Understanding QuickBooks Year-End Closing

QuickBooks Year-End Closing is a critical process for businesses using QuickBooks accounting software. It marks the culmination of financial activities for the fiscal year and prepares the system for the upcoming year. This procedure ensures that financial records are accurate, up-to-date, and compliant with accounting standards. Let’s delve into the significance of QuickBooks Year-End Closing in more detail.

At the core of the Year-End Closing process is the need to finalize financial transactions and make necessary adjustments. This includes reconciling accounts, reviewing financial statements, and addressing any discrepancies. The goal is to present a clear and accurate financial snapshot of the business at the end of the fiscal year. By doing so, businesses can make informed decisions, comply with tax regulations, and provide stakeholders with reliable financial information.

One crucial aspect of QuickBooks Year-End Closing is the adjustment of accruals and prepayments. Accruals involve recognizing revenues and expenses that have been earned or incurred but not yet recorded. Prepayments, on the other hand, involve recognizing income or expenses that have been recorded but relate to the following fiscal year. Adjusting these accounts ensures that the financial statements accurately reflect the economic reality of the business.

Another key consideration during Year-End Closing is the reconciliation of bank and credit card accounts. This involves comparing the transactions recorded in QuickBooks with the actual transactions in bank and credit card statements. Any discrepancies need to be addressed and resolved to ensure the accuracy of financial data. Reconciliation is crucial for detecting errors, fraud, or unauthorized transactions.

In addition to financial adjustments, businesses using QuickBooks need to be mindful of inventory management during Year-End Closing. It’s essential to reconcile the physical inventory on hand with the inventory records in QuickBooks. This process helps identify any discrepancies and ensures that the financial statements accurately reflect the value of the inventory.

Furthermore, Year-End Closing involves reviewing and updating vendor and customer information. This includes verifying outstanding bills, invoices, and payments. It ensures that all financial transactions with vendors and customers are accurately recorded, helping maintain strong relationships and preventing any financial misunderstandings.

Lastly, QuickBooks Year-End Closing is an opportune time to generate and review various financial reports. These reports, such as profit and loss statements, balance sheets, and cash flow statements, provide valuable insights into the financial health of the business. Analyzing these reports can help identify trends, areas for improvement, and areas of success, enabling better strategic planning for the upcoming year.

QuickBooks Year-End Closing is a comprehensive process that goes beyond mere bookkeeping. It involves careful examination, adjustment, and reconciliation of financial data to ensure accuracy, compliance, and informed decision-making. Businesses that execute this process effectively set the stage for a successful start to the new fiscal year.

Importance of Year-End Closing

Year-end closing is a critical process for businesses that serves multiple purposes, each essential for the overall health and success of the organization. This period marks the conclusion of the fiscal year and involves several key tasks that contribute to the smooth functioning of a company’s financial operations.

Compliance Requirements:

One of the foremost reasons for the importance of year-end closing is ensuring compliance with various regulatory and legal requirements. Businesses are obligated to adhere to specific accounting standards and regulations set by governing bodies. Year-end closing allows companies to review their financial records meticulously, ensuring that they meet all necessary compliance standards. This is especially crucial for publicly traded companies, as accurate financial reporting is essential to maintaining transparency and building trust among shareholders, investors, and regulatory authorities.

Accurate Financial Reporting:

Year-end closing plays a pivotal role in generating accurate financial reports. Businesses rely on these reports to evaluate their performance, make informed strategic decisions, and communicate their financial standing to stakeholders. By meticulously closing out financial records at the end of the year, organizations can provide a clear and precise snapshot of their financial health. Accurate financial reporting not only facilitates internal decision-making but also helps build credibility with external parties, such as creditors, investors, and auditors, who depend on reliable financial information.

Preparation for Tax Season:

Another crucial aspect of year-end closing is preparing for the upcoming tax season. The accurate calculation and reporting of income, expenses, and other financial details are essential for filing tax returns. Businesses need to reconcile their accounts, identify deductible expenses, and ensure compliance with tax laws to minimize liabilities and avoid potential penalties. Year-end closing allows organizations to organize their financial data efficiently, making the tax preparation process smoother and less prone to errors. Proper tax planning during year-end closing can also help businesses take advantage of available tax credits and deductions.

The importance of year-end closing cannot be overstated. It is a comprehensive process that goes beyond mere bookkeeping, encompassing compliance, accurate financial reporting, and tax preparation. Businesses that prioritize and execute year-end closing effectively position themselves for sustained success by maintaining financial transparency, complying with regulations, and making informed strategic decisions based on reliable financial information.

Key Components of Year-End Closing

Year-end closing is a critical process for businesses and organizations, involving several key components that contribute to the accurate representation of financial activities. These components include closing the books, adjusting entries, and reviewing financial statements.

