Introduction:

In today’s dynamic business environment, efficient financial management is crucial for the success of any enterprise. This often involves using specialized tools and software to streamline processes and enhance productivity. One such widely recognized and utilized tool is QuickBooks. This introduction provides a glimpse into the significance of QuickBooks in modern business operations and underscores the importance of efficient invoicing and billing processes.

Brief Overview of QuickBooks:

QuickBooks is a comprehensive accounting software developed by Intuit, designed to cater to the needs of businesses, ranging from small startups to large enterprises. Launched in the early 1980s, QuickBooks has evolved over the years to become a versatile solution for various financial tasks, including bookkeeping, invoicing, payroll management, and financial reporting. The software is known for its user-friendly interface and powerful features, making it a popular choice among businesses seeking a reliable and efficient accounting solution.

QuickBooks simplifies complex financial tasks by automating processes, ensuring accuracy, and providing real-time insights into a company’s financial health. Its features include expense tracking, income tracking, tax preparation, and more. Businesses can customize QuickBooks to suit their specific needs, making it a flexible tool for diverse industries.

Importance of Invoicing and Billing in Business:

In the realm of financial management, invoicing, and billing play pivotal roles in maintaining healthy cash flow and building strong client relationships. Efficient invoicing ensures that businesses are compensated for their products or services promptly, avoiding delays in revenue collection. Moreover, accurate and transparent billing practices contribute to the professionalism and credibility of a business.

QuickBooks excels in facilitating smooth and effective invoicing and billing processes. It allows businesses to create professional-looking invoices, track payment statuses, and automate recurring billing, reducing the administrative burden on staff. Timely and accurate invoicing not only helps businesses maintain financial stability but also fosters trust and transparency with clients.

The combination of QuickBooks and robust invoicing and billing practices is integral to the financial success and sustainability of businesses. As technology continues to shape the landscape of financial management, leveraging tools like QuickBooks becomes essential for organizations striving for efficiency, accuracy, and overall excellence in their financial operations.

Getting Started with QuickBooks

When embarking on the journey of using QuickBooks for your business, it’s crucial to begin with a solid foundation. The first step is getting started with the platform, which involves understanding its core functionalities and how they can benefit your business operations. QuickBooks is a powerful accounting software that helps streamline financial processes, track expenses, and manage transactions efficiently. Before delving into the specifics, it’s essential to have a clear understanding of your business needs and objectives to maximize the benefits of QuickBooks.

Setting Up Your QuickBooks Account

The next pivotal phase is setting up your QuickBooks account. This involves creating a profile for your business within the software, inputting relevant information such as company details, contact information, and tax preferences. Proper configuration during this stage ensures accurate financial reporting and seamless integration with your business structure. Additionally, configuring your chart of accounts, payment methods, and other essential settings will lay the groundwork for a smooth accounting process. Taking the time to set up your QuickBooks account correctly will save you time and effort in the long run.

Choosing the Right Plan for Your Business

QuickBooks offers various plans tailored to different business needs. It’s crucial to carefully evaluate and choose the plan that aligns with the size and requirements of your business. Consider factors such as the number of users, features offered, and scalability. Whether you’re a small startup or an established enterprise, selecting the right plan ensures that you have access to the tools and capabilities necessary to manage your finances effectively. Thoroughly exploring the available options and understanding the features of each plan will help you make an informed decision that meets your business objectives.

Installing and Navigating the QuickBooks Software

After choosing the appropriate plan, the next step is to install the QuickBooks software. This process may vary depending on whether you opt for a cloud-based version or a desktop installation. Once installed, familiarize yourself with the software’s interface and navigation. QuickBooks is designed to be user-friendly, but a brief orientation will help you navigate seamlessly through its features. Learn how to enter transactions, generate reports, and utilize key tools for efficient financial management. This step is crucial in ensuring that you can leverage QuickBooks to its full potential, making your accounting tasks more accurate and less time-consuming. Regular updates and staying informed about new features will help you stay ahead of the curve and optimize your use of QuickBooks.

Understanding QuickBooks Invoicing

QuickBooks Invoicing is a crucial aspect of managing your business finances efficiently. It allows you to create, customize, and send professional-looking invoices to your clients. This feature streamlines the billing process, helping you keep track of your income and providing a professional image to your customers.

