a seamless and user-friendly experience.

The primary objective of QuickBooks is to simplify accounting tasks and enhance financial visibility. Businesses can use the software to record income, track expenses, and generate insightful reports, facilitating informed decision-making. With its user-friendly interface and intuitive design, QuickBooks minimizes the learning curve for users, making it accessible even to those with limited accounting expertise.

One notable aspect of QuickBooks is its scalability. The software is adept at accommodating the evolving needs of businesses as they grow. Small startups can utilize the basic functionalities to establish a solid financial foundation, while larger enterprises can leverage advanced features to manage intricate financial structures. QuickBooks’ adaptability makes it a valuable asset for businesses at various stages of development.

Moreover, QuickBooks is equipped with features that promote efficiency and accuracy in financial management. Automated processes, such as invoicing and expense tracking, reduce the risk of errors and save valuable time. The software’s real-time data synchronization ensures that businesses have access to up-to-date financial information, contributing to better decision-making and financial planning.

QuickBooks stands out as a comprehensive accounting solution, catering to businesses of all sizes with its versatile features, user-friendly interface, and scalability. By simplifying financial tasks and providing valuable insights, QuickBooks empowers businesses to focus on growth and success.

The key modules of QuickBooks Customization and Configuration include:

QuickBooks is a popular accounting software that offers a range of modules to meet the diverse needs of businesses. The key modules of QuickBooks can be broadly categorized into QuickBooks Desktop and QuickBooks Online.

QuickBooks Desktop:

QuickBooks Desktop is a comprehensive accounting solution that comes in different editions to cater to various business requirements:

- QuickBooks Pro:

QuickBooks Pro is designed for small and medium-sized businesses. It provides essential features for managing finances, tracking expenses, and generating reports. With a user-friendly interface, it helps businesses streamline their accounting processes.

- QuickBooks Premier:

QuickBooks Premier is a more advanced version, suitable for businesses with industry-specific needs. It includes features tailored for sectors like manufacturing, contracting, nonprofit organizations, and more. QuickBooks Premier provides in-depth financial tracking and reporting capabilities.

- QuickBooks Enterprise:

QuickBooks Enterprise is the most advanced desktop version, offering scalability for larger businesses. It provides advanced inventory management, customizable reporting, and sophisticated user controls. QuickBooks Enterprise is ideal for businesses with complex financial and operational requirements.

QuickBooks Online:

QuickBooks Online is a cloud-based version of the software, providing accessibility from anywhere with an internet connection. It operates on a subscription-based model, and users can choose from different plans based on their business size and needs.

- Cloud-based Version Accessible from Anywhere:

QuickBooks Online allows users to access their financial data and perform accounting tasks from any location, providing flexibility and convenience. This is particularly beneficial for businesses with remote teams or those requiring on-the-go access to their financial information.

- Subscription-Based Service with Different Plans:

QuickBooks Online operates on a subscription model, offering various plans to accommodate different business sizes. Users can choose plans based on the features they require, ensuring that they pay for the functionalities that align with their specific needs and budget constraints.

QuickBooks Desktop and QuickBooks Online cater to businesses of varying sizes and industries, providing them with a suite of tools for efficient financial management. Whether a business prefers the robust capabilities of QuickBooks Desktop or the flexibility of QuickBooks Online, both versions are designed to streamline accounting processes and support overall business success.

Why customize QuickBooks?

Every business is unique, characterized by its own set of processes, reporting requirements, and industry-specific needs. In recognizing this diversity, QuickBooks customization emerges as a pivotal tool, allowing businesses to tailor the software to seamlessly integrate into their operations. The process of customization provides several key advantages that contribute to the overall efficiency, accuracy, relevance, and scalability of the accounting software.

Efficiency:

One of the primary benefits of customizing QuickBooks is the enhancement of operational efficiency. Through customization, businesses can streamline processes by eliminating unnecessary steps and automating repetitive tasks. This not only reduces the time spent on manual efforts but also optimizes workflow, allowing employees to focus on more value-added activities. The result is a more efficient and productive business environment.

Accuracy:

Customization plays a crucial role in ensuring data accuracy within QuickBooks. By tailoring fields and forms to the specific needs of the business, companies can reduce the risk of errors in data entry and reporting. Implementing checks and balances specific to the organization’s requirements further enhances accuracy, fostering confidence in the financial data generated by the software.

