Introduction:

Accounting plays a crucial role in the real estate industry, serving as the financial backbone that enables businesses to manage, track, and optimize their financial resources. In a sector where substantial investments, complex transactions, and regulatory compliance are prevalent, accurate and efficient accounting practices are essential for success. This introduction aims to highlight the significance of accounting in the real estate industry and then shift focus to FreshBooks, shedding light on how this software plays a pivotal role in streamlining accounting processes within the real estate sector.

Importance of Accounting in the Real Estate Industry:

Financial Management: Real estate involves significant financial transactions, including property acquisition, development, and sales. Effective accounting helps in managing these financial aspects by tracking income, expenses, and investments.

Regulatory Compliance: The real estate industry is subject to various regulations and tax laws. Proper accounting ensures compliance with these regulations, reducing the risk of legal issues and financial penalties.

Decision-Making: Accurate financial data provides insights that aid decision-making. Whether it’s assessing the profitability of a project, evaluating investment opportunities, or budgeting for future developments, accounting information is crucial.

Investor Relations: Real estate projects often involve multiple investors or stakeholders. Transparent and reliable accounting practices foster trust among investors by providing clear visibility into the financial health and performance of projects.

Introduction to FreshBooks:

FreshBooks is a cloud-based accounting software designed to simplify financial management for businesses of all sizes. While it is not industry-specific, its features and capabilities make it particularly valuable for real estate professionals looking to streamline their accounting processes.

User-Friendly Interface: FreshBooks offers an intuitive and user-friendly interface, making it accessible even for those without extensive accounting knowledge. This is beneficial for real estate professionals who may not have a finance background but need effective accounting solutions.

Expense Tracking: Real estate projects involve various expenses, from construction costs to property maintenance. FreshBooks allows users to easily track and categorize expenses, providing a clear overview of where the money is going.

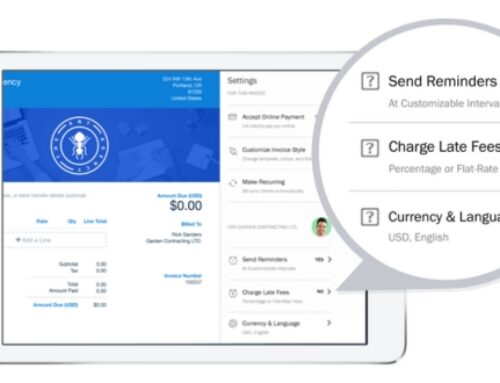

Invoicing and Payments: Real estate transactions often require invoicing and payment processing. FreshBooks automates these processes, allowing users to create professional invoices, send payment reminders, and accept online payments, thereby improving cash flow.

Financial Reporting: The software generates comprehensive financial reports, offering insights into the financial performance of real estate projects. This capability is crucial for strategic planning, identifying trends, and making informed business decisions.

Understanding the Real Estate Accounting Landscape

Unique Accounting Challenges in Real Estate:

Asset Valuation and Depreciation: Real estate assets, such as properties, need to be accurately valued, and their depreciation must be accounted for over time. This requires a thorough understanding of property values, market trends, and depreciation methods.

Complex Revenue Recognition: Real estate transactions often involve multiple revenue streams, such as rental income, property sales, and ancillary services. Properly recognizing and accounting for revenue from these diverse sources can be complex, especially when dealing with long-term lease agreements or development projects.

Financing and Debt Structures: Real estate deals frequently involve complex financing structures, including mortgages, loans, and partnerships. Accountants must navigate the intricacies of interest calculations, debt amortization, and associated costs to accurately reflect the financial health of the real estate portfolio.

Regulatory Compliance: Real estate accounting is subject to a range of regulations and standards, including those set by the Financial Accounting Standards Board (FASB) and other regulatory bodies. Staying compliant with these standards is crucial for financial reporting and transparency.

Lease Accounting Changes: Recent changes in lease accounting standards, such as ASC 842, have impacted how leases are accounted for on financial statements. This requires real estate professionals to reassess their lease agreements and make adjustments to comply with the new standards.

