Introduction

Bookkeeping is a fundamental aspect of financial management for businesses, playing a crucial role in maintaining accurate and organized records of financial transactions. This process is essential for businesses of all sizes, helping them track their financial health, make informed decisions, and comply with regulatory requirements. In this discussion, we will explore the definition of bookkeeping, delve into its importance for businesses, and provide an overview of QuickBooks Bookkeeping Services.

Definition of Bookkeeping

Bookkeeping refers to the systematic recording, organizing, and tracking of financial transactions within a business. It involves maintaining detailed records of all financial activities, including income, expenses, assets, and liabilities. The primary objective of bookkeeping is to provide a clear and accurate picture of a company’s financial position, enabling business owners, managers, and stakeholders to make informed decisions. Bookkeepers use various methods and accounting principles to ensure that financial data is recorded accurately and in a timely manner.

Importance of Bookkeeping for Businesses

Effective bookkeeping is indispensable for the success and sustainability of any business. It serves as the foundation for sound financial management and decision-making. One of the key benefits is that it provides business owners with insights into their cash flow, profitability, and overall financial performance. Accurate and up-to-date financial records also facilitate the preparation of financial statements, which are essential for meeting regulatory requirements, securing loans, and attracting investors.

Furthermore, bookkeeping helps businesses identify areas where they can cut costs, optimize expenses, and improve overall efficiency. By maintaining organized records, businesses can easily track their tax obligations and ensure compliance with tax laws. In summary, bookkeeping is not merely a record-keeping task; it is a strategic tool that empowers businesses to manage their finances proactively and navigate the complexities of the business landscape.

