Understanding FreshBooks Business Expense Optimization

Overview of FreshBooks

- History and Evolution

FreshBooks, founded in 2003 by Mike McDerment, emerged as a solution to the invoicing and accounting challenges faced by small businesses and freelancers. The company was born out of McDerment’s frustration with the inefficiencies of traditional accounting software. Initially serving as a simple invoicing tool, FreshBooks has evolved over the years into a comprehensive cloud-based accounting platform.

In its early stages, FreshBooks focused on streamlining the invoicing process, allowing users to create professional-looking invoices with ease. As technology advanced and customer needs grew, FreshBooks expanded its features to encompass a broader spectrum of accounting tasks. The company has undergone several significant updates and revisions, continually adapting to the changing landscape of business finance.

The evolution of FreshBooks can be traced through the incorporation of user feedback, market trends, and technological advancements. From a humble invoicing tool, it has transformed into a multifaceted financial management platform, catering to the diverse needs of small businesses, freelancers, and independent contractors.

- Core Features and Functionalities

FreshBooks stands out for its user-friendly interface and an array of features designed to simplify accounting processes for non-accountants. Some of its core features include:

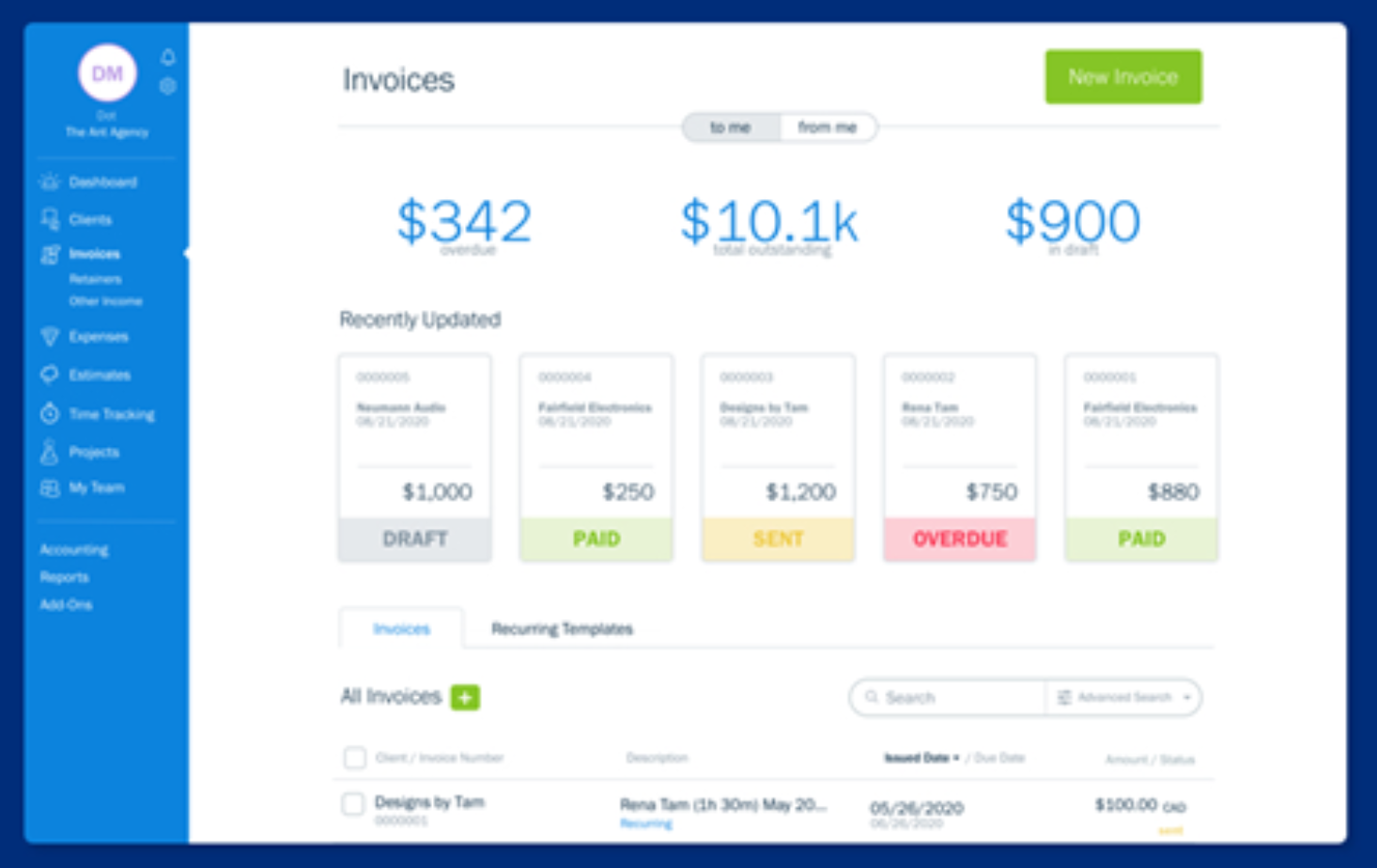

Invoicing: FreshBooks’ invoicing capabilities remain at the heart of its functionality. Users can easily create, customize, and send professional invoices to clients. The platform allows for recurring invoices, automatic payment reminders, and supports multiple currencies.

