Introduction to QuickBooks Setup

QuickBooks, developed by Intuit, is a powerful accounting software that has revolutionized the way businesses manage their finances. Whether you are a small business owner or a seasoned entrepreneur, setting up QuickBooks correctly is crucial for accurate financial management.

Understanding QuickBooks:

Before delving into the setup and installation services, it’s essential to have a basic understanding of what QuickBooks is and how it can benefit your business. QuickBooks is an accounting software that simplifies financial tasks, allowing businesses to track expenses, create invoices, manage payroll, and generate insightful reports. It comes in various versions, including QuickBooks Online, QuickBooks Desktop, and QuickBooks Self-Employed, each catering to specific business needs.

QuickBooks Installation:

Setting up QuickBooks involves distinct processes for QuickBooks Online and QuickBooks Desktop.

QuickBooks Online Installation:

Subscription and Account Creation:

Begin by subscribing to QuickBooks Online and creating an account. This web-based version eliminates the need for installation on individual computers, allowing for accessibility from various devices.

Dashboard Navigation:

Upon login, explore the user-friendly dashboard. It serves as the central hub providing easy access to essential features like invoicing, expense tracking, and financial reports. Navigating through the dashboard sets the stage for efficient use of QuickBooks Online.

Customization:

Tailor QuickBooks Online to suit your business needs. Customize settings such as currency, tax rates, and payment methods to align the software with the specifics of your company. This flexibility ensures that QuickBooks caters to the unique requirements of your business.

QuickBooks Desktop Installation:

System Requirements:

Before initiating the installation process, ensure your computer meets the system requirements for QuickBooks Desktop. Take note of hardware specifications and operating system compatibility to guarantee a smooth installation and optimal performance.

Installation Process:

Follow step-by-step instructions to install QuickBooks Desktop on your computer. This process includes activating the software using the provided license and product key. Adhering to the installation guidelines ensures a successful setup of the accounting software on your local machine.

Company File Setup:

After installation, the next crucial step is to set up a company file. You can either create a new file for your business or import an existing one. This company file will serve as the repository for all your financial data and transactions, forming the backbone of your accounting activities within QuickBooks Desktop.

Whether opting for QuickBooks Online or QuickBooks Desktop, the installation process sets the foundation for an effective and streamlined accounting experience. Understanding the specific steps involved in each option ensures a smooth transition into the world of QuickBooks.

Setting Up Company Information:

Setting up company information in QuickBooks is a critical process that lays the foundation for accurate financial reporting and compliance with accounting standards. This involves configuring various aspects to tailor the software to the specific needs of your business.

Company Profile:

In the initial phase of setting up QuickBooks, you need to provide crucial company information. This includes entering details such as the business name, physical address, and contact information. This basic business information is vital for creating a comprehensive profile within the software.

Moreover, specifying your industry and business type is essential during the setup. This step allows QuickBooks to customize its features to better align with the specific requirements of your business. By accurately defining your industry and business type, you enable the software to provide relevant tools and functionalities tailored to your specific field.

Additionally, determining the fiscal year and accounting method is crucial for proper financial management. You need to set the start date of your fiscal year and choose between cash-basis and accrual-basis accounting methods. This decision affects how transactions are recorded and plays a significant role in generating financial reports that adhere to accounting standards.

Chart of Accounts:

The Chart of Accounts is a fundamental component of QuickBooks that organizes and categorizes your financial data. Customizing the default accounts in this chart is essential to accurately reflect your business structure. This customization includes defining categories such as assets, liabilities, equity, income, and expenses based on the specific needs of your organization.

Furthermore, the ability to create sub-accounts and categories is a powerful feature within the Chart of Accounts. This allows you to organize and streamline your financial data more effectively. By breaking down accounts into sub-categories, you can gain a more detailed and granular view of your financial transactions, making it easier to track and manage your company’s financial health.

The meticulous configuration of company information in QuickBooks involves defining your company profile with accurate business details, specifying industry and business type for tailored features, and setting up the Chart of Accounts with customized accounts and categories to organize financial data effectively. This groundwork ensures that QuickBooks becomes a powerful tool aligned with your business’s unique financial structure and reporting requirements.

Bank and Credit Card Integration:

Efficient financial transaction management is vital for effective accounting, and QuickBooks provides a robust solution through seamless integration with bank and credit card accounts. This integration ensures real-time updates and facilitates reconciliation, streamlining the entire financial tracking process.

