Introduction

In the ever-evolving landscape of business financial management, leveraging the full potential of accounting tools has become paramount. QuickBooks, a robust accounting software, stands as a beacon in this realm, providing businesses with powerful features to streamline financial processes. However, the true optimization of QuickBooks often requires more than just software proficiency; it calls for expert guidance and strategic consulting services.

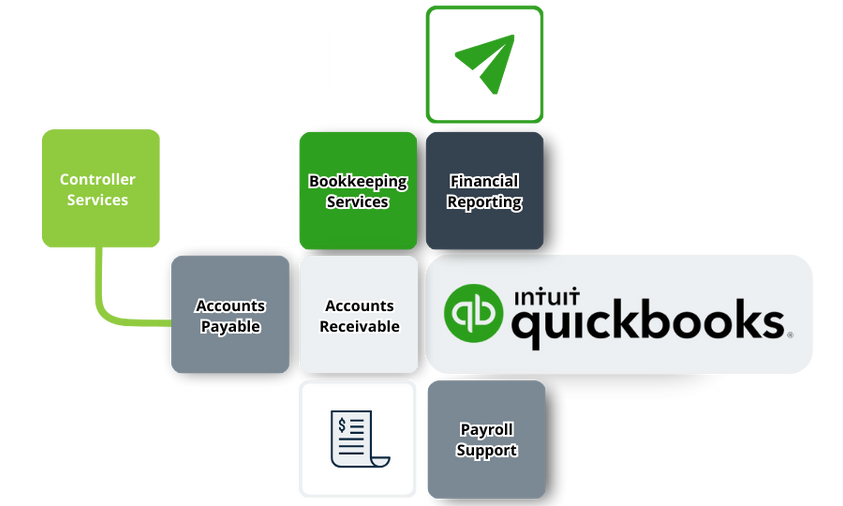

Brief Overview of QuickBooks Consulting Services

QuickBooks Consulting Services encompass a suite of offerings aimed at helping businesses harness the full capabilities of QuickBooks for enhanced financial management. These services go beyond the basics of software usage, delving into customization, optimization, and strategic planning tailored to the unique needs of each business. QuickBooks Consultants, often certified ProAdvisors, bring a wealth of expertise to the table, guiding businesses on a journey to financial efficiency and growth.

Importance of Expert Guidance in Optimizing QuickBooks Usage

While QuickBooks offers a user-friendly interface, its extensive features and functionalities can sometimes be overwhelming for businesses seeking optimal usage. This is where expert guidance becomes invaluable. QuickBooks Consultants possess in-depth knowledge of the software, staying abreast of updates and industry best practices. Their role extends beyond mere troubleshooting; they act as strategic partners, ensuring businesses extract maximum value from QuickBooks.

Navigating Complexity with Ease

QuickBooks, with its myriad features for invoicing, expense tracking, reporting, and more, can be intricate to navigate. QuickBooks Consulting Services simplify this complexity. Consultants work closely with businesses to understand their operations, tailoring QuickBooks settings to align with specific workflows. This customization ensures a seamless integration of QuickBooks into daily processes, enhancing efficiency and accuracy.

Proactive Issue Resolution

One of the key benefits of expert guidance is the ability to foresee and address potential challenges proactively. QuickBooks Consultants analyze a business’s financial landscape, identifying areas of improvement and mitigating risks before they escalate. Whether it’s preventing data entry errors or optimizing cash flow, the consultant’s proactive approach adds a layer of financial foresight to the business strategy.

Role of QuickBooks in Business Financial Management

QuickBooks serves as a linchpin in the financial management of businesses, irrespective of size or industry. Its multifaceted capabilities extend from basic bookkeeping to advanced financial analysis, making it a comprehensive solution for diverse financial needs.

Streamlining Financial Processes

At its core, QuickBooks simplifies financial processes. From creating and sending professional invoices to tracking expenses and generating detailed financial reports, the software streamlines the often time-consuming tasks associated with financial management. This streamlining not only saves time but also reduces the likelihood of errors inherent in manual processes.

Real-time Financial Insights

In the fast-paced business environment, timely decision-making is critical. QuickBooks provides real-time financial insights, allowing businesses to access up-to-the-minute data on income, expenses, and cash flow. This real-time visibility empowers business leaders to make informed decisions, adapt to changing circumstances, and seize opportunities promptly.

Facilitating Strategic Financial Planning

Beyond day-to-day transactions, QuickBooks plays a pivotal role in strategic financial planning. The software’s budgeting and forecasting tools enable businesses to project future financial scenarios based on historical data and anticipated trends. This forward-looking approach is instrumental in setting realistic financial goals and charting a course for sustainable growth.