Relevance:

The customization of QuickBooks extends to the generation of reports that are highly relevant to the business’s performance. Customized reports can be designed to focus on key performance indicators (KPIs), providing insightful and actionable information. Additionally, businesses can adapt the terminology and forms within QuickBooks to align with industry standards, ensuring that the software reflects the language and practices relevant to the specific sector in which the company operates.

Scalability:

As businesses evolve and grow, QuickBooks must be able to adapt accordingly. Customization enables the configuration of QuickBooks to accommodate scalability. This may involve adding or modifying features to meet the changing needs of the business. Whether it’s expanding the chart of accounts, incorporating new modules, or adjusting user permissions, customization ensures that QuickBooks remains a flexible and scalable solution that can grow in tandem with the organization.

The decision to customize QuickBooks is rooted in the acknowledgment of the unique nature of each business. The ability to tailor the software to specific requirements not only enhances operational efficiency and data accuracy but also ensures that QuickBooks remains relevant and scalable as the business evolves. Customization, therefore, becomes a strategic investment in optimizing the functionality of QuickBooks to meet the distinct needs of a dynamic and ever-changing business environment.

Customization vs. Configuration

Customization and configuration are two distinct processes that play vital roles in optimizing software to meet specific business requirements. Before delving into these processes, it’s crucial to understand the fundamental difference between customization and configuration.

Customization:

Customization involves making changes to the software’s existing features to tailor it to the unique needs of a business. This can include modifying forms, reports, and fields within the software to better align with specific business processes. Businesses may add or remove features based on their unique requirements, ensuring that the software reflects the individual nuances of their operations. Customization allows for a more personalized and tailored user experience, addressing specific business challenges and enhancing overall efficiency.

For instance, in the context of QuickBooks, a company may customize its invoicing templates, reports, or user interfaces to better suit its industry-specific terminology or workflow.

Configuration:

On the other hand, configuration refers to the process of setting up the software to align with the overall structure of the business. This involves defining preferences, roles, and access levels within the software. Configuration ensures that the software operates in accordance with the company’s organizational hierarchy and business rules. It also involves adapting the software to industry and regulatory standards, making it compliant with relevant guidelines.

In the case of QuickBooks, the configuration might involve setting up user roles and permissions, defining default preferences for accounting methods, tax codes, and financial reporting, and aligning the software with specific industry standards and regulations.

Significance of Both Processes:

Both customization and configuration are integral to optimizing software like QuickBooks for a particular business. While customization tailors the software to meet specific operational needs, configuration ensures that the software aligns with the broader organizational structure and complies with industry standards. Together, these processes contribute to a seamless and efficient integration of the software into the business environment, enhancing its functionality and effectiveness.

Understanding the difference between customization and configuration is crucial for businesses looking to leverage software solutions such as QuickBooks. By strategically employing both processes, businesses can tailor the software to their unique requirements while ensuring it aligns with broader organizational goals and industry standards.

Key Areas of QuickBooks Customization and Configuration

Customizing QuickBooks involves adapting various aspects of the software to match the unique needs of a business. Here are the key areas where customization can make a significant impact:

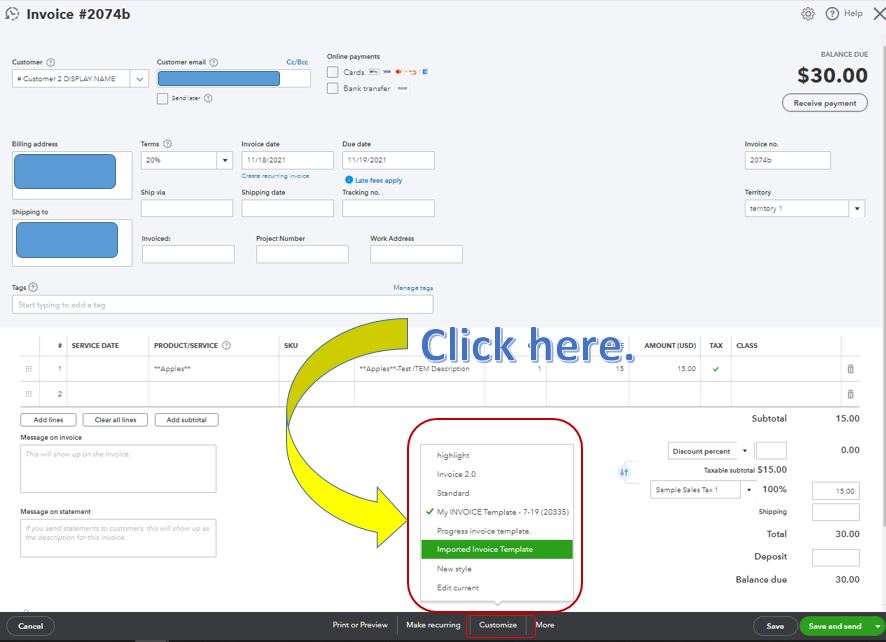

- Forms and Templates:

One crucial aspect of QuickBooks customization is the ability to tailor forms and templates to suit the business’s requirements. This includes customizing invoices, sales receipts, and purchase orders. Businesses can enhance their professional image by adding company logos and modifying layouts for a polished appearance. Moreover, custom fields can be incorporated into these forms to capture specific information relevant to the business processes.

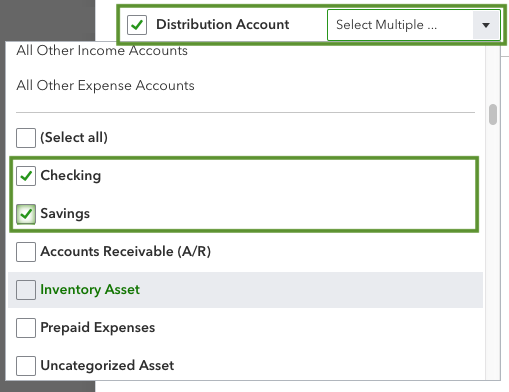

- Chart of Accounts:

The chart of accounts serves as the backbone of a business’s financial structure. QuickBooks allows businesses to tailor this chart to their specific needs. This customization involves adding, modifying, or removing accounts based on the unique financial structure of the business. By doing so, businesses can ensure that their financial reporting is accurate and aligned with their organizational setup.

- Items and Services:

Accurate tracking of products and services is essential for businesses. QuickBooks customization allows for the creation and modification of product and service items. This includes assigning default sales and purchase accounts to streamline reporting and ensure that financial data is recorded accurately.

- Lists and Classes:

Custom lists and classes are powerful tools for categorizing transactions in QuickBooks. Businesses can create custom lists to categorize transactions efficiently. Additionally, the use of classes helps in tracking different departments, locations, or product lines. This customization enhances the organization and clarity of financial data.

- Reports:

QuickBooks offers a range of standard reports, but customization allows businesses to tailor these reports to their specific needs. Users can modify standard reports to focus on particular data points, providing a more detailed and relevant view of financial information. Furthermore, businesses can create custom reports to address unique reporting requirements that may not be covered by the standard options.

- User Roles and Permissions:

Securing sensitive information is critical for businesses. QuickBooks customization includes configuring user roles to control access to various parts of the software. This customization allows businesses to define specific permissions based on job responsibilities, ensuring that users have access only to the information necessary for their roles.

- Automation:

Efficiency is a key benefit of QuickBooks customization. Businesses can set up rules and automation to streamline repetitive tasks, reducing the manual workload. Automation not only saves time but also minimizes the risk of errors in data entry and processing. Additionally, integration with third-party applications enhances functionality, providing a seamless experience across different software platforms.