Importance of Accurate Financial Records:

Informed Decision-Making: Accurate financial records provide real estate professionals with the information needed to make informed decisions. Whether it’s evaluating the performance of an investment property or deciding on the financing strategy for a development project, reliable financial data is crucial.

Risk Management: Real estate is inherently tied to financial risk. Accurate accounting helps in identifying, assessing, and mitigating risks associated with property values, market fluctuations, and financial obligations. This is vital for maintaining a stable and resilient real estate portfolio.

Investor Confidence: Investors, whether they are individuals, institutions, or partners, rely on accurate financial information to assess the performance and potential returns of real estate investments. Transparency in financial reporting enhances investor confidence and trust.

Compliance and Legal Obligations: Real estate professionals need to adhere to various legal and regulatory requirements. Accurate financial records ensure compliance with tax laws, accounting standards, and other legal obligations, reducing the risk of penalties and legal issues.

Facilitation of Audits and Due Diligence: Accurate financial records simplify the auditing process and due diligence activities. Whether it’s an internal audit or an external review by potential investors, having well-maintained financial records streamlines the evaluation process.

Key Features of FreshBooks for Real Estate Accounting

Invoicing and Payment Processing

- Streamlining the Invoicing Process: FreshBooks offers tools to simplify and expedite the creation and distribution of invoices for real estate transactions. This can include customizable templates that are tailored to the specifics of real estate deals.

- Accepting Online Payments: The platform allows real estate professionals to accept payments online, providing convenience for clients and ensuring a faster and more efficient payment process.

- Tracking Transactions: FreshBooks enables users to track and monitor transactions related to real estate deals, providing a clear overview of financial inflows and outflows.

Expense Tracking and Management

- Managing Real Estate Expenses Efficiently: FreshBooks helps real estate professionals keep track of various expenses associated with their business, such as property maintenance, travel, and marketing.

- Integration with Bank Accounts and Credit Cards: By integrating with bank accounts and credit cards, FreshBooks provides a centralized platform for managing financial transactions, reducing manual data entry and ensuring accuracy.

Time Tracking for Real Estate Professionals

- Importance of Time Tracking: Time tracking is crucial in real estate for tasks like property showings, client meetings, and administrative work. FreshBooks allows users to accurately record the time spent on different activities.

- Utilizing FreshBooks for Accurate Time Recording: Real estate professionals can leverage FreshBooks to record billable hours, enhancing transparency in client billing and improving overall time management.

Financial Reporting and Analytics

- Generating Reports Specific to Real Estate Metrics: FreshBooks provides tools to generate custom reports tailored to real estate metrics. This can include reports on property sales, expenses, and profitability.

- Analyzing Financial Data: Real estate professionals can analyze financial data within the platform to gain insights into the financial health of their business, aiding in informed decision-making.

Tax Preparation and Compliance

- Simplifying Tax Preparation: FreshBooks simplifies the tax preparation process for real estate professionals by organizing financial data and providing features like automatic categorization of expenses.

- Ensuring Compliance with Tax Regulations: The platform helps ensure compliance with tax regulations by providing accurate financial records and facilitating easy access to necessary documentation during tax audits.

Integration with Real Estate Management Systems

- Seamless Integration: FreshBooks seamlessly integrates with popular real estate management tools, creating a unified ecosystem. This integration enhances overall efficiency by reducing data silos and streamlining workflows across different platforms.

Real-World Applications and Case Studies

Improved Efficiency in Financial Management:

Real estate professionals often juggle multiple clients, properties, and transactions. FreshBooks streamline financial management by automating invoicing, expense tracking, and time management. Case studies can showcase how this automation has significantly reduced the time spent on manual financial tasks.

A real estate agent can describe how FreshBooks’ automated invoicing has allowed them to quickly generate and send invoices to clients, saving hours each month compared to the traditional manual invoicing process.

Enhanced Accuracy in Financial Transactions:

In the real estate industry, accuracy in financial transactions is crucial. FreshBooks helps prevent errors by providing a user-friendly platform for recording and reconciling transactions. Case studies can highlight instances where professionals have experienced increased financial accuracy and minimized errors in their financial records.

