Understanding QuickBooks

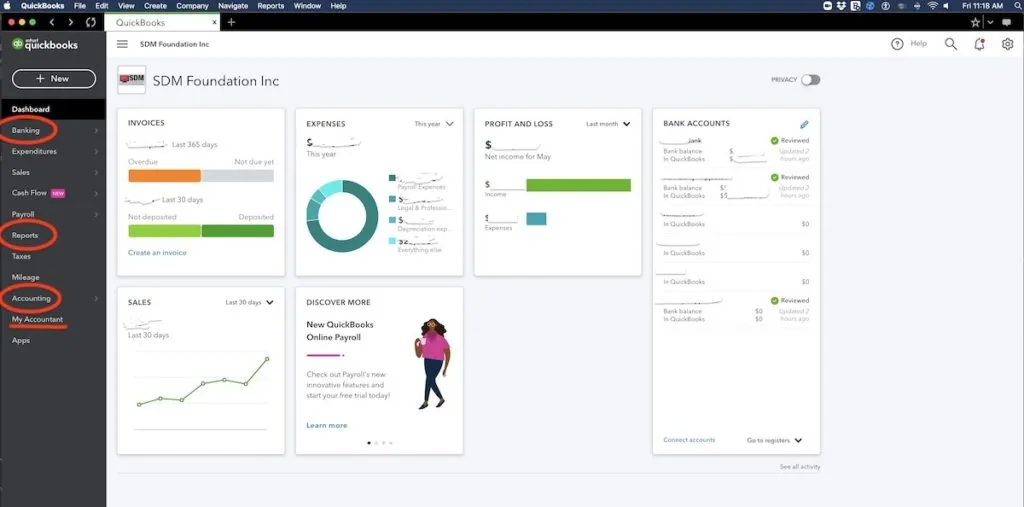

Overview of QuickBooks

QuickBooks is a widely used accounting software that has evolved significantly since its inception. Originally developed by Intuit in the 1980s, it has undergone various transformations to become the versatile tool it is today. The software has continually adapted to the changing needs of businesses, incorporating new features and functionalities with each version.

QuickBooks comes in different versions and editions tailored to meet the diverse requirements of businesses. From the basic QuickBooks Pro to the more advanced QuickBooks Enterprise, users can choose the version that best suits their company’s size and complexity. Each version introduces enhancements and specialized tools to streamline financial management processes.

One critical decision businesses face when adopting QuickBooks is whether to opt for the cloud-based or desktop version. The cloud version offers accessibility from anywhere with an internet connection, promoting collaboration among team members. On the other hand, the desktop version provides a more traditional approach, allowing users to work locally on a single device. Understanding the pros and cons of each option is crucial in determining the most suitable fit for a particular business.

Setting Up QuickBooks

Setting up QuickBooks is a pivotal step in leveraging its capabilities for effective financial management.

- Installation and Configuration: The first step involves installing the software on the chosen platform and configuring it according to the company’s requirements. This process includes customizing settings, such as the currency, time zone, and other preferences, to align with the business’s unique needs.

- Chart of Accounts: The chart of accounts is the backbone of QuickBooks, providing a structured framework for organizing financial transactions. During the setup, businesses need to carefully design their chart of accounts to accurately reflect their financial structure. This involves creating categories for assets, liabilities, equity, income, and expenses, ensuring a comprehensive and organized representation of the company’s financial landscape.

- Connecting Bank Accounts: Linking bank accounts to QuickBooks is a crucial step in automating financial data entry. This process facilitates the seamless import of transactions, reducing manual data input and minimizing errors. QuickBooks supports synchronization with various financial institutions, allowing for real-time updates and accurate financial reporting.

By understanding the history, versions, and deployment options of QuickBooks, businesses can make informed decisions about which version best fits their needs. Additionally, the meticulous setup of the software ensures that it aligns with the company’s financial structure, providing a solid foundation for efficient and accurate accounting processes.

