Introduction:

Retirement planning stands as a cornerstone for individuals charting their financial destinies, a truth especially poignant for small business owners and entrepreneurs. In the intricate dance of business ownership, where every decision reverberates through personal and professional realms, securing one’s financial future requires meticulous planning. This introduction unravels the tapestry of retirement planning, spotlighting the unique challenges faced by entrepreneurs and the instrumental role FreshBooks plays in fostering financial security.

The Importance of Retirement Planning for Small Business Owners

Embarking on the entrepreneurial journey is a bold venture, but amidst the hustle and bustle of daily operations, the significance of retirement planning can be overshadowed. Small business owners navigate a dynamic landscape, where the seeds sown today blossom into the fruits of tomorrow’s financial security. This section delves into why retirement planning is not just a financial exercise but a strategic move for long-term prosperity.

Challenges of Retirement Planning for Entrepreneurs

Entrepreneurs, with their visionary zeal and relentless pursuit of goals, often encounter unique challenges in the realm of retirement planning. The irregular income streams, the intricacies of business valuation, and the blurred lines between personal and business finances paint a complex picture. Here, we unravel the hurdles entrepreneurs face, shedding light on the intricacies that demand tailored solutions.

How FreshBooks Can Help with Retirement Planning

FreshBooks emerges as a beacon of support amidst the challenges of retirement planning for entrepreneurs. This segment outlines the features and functionalities within FreshBooks that cater specifically to the needs of small business owners. From streamlined financial tracking to strategic planning tools, FreshBooks becomes a partner in navigating the intricate journey towards a well-deserved retirement.

Benefits of Using FreshBooks for Retirement Planning

FreshBooks transcends traditional accounting software, evolving into a holistic financial ally for entrepreneurs eyeing retirement. This section articulates the tangible benefits of incorporating FreshBooks into the retirement planning arsenal. Efficiency, accuracy, and strategic insights converge as FreshBooks empowers users to sculpt a robust financial future.

As we embark on this exploration of retirement planning intricacies, challenges, and solutions, keep an eye on the pivotal role FreshBooks plays in harmonizing the financial symphony of small business owners and entrepreneurs. Let this journey unfold, revealing not just the importance of retirement planning but the indispensable role FreshBooks plays in transforming financial aspirations into concrete realities.

Understanding Your Financial Position with FreshBooks

Navigating the intricate landscape of personal finance requires a keen understanding of your financial position, a task made seamless with the aid of powerful tools like FreshBooks. In this exploration, we delve into the depths of financial analysis, utilizing FreshBooks reports to dissect the income statement, balance sheet, and cash flow statement. As we unravel the intricacies, the focus remains on empowering individuals with the insights necessary for effective retirement planning.

Using FreshBooks to Generate Key Financial Reports

FreshBooks serves as a financial compass, guiding users through the creation of key financial reports crucial for a comprehensive analysis. This section offers a step-by-step guide on leveraging FreshBooks to generate reports that lay the foundation for sound retirement planning. From income statements providing a snapshot of revenue and expenses to balance sheets outlining assets and liabilities, FreshBooks transforms raw financial data into actionable insights.

Analyzing Your Income Statement for Retirement Planning

The income statement, a dynamic reflection of financial performance, plays a pivotal role in retirement planning. Here, we dissect the components of an income statement and demonstrate how FreshBooks transforms raw data into a coherent narrative. Unveiling the power of profit and loss analysis, we explore how a meticulous examination of revenue and expenses sets the stage for informed decisions on retirement contributions, investment strategies, and income sustainability.

Assessing Your Balance Sheet for Long-Term Financial Health

A robust retirement plan requires a foundation of long-term financial health, a status intricately linked to the elements embedded in the balance sheet. This segment provides insights into interpreting balance sheets through the lens of retirement planning. FreshBooks, with its user-friendly interface, transforms the often daunting task of asset and liability assessment into a strategic exercise, enabling individuals to gauge their financial standing with precision.