Closing the Books:

Closing the books is the foundational step in the year-end closing process. This involves finalizing all financial transactions for the fiscal year. The goal is to ensure that all revenue and expense accounts have been accurately recorded and that the financial records are up-to-date. Closing the books is a systematic procedure that involves closing temporary accounts, such as revenue and expense accounts, to the retained earnings account. This process helps create a clean slate for the upcoming fiscal year and is essential for accurate financial reporting.

Adjusting Entries:

Adjusting entries are necessary to reflect any transactions or events that occurred during the fiscal year but were not captured in the regular accounting cycle. These entries are crucial for maintaining the accuracy of financial statements. Common adjustments include accruals, deferrals, depreciation, and corrections of errors. By making these adjustments, the financial statements can more accurately represent the economic reality of the business, providing stakeholders with a true and fair view of its financial position. Adjusting entries also help align financial records with accounting principles and standards.

Reviewing Financial Statements:

After closing the books and making necessary adjustments, the next step is to review the financial statements. Financial statements, such as the income statement, balance sheet, and statement of cash flows, provide a comprehensive overview of the organization’s financial performance and position. During the year-end closing process, it is crucial to scrutinize these statements for accuracy and consistency. This involves comparing current financial data with previous periods, identifying trends, and ensuring that the financial statements comply with accounting principles and regulations. The review process is an integral part of financial management and serves as the basis for decision-making by management, investors, and other stakeholders.

Preparing for Year-End Closing in QuickBooks

Backup and Data Verification

Data integrity is crucial in financial management, and as the year comes to a close, preparing for year-end closing in QuickBooks involves several essential steps. One of the foundational aspects is ensuring a robust backup system is in place. The importance of data backup cannot be overstated, as it acts as a safety net against potential data loss. QuickBooks allows users to create comprehensive backups that include financial data, transactions, and other critical information. This step is vital to safeguard financial records and ensure a smooth transition into the new fiscal year.

In addition to backing up data, running data verification tools is an integral part of the year-end closing process in QuickBooks. These tools help identify and rectify any discrepancies or errors in the financial data. QuickBooks provides built-in verification tools that can reconcile accounts, verify transactions, and ensure the accuracy of the entire dataset. This meticulous data verification process contributes to the reliability of financial reports and ensures that the company’s financial records align with the actual state of its finances.

Taking the time to perform thorough data verification not only enhances the accuracy of financial reporting but also contributes to the overall integrity of the accounting system. By addressing any inconsistencies early in the process, businesses can avoid complications during audits or regulatory reviews, fostering transparency and compliance.

Reviewing transactions

Reviewing transactions is a crucial step in financial management, ensuring the accuracy and integrity of recorded financial data. This process involves a comprehensive examination of all financial transactions within a specified period. Businesses and individuals perform transaction reviews to identify discrepancies, errors, or irregularities that may impact the overall financial health.

During the review, meticulous attention is given to each transaction, including purchases, sales, expenses, and income. The goal is to ensure that all entries are correctly categorized, properly documented, and accurately reflect the financial activities of the entity. This process helps in maintaining the reliability of financial statements and reports, providing stakeholders with a clear and transparent view of the financial performance.

Identifying and correcting errors is a critical component of the transaction review process. Errors can occur due to various reasons such as data entry mistakes, system glitches, or misunderstandings in the accounting process. The identification of errors involves cross-referencing transactions with supporting documentation, comparing entries with established financial policies, and conducting thorough analyses to pinpoint inaccuracies.

Once errors are identified, the next step is correction. This may involve adjusting entries, reclassifying transactions, or updating records to rectify the inaccuracies. Timely and accurate error correction is essential for maintaining the integrity of financial records and preventing the propagation of inaccuracies throughout the accounting system.

Reconciling bank and credit card accounts is another crucial aspect of financial management. This process involves comparing the transactions recorded in an organization’s accounting system with the corresponding entries in bank and credit card statements. Discrepancies between the two sets of records are investigated and resolved during the reconciliation process.

Bank and credit card reconciliation serves multiple purposes, including detecting unauthorized transactions, ensuring that all financial activities are accurately captured, and identifying any discrepancies that may indicate fraudulent activities. Additionally, reconciling accounts helps in tracking cash flow, managing liquidity, and providing a clear picture of an entity’s financial position.

Updating Records

Updating records is a crucial aspect of managing information within any organization. This process involves making changes or modifications to existing data to ensure accuracy and relevance. In a business context, updating records typically pertains to customer and vendor information, as well as inventory adjustments.

Customer and Vendor Information:

Maintaining accurate and up-to-date customer and vendor information is essential for effective business operations. Organizations need to track changes in customer details, such as contact information, billing addresses, and preferences. Likewise, staying informed about vendor updates, such as pricing, contact persons, and payment terms, is crucial for establishing and sustaining successful partnerships. Regularly updating these records helps businesses enhance customer relationships, streamline communication, and ensure smooth transactions with vendors.