Financial Statements and Reports

Financial statements are crucial tools for businesses to assess their financial health and communicate their performance to stakeholders. These statements provide a snapshot of a company’s financial position and performance over a specific period. There are three main types of financial statements: the Balance Sheet, Income Statement, and Cash Flow Statement.

Generating Financial Statements

- Balance Sheet: The balance sheet is a snapshot of a company’s financial position at a specific point in time. It presents the company’s assets, liabilities, and equity, showcasing how resources are financed and utilized. Assets are what a company owns, liabilities represent its obligations, and equity indicates ownership.

- Income Statement: Also known as the profit and loss statement, the income statement reflects a company’s revenues, expenses, and profits or losses over a defined period. It provides insights into the company’s operational performance, indicating its ability to generate profits.

- Cash Flow Statement: The cash flow statement tracks the inflow and outflow of cash in a business. It is divided into operating, investing, and financing activities, providing a comprehensive view of how cash is generated and utilized. Understanding cash flow is vital for assessing a company’s liquidity and financial flexibility.

Customizing Reports

Customizing financial reports allows businesses to tailor information to meet specific needs and preferences. This involves adjusting the presentation of data to enhance clarity and relevance. Several customization options are available:

- Adding and Removing Columns: Users can modify reports by adding or removing columns to focus on key metrics or details relevant to their analysis. This flexibility enables a more detailed and personalized view of the financial data.

- Filters and Date Ranges: Applying filters and setting specific date ranges allows users to narrow down information based on criteria such as departments, products, or time periods. This customization is valuable for detailed analysis and understanding how certain factors impact financial performance over time.

- Memorized Reports: Memorized reports are templates that store customized settings, making it easy to reproduce specific reports regularly. This feature streamlines the reporting process and ensures consistency in analyzing financial data.

Generating and customizing financial statements and reports are essential components of financial management. These tools not only provide insights into a company’s financial health but also offer the flexibility to tailor information for more effective decision-making and communication with stakeholders. Whether it’s assessing overall financial position or analyzing specific aspects of the business, the ability to generate and customize reports is a valuable asset for any organization.

Key Financial Ratios

Key financial ratios are essential tools for evaluating a company’s financial health and performance. These ratios provide valuable insights into different aspects of a company’s operations, helping stakeholders make informed decisions. The ratios are broadly categorized into four main groups: liquidity ratios, profitability ratios, efficiency ratios, and solvency ratios.

Liquidity Ratios:

Liquidity ratios measure a company’s ability to meet its short-term obligations and manage its working capital effectively. The two key liquidity ratios are the current ratio and quick ratio.

- Current Ratio:

The current ratio is calculated by dividing a company’s current assets by its current liabilities. It reflects the firm’s short-term liquidity position, indicating its capacity to cover immediate liabilities with available assets. A higher current ratio generally suggests better short-term financial health.

- Quick Ratio:

Also known as the acid-test ratio, the quick ratio provides a more conservative measure of liquidity. It excludes inventory from current assets, focusing on the most liquid assets. This ratio helps assess a company’s ability to meet short-term obligations without relying on the sale of inventory.

Profitability Ratios:

Profitability ratios assess a company’s ability to generate profits relative to its revenue and operating costs. Two key profitability ratios are the gross profit margin and net profit margin.

- Gross Profit Margin:

The gross profit margin is calculated by dividing gross profit by revenue and multiplying by 100 to express it as a percentage. It reveals the percentage of revenue that exceeds the cost of goods sold, indicating how efficiently a company produces and sells its products.

- Net Profit Margin:

The net profit margin is calculated by dividing net profit by revenue and multiplying by 100. It represents the percentage of revenue that remains as profit after deducting all expenses, including taxes and interest. A higher net profit margin indicates better overall profitability.

Efficiency Ratios:

Efficiency ratios measure how well a company utilizes its assets and resources. Two crucial efficiency ratios are the accounts receivable turnover and inventory turnover.

