Understanding Fresh Books Non-Profit Financial Management

The Unique Challenges of Non-Profit Finances:

- Limited Resources:

Non-profit organizations often operate with constrained financial resources compared to for-profit entities. This scarcity of funds requires careful budgeting, prioritization, and strategic allocation to maximize impact while meeting the organization’s mission.

- Dependence on Donations and Grants:

Unlike for-profit businesses that generate revenue through sales, non-profits heavily rely on external funding sources such as donations, grants, and sponsorships. This dependency introduces volatility and requires effective fundraising strategies to maintain a consistent flow of financial support.

- Compliance with Regulatory Requirements:

Non-profits are subject to various regulatory and legal frameworks, including tax-exempt status regulations. Managing compliance is crucial to maintaining the organization’s eligibility for tax benefits and ensuring that funds are used by donor expectations and legal requirements.

- Accountability and Transparency:

Non-profits are accountable to their stakeholders, including donors, volunteers, and the communities they serve. Transparency in financial reporting is essential to build trust and credibility. Donors and supporters want assurance that their contributions are making a positive impact and are being used responsibly.

Importance of Efficient Financial Management:

- Ensuring Sustainability:

Efficient financial management is vital for the long-term sustainability of a non-profit organization. This involves creating financial strategies that consider both short-term goals and long-term viability, ensuring the organization can continue to fulfill its mission over time.

- Facilitating Strategic Decision-Making:

Financial management provides the foundation for strategic decision-making. By having a clear understanding of the organization’s financial health, leaders can make informed decisions regarding program expansions, resource allocations, and other initiatives that align with the non-profit’s mission and goals.

- Building Trust with Stakeholders:

Trust is paramount in the non-profit sector. Effective financial management practices, coupled with transparent reporting, foster trust among donors, volunteers, and the broader community. When stakeholders have confidence in the organization’s financial integrity, they are more likely to support its initiatives and contribute to its success.

Non-profit financial management involves navigating unique challenges, maintaining fiscal responsibility, and strategically utilizing resources to ensure sustainability and build trust with stakeholders. It’s a critical aspect of organizational success in the non-profit sector, where impact and mission fulfillment are top priorities.

Introduction to FreshBooks:

Overview of FreshBooks:

- Cloud-based accounting software:

FreshBooks is a cloud-based accounting software designed to help businesses manage their finances efficiently. Being cloud-based means that users can access their financial data from anywhere with an internet connection, providing flexibility and convenience. This is particularly beneficial for non-profit organizations that may have remote teams or need access to financial information while on the go.

- Features and functionalities:

FreshBooks offers a range of features and functionalities that cater to the diverse needs of businesses, including non-profits. Some key features include invoicing, expense tracking, time tracking, and project management. These tools are essential for organizations to streamline their financial processes and ensure accurate record-keeping.

- Customization for non-profit organizations:

FreshBooks recognizes the unique requirements of non-profit organizations and provides customization options tailored to their needs. This may include specialized invoicing templates, reporting categories relevant to non-profits, and other features that align with the specific accounting and financial management challenges faced by non-profit entities.

Benefits of FreshBooks for Non-Profits:

- Time-saving automation:

Non-profit organizations often deal with numerous transactions and financial activities. FreshBooks helps save time by automating repetitive tasks such as invoicing and expense tracking. Automation reduces manual errors, ensures accuracy, and allows non-profits to focus more on their mission and less on administrative tasks.

- User-friendly interface:

FreshBooks is known for its user-friendly interface, making it accessible even for individuals without extensive accounting backgrounds. This is crucial for non-profit organizations, where staff members may have diverse skill sets. The intuitive design of FreshBooks facilitates easy navigation and minimizes the learning curve, enabling non-profits to efficiently manage their finances.

- Financial reporting and analytics:

For non-profits, understanding their financial health and performance is crucial for decision-making and compliance. FreshBooks provides robust financial reporting and analytics tools that allow organizations to generate comprehensive reports on income, expenses, and other key financial metrics. This visibility helps non-profits make informed decisions, demonstrate accountability to stakeholders, and comply with reporting requirements.

FreshBooks offers a tailored solution for non-profit organizations, addressing their specific needs with a cloud-based platform, versatile features, and user-friendly design, ultimately helping them streamline financial processes and focus more on their mission.