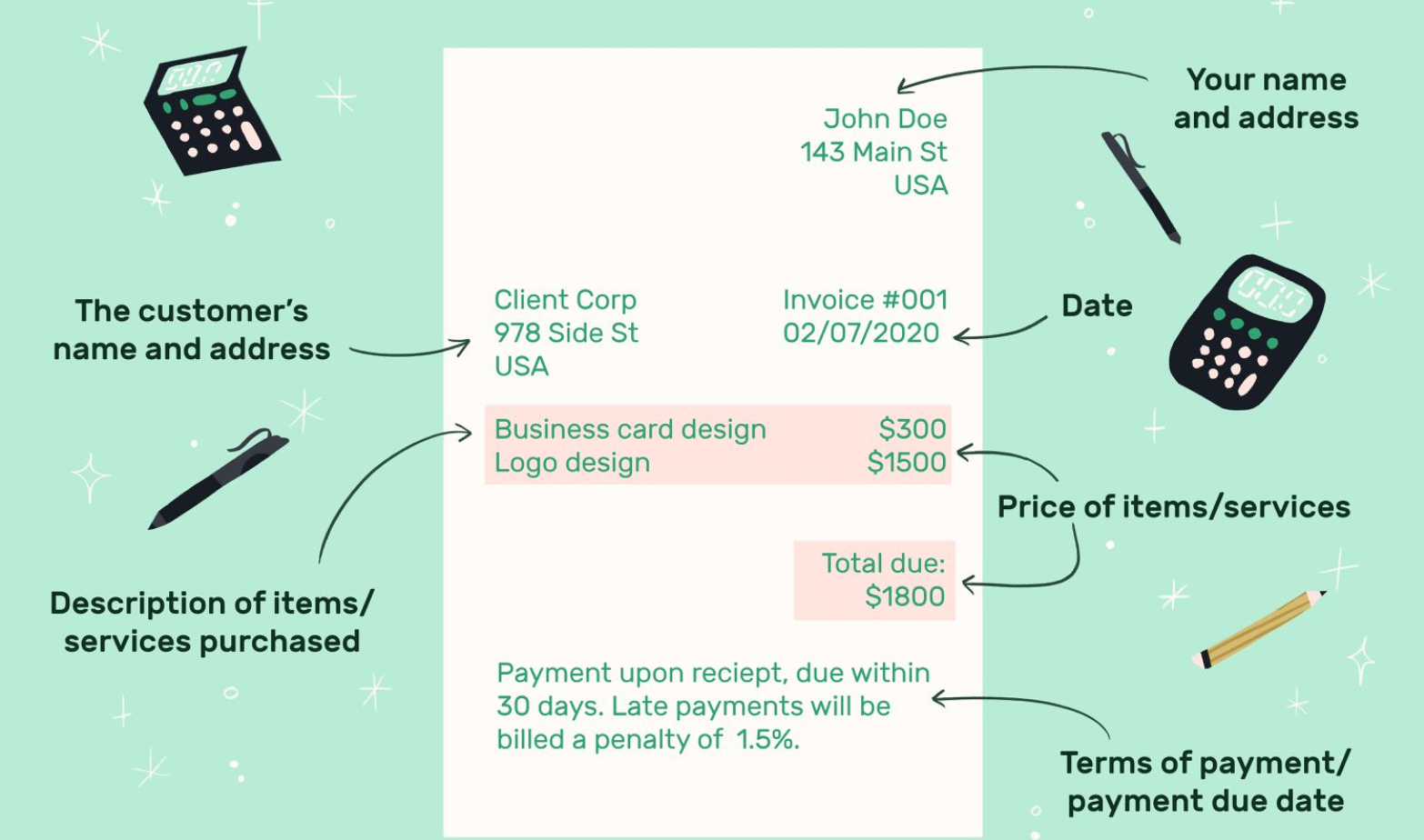

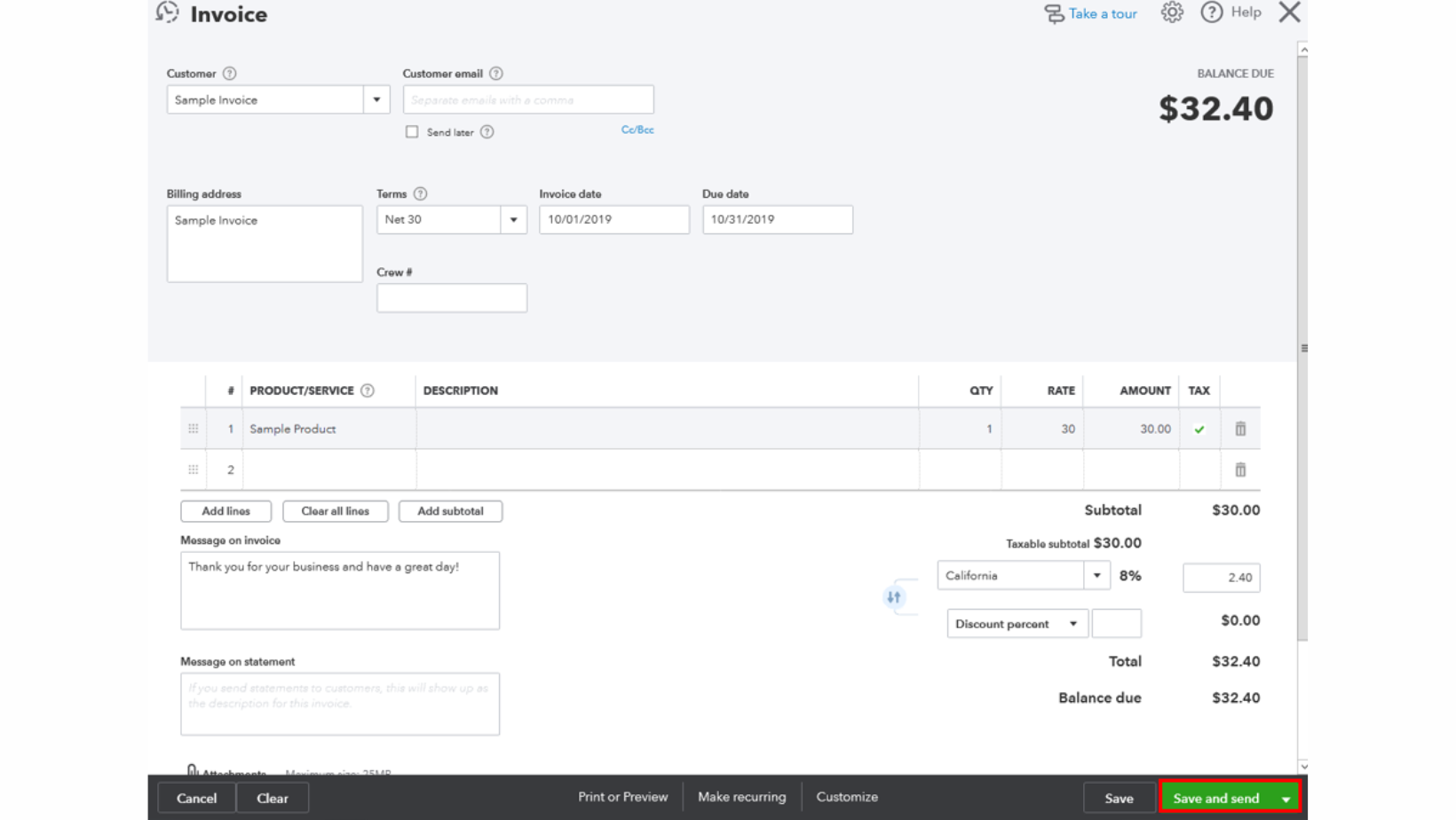

Creating Invoices: Step-by-Step Guide

To create an invoice in QuickBooks, follow a straightforward step-by-step process. Start by entering essential details such as the customer’s name, billing address, and invoice date. Next, add the products or services you provided, along with their respective quantities and rates. QuickBooks automatically calculates the total amount due, ensuring accuracy in your invoicing. This user-friendly process saves time and minimizes errors, making it easier for businesses to maintain organized financial records.

Customizing Invoices to Reflect Your Brand

Customization is key to creating a professional and cohesive brand image. QuickBooks provides tools to personalize your invoices, allowing you to add your company logo, choose colors that align with your brand, and select fonts that match your business style. By tailoring the appearance of your invoices, you not only reinforce brand consistency but also enhance the overall professionalism of your communications with clients.