An example scenario might involve a property manager who previously struggled with tracking multiple expenses for various properties. With FreshBooks, they can input expenses in real time, ensuring that financial records are up-to-date and accurate.

Streamlined Client Communication:

Communication is vital in real estate, and FreshBooks offers features that facilitate smooth client interactions. Case studies can demonstrate how professionals have used the platform to send professional-looking invoices, communicate payment reminders, and maintain transparent financial interactions with clients.

A real estate consultant could share how FreshBooks has improved client relationships by providing a clear and organized overview of financial transactions, ultimately fostering trust and confidence.

Time and Resource Optimization:

Real estate professionals often wear many hats, and time is a valuable resource. FreshBooks can be showcased in case studies as a tool that optimizes time management, allowing professionals to focus more on core business activities and less on administrative tasks.

An example might involve a real estate developer who, by using FreshBooks, has been able to streamline their financial processes, allowing them to dedicate more time to identifying new investment opportunities and fostering strategic partnerships.

Scalability for Growing Businesses:

As real estate businesses expand, their financial management needs evolve. Case studies can illustrate how FreshBooks is scalable and adaptable to the changing needs of growing real estate enterprises.

A case study could feature a property management company that started with a small portfolio and grew exponentially. FreshBooks accommodated their increasing transaction volume, providing a seamless transition and supporting their growth without compromising efficiency.

Tips and Best Practices for Real Estate Accounting with FreshBooks

- Integration with Real Estate Management Software:

Explore integration options between FreshBooks and real estate management software. This ensures seamless data flow between your accounting system and property management tools, reducing manual data entry and minimizing errors.

- Client and Project Setup:

Properly set up clients and projects within FreshBooks to accurately track income and expenses related to specific real estate transactions. Use consistent naming conventions and codes for clarity and organization.

- Categorization of Transactions:

Develop a comprehensive chart of accounts tailored to real estate accounting needs. Categorize transactions accurately to provide detailed insights into property-related income, expenses, and profits. Utilize FreshBooks’ customization features for a personalized chart of accounts.

- Automate Recurring Transactions:

Take advantage of FreshBooks’ automation features for recurring transactions such as rent payments, utility bills, and mortgage payments. This streamlines routine tasks, reduces manual effort, and ensures timely recording of essential transactions.

- Bank Reconciliation:

Regularly reconcile your bank statements with FreshBooks records to identify any discrepancies or missing transactions. This practice helps maintain the accuracy of financial data and provides a clear picture of your real estate business’s financial health.

- Expense Tracking and Receipt Management:

Leverage FreshBooks to track expenses related to property maintenance, repairs, and other real estate-related costs. Utilize the mobile app for on-the-go receipt capture, ensuring all expenses are accounted for and easily accessible during tax season.

- Generate Detailed Reports:

Utilize FreshBooks’ reporting features to generate detailed financial reports specific to real estate. Common reports include profit and loss statements, balance sheets, and cash flow statements. These reports offer valuable insights into the financial performance of individual properties and your overall real estate portfolio.

- Collaboration and User Permissions:

If working with a team or external stakeholders, set up appropriate user permissions in FreshBooks to control access to sensitive financial data. This ensures that only authorized individuals can view or modify critical information.

- Regular Software Updates and Training:

Stay informed about FreshBooks updates and new features relevant to real estate accounting. Provide ongoing training to your accounting team to ensure they are proficient in using the latest tools and functionalities.

- Compliance and Tax Preparation:

Ensure compliance with relevant tax regulations and real estate accounting standards. Use FreshBooks’ tax features to categorize transactions, track deductible expenses, and facilitate a smoother tax preparation process.

Challenges:

Complexity of Real Estate Transactions:

Challenge: Real estate transactions can be intricate with various financial components like property acquisition, leasing, and property management.

Solution: Customize your FreshBooks account to create specific income and expense categories for each type of real estate transaction. Use tags and labels to differentiate between different properties or projects.

Integration with Real Estate Management Systems:

Challenge: Many real estate professionals use specialized management systems for property tracking and tenant management.

Solution: Explore integration options with FreshBooks. Utilize APIs or third-party connectors to sync data seamlessly between FreshBooks and your real estate management system.