Setting Up FreshBooks for Non-Profit Organizations:

Setting up FreshBooks for non-profit organizations involves several key steps to ensure that the accounting and financial management platform aligns with the specific needs and goals of the non-profit sector. Let’s elaborate on the two main sections mentioned:

Account Creation and Configuration:

- Choosing the Right Subscription Plan:

Understanding Non-Profit Plans: FreshBooks often offers specialized plans for non-profits, providing features tailored to their requirements. These may include discounted pricing, additional user seats, or specific functionalities relevant to non-profit financial management.

Assessing Budget and Requirements: Evaluate the budget constraints and organizational requirements to choose a subscription plan that strikes a balance between cost-effectiveness and meeting the non-profit’s accounting needs.

- Customizing Account Settings for Non-Profits:

Setting Up Donation Categories: Tailor the chart of accounts to include specific categories for donations, grants, and other income sources relevant to non-profits.

Tax Exemption Configuration: If applicable, configure tax exemption settings to accurately reflect the non-profit’s tax status.

Grant Tracking: Customize the system to track grants and their utilization, providing transparency and accountability in financial reporting.

Integrating FreshBooks with Other Tools:

- Seamless Integration with CRM Systems:

Customer Relationship Management (CRM): Integration with CRM systems ensures that donor and supporter information is synchronized between FreshBooks and the CRM platform. This helps maintain a comprehensive view of interactions and relationships.

Automated Donor Data Entry: Linking FreshBooks with CRM tools reduces manual data entry by automatically updating donor records, ensuring accuracy and saving time for non-profit staff.

- Compatibility with Fundraising Software:

Fundraising Software Integration: Many non-profits use specialized fundraising software to manage campaigns and collect donations. Ensuring compatibility allows for a streamlined financial process where funds raised are accurately reflected in FreshBooks.

Automated Financial Reporting: Integration with fundraising software enables automatic generation of financial reports, providing insights into the success of fundraising campaigns and overall financial health.

The account creation and configuration steps involve tailoring FreshBooks to the unique financial needs of non-profits, while integration with other tools ensures a cohesive and efficient financial ecosystem that includes CRM and fundraising software. This holistic approach facilitates accurate financial management, enhances transparency, and ultimately supports the non-profit’s mission.

Streamlining Donation Management with FreshBooks:

Tracking Donations:

- Creating Donor Profiles:

When it comes to effective donation management, creating donor profiles is crucial. FreshBooks allows you to input and store detailed information about your donors. This includes their contact details, donation history, and any other relevant information. Having comprehensive donor profiles not only helps in understanding your donor base but also facilitates personalized communication and acknowledgment.

- Recording One-time and Recurring Donations:

FreshBooks enables you to record both one-time and recurring donations efficiently. For one-time donations, you can easily input the amount, date, and purpose, linking it to the respective donor profile. For recurring donations, FreshBooks simplifies the process by automating the recording of repetitive contributions, saving time and reducing the risk of errors. This ensures that you have an accurate and up-to-date record of all donations.

Generating Donation Receipts:

- Automating Receipt Generation:

FreshBooks automates the process of generating donation receipts, saving your organization valuable time and resources. After each donation is recorded, the system can automatically generate and send personalized receipts to donors. Automation not only ensures that receipts are sent promptly but also reduces the likelihood of human error. This feature is especially beneficial for large-scale fundraising campaigns where manual receipt generation may be impractical.

- Ensuring Compliance with Tax Regulations:

Donation receipts are not just acknowledgments; they also play a crucial role in ensuring compliance with tax regulations. FreshBooks is designed to generate receipts that meet the necessary legal requirements, providing donors with the documentation they need for tax deductions. This ensures that your organization remains in good standing with regulatory authorities and builds trust with your donors.

By streamlining donation management through FreshBooks, your organization can enhance efficiency, maintain accurate records, and foster positive relationships with donors. The system’s user-friendly interface and automation features contribute to a seamless and organized donation management process, allowing your team to focus more on your mission and less on administrative tasks.

Expense Tracking and Budgeting with FreshBooks:

Efficient Expense Management:

- Uploading Receipts and Invoices:

FreshBooks allows users to streamline the process of expense tracking by providing a feature to upload receipts and invoices directly into the system. This eliminates the need for manual data entry and ensures that all financial transactions are recorded accurately. Users can simply take a picture of their receipts or upload electronic invoices, and FreshBooks will automatically integrate this information into the expense tracking system.