- Why Choose QuickBooks Consulting Services

In the dynamic landscape of business management, the choice of tools and strategies can significantly impact operational efficiency and financial success. QuickBooks, renowned for its robust accounting capabilities, becomes even more powerful when complemented by expert guidance through QuickBooks Consulting Services. Here are compelling reasons why businesses should consider tapping into the expertise of

QuickBooks Consultants

Unleashing Full Potential

Maximizing the Use of QuickBooks Features

QuickBooks is a feature-rich platform with capabilities that extend far beyond basic bookkeeping. However, unlocking and harnessing these features to their fullest potential requires a nuanced understanding of the software. QuickBooks Consultants bring a depth of knowledge that goes beyond the surface, guiding businesses to explore and utilize features that might otherwise go underutilized.

From invoicing and expense tracking to payroll management and financial reporting, a QuickBooks Consultant navigates the intricate functionalities, ensuring businesses leverage the full spectrum of tools available. This comprehensive approach enhances efficiency by streamlining processes and minimizing the time spent on manual tasks.

Leveraging Advanced Functionalities for Financial Efficiency

Beyond the fundamental features, QuickBooks offers advanced functionalities that can elevate financial management to new heights. QuickBooks Consultants are well-versed in these advanced features, such as inventory tracking, project profitability analysis, and customized reporting. By incorporating these functionalities into a business’s workflow, consultants enhance financial efficiency and provide a competitive edge.

For example, businesses can implement job costing to track expenses related to specific projects, gaining insights into profitability on a granular level. Consultants guide businesses in implementing these advanced features in a way that aligns with their unique requirements, ensuring a tailored approach to financial management.

Tailored Solutions

Customizing QuickBooks to Meet Specific Business Needs

Every business is unique, and QuickBooks Consulting Services recognize and address this individuality. QuickBooks is a flexible platform that can be customized to suit the specific needs and nuances of different industries and businesses. QuickBooks Consultants play a crucial role in tailoring the software to align seamlessly with a business’s operations.

Consultants collaborate closely with businesses to understand their workflows, reporting preferences, and specific financial requirements. They then customize QuickBooks settings, charts of accounts, and workflows to create a bespoke solution. This tailored approach not only enhances the accuracy of financial records but also ensures that businesses can extract relevant insights for informed decision-making.

Addressing Industry-Specific Requirements

Industries often have unique financial challenges and regulatory requirements. QuickBooks Consultants are well-versed in addressing these industry-specific nuances. Whether it’s managing complex invoicing structures in consulting firms or handling inventory intricacies in retail, consultants tailor QuickBooks to meet the specific demands of each industry.

For instance, in the healthcare industry, QuickBooks can be customized to manage patient billing, insurance claims, and compliance reporting. Consultants with expertise in healthcare finance ensure that QuickBooks becomes a valuable asset in navigating the financial intricacies of the industry.

The Synergy of Expertise and Adaptability

The power of QuickBooks Consulting Services lies in the synergy of expertise and adaptability. QuickBooks, as a versatile tool, can cater to businesses of various sizes and industries. However, it is the expertise of QuickBooks Consultants that transforms it from a generic solution to a finely tuned instrument that resonates with the unique rhythm of each business.

Key Benefits of QuickBooks Consulting

QuickBooks Consulting Services offer a myriad of advantages that extend beyond basic software usage. These benefits are designed to enhance overall financial management, providing businesses with the tools and strategies necessary for sustained success. Let’s delve into the key benefits that businesses can derive from engaging QuickBooks Consultants.

Enhanced Efficiency

Streamlining Financial Processes for Time Savings

One of the primary benefits of QuickBooks Consulting Services is the enhanced efficiency in financial processes. QuickBooks, when utilized to its full potential, streamlines various aspects of financial management. QuickBooks Consultants work with businesses to optimize workflows, ensuring that tasks such as invoicing, expense tracking, and reconciliation are executed with maximum efficiency.

For example, consultants may implement automated invoicing processes, reducing the time spent on manual data entry and expediting the billing cycle. By streamlining these processes, businesses not only save time but also reduce the risk of errors associated with manual tasks.

Automation of Repetitive Tasks for Increased Productivity

QuickBooks offers robust automation features that, when strategically implemented, can significantly boost productivity. QuickBooks Consultants identify repetitive tasks within a business’s financial workflows and leverage automation to streamline these processes. This not only frees up valuable time for staff but also minimizes the potential for human errors.