Overview of QuickBooks Bookkeeping Services

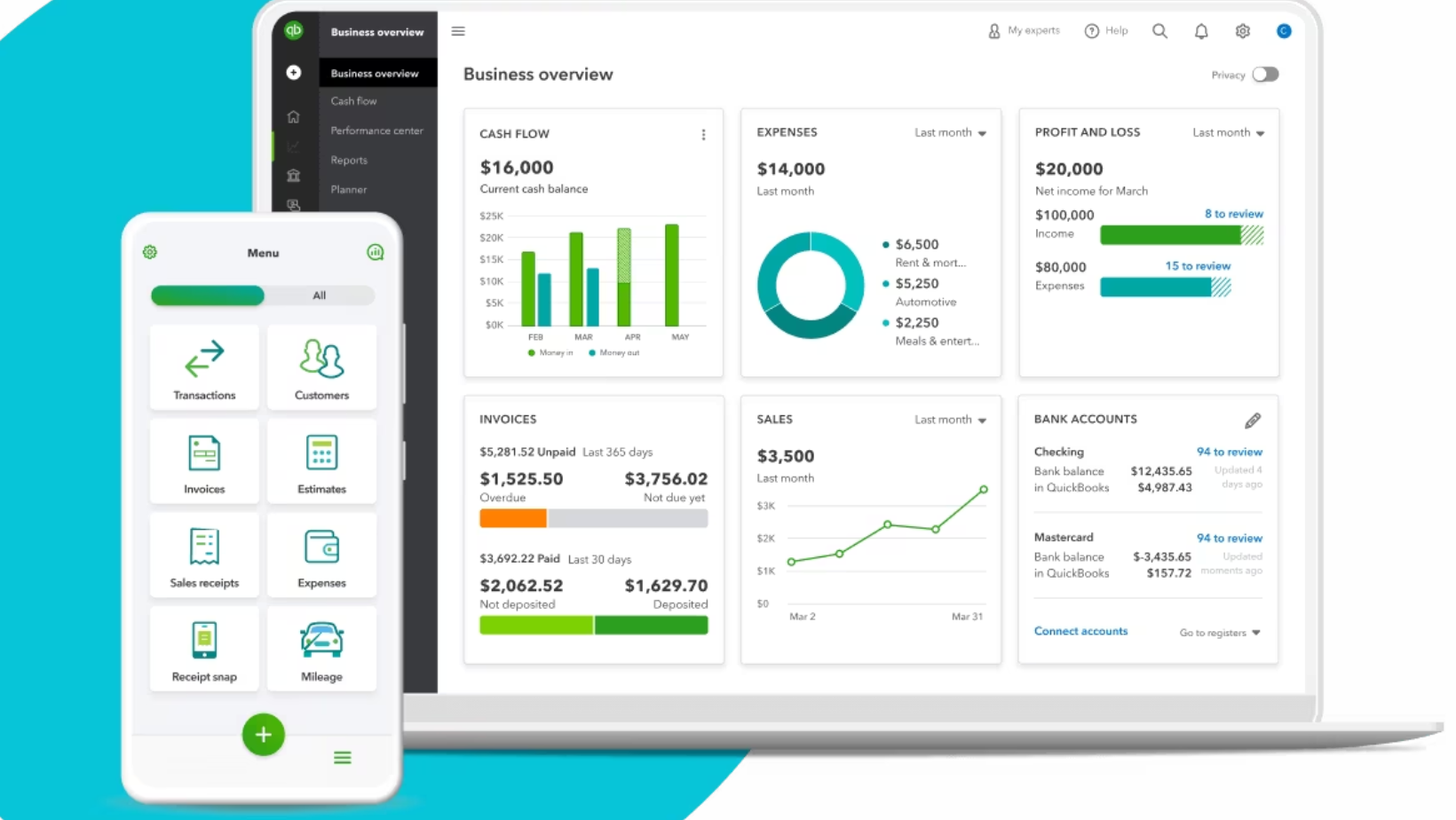

QuickBooks, developed by Intuit, is a widely used accounting software that simplifies and automates bookkeeping processes for businesses. QuickBooks Bookkeeping Services offer a range of features and tools to streamline financial management tasks. These services include but are not limited to invoicing, expense tracking, payroll management, and financial reporting. QuickBooks is designed to be user-friendly, making it accessible to businesses without extensive accounting expertise.

The platform allows businesses to maintain accurate financial records, generate insightful reports, and easily collaborate with accountants or bookkeepers. QuickBooks Bookkeeping Services cater to the diverse needs of businesses, from small enterprises to larger corporations. The software’s versatility and functionality make it a valuable asset for businesses seeking efficient and effective bookkeeping solutions in today’s dynamic and competitive business environment.

Understanding QuickBooks

Introduction to QuickBooks

QuickBooks is a widely used accounting software designed to simplify financial management for businesses of all sizes. Developed by Intuit, QuickBooks has become a staple in the world of finance due to its user-friendly interface and comprehensive set of tools. The software is particularly popular among small and medium-sized enterprises, offering an efficient way to handle various financial tasks without the need for extensive accounting knowledge.

Features and Capabilities

One of the key strengths of QuickBooks lies in its rich set of features and capabilities. The software covers a broad spectrum of financial tasks, including bookkeeping, invoicing, payroll processing, expense tracking, and financial reporting. Users can easily manage accounts payable and receivable, reconcile bank statements, and generate insightful reports to gain a clear understanding of their financial health. QuickBooks also supports third-party integrations, allowing users to connect the software with other business tools and streamline their operations further.

Moreover, QuickBooks offers robust reporting functionalities, enabling users to analyze their financial data and make informed decisions. The software’s customizable reports provide valuable insights into cash flow, profitability, and other key performance indicators, empowering businesses to optimize their financial strategies.

Versions and Pricings

QuickBooks comes in various versions tailored to meet the diverse needs of businesses. The most common editions include QuickBooks Online, QuickBooks Desktop, and QuickBooks Self-Employed. Each version caters to specific business requirements, providing flexibility in terms of access, features, and pricing.