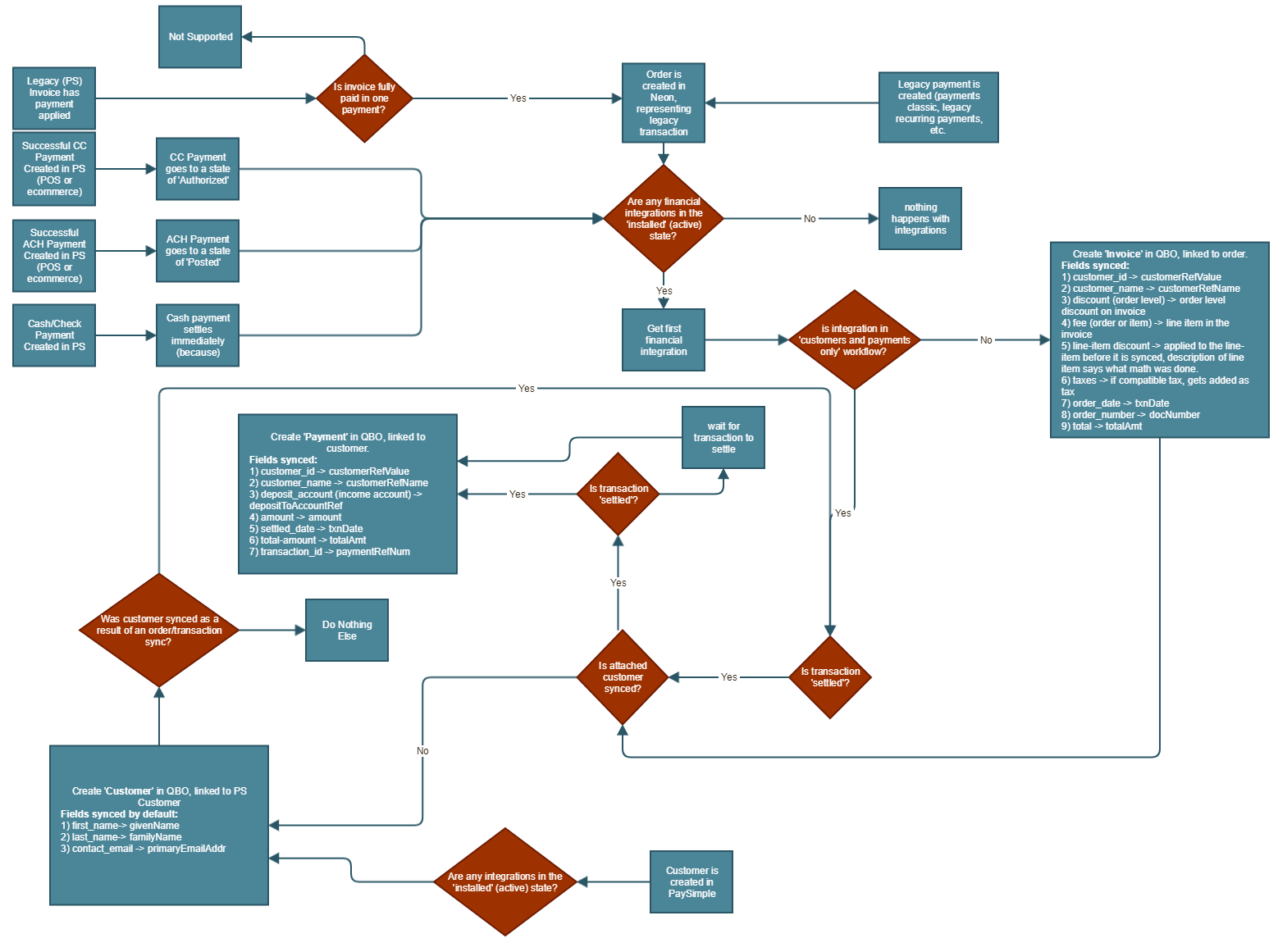

- Integration with Third-Party Apps:

Customizing integrations with third-party applications is essential for businesses that use industry-specific tools. QuickBooks allows for seamless integration with various applications, enhancing the overall functionality of the software. This ensures a smooth flow of data between QuickBooks and other applications, providing a comprehensive and interconnected business solution.

Step-by-Step Guide to QuickBooks Customization and Configuration

1. Assess Business Needs:

The initial step involves a thorough assessment of the business requirements. Pinpoint specific pain points and areas in need of improvement. Additionally, identify reporting needs and ensure compliance with regulatory standards. This understanding serves as the foundation for tailoring QuickBooks to meet the unique needs of the business.

2. Back Up Data:

Prior to initiating any customization, it’s crucial to create a backup of existing data. This step acts as a safety net, preventing potential data loss during the customization process. The backup serves as a restore point in case any issues arise, ensuring the integrity and security of financial information.

