Introduction:

Accounting plays a crucial role in the financial management of businesses, and for sole proprietors, it is especially vital. Sole proprietors are individuals who own and operate their businesses as single entities, and they have distinct accounting needs compared to larger corporations. The financial health of a sole proprietorship directly impacts the owner’s finances, making accurate and efficient accounting practices essential.

Importance of Accounting for Sole Proprietors:

- Financial Tracking:

Sole proprietors often invest their funds into the business. Proper accounting helps in tracking income, expenses, and profits, providing a clear picture of the business’s financial health.

- Tax Compliance:

Sole proprietors are typically taxed on their business income as personal income. Accurate accounting ensures compliance with tax regulations, minimizing the risk of penalties and optimizing tax deductions.

- Decision-Making:

Timely and accurate financial information allows sole proprietors to make informed decisions. Whether it’s expanding the business, making investments, or cutting costs, accounting data provides valuable insights.

- Business Credibility:

Well-maintained financial records enhance the credibility of a sole proprietor’s business. This is important when dealing with clients, suppliers, or financial institutions.

Introduction to FreshBooks:

- User-Friendly Interface:

FreshBooks offers an intuitive and user-friendly interface, making it accessible even for individuals with limited accounting knowledge. This ensures that sole proprietors can easily manage their finances without the need for extensive training.

- Invoicing and Expense Tracking:

For sole proprietors, managing invoices and tracking expenses is crucial. FreshBooks streamlines these processes, allowing users to create professional invoices and effortlessly track expenses.

- Time Tracking:

Many sole proprietors charge for their time or bill hourly rates. FreshBooks includes features for time tracking, making it easy to accurately bill clients for the time spent on projects.

- Tax Preparation:

FreshBooks simplifies tax preparation by categorizing expenses and providing organized financial reports. This feature is especially beneficial for sole proprietors who handle their own tax filings.

- Collaboration and Mobility:

The cloud-based nature of FreshBooks enables users to access their financial data from anywhere, promoting collaboration with accountants or team members. This mobility is particularly advantageous for sole proprietors who are constantly on the move.

Definition and Characteristics of a Sole Proprietorship:

A sole proprietorship is the simplest and most common form of business structure where a single individual owns and operates the business. This individual is the sole owner, making all decisions and assuming all responsibilities.

Single Ownership: The business is owned by one person who is also responsible for its operations and decision-making.

Unlimited Liability: The owner has unlimited personal liability for the business debts and liabilities. This means that personal assets may be used to cover business debts.

Pass-through Taxation: Profits and losses are passed through to the owner’s personal income tax return. The business itself does not pay taxes.

Ease of Formation: Setting up a sole proprietorship is relatively simple and involves fewer formalities compared to other business structures.

Advantages of Being a Sole Proprietor:

Ease of Formation and Dissolution: As mentioned, forming a sole proprietorship is straightforward, and there are minimal formalities. Similarly, dissolving the business is relatively uncomplicated.

Direct Control: The owner has complete control over all aspects of the business, enabling quick decision-making.

Tax Benefits: Pass-through taxation can be an advantage, as the business itself does not pay taxes. Instead, profits are taxed at the owner’s tax rate, which may be lower.

Disadvantages of Being a Sole Proprietor:

Unlimited Liability: The owner’s assets are at risk, as there is no legal separation between the business and personal finances.

Limited Capital: Sole proprietors may find it challenging to raise capital compared to other business structures. Banks and investors may be hesitant due to the lack of a formal business structure.

Limited Expertise: A sole proprietor may lack diverse skills or expertise in certain areas, potentially limiting the business’s growth.

Importance of Maintaining Accurate Financial Records:

Tax Compliance: Accurate records are essential for preparing and filing income tax returns. This ensures compliance with tax laws and regulations.

Financial Management: Detailed financial records help the owner track income, expenses, and profits, providing insights into the business’s financial health. This information is valuable for making informed decisions and planning for the future.

Legal Compliance: Proper record-keeping is essential for meeting legal requirements. It helps in case of audits or legal disputes and ensures transparency in business operations.

Access to Financing: If a sole proprietor needs to secure loans or attract investors, well-maintained financial records provide evidence of the business’s stability and growth potential.

Why FreshBooks for Sole Proprietors?