QuickBooks Online is a cloud-based solution, allowing users to access their financial data anytime, anywhere. It offers a subscription-based pricing model with different plans to accommodate businesses of various sizes. QuickBooks Desktop, on the other hand, is a locally installed software with more advanced features and is often preferred by businesses with complex accounting needs. The pricing for QuickBooks Desktop is typically a one-time purchase.

For freelancers and self-employed individuals, QuickBooks Self-Employed is a simplified version that focuses on tracking income and expenses, calculating quarterly taxes, and maximizing deductions. The pricing for QuickBooks Self-Employed is generally more budget-friendly, catering to the specific needs of independent professionals.

QuickBooks stands out as a versatile and comprehensive accounting solution, offering businesses the tools they need to manage their finances effectively. By understanding the software’s introduction, features, and versions with pricing details, businesses can make informed decisions about adopting QuickBooks to streamline their financial processes.

Getting Started with QuickBooks Bookkeeping

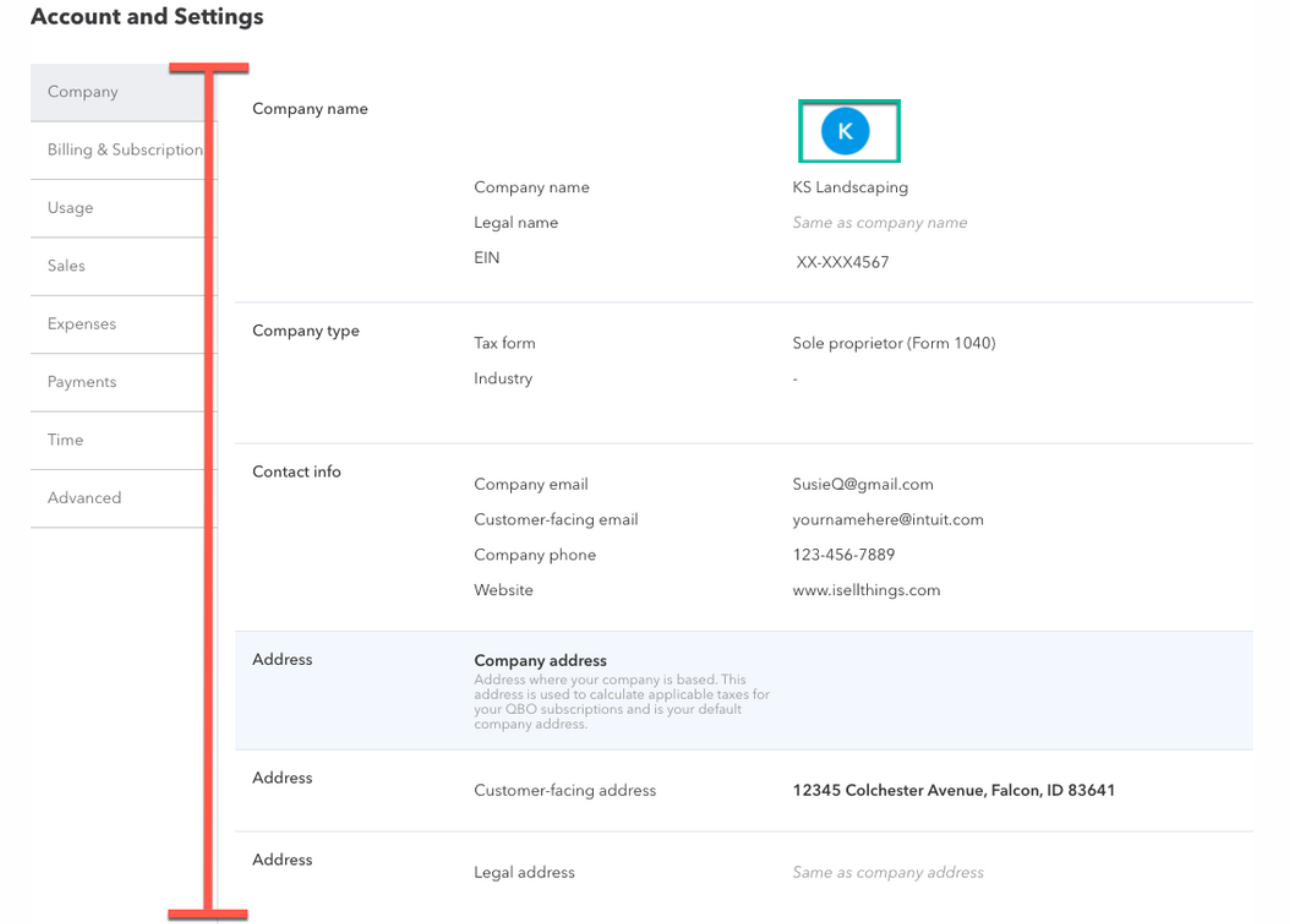

Setting up a QuickBooks Account

Setting up a QuickBooks account is the first crucial step in streamlining your bookkeeping processes. Begin by visiting the official QuickBooks website and selecting the appropriate subscription plan that aligns with your business requirements. QuickBooks offers various plans, each tailored to different business sizes and needs. During the setup process, you’ll be prompted to provide essential information about your business, such as its name, industry, and fiscal year. Ensure accuracy in entering these details as they lay the foundation for your bookkeeping system.

After creating your account, you’ll need to link your business bank accounts to QuickBooks. This integration allows for seamless transaction tracking, reducing manual data entry and the risk of errors. QuickBooks supports connections with numerous financial institutions, making it versatile and adaptable to various banking setups. By linking your accounts, you enable QuickBooks to automatically import and categorize your transactions, saving you time and effort in the long run.

Choosing the Right Version