Consider the automation of bank reconciliations as an example. QuickBooks can be set up to automatically reconcile transactions, reducing the need for manual intervention. Consultants guide businesses in implementing such automation features, empowering them to focus on strategic financial decisions rather than getting bogged down in routine tasks.

Error Prevention and Correction

Identifying and Rectifying Data Entry Errors

Data entry errors are inherent risks in manual financial processes. QuickBooks Consulting Services play a crucial role in identifying and rectifying these errors, ensuring the accuracy of financial records. Consultants conduct thorough reviews of existing data, identifying discrepancies and inconsistencies that may lead to errors in financial reporting.

QuickBooks provides features for data validation and error-checking, and consultants leverage these tools to systematically review financial data. By addressing data entry errors promptly, businesses can maintain the integrity of their financial records and build a foundation of accuracy for decision-making.

Ensuring Accurate Financial Records and Reports

Accurate financial records are the bedrock of sound financial management. QuickBooks Consultants work diligently to ensure that businesses not only avoid errors but also generate reliable financial reports. They assist in customizing report formats to meet specific business needs and industry requirements.

For instance, a manufacturing business may require detailed reports on production costs and inventory levels, while a service-based business may focus on client profitability analysis. QuickBooks Consultants tailor the software to generate reports that provide the precise insights needed for strategic decision-making.

Proactive Issue Resolution

Prompt Identification of Potential Challenges

QuickBooks Consultants function as vigilant guardians of a business’s financial health. Through in-depth analysis and ongoing monitoring, consultants proactively identify potential challenges before they escalate. This proactive approach involves scrutinizing financial data for anomalies, irregularities, or trends that may indicate underlying issues.

For instance, consultants may detect patterns of late payments from clients, allowing businesses to address the issue before it significantly impacts cash flow. Identifying potential challenges at an early stage positions businesses to implement preventive measures and navigate potential pitfalls.

Proactive Solutions to Prevent Financial Discrepancies

Once potential challenges are identified, QuickBooks Consultants don’t stop at mere observation; they actively collaborate with businesses to implement solutions. Whether it’s refining internal processes, adjusting settings within QuickBooks, or providing additional training to staff, consultants take a hands-on approach to prevent financial discrepancies.

Consider a scenario where a business experiences discrepancies in inventory tracking. QuickBooks Consultants may recommend adjustments to the inventory management settings, implement regular audits, and provide training on proper data entry procedures. These proactive measures not only resolve existing issues but also contribute to the establishment of robust financial management practices.

The Transformative Impact of Proactive Financial Management

The key benefits of QuickBooks Consulting Services – enhanced efficiency, error prevention and correction, and proactive issue resolution – collectively contribute to a transformative impact on financial management. Businesses that leverage these services not only optimize their use of QuickBooks but also establish a foundation for sustainable growth.

Services Offered by QuickBooks Consultants

QuickBooks Consultants bring a wealth of expertise to the table, offering a spectrum of services designed to empower businesses in optimizing their financial management. From initial implementation to ongoing support and optimization, these services are tailored to ensure businesses derive maximum value from QuickBooks. Let’s explore the key services provided by QuickBooks Consultants.

Implementation Services

Setting Up QuickBooks Accounts and Configurations

The foundation of effective QuickBooks usage begins with a meticulous setup tailored to the unique needs of a business. QuickBooks Consultants offer implementation services that go beyond the standard installation process. They work closely with businesses to understand their structure, workflows, and reporting requirements.

The setup involves creating and configuring QuickBooks accounts, ensuring that the chart of accounts reflects the business’s financial landscape accurately. Consultants take into account various factors such as income streams, expenses, assets, and liabilities, customizing the chart of accounts to align with specific business operations.

Customizing Chart of Accounts for Accurate Financial Tracking

A well-organized chart of accounts is essential for accurate financial tracking. QuickBooks Consultants delve into the intricacies of a business’s financial structure, creating a chart of accounts that provides detailed insights into income sources, expenditure categories, and financial performance.

For instance, within expenses, consultants may create subaccounts to distinguish between different cost centers or projects. This level of customization facilitates granular financial analysis and reporting, empowering businesses to make informed decisions based on a comprehensive understanding of their financial data.

Training and Support

Providing Comprehensive Training for Users

While QuickBooks boasts a user-friendly interface, its extensive features may require training for users to maximize their efficiency. QuickBooks Consultants offer comprehensive training programs designed to empower staff with the skills necessary for proficient software usage.

Training sessions cover a range of topics, including data entry best practices, utilization of advanced features, and interpretation of financial reports. Consultants tailor training sessions to the specific needs of the business, ensuring that users gain practical insights applicable to their roles.