Tax Compliance for Real Estate:

Challenge: Real estate taxation can be complex, with specific rules and regulations.

Solution: Regularly consult with a tax professional who is familiar with real estate accounting. Ensure FreshBooks is configured to generate accurate financial reports that comply with real estate tax requirements.

Multi-Entity Accounting:

Challenge: Real estate businesses often involve managing multiple properties or entities.

Solution: Leverage FreshBooks’ features for multi-entity accounting. Set up separate accounts for each property or entity and use reporting tools to consolidate financial data for an overall view.

Limitations:

Industry-Specific Features:

Limitation: FreshBooks may lack certain industry-specific features required for real estate accounting.

Mitigation: Supplement FreshBooks with industry-specific software or tools that cater to the unique needs of real estate accounting. Ensure these tools can integrate or exchange data with FreshBooks.

Learning Curve for Real Estate Professionals:

Limitation: Real estate professionals might find it challenging to adapt to a new accounting platform.

Mitigation: Provide comprehensive training for users. Take advantage of FreshBooks’ support resources, tutorials, and customer service to assist in the onboarding process.

Limited Real-Time Collaboration:

Limitation: Real estate transactions often require real-time collaboration among various stakeholders.

Mitigation: Utilize external collaboration tools alongside FreshBooks. Keep communication channels open and establish clear protocols for sharing financial data promptly.

Scalability Issues:

Limitation: As real estate portfolios grow, scalability might become a concern.

Mitigation: Regularly assess your accounting needs and explore advanced features or upgraded plans offered by FreshBooks. Consider consulting with FreshBooks support to ensure your setup is optimized for scalability.

FreshBooks Customer Support and Training

FreshBooks is renowned for its exceptional customer support services, setting a gold standard in the industry. The company places a strong emphasis on providing comprehensive assistance to its users, ensuring a seamless experience with their accounting and invoicing platform. The customer support team at FreshBooks is known for its responsiveness, expertise, and commitment to resolving queries promptly. Whether users encounter technical issues, have inquiries about specific features, or require general guidance, FreshBooks’ support services are designed to address a diverse range of needs.

One of the key strengths of FreshBooks lies in its commitment to user education and empowerment through extensive training resources. Real estate professionals, in particular, can benefit significantly from the tailored training materials available. These resources are designed to enhance the proficiency of real estate professionals in utilizing FreshBooks to its full potential. From video tutorials and webinars to comprehensive written guides, FreshBooks ensures that users have access to a variety of learning formats catering to different preferences and learning styles. This commitment to training not only fosters a more proficient user base but also underscores FreshBooks’ dedication to helping real estate professionals optimize their financial management processes.

FreshBooks not only offers a robust platform for accounting and invoicing but also ensures that its users are well-equipped to leverage the full spectrum of its features through a combination of stellar customer support services and rich training resources, with a particular focus on meeting the needs of real estate professionals. This comprehensive approach sets FreshBooks apart as a user-centric solution that goes beyond merely providing a product, aiming to empower its users for success in their respective fields.

Conclusion

In the fast-paced world of real estate, having a reliable accounting solution is paramount for success. FreshBooks offers a tailored approach to real estate accounting, addressing the unique challenges and requirements of the industry. From property management to compliance and tax filing, FreshBooks empowers real estate professionals with the tools needed to streamline financial processes and achieve sustainable growth. Embracing FreshBooks as a comprehensive accounting solution can unlock new possibilities for efficiency, accuracy, and success in the competitive realm of real estate.

Yes, FreshBooks offers integrations with various real estate management tools to streamline your workflow and centralize data.

Absolutely. FreshBooks provides features to track costs, manage invoices, and monitor profits, making it ideal for real estate investors and flippers

FreshBooks allows you to create and send professional invoices to tenants, and you can even set up recurring invoices for rent payments. Payment processing can be integrated for seamless transactions.

Yes, FreshBooks offers customizable financial reports, allowing you to generate statements that cater specifically to the needs of real estate accounting.

Certainly. FreshBooks enables you to categorize and track various property expenses, providing a comprehensive view of your financial outflows.