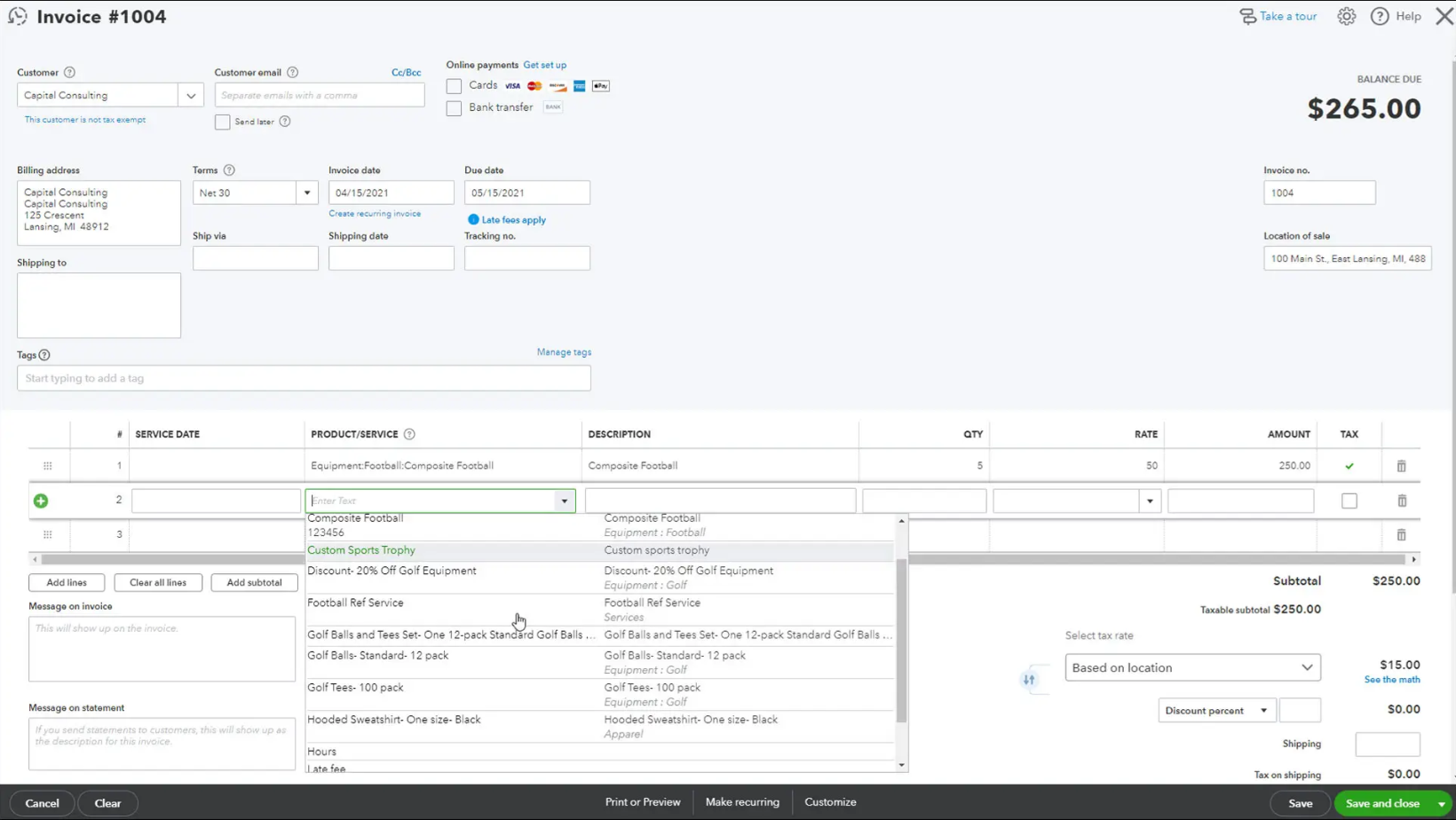

Adding Products and Services to Invoices

In QuickBooks, you can easily add the products and services you offer to your invoices. This feature helps streamline the invoicing process by allowing you to select items from your predefined list, complete with descriptions and prices. This not only accelerates the invoicing process but also ensures accuracy in billing. Additionally, it enables you to maintain a centralized database of your products and services, facilitating better inventory and financial management.