Understanding Your Cash Flow and Its Impact on Retirement Planning

Cash flow, the lifeblood of financial stability, takes center stage as we explore its profound impact on retirement planning. Delving into the intricacies of cash flow statements, we showcase how FreshBooks unveils the ebbs and flows of financial resources. Understanding cash inflows and outflows becomes pivotal in crafting a retirement strategy that aligns with lifestyle expectations and ensures a steady stream of income in the post-professional years.

In this comprehensive exploration, we unravel the threads of financial analysis, intertwining the capabilities of FreshBooks with the nuances of retirement planning. As you embark on this journey of understanding your financial position, let the insights garnered guide you towards a retirement characterized not just by financial security but by the freedom to embrace life’s myriad possibilities.

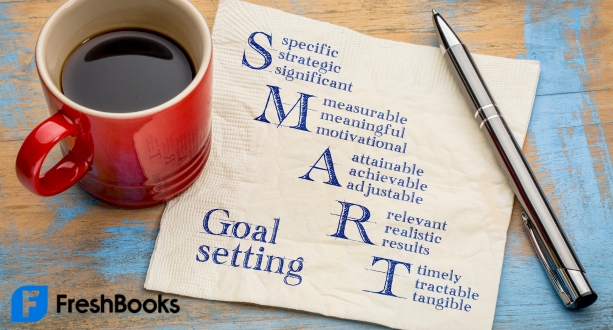

Setting SMART Retirement Goals

Introduction:

Imagine your ideal retirement: sipping margaritas on a tropical beach, exploring ancient ruins, or simply spending quality time with loved ones. The freedom and possibilities are endless, but turning that dream into reality requires a roadmap – one paved with SMART goals and powered by FreshBooks.

This section empowers you, the small business owner or entrepreneur, to transform your retirement aspirations into measurable, achievable milestones using the proven SMART framework. With FreshBooks as your financial navigator, you’ll learn to chart your course, monitor your progress, and adjust your sails for a smooth and satisfying voyage towards financial freedom.

Defining Your Desired Retirement Lifestyle (400 words):

Before setting specific goals, take time to visualize your ideal retirement. Do you crave adventure and exotic locales? Dream of a cozy cabin in the woods? Or perhaps spending more time with family is your top priority. Clearly defining your desired lifestyle helps determine your financial needs and sets the foundation for your SMART goals.

FreshBooks Tools for Lifestyle Analysis:

- Expense tracking: Categorize your spending to understand where your money goes and identify areas for potential savings.

- Cash flow analysis: Analyze your income and expenses to gauge your current spending habits and estimate future cash flow in retirement.

- Budgeting tools: Project your future income and expenses based on your desired lifestyle, allowing you to set realistic goals and budget accordingly.

Crafting SMART Goals for Retirement Savings

With your ideal lifestyle in mind, it’s time to translate your dreams into concrete goals using the SMART framework:

- Specific: Instead of a vague “save for retirement,” specify your target amount. Aim for a percentage of your current income or a specific monthly contribution.

- Measurable: Track your progress! FreshBooks reports and projections help you monitor your savings accumulation and stay motivated.

- Attainable: Set realistic goals based on your current income, financial obligations, and risk tolerance. Utilize FreshBooks’ budgeting tools to ensure your goals are achievable.

- Relevant: Your goals should align with your desired lifestyle and overall financial plan.

- Time-bound: Set deadlines for reaching your milestones. Aim for short-term and long-term goals to maintain momentum and track progress.

FreshBooks Features for Goal Tracking

- Goal setting tools: Set specific savings targets and track your progress in real-time with visually appealing graphs and charts.

- Automated contributions: Schedule automatic transfers from your business account to your retirement savings, ensuring consistent progress towards your goals.

- Investment tracking: Integrate your investment accounts with FreshBooks to monitor your portfolio performance and adjust your strategy as needed.

Utilizing FreshBooks Projections to Monitor Progress

FreshBooks isn’t just about recording past transactions; it’s your partner in financial forecasting. Utilize its powerful projection tools to:

- Estimate future income: Based on historical data and market trends, project your future income to guide your savings goals.