Selecting the right version of QuickBooks is pivotal in optimizing your bookkeeping experience. QuickBooks offers different versions, including Online, Desktop, and Self-Employed, each catering to specific business needs. Consider factors such as the size of your business, the number of users who will access the system, and your preferred method of access (online or offline). For small businesses with a focus on accessibility and collaboration, QuickBooks Online may be the ideal choice. Meanwhile, larger enterprises with complex accounting requirements might benefit from the advanced features offered by QuickBooks Desktop.

Additionally, evaluate the scalability of the chosen version. As your business grows, you want a bookkeeping solution that can adapt and accommodate increasing data and transaction volumes. Regularly review your business requirements to ensure that your chosen QuickBooks version continues to meet your evolving needs.

Customizing for Business Needs

Customizing QuickBooks to align with your business needs is a critical step in optimizing its functionality. Tailor the chart of accounts to reflect the specific categories relevant to your industry and financial structure. This customization ensures accurate financial reporting and analysis. Furthermore, explore the various features and settings within QuickBooks to personalize your bookkeeping experience.

Utilize QuickBooks’ invoicing tools to create professional and branded invoices that represent your business effectively. Set up payment gateways to facilitate timely and secure transactions. Take advantage of customizable reports to gain insights into your financial performance and make informed business decisions. Regularly update and review your customization settings to accommodate changes in your business structure or financial practices.

Getting started with QuickBooks bookkeeping involves setting up an account with accurate business details, choosing the right version based on your business requirements, and customizing the software to enhance its effectiveness for your specific needs. By following these steps, you lay the groundwork for a streamlined and efficient bookkeeping system that contributes to the overall success of your business.

Benefits of QuickBooks Bookkeeping Services

QuickBooks Bookkeeping Services offer a range of advantages that contribute to the efficiency and effectiveness of financial management for businesses. This discussion will delve into four key benefits: Time Efficiency, Cost Savings, Accuracy and Error Reduction, and Accessibility and Cloud Integration.