Setting Up Invoice Templates

QuickBooks offers the flexibility to create and save invoice templates that can be reused for similar transactions. This feature is especially useful for businesses with recurring clients or those offering consistent services. By setting up templates, you can save time on repetitive data entry, ensure uniformity in your invoices, and improve efficiency in your invoicing workflow. This capability is a valuable tool for businesses looking to optimize their invoicing processes and maintain a professional and organized financial system.

Managing Customer Information:

In the realm of business, effective customer information management is paramount to success. This involves not only collecting relevant data but also organizing and utilizing it strategically. The first step is creating comprehensive customer profiles, which serve as digital fingerprints for each client. These profiles typically include basic contact details, purchasing history, and any personalized preferences. Maintaining accuracy and completeness in this information ensures that businesses can tailor their products or services to meet individual customer needs.

Creating and Updating Customer Profiles:

Customer profiles are dynamic entities that require regular updates to remain relevant. As clients interact with a business, new data emerges, ranging from recent transactions to shifts in preferences. Proactively updating customer profiles allows businesses to stay ahead of evolving needs and preferences. This process involves not only recording new information but also analyzing it to identify patterns and trends. Utilizing technology, businesses can streamline this process, ensuring that customer profiles remain accurate and reflective of the latest interactions.

Tracking Customer Transactions:

Transaction tracking is a vital component of managing customer information. It involves recording and monitoring all customer interactions, from purchases to inquiries. This data not only aids in creating a detailed transaction history for each customer but also provides valuable insights into buying behaviors. By analyzing transaction patterns, businesses can identify popular products or services, understand peak buying periods, and even predict future trends. Accurate transaction tracking forms the backbone of informed decision-making and targeted marketing strategies.

Setting Payment Terms and Conditions:

Establishing clear and fair payment terms and conditions is crucial for a smooth business-customer relationship. This involves defining payment methods, due dates, and any applicable discounts or penalties. Transparent communication of these terms helps manage customer expectations and reduces the likelihood of payment disputes. Additionally, businesses can use payment data to identify trends in customer payment behavior, allowing for proactive measures to address potential issues. This aspect of customer information management contributes not only to financial stability but also to fostering trust and reliability in the business-consumer relationship.

Automating Recurring Invoices

Automating recurring invoices is a crucial aspect of efficient financial management for businesses. Recurring invoices are typically used for services or products that are provided on a regular basis, such as monthly subscriptions or ongoing projects. By automating this process, businesses can streamline their invoicing workflows, reduce manual errors, and ensure timely payments. Automation not only saves time but also enhances accuracy, helping businesses maintain a steady cash flow.

The Importance of Recurring Invoices

Recurring invoices play a pivotal role in maintaining a stable and predictable revenue stream for businesses. They are particularly beneficial for subscription-based services, retainer agreements, or any ongoing contractual relationships. The automated generation and delivery of recurring invoices help businesses establish a systematic and reliable billing cycle. This predictability allows companies to better plan their finances, allocate resources efficiently, and forecast future cash flows. Moreover, by automating this repetitive task, businesses can focus on more strategic aspects of their operations, fostering growth and innovation.

Setting Up and Customizing Recurring Invoices

The process of setting up and customizing recurring invoices involves careful configuration to meet the specific needs of a business. This includes determining the billing frequency, specifying the duration of the recurring arrangement, and setting up automatic triggers for invoice generation. Customization options may extend to branding, allowing businesses to include their logo, tagline, and other relevant information on the recurring invoices. The ability to personalize these documents not only enhances the professional appearance of the invoices but also reinforces brand identity.

Additionally, businesses can tailor the content of recurring invoices to include detailed descriptions of the services or products provided, payment terms, and any applicable discounts or fees. This level of customization ensures clarity and transparency in financial transactions, reducing the likelihood of misunderstandings and disputes.

Managing and Editing Recurring Invoices

Efficient management of recurring invoices is essential for adapting to changing circumstances or addressing customer-specific requirements. Automation tools should provide a user-friendly interface for businesses to monitor and manage their recurring invoices easily. This includes functionalities such as reviewing the status of upcoming invoices, tracking payment history, and accessing detailed reports for financial analysis.

Furthermore, businesses may need the flexibility to edit recurring invoices when necessary. Changes in pricing, service scope, or billing details may occur, and the ability to quickly and easily modify recurring invoices is vital. This adaptability ensures that businesses can accommodate evolving customer needs while maintaining accuracy and consistency in their billing processes. Proper management and editing capabilities contribute to a dynamic and responsive invoicing system, fostering positive customer relationships and overall financial health.