Inventory Adjustments:

Inventory management is a key aspect of running a successful business, and keeping inventory records current is vital for maintaining optimal stock levels. Inventory adjustments involve updating records to reflect changes in stock quantities, such as additions, deletions, or corrections. This process helps businesses avoid stockouts, reduce carrying costs, and improve overall operational efficiency. Timely and accurate updates to inventory records also enable organizations to make informed decisions about purchasing, production, and order fulfillment, ultimately contributing to better customer service.

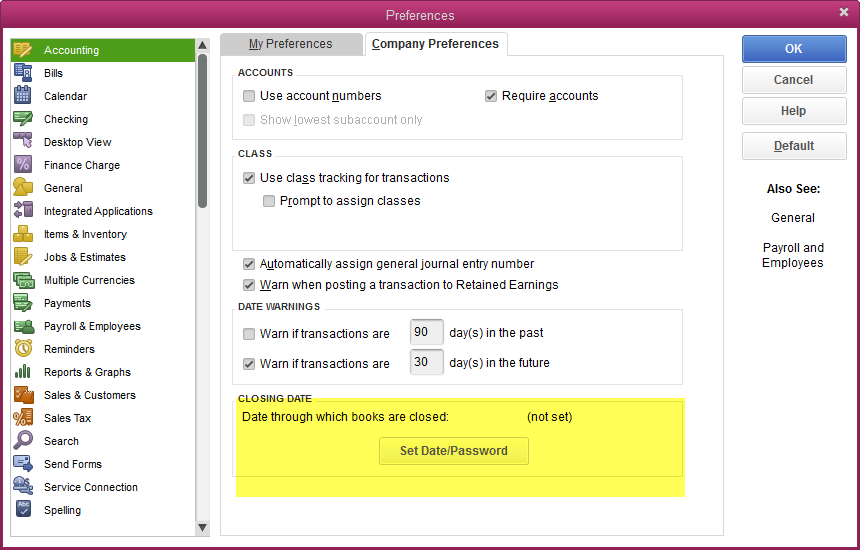

QuickBooks Closing Procedures

Closing the books in QuickBooks is a crucial accounting process that involves several key procedures to ensure the accuracy and integrity of financial records. This involves utilizing tools such as the “Close Company File” tool and reviewing closing date settings.

Closing the Books:

Closing the books refers to the process of finalizing financial transactions for a specific period, typically at the end of a fiscal year. This involves ensuring that all income and expense accounts are accurately recorded and that the financial statements reflect the true financial position of the company. QuickBooks provides a user-friendly feature known as the “Close Company File” tool to facilitate this process.

Explanation of the Close Company File tool:

The Close Company File tool in QuickBooks is designed to help businesses prevent accidental changes to financial data after a certain point in time. When this tool is used, it restricts the modification of transactions dated on or before the specified closing date. This is particularly useful in maintaining data integrity and preventing unauthorized alterations to historical financial information. By utilizing this tool, businesses can have confidence in the accuracy of their financial reports.

Reviewing closing date settings:

Before initiating the closing process, it is essential to review and set the closing date in QuickBooks. The closing date represents the last day of the fiscal year or accounting period, and it signifies the point at which financial data is considered final. QuickBooks allows users to customize closing date settings to align with their specific business requirements. During the review of closing date settings, users can verify that the chosen date accurately reflects the end of the financial reporting period and adjust it if necessary.

QuickBooks closing procedures involve a meticulous approach to ensure the completeness and accuracy of financial records. The Close Company File tool and the review of closing date settings play pivotal roles in safeguarding the integrity of financial data, preventing inadvertent modifications, and providing a clear demarcation for the conclusion of a fiscal period. This attention to detail is essential for businesses to generate reliable financial statements and comply with accounting standards.

Tips and Best Practices

Communicating with Stakeholders

Effective communication with stakeholders is crucial during the closing process. Team members should be promptly notified about impending closings to ensure everyone is on the same page and can plan accordingly. This involves transparently sharing timelines, expectations, and any necessary actions that team members may need to take.

Furthermore, keeping stakeholders informed about changes is equally important. This includes not only the closure itself but any modifications in processes, systems, or personnel that may impact the overall workflow. Regular updates foster a collaborative environment, reduce uncertainties, and promote a sense of ownership among team members.

Utilizing Reporting Tools

The use of reporting tools plays a pivotal role in the efficiency of year-end financial processes. Generating comprehensive year-end financial reports allows for a detailed analysis of the company’s financial health. These reports provide valuable insights into revenue, expenses, and overall financial performance, aiding decision-makers in strategic planning and forecasting.