Time Efficiency

One of the primary advantages of utilizing QuickBooks Bookkeeping Services is the significant time efficiency they bring to financial processes. The platform automates various tasks, such as data entry, transaction categorization, and reconciliation. This automation not only speeds up the bookkeeping process but also reduces the likelihood of errors that may arise from manual data input. With the time saved, businesses can allocate resources to more strategic activities, fostering growth and development.

Cost Savings

QuickBooks Bookkeeping Services can result in substantial cost savings for businesses. The automation and streamlining of financial processes reduce the need for extensive manual labor, minimizing the associated labor costs. Additionally, the platform helps prevent costly errors that might occur in manual bookkeeping, such as miscalculations or missed entries. By ensuring accurate financial records, businesses avoid the financial consequences of inaccuracies and can make more informed decisions.

Accuracy and Error Reduction

Accurate financial records are crucial for informed decision-making and compliance with regulatory requirements. QuickBooks Bookkeeping Services play a pivotal role in ensuring accuracy by automating data entry and calculations. The risk of human error is significantly reduced, leading to reliable financial information. This accuracy not only facilitates better decision-making but also helps businesses maintain transparency and credibility with stakeholders, including investors, creditors, and regulatory bodies.

Accessibility and Cloud Integration

QuickBooks Bookkeeping Services provide the advantage of accessibility and cloud integration. Users can access financial data from anywhere with an internet connection, allowing for real-time collaboration and decision-making. The cloud integration ensures that data is securely stored and backed up, reducing the risk of data loss. This feature is particularly beneficial for businesses with remote teams or multiple locations, fostering seamless collaboration and communication.

QuickBooks Bookkeeping Services offer a comprehensive set of benefits that enhance various aspects of financial management. From time efficiency to cost savings, accuracy, and accessibility, businesses stand to gain a competitive edge by leveraging the capabilities of QuickBooks for their bookkeeping needs.

Core Features of QuickBooks for Bookkeeping

QuickBooks is a comprehensive accounting software that offers a range of core features designed to streamline and enhance the bookkeeping process for businesses. Each feature plays a crucial role in maintaining accurate financial records and facilitating efficient financial management.

Income and Expense Tracking:

One of the fundamental features of QuickBooks is its robust income and expense tracking capability. This function allows businesses to monitor and categorize their sources of income and various expenses in real-time. Users can easily record transactions, whether they are sales, purchases, or other financial activities. This feature provides a detailed overview of the company’s financial health, aiding in budgeting and decision-making processes.

Invoicing and Payment Processing:

QuickBooks simplifies the invoicing and payment processing cycle, enabling businesses to create professional-looking invoices and send them directly to clients. The software allows customization of invoices to include company logos, payment terms, and other relevant details. Additionally, it facilitates online payment options, streamlining the collection process and improving cash flow. This feature not only saves time but also enhances the professionalism of the billing process.

Bank Reconciliation:

Bank reconciliation is a critical aspect of accurate financial management, and QuickBooks excels in this area. The software automatically syncs with bank accounts, credit cards, and other financial institutions, making it easier for users to match transactions and reconcile their books. This ensures that the company’s records align with actual bank statements, reducing the risk of errors and discrepancies. Bank reconciliation is a crucial step in maintaining the integrity of financial data and ensuring financial statements reflect the true financial position of the business.

Financial Reporting:

QuickBooks offers a comprehensive set of tools for generating detailed financial reports. Users can access a variety of pre-built reports, such as profit and loss statements, balance sheets, and cash flow statements. These reports provide valuable insights into the financial performance of the business, helping stakeholders make informed decisions. The customizable nature of the reports allows users to tailor them to their specific needs, ensuring that they get the precise information required for strategic planning and compliance.

QuickBooks stands out for its core features that cater to the diverse needs of businesses in terms of bookkeeping. From tracking income and expenses to facilitating invoicing, payment processing, bank reconciliation, and robust financial reporting, QuickBooks empowers businesses to maintain financial accuracy, efficiency, and transparency in their operations.