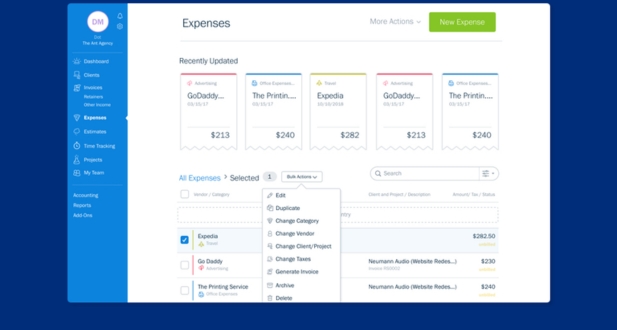

- Categorizing Expenses for Reporting:

To enhance financial reporting and analysis, FreshBooks enables users to categorize expenses. By assigning specific categories to each expense, users can gain insights into where their funds are being allocated. This categorization also facilitates the generation of detailed reports, allowing organizations to understand their spending patterns and make informed decisions.

Budgeting for Non-Profit Success:

- Creating and Monitoring Budgets:

FreshBooks provides tools for non-profit organizations to create detailed budgets. Users can outline their expected income and allocate funds to different expense categories. The system then monitors actual spending against the budget in real-time. This feature is crucial for maintaining financial discipline and ensuring that the organization stays on track with its financial goals.

- Adapting Budgets Based on Fundraising and Expenses:

Non-profit organizations often face fluctuations in income due to fundraising efforts and unexpected expenses. FreshBooks recognizes this challenge and offers the flexibility to adapt budgets dynamically. Users can easily revise their budgets based on changes in fundraising projections or unforeseen expenses, ensuring that the organization remains financially resilient and responsive to evolving circumstances.

Grant Management and Reporting:

Managing Grants Effectively:

- Tracking grant funds:

Effective grant management involves keeping a close eye on how funds are allocated, spent, and utilized. This includes creating a system to track the inflow and outflow of grant funds, ensuring that the funds are used for the intended purposes outlined in the grant agreement. This may involve using specialized software or financial tools to maintain accurate records of grant transactions.

- Complying with grant reporting requirements:

Grant agreements often come with specific reporting requirements that must be met to maintain transparency and accountability. This could involve providing regular updates on the progress of projects funded by the grant, detailing how the funds were spent, and demonstrating the impact achieved. Compliance with these requirements is crucial to maintaining a positive relationship with the grantor and ensuring continued support.

Financial Reporting for Non-Profits:

- Customizing financial reports:

Non-profit organizations need to customize their financial reports to meet the unique needs and requirements of stakeholders, donors, and regulatory bodies. This customization may involve tailoring reports to highlight specific financial metrics, program expenses, or other relevant information. The ability to generate reports that provide a clear and comprehensive view of the organization’s financial health is essential for decision-making and transparency.

- Generating reports for stakeholders and board members:

Stakeholders, including donors and board members, often require detailed financial reports to assess the organization’s performance and impact. Non-profits need to generate reports that effectively communicate financial information, budgetary allocations, and the overall financial health of the organization. These reports play a crucial role in building trust with stakeholders and demonstrating responsible stewardship of funds.

Effective grant management involves meticulous tracking of funds and compliance with reporting requirements. Financial reporting for non-profits goes beyond mere compliance, requiring the customization of reports to meet the diverse needs of stakeholders and board members. Generating clear and comprehensive financial reports is crucial for maintaining transparency, accountability, and fostering trust among those invested in the organization’s mission.

Best Practices for Implementing FreshBooks in Non-Profits:

Customization for Non-Profit Needs:

Custom Fields: Leverage custom fields in FreshBooks to capture and track information specific to non-profit operations. This may include details related to donors, grants, and compliance reporting. Customizing these fields ensures that the system aligns with the unique requirements of non-profit financial management.

Templates: Create templates tailored to non-profit financial documents. This could include invoices, receipts, and financial reports customized to showcase information relevant to donors, grants, and compliance.

Training and Onboarding:

User Training: Provide comprehensive training to staff members responsible for financial management. This ensures that they are proficient in using FreshBooks and are aware of its features and functionalities.

Onboarding Process: Develop an effective onboarding process for new users. A well-structured onboarding program helps in minimizing errors, improving user adoption, and maximizing the benefits of FreshBooks.

Regular Updates and Compliance Checks:

Stay Informed: Keep abreast of updates and new features introduced by FreshBooks. Regularly check for software updates and ensure that the financial processes align with the latest functionalities offered by the platform.