Integrating Payment Gateways:

Integrating payment gateways is a crucial aspect of modern business operations, especially for entities engaged in e-commerce or online transactions. A payment gateway serves as the intermediary between the customer, the merchant, and the financial institutions involved in the transaction. It ensures secure and efficient processing of online payments. The integration process typically involves linking a website or an application to the chosen payment gateway, enabling seamless and secure financial transactions.

Selecting the right payment gateway is a critical decision for businesses. Factors such as security features, transaction fees, ease of integration, and supported payment methods should be considered. Once a payment gateway is chosen, the integration process requires technical implementation, often involving the use of APIs (Application Programming Interfaces). This ensures that the business’s digital platform can communicate effectively with the payment gateway, facilitating a smooth and secure payment experience for customers.

Connecting QuickBooks to Payment Processors:

For businesses looking to streamline their financial processes, connecting QuickBooks to payment processors is a valuable step. QuickBooks, a widely used accounting software, can be integrated with various payment processors to automate the recording and reconciliation of financial transactions. This integration enhances accuracy, saves time, and reduces the likelihood of manual errors associated with data entry.

Connecting QuickBooks to payment processors involves configuring settings within the software to establish a link with the chosen processor. This connection allows for the automatic import of transaction data, simplifying the tracking of income, expenses, and overall financial health. Businesses can also gain real-time insights into their cash flow, helping them make informed decisions based on up-to-date financial information.

Accepting Online Payments:

The ability to accept online payments is essential in the digital age, where consumers prefer the convenience of making purchases or payments online. Whether through e-commerce websites, mobile apps, or online invoicing systems, businesses need to provide secure and user-friendly options for customers to complete transactions electronically. This not only enhances the customer experience but also expands the market reach for businesses beyond geographical boundaries.

To enable online payments, businesses need to integrate suitable payment gateways or processors into their digital platforms. This often involves creating a seamless checkout process that instills confidence in customers regarding the security of their financial information. Additionally, businesses may offer various payment methods, such as credit cards, digital wallets, and bank transfers, to cater to diverse customer preferences.

Managing Payment Gateway Settings:

Once a payment gateway is integrated, managing its settings becomes a crucial task for businesses. Payment gateway settings encompass a range of configurations, including security protocols, transaction limits, and user authentication measures. Businesses must regularly review and update these settings to adapt to evolving security standards, regulatory requirements, and changes in the business environment.

Effective management of payment gateway settings also involves monitoring transaction logs, addressing issues promptly, and optimizing the payment process for efficiency. Businesses may customize settings to align with their specific needs, such as setting up recurring payments, configuring fraud prevention measures, and establishing multi-currency support for international transactions. Regular maintenance and updates ensure that the payment gateway continues to operate seamlessly, providing a secure and reliable payment infrastructure for the business and its customers.

Tracking Expenses and Managing Bills

Effective financial management is crucial for both individuals and businesses. One key aspect of this is tracking expenses and managing bills. This involves maintaining a record of all expenditures and ensuring that bills are paid on time to avoid financial strain or disruptions in services. Utilizing tools like QuickBooks can greatly streamline this process, providing a centralized platform for comprehensive financial management.

Recording Business Expenses in QuickBooks

QuickBooks is a popular accounting software that enables businesses to efficiently record and organize their expenses. Users can input detailed information about each expense, categorize it appropriately, and attach relevant documentation such as receipts or invoices. This meticulous recording not only helps in maintaining accurate financial records but also facilitates easier tax preparation and compliance.

Managing Vendor Information

In the realm of business finance, managing vendor information is a critical component of tracking expenses. QuickBooks allows users to maintain a database of vendor details, including contact information, terms, and payment history. This centralized repository simplifies the process of reconciling transactions, verifying bills, and ensuring that payments are made promptly. Effectively managing vendor information contributes to smoother business operations and fosters positive relationships with suppliers.

Creating and Tracking Bills

Creating and tracking bills is a fundamental aspect of financial management, ensuring that businesses meet their financial obligations on time. QuickBooks provides a user-friendly interface for generating bills, specifying due dates, and assigning appropriate categories. The software then allows users to track the status of each bill, from creation to payment. This feature is invaluable for maintaining a clear overview of financial commitments and avoiding late fees or disruptions in services due to overlooked payments.