- Simulate different scenarios: Play “what if” with various retirement ages, savings rates, and investment returns to gain valuable insights and adjust your goals accordingly.

- Track progress towards milestones: Monitor how your actual savings compare to your projected goals, identifying any deviations and making adjustments when needed.

FreshBooks Insights for Goal Adjustments

Life and markets shift, and so should your goals. Regularly analyze your financial situation and adjust your retirement plan as needed:

- Review your financial statements: Analyze your income statement, balance sheet, and cash flow statement to identify any changes in your financial health that might impact your goals.

- Reassess your lifestyle priorities: Your desired retirement lifestyle might evolve over time. Re-evaluate your priorities and adjust your goals accordingly.

- Adapt to market fluctuations: Economic changes can impact your potential returns. Utilize FreshBooks to monitor your investments and adjust your strategy as needed.

Remember, your retirement goals are a living document, not a set-and-forget blueprint. FreshBooks empowers you to adapt, refine, and ultimately achieve your financial freedom with continuous analysis and adjustments.

Conclusion:

By setting SMART goals, utilizing FreshBooks’ powerful tools, and staying adaptable, you can transform your retirement dreams into a tangible roadmap to financial freedom. Embrace the journey, leverage FreshBooks as your financial co-pilot, and sail towards a future filled with security, fulfillment, and endless possibilities.

Leveraging FreshBooks for Tax-Efficient Retirement Savings:

As a small business owner or entrepreneur, you wear many hats – CEO, marketer, salesperson, and now, retirement planner. But navigating the intricacies of tax-efficient retirement savings can feel like deciphering ancient hieroglyphics. Fear not, for FreshBooks comes to the rescue, your financial Rosetta Stone for unlocking the secrets of maximizing your retirement savings and reducing your tax burden.

Unearthing the Tax Treasures of Retirement Accounts

Not all retirement accounts are created equal, especially when it comes to tax advantages. Let’s explore the hidden gems you can access through your small business:

- Simplified Employee Pension (SEP IRA): A simple and accessible option, the SEP IRA allows you to contribute up to 25% of your net earnings (capped at $66,000 in 2024) for yourself and your employees. The best part? These contributions are tax-deductible, lowering your taxable income and putting more money towards your golden years.

- Solo 401(k): Ideal for solopreneurs and businesses with no employees, the Solo 401(k) offers higher contribution limits ($63,500 for individuals under 50 in 2024) than the SEP IRA. Similar to a traditional 401(k), you can choose pre-tax or Roth contributions, allowing you to optimize your tax strategy based on your current and future income bracket.

Choosing the Right Account for You

Choosing the right retirement account depends on your unique circumstances and financial goals. FreshBooks makes it easy to:

- Compare contribution limits: Utilize FreshBooks’ financial reports to analyze your income and determine the maximum contributions you can make to each account.

- Assess your tax strategy: Consult with a financial advisor to understand how pre-tax and Roth contributions impact your current and future tax situations.

- Consider your business growth: If you plan to hire employees in the future, a SEP IRA might be a simpler option initially, while a Solo 401(k) offers greater flexibility and higher contribution limits as your business scales.

FreshBooks: Your Automated Powerhouse for Retirement Contributions

Say goodbye to manual calculations and missed deadlines! FreshBooks streamlines your retirement saving journey with:

- Automated contributions: Schedule recurring transfers from your business account to your chosen retirement account, ensuring consistent growth towards your golden nest egg.

- Expense tracking and categorization: Categorize your business expenses accurately, providing the foundation for calculating your net earnings and maximizing your SEP IRA contributions.

- Tax reporting tools: Generate comprehensive tax reports that seamlessly integrate with your chosen tax software, saving you time and ensuring accurate filing.

Optimizing Your Deductions:

FreshBooks isn’t just about saving; it’s about savvy tax optimization. Leverage its features to:

- Track all eligible expenses: Ensure you’re not missing out on potential deductions related to your business and retirement planning.

- Categorize deductions meticulously: FreshBooks’ detailed expense categorization helps you claim every eligible deduction with accuracy and ease.