Compliance Review: Conduct regular reviews to ensure that financial processes adhere to changing regulations and compliance requirements. Non-profits often need to comply with specific financial reporting standards, and FreshBooks should be configured to meet these standards.

Data Security Measures:

Password Security: Enforce the use of strong, unique passwords for FreshBooks accounts. Regularly update passwords and implement policies that promote good password hygiene.

Two-Factor Authentication (2FA): Enable two-factor authentication to add an extra layer of security. This ensures that even if login credentials are compromised, unauthorized access is still prevented.

Access Control: Restrict access to FreshBooks to authorized personnel only. Implement role-based access control to ensure that users have access only to the functionalities necessary for their roles.

Integration with Other Tools:

Evaluate Needs: Assess the organization’s workflow and determine if integration with other tools is beneficial. This could include integrating FreshBooks with Customer Relationship Management (CRM) systems, project management tools, or fundraising platforms.

Enhanced Efficiency: Integration helps in streamlining processes, reducing manual data entry, and improving overall efficiency. It ensures that data is consistent across different platforms, minimizing the risk of errors and discrepancies.

FreshBooks Features for Non-Profit Financial Management:

Cloud-Based Accessibility:

Being a cloud-based platform, FreshBooks offers the advantage of accessing financial data from anywhere with an internet connection. This is particularly beneficial for non-profits with remote teams, volunteers, or employees working in different locations.

The cloud-based accessibility enhances collaboration and allows real-time updates, ensuring that everyone involved in financial management can stay connected and informed.

Expense Tracking and Reporting:

FreshBooks provides a streamlined process for tracking expenses incurred by non-profits. This feature aids in maintaining transparency by recording and categorizing expenses accurately.

The platform’s reporting tools enable non-profits to generate detailed reports. These reports can be crucial for internal analysis, compliance with regulations, and demonstrating accountability to donors and stakeholders.

Invoicing and Donation Tracking:

FreshBooks simplifies the invoicing process for non-profits, allowing them to create professional-looking invoices for services rendered or donations received. This can contribute to a positive image and improve relationships with donors.

The platform also facilitates the tracking of donations, providing a centralized system to manage and record contributions. This feature assists in maintaining accurate financial records and understanding the impact of donor support.

Budgeting and Forecasting:

Non-profits often operate with limited resources, and effective budgeting is crucial. FreshBooks offers tools for budgeting and forecasting, empowering organizations to plan their financial activities strategically.

With these features, non-profits can make informed decisions about fund allocation, project planning, and resource management. This contributes to financial stability and sustainability.

Multi-Currency Support:

For non-profits engaged in international activities or receiving donations in different currencies, FreshBooks’ multi-currency support is invaluable. This feature simplifies financial transactions and eliminates the complexities associated with currency conversion.

It ensures accurate recording of financial transactions, enabling non-profits to manage international operations seamlessly.

Integration with Banking and Payment Platforms:

FreshBooks integrates seamlessly with various banking and payment platforms. This integration automates the reconciliation process, reducing the risk of errors associated with manual data entry.

Non-profits can maintain accurate and up-to-date financial records, improving efficiency and minimizing the time spent on administrative tasks.

Customizable Reports for Stakeholders:

Non-profits often need to present financial information to various stakeholders, including donors, board members, and regulatory authorities. FreshBooks allows users to generate customizable reports tailored to the specific needs of different audiences.

This feature enhances communication by presenting financial data in a clear and understandable format, fostering trust and transparency with stakeholders.

Conclusion:

Effective financial management is paramount for the success and sustainability of non-profit organizations. FreshBooks, with its user-friendly interface and tailored features, offers a valuable solution for non-profits seeking to overcome the unique challenges they face in financial management.

By embracing FreshBooks, non-profits can streamline their financial processes, enhance transparency, and build stronger relationships with donors and stakeholders. The case studies presented demonstrate how organizations have successfully leveraged FreshBooks to address specific challenges and achieve greater efficiency in managing their finances.

FreshBooks does not have specific non-profit pricing, but they may offer discounts or promotions from time to time. Non-profits can inquire about available discounts.

FreshBooks provides features such as invoicing, expense tracking, time tracking, and basic reporting that can help non-profits manage their finances effectively.

FreshBooks can track income, including donations and grants. However, it may not have specialized features for comprehensive donor management.

Yes, FreshBooks can be used to track program expenses and budgets, helping non-profits monitor and manage their financial activities.

FreshBooks offers integrations with various applications, and while it may not have specific integrations for non-profits, it can be used alongside other tools for comprehensive management.