Ongoing Support for Troubleshooting and Guidance

QuickBooks Consultants understand that the learning curve extends beyond initial training. To address ongoing queries, challenges, or the need for additional guidance, consultants provide continuous support. This support may come in the form of regular check-ins, virtual assistance, or a dedicated helpdesk, depending on the consulting arrangement.

For instance, if a user encounters challenges in reconciling accounts or generating specific reports, the consultant is readily available to provide step-by-step guidance. Ongoing support ensures that businesses can navigate the intricacies of QuickBooks with confidence and efficiency.

Optimization Strategies

Fine-Tuning QuickBooks Settings for Optimal Performance

QuickBooks, by its nature, is a versatile platform with settings that can be fine-tuned to align with specific business requirements. QuickBooks Consultants specialize in optimizing these settings to enhance overall performance. They assess existing configurations and make recommendations for adjustments based on the evolving needs of the business.

For example, consultants may optimize settings related to invoicing, payroll, or inventory management to streamline processes and improve efficiency. This fine-tuning ensures that QuickBooks operates in harmony with the business’s workflows, maximizing its utility.

Advising on Best Practices for Efficient Financial Management

Beyond technical adjustments, QuickBooks Consultants provide strategic guidance on best practices for efficient financial management. This includes recommendations on how to use features such as budgeting, forecasting, and advanced reporting to gain deeper insights into the business’s financial health.

For instance, consultants may advise on setting up budget goals, monitoring cash flow projections, or utilizing QuickBooks’ reporting tools to track key performance indicators. These strategic insights contribute to informed decision-making and position businesses for long-term financial success.

The Holistic Approach to QuickBooks Optimization

The services offered by QuickBooks Consultants exemplify a holistic approach to optimization. From the foundational setup to ongoing training, support, and strategic guidance, consultants collaborate with businesses to ensure that QuickBooks becomes a dynamic asset in their financial toolkit.

Industries Served by QuickBooks Consulting

QuickBooks Consulting Services are versatile and adaptable, catering to the distinctive needs of various industries. Businesses across different sectors can benefit from tailored solutions and strategic guidance to optimize their financial management processes. Here are key industries served by QuickBooks Consulting:

Small Businesses

Tailored Solutions for Startups and Small Enterprises

Startups and small enterprises form the backbone of the business landscape, and QuickBooks Consulting Services are adept at providing tailored solutions to meet their specific requirements. QuickBooks Consultants collaborate closely with small businesses to understand their unique challenges, opportunities, and financial goals.

The customization of QuickBooks settings, chart of accounts, and workflows ensures that the software aligns seamlessly with the operations of small enterprises. This level of personalization empowers small business owners to efficiently manage their finances, from invoicing and expense tracking to budgeting and reporting.

Simplifying Financial Management for Small Business Owners

For small business owners juggling multiple responsibilities, QuickBooks becomes a valuable ally in simplifying financial management. QuickBooks Consultants not only set up the software for optimal performance but also provide training and ongoing support. The goal is to empower small business owners with the tools and knowledge needed to make informed financial decisions and drive growth.

Professional Services

Addressing Unique Needs of Consultants, Agencies, etc.

Professionals in consulting, agencies, and other service-oriented industries have distinct financial management needs. QuickBooks Consulting Services tailor their approach to address these unique requirements. Consultants work with businesses in this sector to customize QuickBooks for efficient project tracking, client billing, and overall financial visibility.

Consultants and agencies often deal with intricate invoicing structures, diverse revenue streams, and project-specific expenses. QuickBooks Consultants implement features such as time tracking, project profitability analysis, and customized invoicing templates to streamline financial processes specific to professional service providers.

Streamlining Invoicing and Client Management Processes

In the realm of professional services, effective client management and transparent invoicing are crucial for success. QuickBooks Consultants assist businesses in optimizing client and project tracking within the software. This includes setting up systems for managing client information, tracking project milestones, and generating professional invoices that align with the unique billing structures of consulting and agency services.

Retail and E-commerce

Inventory Management and Sales Tracking Solutions

Retail and e-commerce businesses face the complexities of managing inventory, tracking sales, and ensuring a seamless customer experience. QuickBooks Consulting Services extend their expertise to these industries, providing solutions that streamline inventory management and sales tracking.

Consultants guide businesses in utilizing QuickBooks features for accurate inventory tracking, managing stock levels, and reconciling sales transactions. This ensures that retail and e-commerce businesses have real-time visibility into their product availability and can make informed decisions to optimize their supply chain.