- Maximize business deductions: Analyze your expenses to identify opportunities for business deductions that further reduce your taxable income and increase your retirement savings potential.

Remember, tax laws can be complex, and consulting with a qualified financial advisor is crucial for optimal tax planning. But with FreshBooks as your financial ally, you can confidently navigate the landscape of retirement accounts, automate your contributions, and squeeze every penny of tax advantage out of your small business.

Conclusion:

By leveraging FreshBooks’ powerful suite of tools, you can transform your retirement savings from a daunting chore into a tax-optimized journey towards financial freedom. Choose the right account, automate your contributions, and claim every eligible deduction – all while focusing on what you do best: running your thriving small business. With FreshBooks at your side, the future you deserve, filled with sunny beaches or mountain adventures, is closer than you think.

Building a Diversified Investment Portfolio with FreshBooks: Your Key to Long-Term Growth

Imagine your retirement nest egg as a beautiful mosaic. Each piece, a carefully chosen investment, contributes to a vibrant and resilient whole. But to weather the storms of market fluctuations and achieve long-term growth, diversification is your essential grout – holding everything together and ensuring your financial future shines.

In this section, you, the savvy small business owner or entrepreneur, will learn how to build a diversified investment portfolio with FreshBooks as your guide. We’ll explore the power of diversification, tailor your portfolio to your risk tolerance, leverage FreshBooks’ integrations with financial platforms, and equip you with the tools to monitor and adjust your investments over time.

The Power of Diversification

Putting all your eggs in one basket might seem tempting, but it’s a recipe for financial disaster. Diversification, the art of spreading your investments across different asset classes, industries, and geographic regions, is your key to long-term growth and risk mitigation.

- Reduced volatility: When one asset class dips, others might rise, offsetting losses and safeguarding your overall portfolio value.

- Enhanced returns: Diversification opens doors to a wider range of potential returns, allowing you to capture opportunities across different markets.

- Peace of mind: Knowing your investments are spread across various sectors provides a sense of security and reduces stress during market downturns.

Crafting Your Portfolio: Risk Tolerance

Your ideal investment portfolio should reflect your unique risk tolerance. Consider these factors:

- Age and time horizon: The closer you are to retirement, the less risk you might be comfortable with.

- Financial goals: Are you aiming for aggressive growth or income generation?

- Financial situation: Your current income and savings dictate your risk-taking capacity.

Once you understand your risk tolerance, you can determine your asset allocation – the percentage of your portfolio invested in different asset classes like stocks, bonds, real estate, and alternative investments. FreshBooks’ financial analysis tools help you understand your current financial situation and provide a foundation for making informed investment decisions.

FreshBooks Integrations: Your Powerhouse for Portfolio Management

FreshBooks integrates seamlessly with popular financial platforms like Mint, Personal Capital, and Yodlee, allowing you to:

- Aggregate your investments in one place: Gain a holistic view of your entire portfolio, including assets held outside of FreshBooks.

- Track performance and monitor progress: Analyze your portfolio’s performance against your goals and adjust your strategy as needed.

- Automate tasks and rebalancing: Set up automatic rebalancing based on your desired asset allocation, ensuring your portfolio stays on track.

Monitoring and Adjusting: The Art of Staying Agile

Markets are dynamic, and your investment portfolio needs to adapt. Regularly monitor your investments:

- Review your asset allocation: Ensure your portfolio aligns with your changing risk tolerance and financial goals.

- Rebalance your portfolio: Adjust your holdings to maintain your desired asset allocation, preventing overexposure to any one sector.

- Seek professional advice: Consult with a financial advisor for personalized guidance and adjustments based on your specific circumstances.

Remember, building and managing a diversified investment portfolio is a journey, not a destination. FreshBooks provides the tools and integrations to empower you every step of the way. Embrace the power of diversification, tailor your investments to your risk tolerance, and keep your portfolio agile for long-term growth and a secure financial future.