The combination of recording business expenses, managing vendor information, and creating and tracking bills in QuickBooks offers a comprehensive solution for efficient financial management. By leveraging these features, businesses can enhance their financial transparency, minimize errors, and foster a more organized approach to fiscal responsibilities. This, in turn, contributes to the overall stability and success of the business.

Tips and Best Practices for Efficient Invoicing and Billing

Organizing Your Invoicing Workflow:

Efficient invoicing begins with a well-organized workflow. Start by creating a standardized template that includes essential details such as your business name, contact information, client details, and a clear breakdown of the products or services provided. Utilize software or cloud-based tools to streamline the process, allowing you to easily generate, send, and track invoices. Establish a systematic approach to categorizing and archiving invoices, making it easier to retrieve information when needed. By maintaining a structured invoicing workflow, you reduce the likelihood of errors, save time, and enhance overall efficiency.

Setting Clear Payment Terms and Policies:

Clearly defined payment terms and policies are fundamental to a smooth invoicing process. Outline your expectations regarding payment due dates, acceptable payment methods, and any late fees that may apply. Communicate these terms to clients upfront, either in your initial agreement or on the invoice itself. This transparency helps manage client expectations, minimizes misunderstandings, and encourages timely payments. Regularly review and update your payment terms to align with industry standards and ensure they remain fair and reasonable for both parties involved.

Establishing a Follow-Up System for Unpaid Invoices:

Despite your best efforts, some clients may occasionally delay payments. To address this challenge, implement a follow-up system for unpaid invoices. Set up automated reminders a few days before the due date and promptly follow up on overdue payments with polite but firm communication. Consider providing alternative payment options or negotiating a revised payment plan if necessary. A consistent and proactive approach to follow-ups demonstrates your commitment to financial transparency and can significantly improve cash flow while maintaining positive client relationships.

Implementing Best Practices for Data Security:

Invoicing involves handling sensitive financial information, and making data security a top priority. Utilize secure and encrypted invoicing software to protect both your and your client’s information. Regularly update and patch your software to guard against potential vulnerabilities. Educate your team on best practices for handling financial data and ensure that access is restricted only to authorized personnel. Regularly back up your invoicing data to prevent loss in case of technical issues or cyber threats. By prioritizing data security, you not only safeguard your business but also build trust with clients who rely on you to handle their confidential information responsibly.

Conclusion

In conclusion, mastering QuickBooks Invoicing and Billing is a crucial step toward efficient financial management for businesses of all sizes. This comprehensive guide has provided a step-by-step walkthrough, tips for optimization, troubleshooting techniques, and a glimpse into the future trends shaping the invoicing landscape. As technology continues to evolve, staying informed and adapting your practices will be key to maintaining a competitive edge in the business world.

To set up recurring invoices, go to the “Invoicing” or “Sales” tab, select “Recurring Transactions,” and then “New.” Choose “Invoice” as the transaction type, set the schedule, and fill in other details. QuickBooks will automatically generate and send recurring invoices.

QuickBooks supports various payment options, including credit cards, bank transfers, and online payment platforms. You can set up payment gateways like QuickBooks Payments or connect other third-party payment processors.

Yes, QuickBooks allows you to track the status of your invoices. You can see if an invoice is sent, viewed, paid, or overdue. This helps you stay on top of your accounts receivable.

When creating an invoice, you can add discounts and taxes by editing the line items. QuickBooks provides fields for both percentage and fixed-amount discounts. You can also set up tax rates in the settings.

Yes, you can set up automatic invoice reminders in QuickBooks. Under the “Sales” tab, go to “Reminders” and configure the reminder settings. This helps in prompting customers to pay overdue invoices.

QuickBooks has a reconciliation feature. Match payments with corresponding invoices in the “Banking” or “Transactions” section. This ensures accurate tracking of income and helps in balancing your accounts.

Yes, QuickBooks allows you to create estimates. You can convert estimates into invoices when the job is completed. This feature is useful for providing clients with cost estimates before actual work begins.

To generate financial reports, go to the Reports tab and select Sales or Invoicing reports. QuickBooks provides various reports like Sales by Customer, Open Invoices, and Sales Tax Summary, helping you analyze your invoicing and billing activities.