- Accounts Receivable Turnover:

This ratio assesses how quickly a company collects cash from customers. It is calculated by dividing net credit sales by the average accounts receivable during a specific period. A higher turnover indicates effective credit management and quicker cash conversion.

- Inventory Turnover:

The inventory turnover ratio gauges how efficiently a company manages its inventory. It is calculated by dividing the cost of goods sold by the average inventory for a specific period. A higher turnover suggests that a company is selling its inventory quickly, reducing carrying costs and potential obsolescence.

Solvency Ratios:

Solvency ratios evaluate a company’s long-term financial stability and its ability to meet long-term obligations. Two significant solvency ratios are the debt-to-equity ratio and interest coverage ratio.

- Debt-to-Equity Ratio:

The debt-to-equity ratio compares a company’s total debt to its shareholders’ equity. It provides insights into the proportion of financing derived from debt and equity. A lower ratio indicates lower financial risk and reliance on debt for funding.

- Interest Coverage Ratio:

The interest coverage ratio measures a company’s ability to meet its interest obligations. It is calculated by dividing earnings before interest and taxes (EBIT) by interest expenses. A higher ratio signifies better coverage and a reduced risk of financial distress due to interest payments.

Advanced Features for Financial Analysis

In the realm of financial analysis, advanced features play a pivotal role in providing organizations with deeper insights and a more nuanced understanding of their financial performance. This involves leveraging sophisticated tools and functionalities that go beyond basic accounting practices. Let’s delve into three key advanced features: Job Costing, Class and Location Tracking, and Third-Party Integrations.

Job Costing

Job Costing is a crucial aspect of financial analysis, especially for businesses involved in projects and contracts. This feature involves tracking project costs meticulously, allowing organizations to allocate expenses accurately to specific jobs. By doing so, businesses can obtain a granular view of their financial landscape, enabling them to identify cost overruns, optimize resource allocation, and make informed decisions on project profitability. Analyzing profitability by job becomes more precise, facilitating strategic planning and resource management.

Class and Location Tracking

Class and Location Tracking are advanced features that empower organizations to segment their financial data based on different criteria. Class Tracking involves categorizing transactions based on classes, such as departments, product lines, or business units. Similarly, Location Tracking allows for the segmentation of financial data based on geographical locations. This segmentation facilitates comparative analysis, enabling businesses to assess the financial performance of different segments side by side. This nuanced insight aids in identifying trends, strengths, and areas for improvement within the organization’s diverse operational facets.

Third-Party Integrations

Integration with third-party applications has become a cornerstone for modern financial analysis systems. Two key integrations, Customer Relationship Management (CRM) and E-commerce, enhance the depth and breadth of financial insights.

- CRM Integration: By integrating with CRM systems, financial analysis tools gain access to customer-related data. This linkage allows organizations to correlate financial data with customer interactions, providing a holistic view of customer profitability, acquisition costs, and overall customer lifetime value. This integrated approach aids in crafting targeted financial strategies and optimizing customer-centric operations.

- E-commerce Integration: For businesses engaged in online transactions, integrating financial analysis tools with e-commerce platforms is imperative. This integration ensures that financial data from online sales is seamlessly incorporated into overall financial reports. It enables businesses to track revenue, analyze product performance, and assess the impact of marketing strategies on online sales, fostering a comprehensive understanding of the e-commerce dimension within the broader financial context.

These advanced features represent a paradigm shift in financial analysis, offering organizations the tools they need to navigate an increasingly complex business environment. Whether it’s understanding project-specific profitability, segmenting data for comparative analysis, or integrating with external systems, these features empower businesses to make more informed, strategic decisions based on a comprehensive understanding of their financial landscape.

Troubleshooting and Common Issues

Reconciliation Challenges:

When it comes to financial processes or any system involving data synchronization, reconciliation challenges are inevitable. One primary aspect is identifying discrepancies in data sets. This involves comparing records from different sources to ensure consistency. Discrepancies may arise due to human error, system glitches, or data corruption. Timely identification of these issues is crucial to maintaining accurate and reliable information.