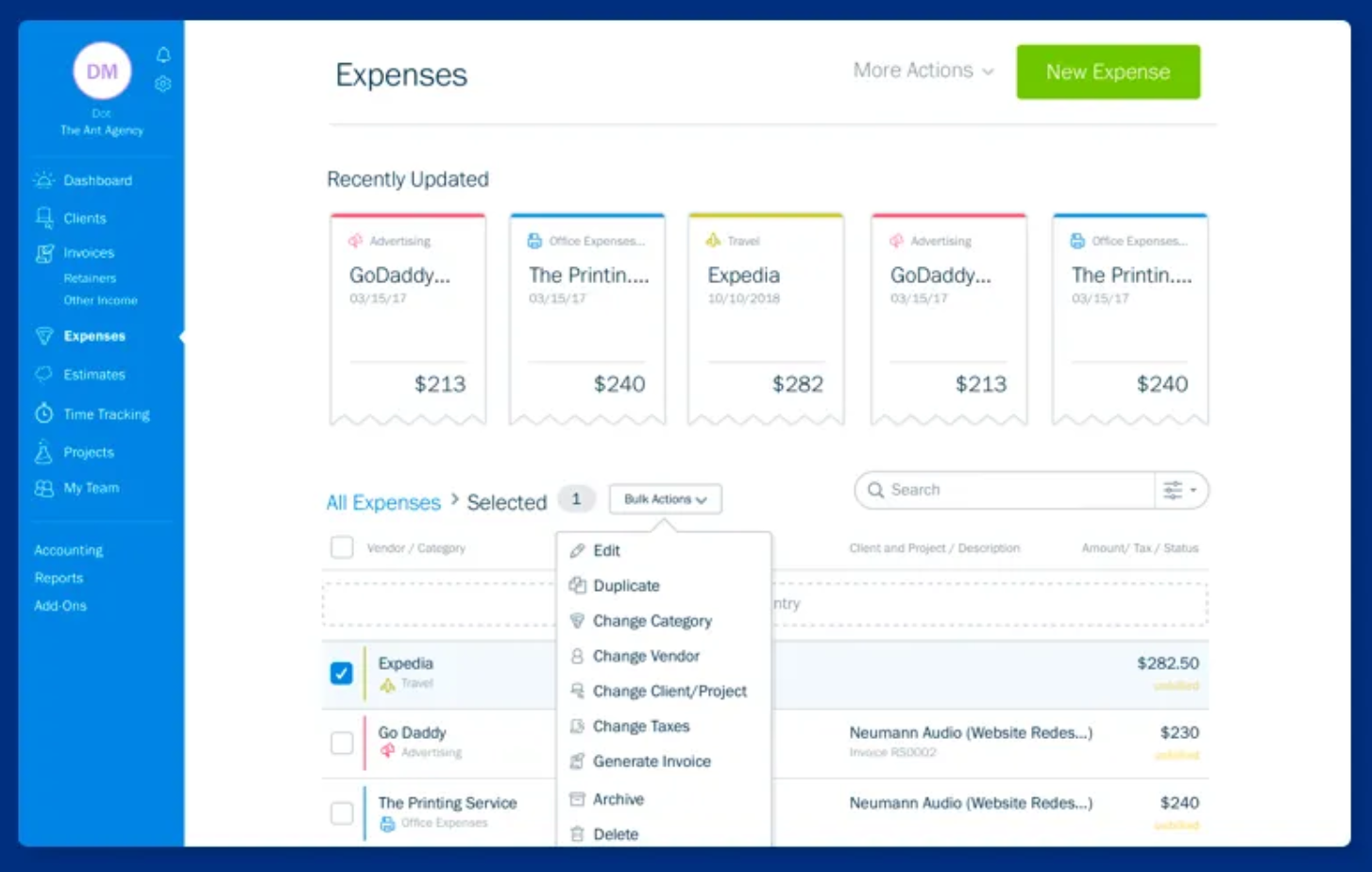

Expense Tracking: Tracking business expenses is made simple with FreshBooks. Users can categorize expenses, capture receipts using the mobile app, and reconcile transactions effortlessly. This feature provides a holistic view of a business’s financial health.

Time Tracking: FreshBooks enables users to track billable hours with its intuitive time-tracking feature. This is particularly useful for service-based businesses and freelancers who charge clients based on hours worked.

Reporting and Analytics: FreshBooks offers a range of financial reports that provide insights into a business’s performance. From profit and loss statements to expense reports, these tools empower users to make informed decisions and plan for the future.

Project Management: The platform includes project management tools that allow users to collaborate with team members, track project progress, and manage tasks efficiently. This integrated approach enhances overall productivity and communication.

Integration Capabilities: Recognizing the importance of a seamless workflow, FreshBooks integrates with various third-party applications such as payment gateways, CRM software, and e-commerce platforms. This ensures that users can connect FreshBooks with their existing tools, creating a unified business ecosystem.

FreshBooks has evolved from a simple invoicing tool into a comprehensive accounting solution that empowers small businesses and freelancers. Its user-friendly interface, coupled with a robust set of features, makes it a go-to choice for those seeking an efficient and accessible financial management solution. As FreshBooks continues to adapt to the ever-changing landscape of business, it remains a valuable asset for individuals and organizations looking to streamline their accounting processes.

FreshBooks as an Expense Management Solution

- Expense Tracking Capabilities:

FreshBooks offers robust expense tracking capabilities, allowing users to record and monitor their business expenditures efficiently. Users can easily input and categorize expenses within the FreshBooks platform. This includes a user-friendly interface that simplifies the process of entering expenses, making it accessible for individuals and businesses to keep a close eye on their financial outflows.

- Integration with Bank Accounts and Credit Cards:

To streamline the expense management process, FreshBooks integrates seamlessly with users’ bank accounts and credit cards. This integration automates the data entry process by importing transactions directly from these financial sources into the FreshBooks platform. This not only saves time but also reduces the likelihood of manual errors in recording expenses. It provides users with an up-to-date and accurate overview of their financial transactions.

- Customizable Expense Categories:

FreshBooks recognizes that businesses have diverse expense structures. To accommodate this, the platform offers customizable expense categories. Users can tailor expense categories to align with their specific business needs and industry requirements. This flexibility ensures that the expense management system is adaptable to different types of businesses, allowing for more personalized and accurate financial tracking.

FreshBooks serves as a comprehensive expense management solution by offering intuitive expense tracking features, seamless integration with bank accounts and credit cards, and the flexibility to customize expense categories. This combination of features simplifies the process of managing and monitoring expenses, providing businesses with the tools they need to maintain financial clarity and make informed decisions.

Setting Up Your FreshBooks Account for Expense Optimization

Account Configuration:

Creating and Customizing Your Account:

The first step in harnessing the power of FreshBooks for expense optimization is to create and customize your account. Begin by signing up and providing relevant business information. FreshBooks allows you to personalize your account by adding your company logo, setting up invoice templates, and configuring default settings. This not only enhances your brand identity but also streamlines the invoicing process, contributing to a more organized financial workflow.

Connecting Bank Accounts and Credit Cards:

To fully optimize expense tracking, integrating your bank accounts and credit cards with FreshBooks is essential. This seamless integration automates the process of importing transactions, reducing manual data entry and minimizing errors. FreshBooks supports connections with major banks and credit card providers, ensuring that your financial data is up-to-date and accurate. By automating the transaction import process, you gain real-time insights into your expenses, enabling proactive financial decision-making.