FreshBooks is a cloud-based accounting software designed to simplify financial management for businesses of all sizes, and it particularly excels as a solution for sole proprietors. Here’s a closer look at why FreshBooks is an ideal choice for sole proprietors:

Overview of FreshBooks and its Features:

FreshBooks is an intuitive and comprehensive accounting software that offers a range of features to help businesses manage their finances efficiently. It provides tools for invoicing, expense tracking, time tracking, project management, and reporting. The platform is accessible from any device with an internet connection, making it convenient for sole proprietors who are often on the go.

Key features of FreshBooks include:

- Invoicing: Create professional-looking invoices, customize them to reflect your brand, and easily send them to clients. The platform also allows you to set up recurring invoices for regular clients.

- Expense Tracking: Keep tabs on your business expenses by capturing receipts with your smartphone camera, categorizing expenses, and tracking spending over time. This feature is particularly useful for sole proprietors who need to monitor their cash flow closely.

- Time Tracking: If you bill clients based on hours worked, FreshBooks has a built-in time tracking feature that allows you to log hours spent on specific projects or tasks. This ensures accurate invoicing and helps in managing your time effectively.

- Project Management: Collaborate with clients and team members by managing projects directly within FreshBooks. Track project progress, share files, and keep communication centralized for improved efficiency.

- Reports and Insights: FreshBooks provides detailed financial reports that give you a snapshot of your business’s financial health. Analyze profit and loss statements, expense reports, and other key metrics to make informed business decisions.

Tailored Solutions for Sole Proprietors:

FreshBooks recognizes the unique needs of sole proprietors, who often operate as one-person businesses. The platform is designed to accommodate the specific challenges and requirements of solo entrepreneurs, offering a streamlined and simplified approach to accounting and financial management.

- Ease of Use: The software is user-friendly, with an intuitive interface that doesn’t require extensive accounting knowledge. This is crucial for sole proprietors who may be handling their finances without professional assistance.

- Scalability: FreshBooks can grow with your business. Whether you’re just starting as a sole proprietor or planning to expand, FreshBooks can adapt to your changing needs.

- Affordability: Sole proprietors often have budget constraints, and FreshBooks offers pricing plans that are reasonable for small businesses. This makes it a cost-effective choice for individuals managing their businesses.

Accessibility and User-Friendly Interface:

FreshBooks stands out for its accessibility and user-friendly design. As a cloud-based platform, it allows sole proprietors to access their financial information from anywhere with an internet connection. The user interface is designed to be straightforward to navigate, minimizing the learning curve for users who may not have a background in accounting.

The user-friendly interface is particularly advantageous for sole proprietors who may not have dedicated accounting staff. It allows them to efficiently handle invoicing, expenses, and other financial tasks without the need for extensive training.

FreshBooks is a tailored solution for sole proprietors due to its robust features, scalability, affordability, and user-friendly design. Whether you’re a freelancer, consultant, or any other type of solo entrepreneur, FreshBooks provides the tools needed to manage your finances effectively, allowing you to focus on growing your business.

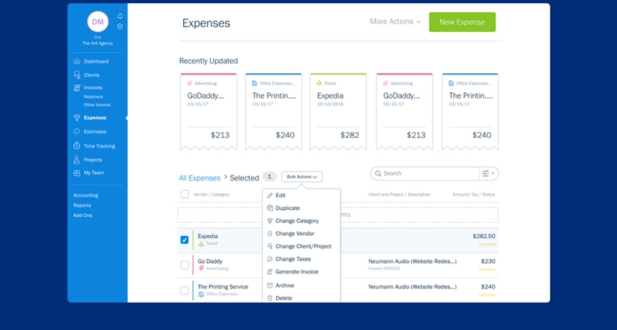

Expense Tracking and Receipt Management

Expense tracking and receipt management are critical aspects of financial management for businesses and individuals alike. The mentioned process involves using FreshBooks, a popular accounting software, to streamline and simplify these tasks. Here’s a more detailed breakdown of each step:

Utilizing FreshBooks for Expense Tracking:

- Software Overview: FreshBooks is a cloud-based accounting software designed to help businesses manage their finances efficiently. It offers features such as invoicing, time tracking, and expense tracking.

- Expense Tracking: Users can record their business expenses directly within FreshBooks. This includes entering details such as the date of the expense, the amount spent, and a description of the expense.

- Categorization: Expenses can be categorized based on different criteria like purpose, payment method, or any custom categories relevant to the business.

Uploading and Categorizing Receipts:

- Receipt Management: Users can upload digital copies of receipts directly into FreshBooks. This can be done through various methods such as uploading scanned images, taking pictures with a mobile device, or forwarding email receipts to a designated FreshBooks email address.