Integration with Point-of-Sale Systems for Seamless Transactions

QuickBooks Consultants facilitate the integration of QuickBooks with point-of-sale (POS) systems, enhancing the efficiency of transactions for retail and e-commerce businesses. This integration ensures that sales data, inventory changes, and financial transactions seamlessly flow into QuickBooks, eliminating manual data entry and reducing the risk of errors.

By serving a diverse range of industries, QuickBooks Consulting Services showcase their adaptability and effectiveness in providing industry-specific solutions. In the subsequent sections, we will explore how these services contribute to driving growth and strategic financial planning in businesses across various sectors.

How QuickBooks Consulting Drives Growth

QuickBooks Consulting Services play a pivotal role in propelling businesses towards growth by providing strategic financial insights and fostering adaptability. Here’s how QuickBooks Consulting drives growth:

Strategic Financial Planning

Utilizing QuickBooks for Budgeting and Forecasting

QuickBooks becomes a catalyst for growth through strategic financial planning. QuickBooks Consulting Services assist businesses in leveraging the software’s robust budgeting and forecasting tools. By analyzing historical data and projecting future financial scenarios, businesses gain clarity on their financial trajectory.

This strategic financial planning enables businesses to set realistic goals, allocate resources efficiently, and identify opportunities for expansion. QuickBooks’ forecasting capabilities empower businesses to anticipate market trends and make data-driven decisions that contribute to sustained growth.

Scalability and Flexibility

Adapting QuickBooks to Growing Business Requirements

As businesses evolve, QuickBooks Consulting Services ensure that the software scales seamlessly with growing requirements. Consultants assess the changing needs of the business and implement adjustments in QuickBooks settings, chart of accounts, and workflows.

Ensuring Flexibility to Accommodate Changes in Operations

QuickBooks’ adaptability is a key driver of growth. QuickBooks Consultants guide businesses in configuring the software to accommodate changes in operations, whether it’s expanding product lines, entering new markets, or diversifying services. The flexibility of QuickBooks ensures that businesses can navigate transitions with agility, positioning themselves for continued growth.

In essence, QuickBooks Consulting Services not only optimize day-to-day financial management but also contribute to the strategic foresight and adaptability needed for sustained business growth.

Tips for Choosing the Right QuickBooks Consultant

Selecting the right QuickBooks Consultant is crucial for unlocking the full potential of the software and optimizing financial management. Here are key tips to guide businesses in making an informed choice:

Expertise and Certification

Ensuring Consultants Are Certified QuickBooks ProAdvisors

Certification as a QuickBooks ProAdvisor is a fundamental criterion for assessing a consultant’s proficiency. Certified ProAdvisors undergo rigorous training and exams to demonstrate their comprehensive knowledge of QuickBooks. This certification ensures that consultants possess the skills needed to navigate the intricacies of the software and provide expert guidance.

Verifying Expertise in Relevant Industries and Business Sizes

Beyond certification, it’s essential to evaluate a consultant’s expertise in specific industries and business sizes. Different sectors have unique financial requirements, and a consultant with experience in relevant industries is better equipped to tailor QuickBooks to meet specific challenges and opportunities.

Customization Capabilities

Assessing the Consultant’s Ability to Customize QuickBooks

The ability to customize QuickBooks is a hallmark of an effective consultant. Businesses should assess the consultant’s proficiency in adapting the software to align with unique workflows, reporting preferences, and industry-specific needs. A consultant with strong customization capabilities ensures that QuickBooks becomes a tailored solution rather than a one-size-fits-all approach.

Tailoring Solutions to Align with Specific Business Goals

Effective customization goes beyond basic settings. The right consultant collaborates closely with businesses to understand their overarching goals and tailors QuickBooks to support those objectives. This strategic alignment ensures that the software becomes an integral part of achieving specific business milestones and objectives.

Client Testimonials and Reviews

Checking Testimonials and Reviews from Previous Clients

Client testimonials and reviews provide valuable insights into a consultant’s track record. Businesses should thoroughly review feedback from previous clients to gauge the consultant’s effectiveness, responsiveness, and overall satisfaction.

Seeking Recommendations to Validate the Consultant’s Track Record

Seeking recommendations from industry peers or other businesses within the consultant’s portfolio can offer additional validation. Recommendations provide firsthand accounts of a consultant’s impact on businesses similar to yours, offering a real-world perspective on their capabilities.

Choosing the right QuickBooks Consultant is an investment in the long-term success of your financial management. By prioritizing expertise, customization capabilities, and client testimonials, businesses can confidently select a consultant who aligns with their unique needs and goals.