Bank Feeds Setup:

One of the key features of QuickBooks is its ability to link directly to your bank accounts. Through this functionality, users can effortlessly import transactions into the software automatically. This automation not only saves time but also minimizes the risk of manual errors that may occur during data entry. By establishing this direct link, QuickBooks establishes a reliable and secure connection with your financial institutions, enabling a smooth flow of information.

Reconciliation Process:

Regular reconciliation is a crucial aspect of maintaining accurate financial records, and QuickBooks simplifies this process. Users can reconcile their bank and credit card statements directly within the platform. This reconciliation functionality helps to identify and rectify any discrepancies between the recorded transactions in QuickBooks and the actual transactions in the bank or credit card statements. This not only ensures the accuracy of financial data but also helps in detecting any unauthorized or fraudulent activities promptly.

By providing a user-friendly interface for reconciliation, QuickBooks empowers businesses to stay on top of their financial health. This proactive approach to financial management aids in making informed decisions based on precise and up-to-date information. Overall, the integration of bank and credit card accounts into QuickBooks contributes to the efficiency and accuracy of accounting processes, fostering better financial control for businesses of all sizes.

QuickBooks Preferences and Settings:

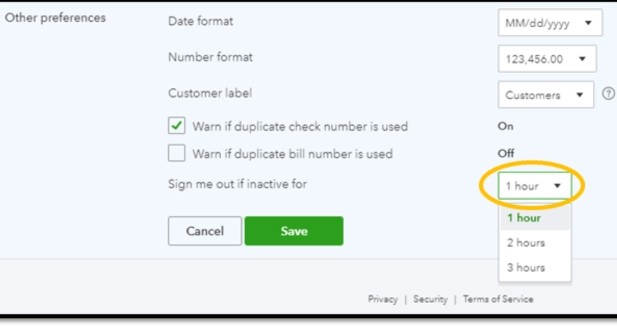

QuickBooks Preferences and Settings play a crucial role in customizing the software to meet the specific needs and operational nuances of your business. Fine-tuning these settings ensures that QuickBooks aligns seamlessly with your business processes and accurately reflects your financial transactions in its reports.

General Preferences:

One of the fundamental aspects of QuickBooks customization involves setting up General Preferences. Within this category, adjusting Date and Number Formats is essential. This allows you to tailor the way dates and numerical data are displayed to match your regional and business preferences. Ensuring consistency in these formats streamlines data interpretation and enhances the user experience.

Another key aspect under General Preferences is configuring Default Accounts. Here, you can specify default accounts for different transaction types, such as sales, purchases, and payments. By defining default accounts, you establish a standardized framework for recording transactions, promoting accuracy and efficiency in your financial record-keeping.

Payroll and Employee Setup:

For businesses using QuickBooks Payroll, configuring Payroll Preferences is crucial. This entails setting preferences related to employee compensation, taxes, and deductions. Customizing these settings ensures that your payroll processing aligns with the specific payroll policies and regulations applicable to your business. It enhances accuracy in payroll calculations and facilitates compliance with tax obligations.

Employee Information is another integral aspect of QuickBooks customization. Inputting accurate details for each employee, including personal information, tax withholdings, and payroll schedules, is essential. This information serves as the foundation for precise payroll processing, tax filings, and employee-related financial reporting. Accurate and up-to-date employee details contribute to compliance with regulatory requirements and smooth HR management.

The meticulous customization of QuickBooks Preferences and Settings, particularly in the areas of General Preferences and Payroll/Employee Setup, empowers businesses to leverage the software effectively. By aligning QuickBooks with specific business requirements, organizations can streamline financial processes, enhance reporting accuracy, and ensure compliance with regulatory standards. Taking the time to fine-tune these settings is an investment in the efficiency and reliability of your financial management system.

Invoicing and Sales:

Invoicing and Sales play a crucial role in the financial management of businesses, and QuickBooks stands out as a comprehensive solution that caters to the diverse needs of organizations. Here’s a detailed breakdown of its features in this domain:

Customer and Vendor Setup:

In the realm of customer and vendor management, QuickBooks excels in providing tools for organizing and maintaining crucial information. The platform allows users to input detailed customer data, including contact information and specific payment terms. This feature not only ensures efficient communication with clients but also contributes to accurate and timely payment processing.

Similarly, QuickBooks aids in the systematic organization of vendor information. By storing vendor details, businesses can effectively track expenses and manage payments. This feature enhances financial transparency and facilitates smoother interactions with suppliers and service providers.