Configuring Expense Categories:

Tailoring expense categories to align with your business structure is a pivotal aspect of effective expense optimization. FreshBooks allows you to create and customize expense categories that match your specific needs. By organizing expenses into relevant categories, you gain a granular view of your spending patterns. This, in turn, facilitates better budgeting and financial planning. Take advantage of FreshBooks’ flexibility in configuring expense categories to ensure that your account reflects the unique financial landscape of your business.

User Permissions and Access Control:

Setting Up User Roles for Effective Collaboration:

Collaboration is key to successful financial management, especially in a business environment with multiple team members handling various aspects of the accounting process. FreshBooks provides a robust user management system that allows you to define roles and permissions for each user. Establishing roles such as administrator, accountant, or staff member ensures that responsibilities are clearly defined, promoting accountability and preventing unauthorized access to sensitive financial information.

Managing Access to Sensitive Financial Data:

FreshBooks prioritizes security, and as such, it offers granular control over who can access sensitive financial data. By setting up access controls, you can restrict certain users from viewing or modifying specific financial information. This feature is particularly valuable in safeguarding sensitive data, such as payroll information or confidential financial reports. FreshBooks’ user-friendly interface makes it easy to manage access permissions, providing a secure environment for collaborative financial management.

Setting up your FreshBooks account for expense optimization involves a strategic approach to account configuration and user permissions. By customizing your account settings, connecting bank accounts, and configuring expense categories, you create a foundation for streamlined and efficient expense tracking. Additionally, establishing user roles and managing access controls ensures that your financial data remains secure and accessible only to authorized personnel. As you embark on this journey to optimize your expenses with FreshBooks, these steps will empower you to make informed financial decisions, foster collaboration, and drive the success of your business.

Efficient Expense Tracking with FreshBooks

Recording Expenses:

Manual entry of expenses:

Users can manually input their expenses into the FreshBooks system. This can include details such as the date, amount, category, and any additional notes related to the expense. Manual entry provides flexibility for users to record various types of expenses accurately.

Uploading receipts and attaching documents:

FreshBooks allows users to upload digital copies of receipts and attach relevant documents to their expense entries. This feature helps in maintaining a digital record of all supporting documents, making it easier for users to track and verify expenses during audits or financial reviews.

Leveraging mobile apps for on-the-go expense tracking:

With FreshBooks mobile apps, users can conveniently track their expenses on the go. Whether it’s capturing a receipt using the phone’s camera or entering expenses in real-time, this feature ensures that users can stay up-to-date with their financial records no matter where they are.

Automation Features:

Auto-categorization of expenses:

FreshBooks employs automation to categorize expenses automatically. This reduces the manual effort required to categorize each expense individually. The system can learn from user behavior and previous categorizations to improve accuracy over time.

Bank reconciliation for accurate tracking:

The platform supports bank reconciliation, allowing users to match their recorded expenses with bank transactions. This helps ensure that all expenses are accurately accounted for and reduces the likelihood of errors in financial records.

Bulk expense uploads and edits:

FreshBooks enables users to upload multiple expenses simultaneously, streamlining the process for businesses with a high volume of transactions. Additionally, bulk editing features provide efficiency in managing and updating multiple expense entries at once, saving time and effort for users.

FreshBooks offers a comprehensive set of features for recording and tracking expenses efficiently. Whether through manual entry, mobile apps, or automation, users can manage their expenses with ease, ensuring accuracy and saving valuable time in the process.

Expense Reports and Analytics: A Comprehensive Overview

Generating Comprehensive Reports

- Profit and Loss Reports:

Profit and loss reports are foundational documents that provide a comprehensive overview of a company’s financial performance over a specific period. They outline revenues, costs, and expenses, allowing stakeholders to assess profitability.

These reports are crucial for identifying areas of financial strength and weakness, enabling businesses to make informed adjustments to their operations.

- Expense Breakdown by Category:

Understanding where and how money is spent is essential for budgetary control. Expense breakdown reports categorize expenditures, providing a detailed breakdown of costs across different facets of the business.

This level of granularity allows for targeted cost-cutting measures or reallocation of resources based on the priorities of the organization.

- Customized Reports for Specific Business Needs:

Recognizing the diversity of businesses, customizable reports cater to the unique needs of different organizations. Whether it’s tracking specific projects, departments, or expense types, customization enhances the relevance and applicability of the information presented.