Customizing reports for specific needs is another best practice. Different stakeholders may require distinct sets of information. Tailoring reports ensures that each stakeholder receives the relevant data pertinent to their roles or interests. This personalized approach enhances the usability and relevance of the information provided through reporting tools.

Staying Compliant with Tax Regulations

Adhering to tax regulations is paramount for any organization, and staying informed about updates in the tax code is a fundamental aspect of compliance. Understanding tax code updates ensures that the organization incorporates any changes into its financial practices, minimizing the risk of non-compliance and associated penalties.

Ensuring accurate payroll tax reporting is a specific focus within tax compliance. Mistakes in payroll tax reporting can lead to serious legal and financial consequences. Therefore, implementing robust systems and processes to guarantee accuracy in payroll tax reporting is essential. This involves regular audits, staying updated on tax law changes, and employing professionals with expertise in tax regulations.

Effective communication, efficient use of reporting tools, and strict adherence to tax regulations are integral components of a successful year-end closing process. These best practices contribute to the overall financial health of the organization, promote transparency, and mitigate risks associated with non-compliance or misinformation.

QuickBooks Closing Procedures:

In the realm of accounting, QuickBooks is a widely used software that facilitates efficient financial management for businesses. QuickBooks closing procedures are a crucial step in ensuring the accuracy and completeness of financial records. These procedures involve several key components, including making adjusting entries and handling depreciation.

Making Adjusting Entries:

Adjusting entries is essential for bringing the financial records up to date and reflecting the true financial position of a business. The first step in QuickBooks closing procedures is identifying necessary adjustments. This may include correcting errors, recognizing accrued expenses or revenues, and adjusting for any discrepancies in the financial statements. Once these adjustments are identified, they are entered into QuickBooks through adjusting journal entries. This meticulous process ensures that the financial statements provide an accurate representation of the company’s financial health.

Handling Depreciation:

Depreciation is a critical accounting concept that reflects the allocation of the cost of tangible assets over their useful life. QuickBooks closing procedures involve handling depreciation by updating fixed asset records and verifying depreciation schedules. Updating fixed asset records entails adjusting the book value of assets to account for depreciation, which is crucial for presenting an accurate balance sheet. Verifying depreciation schedules ensures that the calculated depreciation aligns with accounting principles and the actual wear and tear of the assets.

QuickBooks closing procedures are a systematic approach to finalizing financial records. Making adjusting entries addresses any discrepancies or errors while handling depreciation ensures that fixed assets are accurately reflected in the financial statements. These steps contribute to the production of reliable and transparent financial reports, aiding businesses in making informed decisions and meeting regulatory requirements.

Post-Closing Activities

Post-closing activities in business play a crucial role in maintaining organized and efficient financial records. These activities are essential to ensure a smooth transition from one fiscal year to the next. The two main components of post-closing activities are archiving and storing data, and planning for the next fiscal year.

Archiving and Storing Data:

One fundamental post-closing activity is the creation of a secure data archive. This involves systematically storing financial records and documents in a safe and easily accessible manner. Archiving ensures that important data is preserved for compliance purposes, audits, and historical analysis. By securely archiving data, a company can mitigate the risk of losing critical information and maintain transparency in its financial reporting.

Another key aspect of archiving is documenting the year-end closing process for future reference. This documentation serves as a valuable resource for training new personnel or refreshing the memory of existing staff on the specific procedures followed during the year-end closing. Comprehensive documentation contributes to knowledge continuity within the organization, promoting consistency and accuracy in financial reporting over time.

Planning for the Next Fiscal Year:

After completing the year-end closing, it is essential to engage in proactive planning for the upcoming fiscal year. This involves a thoughtful review of lessons learned from the previous year. By analyzing successes and challenges encountered during the year-end closing process, the organization can identify areas for improvement and implement strategies to enhance efficiency and accuracy in future closings.

Setting up the new fiscal year in accounting software, such as QuickBooks, is a critical step in planning for the future. This includes configuring accounts, updating financial parameters, and ensuring that the system is aligned with any changes in the business’s structure or financial goals. Properly setting up the new fiscal year streamlines financial operations and enables the organization to start the year with accurate and up-to-date financial information.

Post-closing activities are integral to the financial management of any business. Archiving and storing data ensures the preservation of crucial information while planning for the next fiscal year and allows for continuous improvement and preparation for future financial challenges. These activities collectively contribute to the overall stability and success of the organization’s financial management processes.

Conclusion

In conclusion, mastering the QuickBooks Year-End Closing process is essential for businesses seeking financial accuracy, compliance, and a smooth transition into the new fiscal year. This comprehensive guide has explored the importance of year-end closing, provided step-by-step procedures, and offered valuable tips and best practices. By following these guidelines, businesses can navigate the complexities of QuickBooks Year-End Closing with confidence, ensuring a solid financial foundation for the future.