3. Customize Forms and Templates:

Navigate to the customization menu to modify forms and templates within QuickBooks. This step allows for the creation of personalized documents that align with the branding and information requirements of the business. Additionally, users can add custom fields to capture specific details on transactions, enhancing the depth of recorded information.

4. Modify Chart of Accounts:

Review the current chart of accounts to ensure alignment with the business’s financial structure. Add, modify, or remove accounts as necessary to accurately reflect the organization’s financial transactions. This step is essential for maintaining precision in financial reporting and analysis.

5. Configure Lists and Classes:

Customize lists for categorizing transactions based on unique business needs. Integrate the use of classes to effectively track different segments within the business. This enhances the organization’s ability to segment and analyze financial data for improved decision-making.

6. Set Up User Roles and Permissions:

Define user roles based on job responsibilities within the organization. Configuring permissions ensures that users have access only to the information relevant to their roles, thereby safeguarding sensitive financial data. This step is crucial for maintaining security and confidentiality.

7. Explore Automation Options:

Identify repetitive tasks that can be automated to enhance efficiency. Set up rules and automation features within QuickBooks to streamline processes. Automation reduces the risk of errors, increases productivity, and allows staff to focus on more strategic aspects of their roles.

8. Integrate Third-Party Apps:

Explore available integrations with industry-specific tools that complement QuickBooks functionality. Configuring these integrations ensures a seamless flow of data between different platforms, improving overall operational efficiency and accuracy in data recording.

9. Test and Train:

Prior to full implementation, rigorously test the customized configurations in a controlled environment. This step allows for the identification and resolution of any potential issues. Concurrently, provide comprehensive training to users to familiarize them with the new features and workflows, ensuring a smooth transition.

10. Monitor and Adjust:

After implementation, establish a system for monitoring the performance of customized features. Regularly assess the effectiveness of the configurations and make adjustments as the business evolves or as new requirements emerge. This ongoing evaluation ensures that QuickBooks continues to meet the dynamic needs of the organization.

Challenges and Considerations in QuickBooks Customization

Businesses leveraging QuickBooks customization for tailored financial management solutions encounter various challenges and considerations that necessitate careful attention. The following points shed light on these potential hurdles:

Updates and Compatibility:

One of the critical challenges associated with QuickBooks customization revolves around updates and compatibility. To ensure the seamless functioning of customized features, businesses must vigilantly check for software updates. It is crucial to assess the compatibility of these updates with the tailored configurations. Prior to implementing updates in the live system, businesses are advised to conduct testing in a sandbox environment. This precautionary step helps identify any potential issues or conflicts that may arise post-update.

Data Migration:

During the transition to a customized QuickBooks setup, businesses must carefully plan and execute data migration. The process of moving financial data from existing systems to the customized setup demands meticulous attention to detail. Post-migration, it becomes imperative to verify the accuracy of the transferred data to eliminate discrepancies that could adversely affect financial reporting and analysis.

Training and User Adoption:

Ensuring the successful integration of customized features requires a significant investment in training and promoting user adoption. Businesses must prioritize comprehensive training programs to equip users with the necessary skills and understanding of the new features. Ongoing support mechanisms are equally crucial, as they address user concerns and encourage the seamless adoption of customized functionalities.

Security:

Protecting sensitive financial data is paramount in any customized QuickBooks environment. Implementing robust security measures becomes a critical consideration. Regular audits of user access and permissions are essential to identify and rectify any unauthorized access points. This proactive approach safeguards the integrity and confidentiality of financial information.

Documentation:

Maintaining detailed documentation is fundamental for the successful management of a customized QuickBooks setup. Businesses should document every aspect of the customized configurations, including specific changes and the rationale behind them. This documentation serves as a valuable resource for troubleshooting, system upgrades, and ensuring continuity in cases of staff turnover or changes in the development team.

Conclusion

Customizing and configuring QuickBooks is a strategic approach to optimizing the software for the unique needs of a business. By tailoring forms, reports, and workflows, businesses can enhance efficiency, accuracy, and relevance in their financial management processes. However, customization requires careful planning, testing, and ongoing monitoring to ensure a seamless and secure user experience.