Tailoring reports to address specific business needs fosters a more nuanced understanding of financial dynamics, empowering businesses to make strategic decisions aligned with their objectives.

- Analyzing Expense Trends

Beyond the creation of reports, the true value lies in the ability to glean meaningful insights from the data. Analyzing expense trends involves a multifaceted approach, including the following key elements:

Identifying Spending Patterns:

- Forecasting Future Expenses:

Leveraging historical data, businesses can forecast future expenses with greater accuracy. This foresight is invaluable for budgeting and resource planning.

Forecasting enables organizations to anticipate financial requirements, avoid cash flow bottlenecks, and make proactive decisions to mitigate potential financial challenges.

- Utilizing Insights for Strategic Decision-Making:

The ultimate goal of expense analytics is to provide actionable insights for strategic decision-making. Armed with a thorough understanding of financial data and spending trends, businesses can make informed choices that align with their overarching goals. Whether it’s expanding operations, optimizing resources, or adjusting pricing strategies, the insights derived from expense analytics empower businesses to navigate the complexities of the market with confidence.

The synergy between generating comprehensive reports and analyzing expense trends is indispensable for effective expense management. This process is not merely about recording financial transactions; it is a strategic imperative that enables businesses to navigate the ever-evolving landscape with agility and foresight. As technology continues to advance, businesses must harness the power of robust expense reporting and analytics to stay ahead in an increasingly competitive environment.

Integrations for Enhanced Expense Management

Third-Party Integrations:

- Connecting FreshBooks with Project Management Tools:

One of the key aspects of efficient expense management is the seamless collaboration between accounting and project management. Integrating FreshBooks with popular project management tools, such as Trello, Asana, or Jira, empowers businesses to synchronize financial data with project progress. This integration facilitates real-time tracking of expenses associated with specific projects, ensuring accurate budgeting and timely invoicing. Project managers can gain deeper insights into project costs, allocate resources effectively, and make informed decisions to enhance overall project efficiency.

- Integration with Payment Gateways for Seamless Transactions:

In the realm of financial transactions, the integration of FreshBooks with various payment gateways is pivotal. Enabling seamless transactions through popular gateways like PayPal, Stripe, or Square enhances the invoicing process. Clients can conveniently settle invoices using their preferred payment methods, resulting in quicker payment cycles. Furthermore, automated reconciliation of payments within FreshBooks reduces the risk of errors and improves overall financial accuracy.

- Syncing FreshBooks with CRM Systems:

Customer Relationship Management (CRM) systems play a crucial role in maintaining strong customer connections. Integrating FreshBooks with CRM platforms like Salesforce or HubSpot ensures a unified view of customer interactions and financial transactions. This synergy empowers sales and finance teams with comprehensive customer insights, enabling them to tailor their strategies for improved customer satisfaction. Additionally, it streamlines the invoicing process by automatically updating customer information and ensures consistency across all customer touchpoints.

API and Custom Integrations:

- Building Custom Workflows for Unique Business Requirements:

Every business has unique workflows and processes that may not align with off-the-shelf solutions. FreshBooks provides the flexibility to build custom workflows tailored to specific business requirements. Through custom integrations, businesses can automate intricate processes, such as expense approvals or vendor management, ensuring that the accounting system aligns seamlessly with the organization’s operational nuances. This not only enhances efficiency but also reduces the risk of manual errors associated with complex business processes.

- Leveraging FreshBooks API for Tailored Solutions:

FreshBooks offers a robust API (Application Programming Interface) that allows businesses to develop tailored solutions and integrations. This API empowers developers to create custom applications or connect FreshBooks with proprietary software, providing a bespoke experience. Whether it’s streamlining inventory management, integrating with proprietary reporting tools, or developing unique financial dashboards, leveraging the FreshBooks API offers limitless possibilities for businesses to enhance expense management according to their specific needs.

Integrating FreshBooks with third-party tools, payment gateways, and custom solutions is pivotal for achieving enhanced expense management. These integrations not only streamline financial processes but also contribute to improved collaboration, increased efficiency, and accurate decision-making. Businesses that leverage the full potential of integrations within the FreshBooks ecosystem are better positioned to navigate the complexities of modern expense management, ultimately driving success and sustainability in their operations.