Reconciliation Reports play a pivotal role in addressing these challenges. These reports provide a detailed overview of the reconciliation process, highlighting variances and discrepancies. By utilizing such reports, businesses can streamline their troubleshooting efforts and expedite the resolution of reconciliation challenges.

Data Security and Backups:

In the digital age, safeguarding sensitive information is paramount. Data security is a multifaceted concern, encompassing protection against cyber threats, unauthorized access, and data breaches. Best practices for data security involve implementing robust access controls, encryption protocols, and regular security audits. These measures not only protect against external threats but also mitigate internal risks.

Automated Backups serve as a safety net in the event of data loss or system failures. Regularly backing up data ensures that even if a security breach or technical glitch occurs, critical information can be restored. Automated backups are especially advantageous, as they reduce the dependency on manual processes, ensuring a consistent and reliable safeguard against data loss.

Addressing reconciliation challenges requires a proactive approach in identifying discrepancies and leveraging reconciliation reports for efficient troubleshooting. Simultaneously, prioritizing data security through best practices and automated backups is essential for maintaining the integrity and availability of critical information. These two aspects collectively contribute to a robust and resilient data management framework.

Best Practices for QuickBooks Financial Analysis

Regular Updates and Training:

In the realm of QuickBooks financial analysis, staying current with updates and providing ongoing training for users is paramount. QuickBooks frequently releases updates to enhance features, improve security, and address any bugs or issues. Therefore, it is essential for businesses to stay informed about these updates to optimize the software’s functionality.

Continuous training for users is equally important. QuickBooks is a powerful tool with various features that may not be fully utilized without adequate knowledge. Regular training sessions ensure that users are well-versed in the latest functionalities, reducing the likelihood of errors and enhancing overall efficiency. This commitment to ongoing education contributes to a more effective and streamlined financial analysis process.

Collaboration and Multi-User Access:

Efficient collaboration is a cornerstone of successful financial analysis, and QuickBooks facilitates this through its multi-user access capabilities. Setting user permissions is crucial to maintain data integrity and restrict access to sensitive financial information. Properly configuring user permissions ensures that team members only have access to the information relevant to their roles, safeguarding the confidentiality and accuracy of financial data.

In addition to user permissions, collaboration tips for teams can further enhance the efficiency of financial analysis processes. This may involve establishing clear communication channels within the software, using shared documentation, and implementing best practices for data entry. These collaborative efforts promote a cohesive and synchronized approach to financial analysis, fostering a more accurate and insightful interpretation of the data.

Utilizing Support Resources:

Even with regular updates and comprehensive training, users may encounter challenges or have questions during financial analysis processes. QuickBooks offers a range of support resources to address these issues.

Online resources and tutorials play a vital role in self-help and troubleshooting. Businesses should encourage users to leverage these materials to enhance their proficiency with the software. Whether through video tutorials, knowledge articles, or user forums, online resources provide valuable insights and solutions to common challenges.

Additionally, QuickBooks provides customer support channels for more personalized assistance. Users can reach out to the support team for guidance on specific issues, ensuring that any obstacles encountered during financial analysis can be swiftly addressed. This direct support helps users navigate complex scenarios, ultimately contributing to a smoother and more effective financial analysis experience.

Real-World Case Studies

Small Business Success Story

In this compelling case study, we delve into the transformative impact of QuickBooks on a small business’s financial management. The narrative unfolds as we explore the challenges the business faced before adopting QuickBooks and the subsequent positive outcomes. From streamlining invoicing processes to simplifying payroll management, we highlight specific areas where QuickBooks played a pivotal role. Moreover, we share lessons learned along the way and offer practical tips for other small businesses looking to leverage QuickBooks effectively. Through this case study, readers gain valuable insights into how a compact solution like QuickBooks can empower small businesses to overcome financial hurdles and thrive in today’s competitive landscape.