Invoicing and Sales Receipts:

QuickBooks goes beyond basic invoicing by offering customizable templates, allowing businesses to create professional and branded invoices tailored to their unique identity. The platform’s user-friendly interface simplifies the process of designing invoices, and users can add their logos for a polished and personalized touch. This customization not only enhances the professional appearance of documents but also reinforces brand consistency.

Additionally, QuickBooks streamlines transactions completed at the point of sale through the use of sales receipts. These receipts serve as immediate documentation for transactions, providing businesses with an efficient means of recording sales and ensuring accuracy in their financial records. By incorporating this feature, QuickBooks enables businesses to maintain a real-time record of their revenue, contributing to enhanced financial control and decision-making.

QuickBooks stands as a robust solution for businesses looking to optimize their invoicing and sales processes. Its customer and vendor management capabilities, combined with customizable invoicing features and efficient sales receipt functionality, make it a valuable tool for organizations aiming to streamline their revenue generation and financial management workflows.

Reporting and Analysis:

QuickBooks stands out as a robust financial management tool, excelling in its capacity to produce detailed reports that provide valuable insights into the financial health of your business.

Financial Reports:

One of the key strengths of QuickBooks lies in its ability to generate comprehensive financial reports. The Profit and Loss statement is a fundamental tool for analyzing the income and expenses of your business, offering a clear overview of its financial performance over a specific period. This report is crucial for identifying trends, making informed financial decisions, and evaluating the overall profitability of your operations.

Another vital financial report provided by QuickBooks is the Balance Sheet. This document offers a snapshot of your business’s financial position at a given point in time. It breaks down your assets, liabilities, and equity, providing a holistic view of your company’s financial standing. The Balance Sheet is instrumental in assessing the overall health and stability of your business, aiding in strategic planning and decision-making.

Custom Reports:

QuickBooks further enhances its versatility by offering customizable reports tailored to your specific needs. The Report Customization feature allows you to modify columns, apply filters, and set date ranges, ensuring that the generated reports align precisely with your business requirements. This level of customization empowers you to focus on the specific financial metrics and data points that are most relevant to your decision-making processes.

Scheduled Reports:

Efficiency is a key aspect of QuickBooks, and the Scheduled Reports feature exemplifies this. Users can set up automated schedules to receive regular updates on key financial metrics. This automation not only saves time but also ensures that you stay consistently informed about critical aspects of your business. Whether it’s monitoring cash flow, tracking expenses, or analyzing revenue trends, the Scheduled Reports feature enables you to stay on top of your financial data without manual effort.

QuickBooks excels in its reporting and analysis capabilities, providing a comprehensive suite of financial reports that empower businesses to make informed decisions. The flexibility of customizing reports and the convenience of scheduled updates contribute to the overall efficiency and effectiveness of financial management within the QuickBooks platform.

Data Security and Backups:

Ensuring the security of your financial data is of utmost importance, and QuickBooks offers a comprehensive set of tools to safeguard your information from potential loss or unauthorized access.

User Access Controls:

QuickBooks facilitates robust user access controls through the assignment of specific roles and permissions. This feature enables businesses to tailor access based on individual responsibilities within the organization. By defining user roles, you can restrict access to sensitive financial data, ensuring that each user only has the necessary permissions to fulfill their designated tasks.

Password Protection:

To fortify the security of your QuickBooks account, the implementation of strong password policies is paramount. QuickBooks allows users to set up and enforce rigorous password protection measures, including password complexity requirements and periodic password changes. This serves as an additional layer of defense against unauthorized access and helps maintain the integrity of your financial data.

Data Backups:

QuickBooks offers a robust data backup system to mitigate the risk of data loss. Automatic backups can be configured to occur at regular intervals, ensuring that the latest version of your company file is regularly saved. This feature provides a safety net in the event of accidental data corruption, system failures, or other unforeseen circumstances that could compromise your financial records.

External Backups:

In addition to automatic backups, it is advisable to take proactive measures by creating manual backups and storing them in external locations. This extra layer of precaution adds a critical element of security by safeguarding your financial data from potential on-site disasters, such as hardware failures, fires, or theft. Storing backups externally ensures that, even in the face of unforeseen events, you can quickly restore your financial data and resume normal operations.

By combining user access controls, password protection, automatic backups, and external backups, QuickBooks provides a robust framework for data security. These measures not only protect sensitive financial information but also contribute to the overall resilience of your business operations.

Troubleshooting and Support:

Despite QuickBooks’ user-friendly interface, users may encounter issues or have questions during their QuickBooks journey. Accessing the right support resources is crucial for a smooth experience.

Help Center and Documentation:

QuickBooks provides comprehensive online resources to assist users in resolving issues and navigating the software effectively.