Advanced Features for Comprehensive Bookkeeping

Payroll Management:

One crucial aspect of comprehensive bookkeeping is efficient payroll management. This feature enables businesses to automate the calculation and distribution of employee salaries, taxes, and other deductions. With payroll management integrated into bookkeeping software, businesses can streamline the payroll process, reduce errors, and ensure compliance with tax regulations. This not only saves time for the finance team but also minimizes the risk of payroll-related mistakes, contributing to overall financial accuracy.

Inventory Tracking:

Effective inventory tracking is essential for businesses that deal with physical products. This feature allows organizations to monitor stock levels, track product movement, and manage reorder points seamlessly. With real-time updates on inventory status, businesses can prevent stockouts, reduce excess inventory costs, and optimize their supply chain. The integration of inventory tracking into bookkeeping systems facilitates a more holistic financial overview by aligning sales and expenses with the actual movement of goods.

Time Tracking:

Time tracking is a valuable tool for businesses that bill clients based on hourly rates or for internal purposes such as project management. This feature allows employees to record the time spent on specific tasks, projects, or clients. By integrating time tracking into bookkeeping software, businesses can accurately allocate labor costs to projects, enhance project profitability analysis, and improve resource management. This not only contributes to precise financial reporting but also aids in optimizing workforce efficiency.

Integration with Third-Party Apps:

To enhance the versatility of bookkeeping software, integration with third-party apps is a key advanced feature. This allows businesses to connect their bookkeeping system with other specialized tools such as customer relationship management (CRM), payment gateways, or e-commerce platforms. By seamlessly sharing data between these applications, businesses can streamline workflows, reduce manual data entry, and maintain data consistency across various platforms. Integration with third-party apps broadens the scope of bookkeeping software, enabling businesses to create a more interconnected and efficient ecosystem.

The incorporation of advanced features like payroll management, inventory tracking, time tracking, and integration with third-party apps enhances the capabilities of bookkeeping systems. These features contribute to accuracy, efficiency, and a more comprehensive financial overview, enabling businesses to make informed decisions and maintain robust financial health.

Industry-Specific Solutions

Industry-specific solutions play a crucial role in catering to the unique needs and requirements of businesses operating in different sectors. QuickBooks, a popular accounting software, offers tailored solutions for various industries, providing specialized features and functionalities that align with specific business models. Let’s delve into three industry-specific solutions offered by QuickBooks:

QuickBooks for Retail Businesses:

For retail businesses, managing inventory, sales, and customer transactions are paramount. QuickBooks for Retail provides a comprehensive set of tools designed to streamline these processes. It allows retailers to track and manage inventory levels, monitor sales in real-time, and generate detailed reports on product performance. Additionally, features such as point-of-sale integration and purchase order management contribute to a seamless retail accounting experience. This industry-specific solution enables retailers to stay organized, make informed business decisions, and optimize their financial operations.

QuickBooks for Service-Based Businesses:

Service-based businesses have distinct accounting needs that revolve around project management, time tracking, and invoicing for services rendered. QuickBooks for Service-Based Businesses addresses these requirements by offering functionalities such as project tracking, job costing, and easy invoicing. Service professionals can track billable hours, allocate resources efficiently, and generate invoices promptly. The software’s user-friendly interface makes it accessible for businesses in fields like consulting, marketing, or IT services. This tailored solution allows service-based businesses to maintain accurate financial records and enhance overall operational efficiency.

QuickBooks for Freelancers and Self-Employed Individuals:

Freelancers and self-employed individuals face unique challenges in managing their finances, given the variability of income and the need for tax compliance. QuickBooks for Freelancers and Self-Employed Individuals is designed to simplify these challenges. It includes features for tracking income and expenses, managing deductions, and generating reports for tax purposes. The software also facilitates easy invoicing and provides insights into the financial health of the business. With a focus on user-friendly tools and automation, this solution enables freelancers and self-employed professionals to manage their finances efficiently, saving time and reducing the stress associated with financial management.