Budgeting for Retirement with FreshBooks

The journey to a secure retirement starts with a single step – creating a realistic budget. It might seem daunting, but with FreshBooks as your financial co-pilot, navigating the terrain of retirement planning becomes a breeze. In this section, you’ll discover how to:

- Craft a Budget that Embraces Your Present and Future: Forget generic templates! FreshBooks empowers you to create a personalized budget that balances your current needs with your future aspirations. Analyze your income and expenses through detailed reports, categorize them meticulously, and identify areas where you can optimize your spending.

- Harness the Power of FreshBooks Budgeting Tools: Forget spreadsheets and sticky notes! FreshBooks offers intuitive budgeting tools that make managing your finances a joy. Set your retirement savings goals as a budget category, track your progress towards them in real-time with visually appealing graphs, and receive alerts when you’re nearing your limits.

- Become a Savvy Expense Tracker: Every penny counts! FreshBooks helps you identify areas where you can trim unnecessary expenses. Analyze your spending habits by category, discover hidden subscriptions, and explore alternative options for everyday purchases. Remember, even small savings add up significantly over time, fueling your retirement nest egg.

- Adapt and Conquer: The Art of Budget Flexibility: Life is dynamic, and so should your budget. FreshBooks allows you to adjust your budget as your income and expenses change. Unexpected expenses? No problem! Simply adjust your categories and savings goals to maintain your financial equilibrium.

FreshBooks is your financial compass, guiding you towards a secure and fulfilling retirement. Remember, budgeting isn’t about deprivation; it’s about making conscious choices and prioritizing your future well-being. With FreshBooks by your side, you can chart a course towards financial freedom, one smart spending decision at a time.

Seeking Professional Advice and Resources

While FreshBooks empowers you to take charge of your financial future, there are times when expert guidance can make all the difference. This section helps you navigate additional resources and support for your retirement planning journey.

Consulting a Financial Advisor:

For personalized strategies and in-depth analysis, consider consulting a qualified financial advisor. They can:

- Review your financial situation: Analyze your income, expenses, assets, and liabilities to tailor a retirement plan to your specific needs and risk tolerance.

- Develop investment strategies: Recommend suitable investment vehicles based on your goals and risk appetite.

- Monitor and adjust your plan: Provide ongoing guidance and adjust your strategy as your life and economic conditions evolve.

Online Resources and Tools:

Don’t underestimate the power of online resources! Utilize valuable tools like:

- Retirement calculators: Estimate your future retirement income needs and project potential returns on your investments.

- Investment guides: Stay informed about market trends and different investment options.

- Financial blogs and podcasts: Access valuable insights and tips from financial experts.

FreshBooks Support:

Remember, you’re not alone on your journey! FreshBooks customer service is ready to answer your questions about the platform’s retirement planning features, from budgeting tools to integrations with financial platforms.

Remember, seeking professional advice and utilizing comprehensive resources can significantly enhance your retirement planning success. Don’t hesitate to get expert guidance, stay informed, and leverage the full potential of FreshBooks and other helpful tools. By combining your own initiative with valuable external support, you can confidently craft a secure and fulfilling retirement plan.

Conclusion

In conclusion, FreshBooks emerges not merely as an accounting platform but as a strategic ally in the pursuit of a secure and fulfilling retirement. As we traverse the landscape of retirement planning, the integration of FreshBooks becomes a beacon, illuminating the path with user-friendly tools, insightful reports, and a holistic approach to financial management.

The importance of retirement planning for small business owners and entrepreneurs cannot be overstated, and FreshBooks proves its mettle by addressing the unique challenges faced by this dynamic group. It transforms the complexities of financial statements into actionable intelligence, empowering users to make informed decisions that resonate well into their retirement years.

From navigating income statements to assessing balance sheets and understanding the ebb and flow of cash, FreshBooks becomes a key player in the intricate dance of retirement planning. This conclusion serves not just as the endpoint of our exploration but as a launching pad for small business owners and entrepreneurs, propelling them towards a retirement characterized by financial security, peace of mind, and the freedom to savor the fruits of their hard work. With FreshBooks as a trusted companion, the journey towards retirement becomes not just a financial endeavor but a strategic pursuit of lifelong prosperity.