Online Resources: The QuickBooks Help Center is a valuable repository of information, offering users access to extensive documentation. Users can find step-by-step guides and troubleshooting tips, enabling them to address common problems independently.

Community Forums: Engaging with the QuickBooks community forums is another avenue for users to seek assistance. By participating in discussions, users can tap into the collective knowledge of other experienced users and experts. This collaborative environment can provide insights and solutions to a wide range of issues.

Customer Support:

For more personalized assistance, QuickBooks offers direct customer support services.

Contacting Support: Users facing technical challenges or complex queries can reach out to QuickBooks’ dedicated customer support. This direct line of communication ensures that users receive timely and tailored assistance from trained professionals, helping to resolve issues efficiently.

Software Updates: Staying informed about software updates and patches is essential for users to benefit from the latest features and security measures. Regular updates not only enhance the overall performance of QuickBooks but also address any known issues, ensuring a more stable and secure user experience.

QuickBooks recognizes the importance of troubleshooting and support in ensuring user satisfaction. The combination of robust online resources, community engagement, and direct customer support creates a comprehensive support ecosystem, empowering users to overcome challenges and make the most of the QuickBooks platform.

Advanced Customization and Integrations for Growing Businesses

Third-Party Integrations:

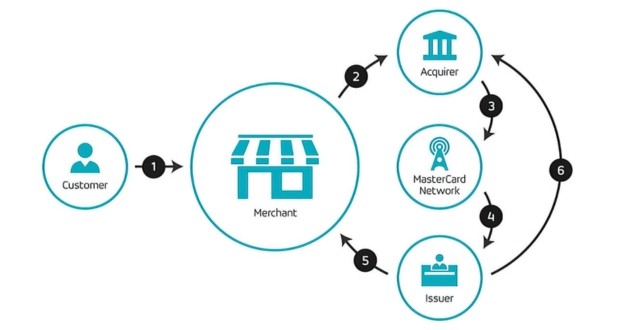

As your business evolves, integrating third-party tools becomes essential to streamline operations. One crucial aspect is Payment Processors. By seamlessly integrating payment processors with QuickBooks, you ensure smooth financial transactions and simplify the reconciliation process. This not only enhances customer experience but also brings efficiency to your financial management.

Additionally, exploring integrations with Business Management Tools is vital. By connecting QuickBooks with other business management solutions, you can create a cohesive ecosystem that promotes productivity and efficiency. This could involve integrating with CRM systems, project management tools, or inventory management software, allowing for a holistic approach to business operations.

Advanced Customization:

Customization is key to adapting QuickBooks to the unique needs of your growing business. Custom Fields provide a powerful tool for tailoring QuickBooks forms to your specific requirements. Whether you need to capture industry-specific information or unique transaction details, custom fields empower you to mold the software to fit your business like a glove.

Moreover, Advanced Reporting features play a pivotal role in extracting nuanced insights from your financial data. As your business complexity increases, basic reports may not suffice. Utilizing advanced reporting functionalities allows you to create customized reports that provide a deeper understanding of your financial performance. This could involve generating specialized reports for different stakeholders or drilling down into specific aspects of your financial data for more comprehensive analysis.

As your business expands, the ability to customize and integrate becomes crucial. Third-party integrations bring in external functionalities, while advanced customization ensures QuickBooks aligns precisely with your business processes. This dynamic approach not only optimizes your workflow but also positions your business for sustained growth by leveraging the full capabilities of the QuickBooks platform.

Conclusion:

Setting up and installing QuickBooks is a critical step in establishing a robust financial management system for your business. From the initial installation process to advanced customization options, this comprehensive guide has covered the key aspects of QuickBooks setup and installation services. As you embark on your QuickBooks journey, remember that continuous learning, regular updates, and efficient utilization of support resources are essential for maximizing the benefits of this powerful accounting software.

Professional help ensures that QuickBooks is set up correctly from the start, minimizing errors and ensuring optimal use of the software. Experts can customize the settings based on your business requirements.

While it’s possible for some users to set up QuickBooks independently, professional services can save time and help avoid common mistakes. Experts can also provide guidance on best practices.

During setup, you’ll need information such as company details, chart of accounts, customer and vendor information, bank accounts, and any specific industry-related preferences.

The time required for setup depends on the complexity of your business and the amount of data to be entered. On average, it can take a few hours to a day for basic setups, but more complex setups may take longer.

QuickBooks can be installed on a single computer or on a network for multiple users. The choice depends on the size and structure of your business.