- OCR Technology: Many accounting software, including FreshBooks, often use Optical Character Recognition (OCR) technology to extract relevant information from receipts. This helps automate the data entry process, reducing manual effort and minimizing errors.

- Linking Receipts to Expenses: Each uploaded receipt can be linked to the corresponding expense entry, providing a clear audit trail and making it easy to verify transactions.

Generating Expense Reports for Tax Deductions:

- Expense Reports: FreshBooks allows users to generate detailed expense reports. These reports compile all the recorded expenses, providing a comprehensive overview of where the money has been spent.

- Tax Deductions: By accurately tracking and categorizing expenses, businesses can easily identify deductible expenses for tax purposes. Come tax time, the generated expense reports serve as valuable documentation for claiming deductions and complying with tax regulations.

- Customization: FreshBooks often allows users to customize expense reports based on specific criteria, making it easier to tailor the reports to meet the requirements of tax authorities or internal reporting standards.

Leveraging FreshBooks for expense tracking and receipt management streamlines the financial record-keeping process. It not only enhances accuracy and efficiency but also facilitates the generation of detailed reports that can be crucial for tax planning, compliance, and overall financial analysis.

Setting Up Your FreshBooks Account

Step-by-step guide on creating a FreshBooks account:

- Start by visiting the FreshBooks website and clicking on the “Sign Up” or “Get Started” button.

- You will be prompted to enter your email address and create a password. This will serve as your login credentials.

- Provide basic information about your business, such as your business name, industry, and location.

- Follow the on-screen instructions to set up your account. FreshBooks may ask for additional details depending on your business type.

Personalizing your account settings for sole proprietorship:

- Once your account is created, navigate to the account settings section.

- Update your business profile with accurate information, including your business name, logo, and contact details.

- Configure your billing preferences, such as currency, time zone, and date format.

- Customize your invoice template to reflect your brand identity. This may include adding a personalized message, choosing colors, and including your business logo.

Connecting bank accounts and integrating financial data:

- FreshBooks allows you to connect your bank accounts to streamline financial transactions.

- Navigate to the banking or financial integration section within FreshBooks.

- Follow the instructions to link your bank accounts securely. FreshBooks uses industry-standard security measures to protect your financial data.

- Once connected, FreshBooks can automatically import and categorize your transactions, saving you time on manual data entry.

- Set up any additional integrations you may need, such as connecting to payment gateways or third-party apps that complement your business operations.

Time Tracking and Project Management

Time Tracking for Service-Based Businesses:

- FreshBooks: FreshBooks is a cloud-based accounting and invoicing software designed to meet the needs of service-based businesses. One of its key features is time tracking, which allows businesses to monitor the hours spent on specific tasks or projects. This is particularly crucial for professionals who bill their clients based on hourly rates.

- How it Aids in Time Tracking: FreshBooks provides a user-friendly interface for users to log their work hours. This can be done manually or by using timers. The system captures details like when the work started, when it ended, and any breaks taken. This data is essential for accurate billing and helps businesses understand how time is allocated across different projects.

Project Management Tools:

- Tracking Tasks and Deliverables: Beyond time tracking, FreshBooks may offer project management tools that enable users to break down larger projects into manageable tasks. Each task can be assigned to specific team members, with deadlines and priorities attached. This feature ensures that everyone involved in a project is on the same page and that tasks are completed promptly.

Integration of Time Tracking with Invoicing:

- Seamless Invoicing: FreshBooks integrates time tracking seamlessly with its invoicing system. Once time entries are logged, users can easily generate invoices based on the billable hours. This automation reduces the likelihood of errors and ensures that clients are billed accurately for the services provided.

- Efficiency and Accuracy: The integration of time tracking with invoicing not only streamlines the billing process but also enhances accuracy. Users can include detailed reports of the work done, making it transparent for clients to understand the value they are receiving. This can be especially important for maintaining positive client relationships.

FreshBooks serves as a comprehensive solution for service-based businesses, offering features that go beyond basic accounting. By incorporating time tracking, project management, and seamless invoicing, it helps businesses manage their workflow efficiently, improve transparency, and ensure accurate billing for their services.

Tax Preparation and Reporting:

- Data Organization: FreshBooks helps businesses organize their financial data systematically. It provides a platform where users can input and categorize income, expenses, and other financial transactions. This organized data is crucial for accurate tax preparation.