Tips and Tricks for Effective QuickBooks Bookkeeping

Best Practices for Data Entry:

Accurate data entry is the foundation of effective QuickBooks bookkeeping. Implementing best practices in this area is crucial for maintaining clean and reliable financial records. Ensure consistency in naming conventions for accounts, customers, and vendors to avoid confusion. Double-check numerical entries to prevent errors that could lead to discrepancies in financial reports. Regularly reconcile your accounts to identify and resolve any discrepancies promptly. Additionally, keep detailed records and supporting documentation for all transactions, making audits and reviews more straightforward.

Utilizing Automation Features:

QuickBooks offers a range of automation features that can significantly streamline your bookkeeping processes. Take advantage of features such as automatic bank feeds, which enable the software to automatically download and categorize transactions. Set up recurring transactions for regular bills and invoices to save time on repetitive data entry. Explore the integration of third-party apps to further automate tasks like expense tracking or payroll. Automation not only increases efficiency but also reduces the risk of human error, allowing you to focus on more strategic aspects of your business.

Regular Backups and Security Measures:

Protecting your financial data is paramount. Regularly back up your QuickBooks files to ensure you have a recent copy in case of data loss or system failure. Utilize secure cloud-based storage or external drives for these backups. Implement strong password policies and consider using multi-factor authentication to enhance the security of your QuickBooks account. Regularly update your software to patch security vulnerabilities, and be cautious with user access permissions, granting only the necessary level of access to each team member to prevent unauthorized changes or data breaches.

Training and Support Resources:

Invest time in training yourself and your team on the functionalities of QuickBooks. Many resources are available, such as online tutorials, user guides, and webinars provided by Intuit, the company behind QuickBooks. Consider enrolling in formal training courses or hiring a QuickBooks-certified professional for personalized assistance. Regularly check for software updates to stay informed about new features and improvements. Engage with the QuickBooks community through forums and discussion groups to exchange tips and troubleshoot issues. Utilizing the available support resources ensures that you harness the full potential of QuickBooks for your bookkeeping needs.

Conclusion

QuickBooks’ industry-specific solutions demonstrate the software’s adaptability to the diverse needs of businesses. By tailoring its features to the requirements of retail, service-based, and freelance/self-employed sectors, QuickBooks provides a reliable and efficient accounting solution that contributes to the success of businesses in these industries.

QuickBooks is widely used for bookkeeping due to its user-friendly interface, extensive features, and compatibility with various business needs. It helps automate financial tasks, track expenses, and generate reports, making it easier for businesses to manage their finances.

QuickBooks can automatically import bank transactions, helping in the reconciliation process. Users can match transactions, identify discrepancies, and reconcile accounts efficiently, ensuring that the company’s financial records align with bank statements.

Yes, QuickBooks offers payroll services that allow businesses to manage employee salaries, deductions, and tax filings. It automates payroll processes, helping to ensure accurate and timely payment to employees while maintaining compliance with tax regulations.

Yes, QuickBooks is particularly well-suited for small businesses. It offers various versions and plans tailored to the specific needs and size of a business, providing scalability as the business grows.

QuickBooks employs advanced security measures, including encryption and multi-factor authentication, to protect financial data. Additionally, they regularly update their software to address any vulnerabilities and comply with industry standards.

Yes, QuickBooks can generate a variety of financial reports, including profit and loss statements, balance sheets, cash flow statements, and more. These reports provide insights into the financial health of the business, aiding in decision-making.

QuickBooks offers extensive training resources, including tutorials, webinars, and documentation. Additionally, there are many online courses and third-party resources that provide in-depth training on using QuickBooks for bookkeeping.

Yes, QuickBooks can integrate with a variety of third-party applications and business software. This includes CRM systems, e-commerce platforms, and other tools, streamlining data flow and reducing manual data entry.