Advanced Features for Expense Optimization in FreshBooks

Multi-Currency Support

One of the challenges in a globalized business environment is managing expenses in different currencies. FreshBooks addresses this complexity with its robust Multi-Currency Support feature. This functionality allows businesses to seamlessly manage expenses incurred in various currencies, eliminating the need for manual conversions and reducing the risk of errors.

Managing expenses in different currencies:

FreshBooks empowers users to input expenses in their original currency, providing a clear and accurate representation of the financial transactions. This feature simplifies the recording process for international expenses, ensuring that financial records accurately reflect the economic reality of the transactions.

Handling exchange rates within FreshBooks:

The platform dynamically updates exchange rates, ensuring that conversions are based on the most recent data. This real-time functionality not only enhances accuracy but also minimizes the impact of currency fluctuations on financial reporting. Users can confidently make informed decisions based on the most up-to-date financial information.

Project-Based Expense Tracking

For businesses engaged in multiple projects simultaneously, it is crucial to have a system that allows for the seamless allocation of expenses to specific projects. FreshBooks’ Project-Based Expense Tracking feature provides a solution that goes beyond basic expense management.

Allocating expenses to specific projects:

Users can easily assign expenses to specific projects within FreshBooks. This granular tracking capability ensures that businesses can accurately measure the financial impact of each project. By associating expenses directly with projects, businesses gain valuable insights into the cost structure of individual initiatives.

Analyzing project profitability through expense data:

The platform facilitates in-depth analysis by offering comprehensive reports that break down expenses on a per-project basis. This data-driven approach enables businesses to assess the profitability of each project, identify areas for cost optimization, and make informed decisions to maximize returns.

Expense Approval Workflows

Maintaining control and compliance with company policies is essential for effective expense management. The Expense Approval Workflows feature in FreshBooks ensures that all expenses undergo a structured approval process, promoting transparency and adherence to organizational guidelines.

Implementing approval processes for expenses:

FreshBooks allows businesses to establish customizable approval workflows. This means that expenses can be routed through a predefined chain of approvers, ensuring that each transaction aligns with company policies before being recorded. This not only reduces the risk of unauthorized spending but also streamlines the approval process.

Ensuring compliance with company policies:

By incorporating expense approval workflows, FreshBooks assists businesses in maintaining compliance with internal policies and regulatory requirements. The platform provides an audit trail, allowing organizations to trace the approval history of each expense. This transparency not only satisfies regulatory obligations but also enhances the overall integrity of financial processes.

Conclusion

In conclusion, FreshBooks serves as a powerful ally in optimizing business expenses. By understanding the platform’s features, implementing best practices, and leveraging advanced functionalities, businesses of all sizes can enhance their financial efficiency, ensure compliance, and unlock new levels of success. This guide aims to empower businesses to make the most of FreshBooks and embark on a journey toward sustainable growth through effective expense management.

FreshBooks streamlines expense tracking, categorization, and reporting. It allows you to easily capture and organize expenses, providing insights into where your money is going and helping you make informed financial decisions.

Yes, FreshBooks integrates with various banks, allowing you to automatically import transactions. This simplifies the expense tracking process and ensures accuracy in your financial records.

Absolutely. FreshBooks allows you to upload and attach receipts to your expenses. This ensures that you have proper documentation for tax purposes and compliance.

FreshBooks uses smart categorization algorithms to automatically categorize expenses based on transaction data. You can also customize categories to align with your specific business needs.

Yes, FreshBooks enables you to set spending limits for different expense categories. It provides alerts when you approach or exceed these limits, helping you stay within budget.

Absolutely. FreshBooks offers mileage tracking features, allowing you to log and calculate travel expenses easily. This is particularly useful for businesses with employees who travel frequently.

FreshBooks simplifies tax preparation by providing detailed expense reports. You can export these reports or share them directly with your accountant, streamlining the tax filing process.

Yes, FreshBooks offers a mobile app that allows you to manage expenses, capture receipts, and track your business finances from anywhere, providing flexibility for on-the-go entrepreneurs.

Certainly. FreshBooks provides tutorials, webinars, and a support team to help users effectively utilize the expense optimization features. Additionally, there’s an extensive knowledge base for self-help resources.