- Automated Bookkeeping: FreshBooks automates many bookkeeping tasks, reducing the likelihood of errors in financial records. This is especially important during tax preparation, where precision is essential for compliance and maximizing deductions.

- Expense Tracking: The platform allows users to easily track business expenses, including receipts and invoices. This not only simplifies expense management throughout the year but also ensures that all deductible expenses are accounted for during tax preparation.

Generating Financial Reports for Tax Purposes:

- Profit and Loss Statements: FreshBooks generates detailed profit and loss statements, providing a comprehensive overview of the business’s financial performance. These statements are invaluable during tax preparation, helping to determine taxable income.

- Balance Sheets: FreshBooks can generate balance sheets that outline a business’s assets, liabilities, and equity. This is useful for assessing the overall financial health of the business and can be important for tax reporting purposes.

- Tax Summary Reports: The platform may offer specific reports designed to summarize tax-related information. These reports can include details such as deductible expenses, income sources, and tax liabilities, streamlining the tax filing process.

Staying Compliant with Tax Regulations for Sole Proprietors:

- Up-to-date Tax Rates: FreshBooks keeps users informed about current tax rates, ensuring that calculations are accurate and compliant with the latest regulations. This is particularly crucial for sole proprietors, as they are personally responsible for their business taxes.

- Automated Tax Calculations: The platform may automate the calculation of various taxes, including income taxes and self-employment taxes. This not only saves time but also reduces the risk of miscalculations that could lead to compliance issues.

- Reminders and Deadlines: FreshBooks may provide features that alert users to important tax deadlines, helping sole proprietors stay on top of their obligations and avoid penalties associated with late filings.

FreshBooks plays a vital role in simplifying tax preparation for sole proprietors by providing tools for data organization, automated bookkeeping, generating essential financial reports, and ensuring compliance with tax regulations. This not only saves time but also contributes to accurate and hassle-free tax filing processes.

Security and Data Protection

Commitment to Data Security:

FreshBooks expresses a strong commitment to ensuring the security of user data. This commitment is likely rooted in the recognition of the sensitive nature of financial information that users entrust to the platform. The company likely employs a combination of technological measures, policies, and ongoing initiatives to safeguard user data from unauthorized access, breaches, or any form of compromise.

Implementing Best Practices for Protecting Financial Information:

To uphold their commitment to data security, FreshBooks is likely to implement industry best practices specifically tailored to protect financial information. These practices may include encryption protocols to secure data both during transmission and storage, secure access controls to ensure that only authorized personnel can access sensitive information, and regular security audits or assessments to identify and address potential vulnerabilities.

Backing Up and Securing Your FreshBooks Account:

Backing up and securing user accounts is crucial for both data protection and business continuity. FreshBooks likely has mechanisms in place to regularly back up user data, ensuring that in the event of data loss or system failures, users can quickly recover their information. Additionally, securing user accounts involves features such as multi-factor authentication, strong password policies, and other measures to prevent unauthorized access.

FreshBooks is committed to maintaining a high standard of security for its users’ financial information. This involves the implementation of best practices, robust data protection measures, and the incorporation of features that enhance the security of user accounts. This commitment is essential for building and maintaining trust among users who rely on FreshBooks for managing their financial data.

Conclusion

FreshBooks has emerged as a game-changer for sole proprietors, providing a user-friendly and efficient platform for accounting needs. By understanding the features, benefits, and best practices outlined in this guide, sole proprietors can harness the full potential of FreshBooks to manage their finances effectively, save time, and focus on the growth and success of their businesses.

Yes, FreshBooks is well-suited for sole proprietors. It offers features tailored to the needs of solo entrepreneurs, such as simplified invoicing, expense tracking, and tax preparation tools.

FreshBooks allows sole proprietors to easily create and send professional invoices. Users can customize invoices, set up recurring billing, and accept online payments, streamlining the invoicing process.

Yes, FreshBooks includes expense tracking features. Sole proprietors can upload receipts, categorize expenses, and monitor spending, making it easier to manage finances and prepare for taxes.

Absolutely. FreshBooks provides tools to simplify tax preparation for sole proprietors. Users can generate detailed financial reports, track deductible expenses, and export data for easy integration with tax software.

Yes, FreshBooks is designed with a user-friendly interface that doesn’t require extensive accounting knowledge. It offers intuitive features, making it accessible for sole proprietors without a background in accounting.